Asset Managers Forum Meeting Program - February 2015

advertisement

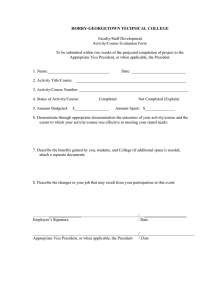

| asset management group Asset Managers Forum Member Meeting Wednesday, February 11, 2015 | SIFMA Conference Center, NYC Asset Managers Forum AMF Mission Statement Dedicated to facilitating collaboration among the buy-side operations community, the Asset Managers Forum (AMF) brings together subject matter experts to discuss and develop practical solutions to highly topical operational challenges. The AMF’s mission is to provide thought leadership and guidance on pertinent industry issues and to create a premier venue for operations professionals to develop and share best practices in order to drive industry change. AMF MEMBER MEETING PROGRAM Wednesday, February 11 8:30 a.m. – 9:00 a.m. 10:45 a.m. – 11:45 a.m. Registration and Breakfast Break-out Committee Meetings: n 9:00 a.m. – 9:10 a.m. Operational Risk Committee Opening Remarks 11:45 a.m. – 12:45 p.m. Tim Cameron Managing Director SIFMA Panel Discussion – Derivatives: What’s New with CCPs? 9:10 a.m. – 9:20 a.m. AMF Housekeeping Jesse Robinson GE Asset Management n n Election of AMF Leadership: Michael Herskovitz of Alliance Bernstein as the Chair of the AMF Steering Committee, and Cynthia Meyn of PIMCO as the Vice Chair of the AMF Steering Committee Election of new AMF Steering Committee member: Albert Trageser of MacKay Shields As the CCP matrix is in the process of being updated, this panel will give the central counterparties a chance to address developments in the cleared derivatives space, and share what is new with each CCP. The panel will also share news of the work being done to create a standard ID for cleared contracts, to ease the processing hurdles through-out the lifecycle of the trade, increase processing efficiency and reduce operational risk. MODERATOR: Samuel Ely Gamma PANELISTS: 9:20 a.m. – 10:30 a.m. Panel Discussion: Shorter Settlement Cycle in the U.S. A shorter settlement cycle reduces systemic and operational risk, in addition to reducing counterparty risk and consequently the amount of collateral required to settle trades. However, there are many elements that need to be considered as the U.S. works towards settling trades on a T+2 cycle. This panel will describe the structure, industry process and tactical plan created to facilitate the move to T+2. Panelists will also raise some issues the working groups are currently looking at and share insights to the types of discussions taking place within the Industry Working Group and issue-specific work streams. Cynthia Meyn PIMCO PANELISTS: John Abel DTCC Will Leahey SIFMA Brent Blake StateStreet Lou Rosato BlackRock Networking Break Christopher Licini LCH Michael Burg StateStreet Joshua Satten Northern Trust Elizabeth Flores CME 12:45 p.m. – 1:30 p.m. Networking Luncheon Hosted by Securities Quote Xchange, LLC 1:30 p.m. – 2:00 p.m. AMF Steering Committee Update – AMF Priorities in 2015 MODERATOR: 10:30 a.m. – 10:45 a.m. Peter Borstelmann ICE Clear Credit This session will discuss the responses to the 2015 AMF Member Survey, and the goals and priorities of the Asset Managers Forum for 2015. We encourage members to contribute to the discussion. Michael Herskovitz Alliance Bernstein (AMF Chair) Cynthia Meyn PIMCO (AMF Vice Chair) Asset Managers Forum 2:00 p.m. – 3:00 p.m. Break-out Committee Meetings: n Collateral Committee n Custodian Committee 3:00 p.m. – 3:15 p.m. Networking Break 3:15 p.m. – 4:15 p.m. Panel Discussion: Operational Challenges Relating to the New Margin Rules This panel will discuss developments related to collateral and margin, and how the buy side is impacted. Panelists will touch on the differences between the U.S. and Europe, including the need to repaper agreements and the time and resources required, collateral eligibility, the impact of multiple currencies on margin calls, and other operational issues. The panelists will discuss whether the collateral crunch is a myth or reality, and whether they worry about liquidity. From operational perspective, panelists will discuss the impact of collateral management moving to the front office, and whether firms are looking at cross asset class optimization for collateral, and pretrade optimization in the cleared space. In addition, the panelists will address new services on electronic margining and collateral moves. MODERATOR: Neil Wright DerivPRODUCT PANELISTS: Mary Harris Tri-Optima Gerard Lionetti Franklin Templeton Jennifer Ibrahim BlackRock Joe Streeter StateStreet 4:15 p.m. – 4:20 p.m. Closing Remarks 4:20 p.m. – 6:00 p.m. Networking Reception AMF MEMBER MEETING BIOGRAPHIES JOHN ABEL is currently the Vice President of Settlement and Asset Servicing Strategy in the Product Management group at the Depository Trust and Clearing Corporation (DTCC). Mr. Abel’s primary responsibilities include identifying, evaluating and developing strategic business opportunities within DTCC’s Settlement and Asset Servicing Product lines. In addition, Mr. Abel is currently reasonable for leading DTCC’s initiative to move to a shorter settlement cycle in the U.S. (T+2). Mr. Abel began his career at DTCC in 1987, and has held a number of Operational and Project related positions. BRENT BLAKE is a Vice President at StateStreet. PETER BORSTELMANN is a Senior Director – Head of Strategy at ICE Clear Credit. MICHAEL BURG is currently a Derivative product manager in State Streets Global Product and Platform Support group. He joined State Street in December of 2014. As Global Services Derivative Product Manager he is responsible for helping to define and build a robust derivative offering for end-to-end derivative support for middle and back office. Prior to joining State Street Michael was a Vice President with Bank of New York Mellon’s Derivative 360 (D360) Business Unit. He worked as a Senior Derivative Product Specialist with responsibilities for the sales support and new business implementation of various D360 clients to the BNY Mellon service model. He was also responsible for product expansion and industry awareness with regards to derivatives for BNY Mellon. Michael is the current co-chair for the ISITC Working Group and the AMF Derivative Standardization working group. I am also a member of SWIFTNet FpML CUG, SIFMA Collateral Management group, ISDA FpML IM/Custodian Forum, and SIFMA Derivative Operations group. Michael began his career at Mellon Bank NA in the Derivative Operations Group in 1997. He also spent a year and a half with Citigroup’s WWSS (World Wide Securities Services) group in their global fund accounting group, before returning back to Mellon’s Derivative Services Group where he held various senior management roles in derivative operations. He received his Bachelor’s degree in accounting and finance from St. Vincent College, Latrobe in 1997 and his MBA from the University of Phoenix in 2001. SAMUEL ELY is a Founding Partner of Gamma Derivatives Solutions. He is a respected authority on the trading and clearing of derivatives. Having worked in senior management roles at several top-tier firms, he formed Gamma Derivatives Solutions. As the founding partner, Samuel oversees a network of experienced professionals with a proven track record in delivering cost effective solutions for derivatives practitioners. Gamma Derivatives Solutions has expertise across the derivatives space and in particular in the evolution of the derivatives market and central counterparty clearing. Samuel started his career in London at a specialist market making firm trading derivatives before moving into management. During his time at Goldman Sachs and JPMorgan amongst others he was closely involved in the clearing of all derivative asset classes including Rates, Credit, Equity and Commodities. Since moving to New York he has worked for leading consulting companies developing and leading derivatives practices and delivering globally for a variety of clients in the industry including market infrastructure providers, clearing houses, sellside and buyside. Samuel is a chartered fellow of the Chartered Institute for Securities and Investments (CISI), as well as engaged with SIFMA and other global industry bodies. ELIZABETH FLORES was appointed Executive Director, Client Development and Sales, at CME Group in February 2012. She is a relationship manager for some of our largest asset manager clients and has been working on OTC clearing since the 2009 launch. Prior to her current role she was a Director of Interest Rate Products at CME Group responsible for the development of Eurodollar, Treasury, and Fixed Income Index products. Before joining the CME Group, Flores worked for Cole Partners, a marketing firm specializing in hedge funds. Flores began her career on the CME Trading Floor, eventually moving to Carr Futures, now NewEdge Group, where she was a First Vice President on the Institutional Desk, specializing in Interest Rate Futures and Options. Flores holds a bachelor’s degree from the University of Michigan and an MBA with concentrations in Finance and Statistics from the Booth School of Business at the University of Chicago. MARY HARRIS is the Business Manager in North America for triResolve, TriOptima’s Counterparty Exposure Management and Portfolio Reconciliation service. Mary is actively involved in industry initiatives and is responsible for assessing North American business needs in post-trade processing. Mary is also instrumental in driving global strategy for triResolve. Prior to joining TriOptima, Mary was Managing Director at Summit Systems. Mary has more than twenty years of OTC Derivatives experience, primarily in client services management, implementation, software development and integration for front, middle and back-office applications across derivative asset classes. Mary holds a degree in Accounting from Hofstra University. Asset Managers Forum MICHAEL HERSKOVITZ is Senior Vice President, Fixed Income Risk Operations and Technology. In this role he also oversees Derivatives and Insurance Operations. Michael joined AllianceBernstein in late 2006 from UBS where he was the Managing Director of Risk and Finance Technology group. Michael has held senior technology management and research positions with Morgan Stanley, including the London based role of international CIO, Merrill Lynch and ZurichScudder Investments. Michael started his financial services career working on Merrill Lynch’s corporate bond trading desk as a hedging/arbitrage analyst before becoming a recognized innovator as a Mortgage-Backed Securities research analyst. Over his 20+ year career in financial services he has had extensive analytical and technical experience with fixed-income, commodities, derivative products and risk management. Michael has co-authored two books and several research papers on Mortgage-Backed Securities pricing and analytics. He graduated from Carnegie-Mellon University with a BS in Operations Research and an MS in Industrial Administration.. JENNIFER IBRAHIM, Director, is a member of BlackRock’s Business Operations as part of Investment Operations. She is a senior member of the firm’s Market Initiatives Team. This team coordinates all operational initiatives associated with meeting Dodd Frank Act commitments for Over the Counter (OTC) derivatives working alongside the Market Structure, Portfolio Management, Technology, and Legal teams. Prior to moving to her current role, Ms. Ibrahim managed BlackRock’s US Derivative Operations where she was responsible for collateral management across fixed income and equity and swap payments. In addition, she has contributed to enhancing the firm’s system capabilities and developing the operations infrastructure for derivatives. Prior to joining BlackRock in 2005, Ms. Ibrahim worked for Deutsche Bank and Mizuho Capital Markets on their Collateral Management teams. Ms. Ibrahim earned a BS degree in Business Administration and Computer Information Systems from Rider University in 2000. WILL LEAHEY is a Vice President in SIFMA’s Operations and Technology Group. He is a Staff Advisor to the following SIFMA Committees and Working Groups: Clearing Firms Committee; Capital Markets and Private Client Operations Committee; Unclaimed Property Task Force; Think Tank Resource Group (industry service and technology providers); the Comprehensive Automated Risk Data System (CARDS) Operations Working Group; and the Cost Basis Operations Working Group. Focus areas include: the industry’s analysis of a Shortened Settlement Cycle; a comprehensive IndustryWide Project Timeline; Consolidated Audit Trail cost and funding analysis; and socializing operations issues related to emergent operations and technology issues (e.g., Money Market Fund Reform, SEC Rule 15c3-5 Market Access). Prior to joining SIFMA, Will spent five years in FINRA’s Market Regulation Department regulating the New York equities markets. Prior to FINRA, Will was an attorney in the policies and procedures group of Bear Stearns. Will is a graduate of Brooklyn Law School, and a member of the New York State Bar. Will graduated summa cum laude from SUNY Albany with a Bachelor of Science in Finance. CHRISTOPHER LICINI is a Director at LCH. GERARD LIONETTI is currently an independent consultant focused on Regulatory Reform and Centralized Clearing of Derivatives (Dodd Frank and EMIR). For the past three years Gerard has been working with Franklin Templeton as it relates to their operational, front office and technology implementations for derivatives trade capture, processing and reporting. He has been in the Securities Industry for over 30 years and brings with him a wealth of knowledge across functions and asset classes. Prior to consulting Gerard was with UBS for 20 years where he had the opportunity to manage settlement teams, Led the Equities and Fixed Income Middle Offices as well as worked for the Front Office as a Business Manager focused on Client Connectivity, STP and Change Management. He has also led many different initiatives across functions focused on automation. Gerard is active in industry groups and was a member of the Omgeo Advisory Board on two separate occasions. CYNTHIA MEYN is currently Executive Vice President of Operations at PIMCO and has been in this role since August 2008. At PIMCO, Cynthia has oversight for trade floor operations in New York and back-office operations globally, which encompasses production supervision for nearly $2.0 trillion in assets under management. Cynthia also has ownership of strategic growth and automation projects, broker and bank oversight, operational risk, and leadership within financial service industry operational initiatives. Prior to PIMCO, Cynthia served as Managing Director of North American Operations for Morgan Stanley Investment Management from August 2006 through May 2008. From 2000 – 2006, Cynthia served as global co-director of Fixed Income and Derivatives Technology at AllianceBernstein. Before this, Cynthia held a leadership role as Managing Director of Global Fixed Income Technology at Cantor Fitzgerald; Chief Technology Officer and Chief Risk Officer at Mizuho Capital Markets; and Vice President of Derivatives Technology at Lehman Brothers. Cynthia started her career at Morgan Stanley in 1985 working within both the Technology and Controllers departments supporting the derivatives product business. In her role, Cynthia serves as a member of the Board of Directors of DTCC, the Board of Managers of Omgeo, and the Board of Trustees of CUSIP. Cynthia also serves as a member of the Operations Steering Committee within ISDA, the Collateral Steering Committee within ISDA, the AMF MEMBER MEETING BIOGRAPHIES Operations and Technology Steering Committee within SIFMA, and the steering committee of the Asset Managers Forum within SIFMA, where she serves as Treasurer. In 2014, Cynthia won the FTF News Innovation and Technology Award for Operations Business Person of the Year for her contributions to systemic risk reduction. In 2014, Cynthia was published as co-author of two Harvard Business School case studies that examined crowd-sourced technological innovation within Netflix. JESSE D. ROBINSON is Vice President with GE Asset Management responsible for Investment Operations covering all asset classes globally. Prior to joining GE, Jesse was the Manager of Investment Support in New York for Western Asset Management. In addition Jesse has spent time on the sell side with UBS in various operations roles. Jesse is a member of SIFMA’s Asset Manager’s Forum’s Steering Committee. Jesse has been a key leader and participant in several industry working groups including Tri-Party Repo, Overdrafts, Match to Settle, and TMPG. Jesse has also served as a member of the Omgeo Advisory Board. Jesse holds a BS in Business Administration from the University of Vermont. LOUIS J. ROSATO, III, Director, is a member of BlackRock’s Investment Operations Group. He is responsible for Trading Operations in the Americas and has oversight responsibility across the Confirmation and Settlements functions for all global products including Cash Securities and Derivatives, and is a member of the firms Fixed Income and Liquidity Trading Oversight Committees. Before taking on his current role, Mr. Rosato lead the Global Trade Confirmations Teams in the US and EMEA. In previous roles at BlackRock he was regional Head of Fixed Income and Equity Trade Operations, as well Head of the firms retail Separately Managed Account Operation. Prior to joining BlackRock in 2004, Mr. Rosato was with Jennison Associates, LLC where he was responsible for establishing and managing the firms SMA Trading and Operations Teams. He performed similar roles for 1838 Investment Advisors and Rittenhouse Financial Services. He began his career in 1987 as an Operations Analyst with the Federal Reserve Bank of Philadelphia. Mr. Rosato is a former member of the OMGEO Regional Advisory Council: Americas and actively participates on several FPL Global PostTrade Working Groups. He earned a BS degree in Business Administration from Widener University. JOSHUA Q. SATTEN is a Practice Lead in Northern Trust’s Enterprise Business Architecture group where he focuses on target operating model design, derivative regulations and operations, market innovation, and fund servicing. Most recently he was a Practice Lead in Northern Trust’s Global Derivatives Practice where he was supporting an enterprise-wide transformation of Northern Trust’s Derivatives Client Services encompassing Custody, Outsourcing, and Administration across operations, valuations, and collateral. Prior, Mr. Satten was the Global Head of OTC Structured Products for Northern Trust Hedge Fund Services, overseeing back-office and middle-office operations as well as regulatory support across a dynamic client base comprising over $200 billion in assets under administration. He is in the unique position of representing both firm and client operations in respect to working groups and initiatives across the OTC and other industries, while also acting in the capacity of operations management, client service, and implementation for clients across the North America, EMEA, and APAC regions. Before joining Northern Trust Hedge Fund Services, Mr. Satten was Head of OTC Structured Products for Omnium (founded in 2007 by Citadel and acquired by Northern Trust in 2011). Prior to that, he was operations manager for BlueMountain Capital Management where he oversaw global trade support for all Listed and OTC products. Mr. Satten began his career as an OTC Documentation Specialist, first with JP Morgan Chase and then with Bear Stearns, with a focus on Interest Rate, Exotic Equity, and Structured Credit derivatives. Mr. Satten holds an Executive M.B.A. in Management and Finance from the Fordham University Graduate School of Business, a Masters of Science in Urban Affairs from CUNY-Hunter College, and a Bachelor of Arts degree from Fordham University in Economics and Sociology. JOE STREETER is a Vice President at StateStreet. NEIL WRIGHT is the managing principal and founder of DerivPRODUCT LLC. DerivPRODUCT is an Advisory and Consultancy Services Company that is focused on the Capital Markets with particular emphasis on Derivatives and Collateral. Mr. Wright also acts as an Industry Advisor to Sapient Global Markets and as a Strategic Advisor to SwapsHub. A bank operations executive with 25 years of experience in capital markets operations and audit and control, Mr. Wright began his career at Chase Manhattan Bank as an internal auditor. He managed Chase’s Internal Control Group for all operations in Europe, and then became the global head of Derivative Operations. In this role he consolidated all operations into one processing center of excellence and managed the consolidations of the Derivative Processing groups during two major mergers: Chase/Chemical and Chase/JP Morgan. After JPMorgan Chase, he joined Citigroup and was the global head of Commodity Operations while also running the Derivative Collateral Management Group. Prior to establishing DerivPRODUCT, Mr. Wright was a senior vice president at State Street Corporation as the head of the Derivatives and Collateral Product and Strategy Group. Mr. Wright has been active in all industry groups relating to derivative operations, including serving as chairman of ISDA’s North American Operations Committee, Board Member of FpML.org., founding member of the SWIFT Derivative User Committee, co-chair of the AMF Derivatives Operations Committee and the ISDA Steering Committee for the Clearing Connectivity Standard. . Asset Managers Forum THANK YOU TO OUR SPONSOR The Securities Quote Xchange, or better known as SQX, provides electronic delivery of end-of­ day quotations for difficult to price securities. Typically the data would include various asset classes and derivative products along with market data such as Average life, speed, spread currency code and usually we can incorporate any other data you may need for reconciliation as long as the dealer can provide it to us. Our data source originates from a network of 400 plus broker/dealers. SQX has developed an electronic web solution to facilitate the timely and accurate delivery of these quotes. You can download your data via Excel links or FTP as many times during the day as you wish. If you are using FTP you can automate the download. The system is safe, efficient and secure. Last summer we completed at massive development to automate 94% ofthe processing of this data. This new system eliminates 94% of the manual process of collecting data and lowers operational risk saving the user time and money. The delivery now is much faster where before it took minutes and now takes less than a second. Our new system can now handle 30,000 quotes a day. We offer 3 pricing platforms for market data: fixed income, SWAPS and OTC Options. Each customer is assigned a password protected SQX web page and can look over our shoulder as pricing progresses throughout the day. We believe it is very important that we stay in touch during the day. It’s important you know what’s going on during the day. For example we have a variance% that if it exceeds over or under you may want us to challenge the price with the dealer. We also send you status reports during the day and a late dealer report at the end of the day. We will need your initial help in getting the dealer on board. We offer a standard email request that you can use and once on board there are no problems. Most of your dealers are already on board our system. We find that it only takes a couple of days to get them on board. We qualify as an independent data provider. We have been business for eleven years. Contact: James K. Blinn, President & CEO, Securities Quote Xchange LLC / 630.870.1101 jimb@sqx.com / www.sqx.com AMF MEMBER MEETING John Abel Vice President, Product Management The Depository Trust & Clearing Corporation (DTCC) New York, NY David Askin Senior BVAL Specialist Bloomberg L.P. New York, NY Elvir Bacaj Operations Manager GE Asset Management Incorporated Stamford, CT Corry Bazley Director & Head of Americas Over-the-Counter Financial Sales Intercontinental Exchange (ICE) New York, NY Justin Bergolios Manager T. Rowe Price Associates, Inc. Baltimore, MD Brent Blake Vice President State Street Corporation North Quincy, MA Joseph Blandino Vice President Markit Group Limited New York, NY James Blinn President & CEO Securities Quote Xchange, LLC (SQX) Aurora, IL Peter Borstelmann Senior Director , Head of Strategy ICE Clear Credit New York, NY Lucrecia Boulton VP - Ops Relationship Management Bank of America Merrill Lynch New York, NY Jason Brasile Vice President State Street Corporation New York, NY Carol Brown AVP, Collateral Product Management State Street Bank and Trust Company Boston, MA Mike Burdian Senior Vice President PIMCO Newport Beach, CA ATTENDEES Michael Burg Vice President State Street Corporation Pittsburgh, PA Elizabeth Flores Director CME Group Chicago, IL Mark Caldwell Associate Goldman Sachs Asset Management, L.P. Salt Lake City, UT Spencer Gallagher Senior Director, Reference Data Interactive Data Pricing and Reference Data New York, NY Timothy Cameron Managing Director SIFMA Washington, DC Sam Chari EVP, Enterprise Risk Manager PIMCO Newport Beach, CA Brian Cheney Vice President Goldman, Sachs & Co. Salt Lake City, UT Abhijit Choudhary Vice President Goldman Sachs Asset Management, L.P. Jersey City, NJ Thomas Ciulla Partner PricewaterhouseCoopers LLP New York, NY Camille Clingan Vice President, Risk Manager AllianceBernstein L.P. New York, NY Roger Cowie Vice President JPMorgan Chase & Co. New York, NY Fernando Davila Business Manager Bloomberg L.P. New York, NY Theresa DeMaio Vice President JPMorgan Chase & Co. New York, NY Juanita Dunham Senior Business Operations Analyst The Capital Group Companies, Inc. Irvine, CA Jean Ebbott Director SEI Investments Oaks, PA Samuel Ely Founding Partner Gamma Derivatives Solutions Melissa Garcia Vice President Credit Suisse Group AG New York, NY Courtney Gavin Vice President Brown Brothers Harriman & Co. Boston, MA Jennifer Gever Senior Director CME Group New York, NY Amy Gilfenbaum MD Neuberger Berman LLC New York, NY Tim Halladay Vice President The Goldman Sachs Group, Inc. Salt Lake CIty, UT Mary Harris Business Manager TriOptima New York, NY Michael Herskovitz Senior Vice President, Partner AllianceBernstein L.P. New York, NY Michael Hopkins President Broadridge Financial Solutions, Inc. Jersey City, NJ Dave Hosler Director Credit Suisse Securities (USA) LLC New York, NY Jennifer Ibrahim Director BlackRock New York, NY Mayur Java Manager PricewaterhouseCoopers LLP New York, NY As of February 9, 2015 Asset Managers Forum Jonathan Johnston Relationship Manager Omgeo LLC New York, NY Stephen Luksteid Manager Franklin Templeton Investments Short Hills, NJ Jesse Robinson Vice President GE Asset Management Incorporated Stamford, CT Gaurav Joshi Manager - FS Advisory PricewaterhouseCoopers LLP New York City, NY Kimberly McDoyle Manager NYL Investors LLC New York, NY Louis Rosato Director BlackRock Wilmington, DE Cihan Kasikara Director Franklin Templeton Investments Short Hills, NJ Malene McMahon Senior Business Manager SWIFT New York, NY Kris Rovelli Vice President Bank of America Corporation Boston, MA Steven Kelly Business Manager Bloomberg L.P. New York, NY Anthony Medici Director BlackRock wilmington, DE Mousa Salem Vice President Goldman Sachs Asset Management, L.P. Jersey City, NJ Norma Khan Analyst TIAA-CREF New York, NY Cynthia Meyn Executive Vice President & Senior Operations Manager PIMCO New York, NY Joshua Satten Enterprise Business Architect The Northern Trust Company Chicago, IL Charles Kim Head of Operational Risk Voya Investment Management Atlanta, GA Albert Morabito Director Federated Investors, Inc. Pittsburgh, PA Angela Schofield Managing Director, Investment Operations Wellington Management Company Boston, MA Louis Nazzaro Managing Director BNY Mellon Asset Servicing New York, NY Debbie Seidel Vice President T. Rowe Price Associates, Inc. Baltimore, MD Kyla LaPierre Senior Vice President State Street Corporation Quincy, MA Tricia Nguyen Office Manager TriOptima New York, NY Kishori Shah Vice President Morgan Stanley & Co. LLC New York, NY William Leahey Vice President SIFMA New York, NY Elisa Nuottajarvi Manager SIFMA New York, NY Sukrutha Shankar Officer State Street Corporation New York, NY Christopher Licini Director LCH.Clearnet Limited New York, NY Jack O’Brien VP J.P. Morgan Asset Management New York, NY Santosh Shinde Executive Director JPMorgan Chase & Co. New York, NY Gerard Lionetti Consultant Franklin Templeton Investments New York, NY Darragh O’Byrne Director UBS Investment Bank Stamford, CT Mary Shine Lead Manager T. Rowe Price Associates, Inc. Baltimore, MD Ana Lotharius Global Product Manager Omgeo LLC Boston, MA Thomas Price Managing Director SIFMA New York, NY Joe South President Shadow Financial Systems, Inc. Piscataway, NJ Larry Lubitz Associate Director CLS Bank International New York, NY Oma Rampaul Sr. Anaylst, Investment Svr. TIAA-CREF New York, NY Russell Stamey Senior Vice President The Northern Trust Company Chicago, IL Linda Kraus Managing Director New York Life Investment Management LLC New York, NY As of February 9, 2015 AMF MEMBER MEETING Robert Stewart Senior Vice President Brown Brothers Harriman & Co. Boston, MA Ian Teal Collateral Management Specialist State Street Global Services Quincy, MA Joseph Streeter Vice President State Street Corporation New York, NY Joyce Thormann Head of North American Sales and Relationship Management Euroclear Bank SA/NV New York, NY Omesh Sundaramguru Vice President JPMorgan Chase & Co. New York, NY Nora Tajian Senior Account Executive TriOptima New York, NY Gregg Weintraub Vice President State Street Corporation Princeton, NJ ATTENDEES Martin Williams Vice President, Reference Data Product Development Interactive Data Pricing and Reference Data New York, NY Neil Wright Industry Consultant DerivPRODUCT, LLC Summit, NJ Franky Zhu Director of Operational Risk AllianceBernstein L.P. New York, NY As of February 9, 2015 New York | Washington | www.SIFMA.org