Global Auto Report - Global Banking and Markets

advertisement

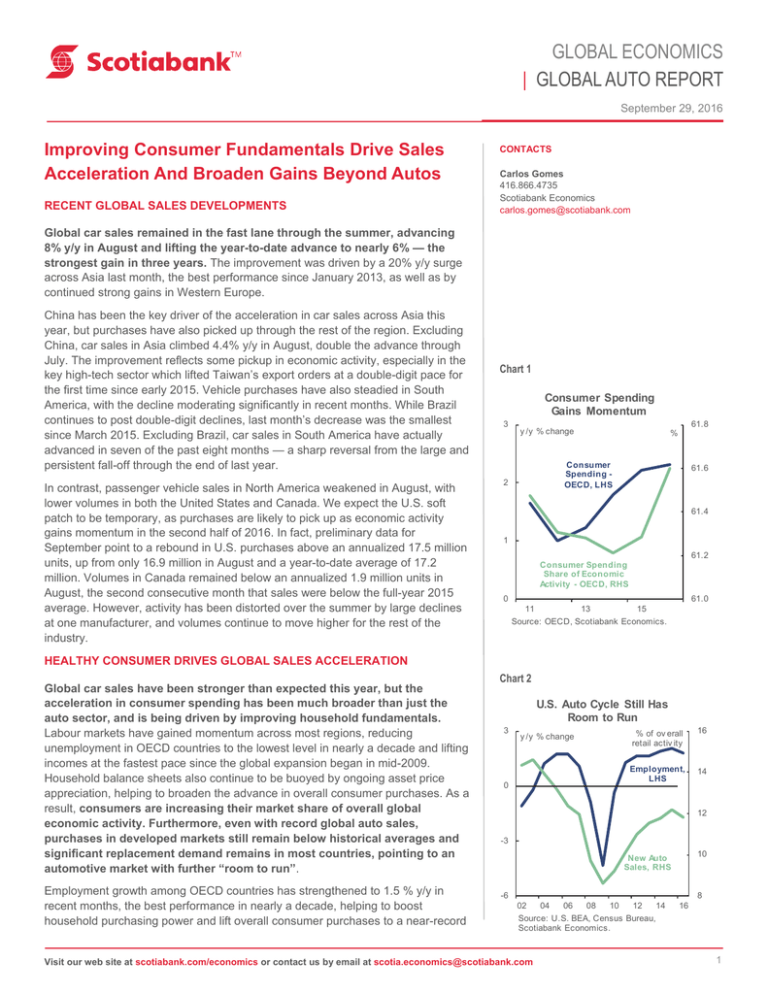

GLOBAL ECONOMICS | GLOBAL AUTO REPORT September 29, 2016 Improving Consumer Fundamentals Drive Sales Acceleration And Broaden Gains Beyond Autos RECENT GLOBAL SALES DEVELOPMENTS CONTACTS Carlos Gomes 416.866.4735 Scotiabank Economics carlos.gomes@scotiabank.com Global car sales remained in the fast lane through the summer, advancing 8% y/y in August and lifting the year-to-date advance to nearly 6% — the strongest gain in three years. The improvement was driven by a 20% y/y surge across Asia last month, the best performance since January 2013, as well as by continued strong gains in Western Europe. China has been the key driver of the acceleration in car sales across Asia this year, but purchases have also picked up through the rest of the region. Excluding China, car sales in Asia climbed 4.4% y/y in August, double the advance through July. The improvement reflects some pickup in economic activity, especially in the key high-tech sector which lifted Taiwan’s export orders at a double-digit pace for the first time since early 2015. Vehicle purchases have also steadied in South America, with the decline moderating significantly in recent months. While Brazil continues to post double-digit declines, last month’s decrease was the smallest since March 2015. Excluding Brazil, car sales in South America have actually advanced in seven of the past eight months — a sharp reversal from the large and persistent fall-off through the end of last year. In contrast, passenger vehicle sales in North America weakened in August, with lower volumes in both the United States and Canada. We expect the U.S. soft patch to be temporary, as purchases are likely to pick up as economic activity gains momentum in the second half of 2016. In fact, preliminary data for September point to a rebound in U.S. purchases above an annualized 17.5 million units, up from only 16.9 million in August and a year-to-date average of 17.2 million. Volumes in Canada remained below an annualized 1.9 million units in August, the second consecutive month that sales were below the full-year 2015 average. However, activity has been distorted over the summer by large declines at one manufacturer, and volumes continue to move higher for the rest of the industry. Chart 1 Consumer Spending Gains Momentum 3 y /y % change 61.8 % Consumer Spending OECD, LHS 2 61.6 61.4 1 61.2 Consumer Spending Share of Economic Activity - OECD, RHS 61.0 0 11 13 15 Source: OECD, Scotiabank Economics. HEALTHY CONSUMER DRIVES GLOBAL SALES ACCELERATION Global car sales have been stronger than expected this year, but the acceleration in consumer spending has been much broader than just the auto sector, and is being driven by improving household fundamentals. Labour markets have gained momentum across most regions, reducing unemployment in OECD countries to the lowest level in nearly a decade and lifting incomes at the fastest pace since the global expansion began in mid-2009. Household balance sheets also continue to be buoyed by ongoing asset price appreciation, helping to broaden the advance in overall consumer purchases. As a result, consumers are increasing their market share of overall global economic activity. Furthermore, even with record global auto sales, purchases in developed markets still remain below historical averages and significant replacement demand remains in most countries, pointing to an automotive market with further “room to run”. Employment growth among OECD countries has strengthened to 1.5 % y/y in recent months, the best performance in nearly a decade, helping to boost household purchasing power and lift overall consumer purchases to a near-record Chart 2 U.S. Auto Cycle Still Has Room to Run 3 y /y % change 0 % of ov erall retail activ ity 16 Employment, LHS 14 12 -3 10 New Auto Sales, RHS -6 8 02 04 06 08 10 12 14 Source: U.S. BEA, Census Bureau, Scotiabank Economics. Visit our web site at scotiabank.com/economics or contact us by email at scotia.economics@scotiabank.com 16 1 GLOBAL ECONOMICS | GLOBAL AUTO REPORT September 29, 2016 62% of overall economic activity (see chart 1). In fact, consumer spending has accelerated across the OECD and is now advancing at the fastest pace since mid-2009. Real income growth has also picked up, and household wealth continues to gain momentum, advancing in excess of 5% y/y in Canada, 3% in the United States and has been steadily improving in recent years across Europe. Rising incomes and household wealth provide a positive backdrop for overall consumer spending and the vehicle sales outlook, which, while improving, still remains below historical averages relative to both population and income trends. For example, in the U.S. and Canada, household spending at motor vehicle dealers normally accounts for more than 20% of overall retail activity, with new vehicle purchases normally representing 12-13% of overall retail purchases. As chart 2 demonstrates, while new vehicle sales have been climbing, spending on new cars and light trucks in the United States still remains well below historical averages, even as employment growth has been much stronger than during the previous economic cycle. Furthermore, real non-automotive spending has been accelerating in the United States and is now advancing 3% y/y — the fastest growth since 2006 and nearly 50% above the pace of expansion from mid-2009 through 2015. A similar trend is also evident across Europe, with real non-automotive retail sales rising 3% y/y for the members of the EU 19. This represents the largest gain of the past decade and a sharp reversal from the declines that remained in place from early 2008 through late 2013. Spain and Sweden are leading the way, but most countries are posting solid gains. The advance is even stronger in Eastern Europe, with several nations reporting increases in real non-automotive spending that is approaching a doubledigit pace. Overall consumer spending has also broadened across Asia, and is now advancing by more than 4% y/y, more than double the pace evident in early 2015. India is leading the way, with consumer spending jumping nearly 7% y/y. However, most other countries in the region are reporting consumer spending gains that are hovering around 4% y/y, a much stronger performance than overall economic growth. Japan is the exception, with aging consumers continuing to lag. However, even on the island nation, consumer purchases turned positive year-over-year in the second quarter, advancing at the fastest pace in two and a half years. Some improvement is also becoming evident across South America. During the second quarter, consumer spending outside of Brazil climbed 2% y/y, led by a 3.5% gain in Peru and 2.5% advances in both Chile and Colombia. The decline in consumer purchases even moderated in Brazil, alongside some improvement in confidence and a pickup in business investment, much of it geared to the auto industry. The improving trend in consumer activity across the globe points to an eventual upturn in production and trade. However, the rebound continues to be delayed by ongoing geopolitical, business and other uncertainties. INTERNATIONAL CAR SALES OUTLOOK (m illions of units ) 1990-99 2000-12 2013 2014 2015 2016f 39.20 16.36 1.27 14.55 0.54 52.57 17.68 1.59 15.12 0.97 68.65 18.33 1.74 15.53 1.06 71.18 19.42 1.85 16.44 1.13 72.61 20.64 1.90 17.39 1.35 75.76 21.01 1.96 17.50 1.55 13.11 3.57 13.96 3.27 11.55 2.95 12.11 3.04 13.20 3.21 13.86 3.33 Eastern Europe Rus s ia 1.18 0.78 2.95 1.75 4.04 2.78 3.81 2.49 3.15 1.60 3.05 1.42 Asia China** India 6.91 0.43 0.31 15.01 5.77 1.13 29.98 16.30 1.83 31.69 18.37 1.87 32.29 20.01 2.06 34.84 22.41 2.10 South Am erica Brazil 1.64 0.94 2.97 1.84 4.75 2.76 4.15 2.50 3.33 1.82 3.00 1.45 TOTAL SALES North Am erica* Canada United States Mexico W estern Europe Germ any *Includes light trucks. **Includes cros sover utility vehic les f rom 2005. Visit our web site at scotiabank.com/economics or contact us by email at scotia.economics@scotiabank.com 2 GLOBAL ECONOMICS | GLOBAL AUTO REPORT September 29, 2016 CANADA/U.S. MOTOR VEHICLE SALES OUTLOOK 1991-05 Average CANADA Cars Dom es tic Trans plants Im ports Light Trucks 2006-13 15.5 8.3 7.2 NORTH AMERICAN PRODUCTION* CANADA UNITED STATES MEXICO 2015 (thous ands of units , annualized) 1,618 1,851 786 759 488 512 270 329 298 247 832 1,092 (m illions of units , annualized) 13.8 16.4 6.7 7.7 7.1 8.7 1,398 797 583 178 214 601 UNITED STATES Cars Light Trucks 2014 (m illions of units , annualized) 13.86 17.43 2.22 2.39 9.27 11.67 2.37 3.37 15.58 2.50 11.67 1.41 2016 Jan-July** Annual f 1,898 714 476 327 238 1,184 1,959 678 454 311 224 1,281 1,955 680 450 315 230 1,275 17.4 7.5 9.9 17.3 6.9 10.4 17.5 7.0 10.5 17.95 2.28 12.10 3.57 18.20 2.45 12.20 3.55 18.20 2.40 12.25 3.55 *Inc ludes transplants; light, medium and heavy truc ks. **Canadian sales are Sc otiabank estimates. VEHICLE SALES OUTLOOK BY PROVINCE* (thous ands of units , annual rates ) 2016 Jan-July** Annual f 1994-05 Average 2006-13 2014 2015 1,446 1,618 1,851 1,898 1,959 1,955 ATLANTIC 102 121 137 140 139 140 CENTRAL Quebec Ontario 936 366 570 1,002 410 592 1,139 420 719 1,205 444 761 1,272 464 808 1,271 470 801 W EST Manitoba Sas katchewan Alberta Britis h Colum bia 408 42 36 166 164 495 47 48 227 173 575 56 56 269 194 553 56 54 236 207 548 56 52 222 218 544 56 53 220 215 CANADA *Includes cars and light trucks . **Scotiabank es tim ates . 900 300 thousands of units 70 thousands of units 275 800 60 250 700 225 Ontario 50 200 600 175 500 British Columbia 150 Quebec 400 40 30 100 75 50 80 84 88 92 96 00 Manitoba 125 300 200 thousands of units Alberta 04 08 12 16 Saskatchewan Atlantic 80 84 88 92 96 00 04 08 12 16 20 80 84 88 92 96 00 04 08 12 16 Includes cars and trucks (light, medium and heavy). Shaded bars indicate U.S. recession periods. Visit our web site at scotiabank.com/economics or contact us by email at scotia.economics@scotiabank.com 3 GLOBAL ECONOMICS | GLOBAL AUTO REPORT September 29, 2016 AUTO MARKET SHARE BY MANUFACTURER — CANADA* (thous ands of units , not s eas onally adjus ted) TOTAL Big Three General Motors Ford Chrys ler Japanes e Honda Toyota Nis s an Mazda Mits ubis hi Subaru Hyundai Volks wagen Kia BMW Mercedes -Benz Other 2015 Jan to Aug Units % of Total 2016 Jan to Aug Units % of Total 501.6 109.7 48.2 39.0 22.5 100.0 21.9 9.6 7.8 4.5 465.4 95.3 45.6 33.9 15.8 100.0 20.5 9.8 7.3 3.4 64.6 13.5 6.2 5.2 2.1 100.0 20.9 9.6 8.1 3.2 58.6 11.4 6.0 3.7 1.7 100.0 19.4 10.3 6.3 2.8 213.2 64.4 66.5 35.2 29.8 6.7 10.7 42.5 12.8 13.3 7.0 5.9 1.3 2.1 202.1 63.5 63.7 35.0 22.3 7.0 10.5 43.4 13.7 13.7 7.5 4.8 1.5 2.3 27.3 9.2 8.2 4.3 3.6 0.9 1.1 42.3 14.2 12.8 6.7 5.6 1.4 1.7 24.5 8.0 7.5 4.0 2.8 0.8 1.5 41.9 13.7 12.7 6.8 4.9 1.3 2.4 61.5 41.3 31.8 16.4 14.9 12.8 12.3 8.2 6.3 3.3 3.0 2.5 60.2 34.1 29.4 15.7 15.3 13.3 12.9 7.3 6.3 3.4 3.3 2.9 8.7 5.5 4.3 2.0 1.7 1.6 13.5 8.5 6.6 3.1 2.7 2.4 8.8 4.2 3.9 2.0 2.0 1.8 15.0 7.2 6.7 3.3 3.4 3.1 2015 Aug Units % of Total 2016 Aug Units % of Total *Source: Dealer sales from the Global Automakers of Canada. TRUCK MARKET SHARE BY MANUFACTURER — CANADA* (thous ands of units , not s eas onally adjus ted) 2015 Jan to Aug Units % of Total 2016 Jan to Aug Units % of Total 2015 Aug Units % ot Total Units 2016 Aug % of Total TOTAL Big Three General Motors Ford Chrys ler 809.4 456.6 126.5 148.9 181.2 100.0 56.4 15.6 18.4 22.4 888.9 486.1 128.4 174.8 182.9 100.0 54.7 14.4 19.7 20.6 113.8 64.7 18.4 21.4 24.9 100.0 56.9 16.2 18.8 21.9 115.7 61.7 16.5 25.3 19.9 100.0 53.3 14.3 21.8 17.2 Other Dom es tic 28.8 3.6 24.8 2.8 3.5 3.0 3.1 2.7 218.8 52.3 75.1 52.3 19.0 7.6 20.2 27.0 6.5 9.3 6.5 2.3 0.9 2.5 251.4 60.7 86.6 57.5 24.5 8.2 22.1 28.3 6.8 9.7 6.5 2.7 0.9 2.5 31.1 8.1 10.1 7.5 3.2 1.4 2.2 27.4 7.1 8.8 6.6 2.8 1.3 2.0 35.3 9.8 11.2 7.5 3.7 1.3 3.1 30.5 8.5 9.7 6.5 3.2 1.1 2.6 Hyundai Kia 33.4 15.9 4.1 2.0 40.4 21.5 4.5 2.4 4.3 2.0 3.7 1.8 4.6 2.8 4.0 2.4 Other Im ports 55.9 6.9 64.7 7.3 8.2 7.2 8.2 7.1 LIGHT TRUCKS 785.4 97.0 869.7 97.8 110.9 97.5 113.5 98.1 Japanes e Honda Toyota Nis s an Mazda Mits ubis hi Subaru *Source: Dealer sales f rom the Global A utomakers of Canada. Visit our web site at scotiabank.com/economics or contact us by email at scotia.economics@scotiabank.com 4 GLOBAL ECONOMICS | GLOBAL AUTO REPORT September 29, 2016 AUTO SALES BY PROVINCE (thous ands of units , not s eas onally adjus ted) CANADA ATLANTIC Newfoundland Nova Scotia New Bruns wick Prince Edward Is land CENTRAL Quebec Ontario W EST Manitoba Sas katchewan Alberta Britis h Colum bia 2015 Jan to July 2016 Jan to July 2015 July 2016 July 436.4 405.4 66.7 59.1 34.5 7.2 14.7 10.4 2.2 30.1 6.3 12.6 9.2 2.0 5.9 1.2 2.5 1.8 0.4 3.8 0.8 1.7 1.0 0.3 306.2 133.6 172.6 286.1 123.5 162.6 46.6 20.8 25.8 42.7 18.8 23.9 95.7 9.6 6.6 32.4 47.1 89.2 8.8 5.6 29.4 45.4 14.2 1.7 1.1 4.6 6.8 12.6 1.5 0.8 4.0 6.3 TRUCK SALES BY PROVINCE* (thous ands of units , not s eas onally adjus ted) 2015 Jan to July 2016 Jan to July 2015 July 2016 July 698.2 776.6 114.5 116.9 50.2 13.6 18.0 16.1 2.5 56.7 14.4 20.3 18.7 3.3 9.2 2.5 3.3 2.9 0.5 8.1 1.9 3.1 2.6 0.5 CENTRAL Quebec Ontario 412.4 132.8 279.6 483.0 157.3 325.7 66.9 21.7 45.2 73.4 24.4 49.0 W EST Manitoba Sas katchewan Alberta Britis h Colum bia 235.6 23.2 25.1 110.7 76.6 236.9 24.5 24.4 101.9 86.1 38.4 3.9 4.1 17.7 12.7 35.4 3.6 3.7 15.1 13.0 CANADA ATLANTIC Newfoundland Nova Scotia New Bruns wick Prince Edward Is land *Light, medium and heavy trucks. Visit our web site at scotiabank.com/economics or contact us by email at scotia.economics@scotiabank.com 5 GLOBAL ECONOMICS | GLOBAL AUTO REPORT September 29, 2016 CANADIAN MOTOR VEHICLE PRODUCTION* (thous ands of units , not s eas onally adjus ted) 2015 Jan to Aug 2016 Jan to Aug 2015 Aug 2016 Aug 1,462.1 1,597.0 208.4 217.9 CAR Chrys ler GM Honda Toyota 601.4 173.1 138.8 122.1 167.4 542.4 162.4 80.6 138.3 161.1 78.1 23.3 17.9 15.6 21.3 75.9 24.8 10.9 19.1 21.1 TRUCKS** Chrys ler Ford GM Honda Toyota Others 860.7 121.5 115.8 247.1 136.2 229.7 10.4 1,054.6 210.7 186.0 267.4 139.7 242.3 8.5 130.3 33.3 15.6 34.3 16.7 29.1 1.3 142.0 26.8 24.3 40.8 16.2 32.7 1.2 TOTAL *Production data f rom Ward’s Automotive Reports. **Light, medium and heavy trucks. Canada — Motor Vehicle Production 3.4 Canada — World Auto Trade Balances 3.4 50 3.0 40 2.6 2.6 30 2.2 2.2 20 quarterly 3.0 Total 50 billions of dollars 40 Assembled vehicles 30 20 Total 1.8 1.8 10 10 1.4 1.4 0 0 1.0 1.0 -10 Cars Trucks* 0.6 0.2 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 16 Millions of units, seasonally adjusted annual rates. *Light, medium and heavy trucks. -10 Parts 0.6 -20 0.2 -30 -20 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 16 -30 2016 data are January-July annualized. Visit our web site at scotiabank.com/economics or contact us by email at scotia.economics@scotiabank.com 6 GLOBAL ECONOMICS | GLOBAL AUTO REPORT September 29, 2016 New & Used Car Prices Scotiabank Car Price Indicators — Canada year-over-year per cent change 25 25 Used* 15 15 New 5 5 CPI -5 -5 -15 79 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 16 -15 *Scotiabank estimate from Canadian Black Book data. Scotiabank Car Price Indicators — Canada 20 20 thousands of dollars by age of car, seasonally adjusted 18 18 16 16 14 14 1 Year 12 12 10 10 2 Year 8 6 8 6 4 Year 4 4 2 7980 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 16 2 Scotiabank estimate from Canadian Black Book data. Scotiabank Car Price Indicators — United States year-over-year per cent change 25 15 15 Used 5 -15 5 CPI New -5 79 80 82 84 86 88 90 92 94 96 25 98 00 -5 02 04 06 08 10 12 14 16 -15 Consumer price indices for new and used cars. Shaded areas indicate recession periods. Visit our web site at scotiabank.com/economics or contact us by email at scotia.economics@scotiabank.com 7 GLOBAL ECONOMICS | GLOBAL AUTO REPORT September 29, 2016 CANADIAN CORPORATE FINANCIAL PERFORMANCE MOTOR VEHICLE DEALERS AND REPAIR SHOPS Annual 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Quarterly at annual rates 2015Q2 Q3 Q4 2016Q1 Q2 Net Incom e After Tax ($ m il) 594 571 799 942 1089 1142 1392 1649 1664 1748 2215 2740 2854 Pre-Tax Profit Margin (%) 0.91 0.69 0.93 1.20 1.41 1.43 1.84 2.06 1.99 1.97 2.32 2.65 2.57 3124 3244 2988 1964 3136 2.61 2.76 2.65 1.93 2.43 929 -68 1.28 0.10 Average (89-15) Low (89-15) Def inition of Ratios: Pre-tax Prof it Margin: pre-tax income/sales Inventory Turnover Ratio: sales/inventory Inventory Turnover Ratio 5.30 4.98 5.35 5.16 5.05 5.04 5.34 4.91 5.17 4.86 5.08 5.10 5.07 Interes t Coverage Ratio 2.65 2.25 2.55 2.64 3.36 3.51 4.85 5.34 5.19 5.32 6.64 7.56 7.81 Debt/ Equity Ratio 2.91 3.17 2.74 2.75 2.56 2.44 2.07 2.11 2.02 2.03 2.02 1.86 1.87 Return on Shareholders Equity (%) 10.14 10.49 12.90 14.37 15.13 14.66 16.99 18.09 17.44 16.71 20.08 20.90 20.50 5.41 5.32 4.98 4.57 5.33 8.14 8.80 7.57 6.52 8.73 1.92 1.82 1.84 1.94 1.91 23.07 23.05 20.63 13.75 21.45 6.03 4.38 3.30 1.10 2.33 3.57 12.05 -1.20 Interest Coverage Ratio: (pre-tax income and interest payments)/(interest payments) Debt/Equity Ratio: (short-term and long-term debt)/total equity Return of Shareholders’ Equity: af ter-tax income/total equity Retail Auto Dealer Bankruptcies 10 10 number of bankruptcies 8 8 2014 2013 6 6 2012 4 4 2 2 0 Jan. Feb. Mar. Apr. May June July Aug. Sept. Oct. Nov. Dec. 0 New car dealers only; cumulative total during the year. Visit our web site at scotiabank.com/economics or contact us by email at scotia.economics@scotiabank.com 8 GLOBAL ECONOMICS | GLOBAL AUTO REPORT September 29, 2016 This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents. These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report. Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations. Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment. This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank. ™ Trademark of The Bank of Nova Scotia. Used under license, where applicable. Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority. Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities. Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law. Visit our web site at scotiabank.com/economics or contact us by email at scotia.economics@scotiabank.com 9