HYUNDAI MOTOR COMPANY AND ITS SUBSIDIARIES HYUNDAI

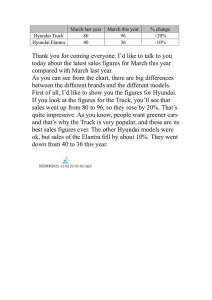

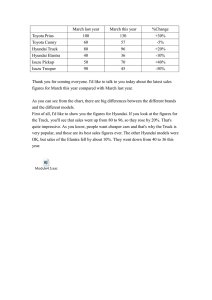

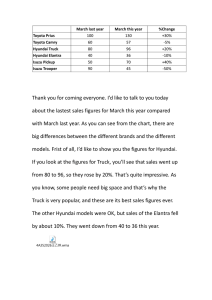

advertisement