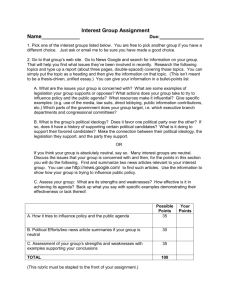

Market Neutral Strategies

advertisement