financing and training needs of small-scale private

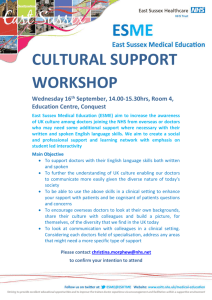

advertisement