Credit Opinion: Dominion Gas Holdings, LLC

Global Credit Research - 11 Dec 2015

Richmond, Virginia, United States

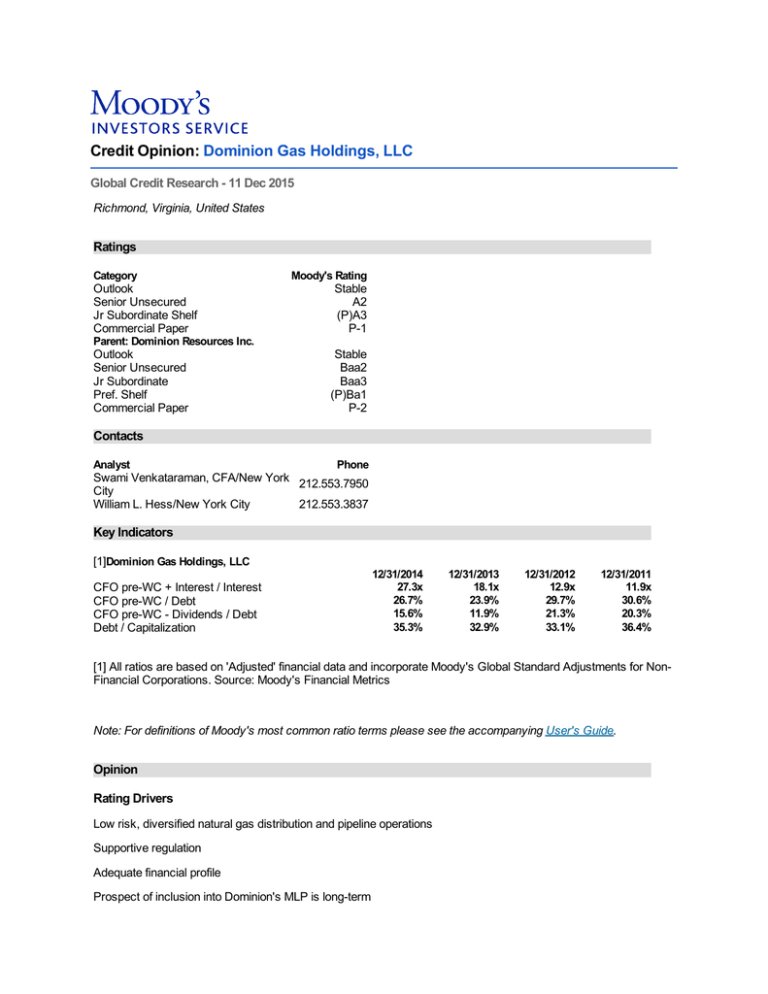

Ratings

Category

Outlook

Senior Unsecured

Jr Subordinate Shelf

Commercial Paper

Moody's Rating

Stable

A2

(P)A3

P-1

Parent: Dominion Resources Inc.

Outlook

Senior Unsecured

Jr Subordinate

Pref. Shelf

Commercial Paper

Stable

Baa2

Baa3

(P)Ba1

P-2

Contacts

Analyst

Phone

Swami Venkataraman, CFA/New York 212.553.7950

City

William L. Hess/New York City

212.553.3837

Key Indicators

[1]Dominion Gas Holdings, LLC

CFO pre-WC + Interest / Interest

CFO pre-WC / Debt

CFO pre-WC - Dividends / Debt

Debt / Capitalization

12/31/2014

27.3x

26.7%

15.6%

35.3%

12/31/2013

18.1x

23.9%

11.9%

32.9%

12/31/2012

12.9x

29.7%

21.3%

33.1%

12/31/2011

11.9x

30.6%

20.3%

36.4%

[1] All ratios are based on 'Adjusted' financial data and incorporate Moody's Global Standard Adjustments for NonFinancial Corporations. Source: Moody's Financial Metrics

Note: For definitions of Moody's most common ratio terms please see the accompanying User's Guide.

Opinion

Rating Drivers

Low risk, diversified natural gas distribution and pipeline operations

Supportive regulation

Adequate financial profile

Prospect of inclusion into Dominion's MLP is long-term

Corporate Profile

Dominion Gas Holdings, LLC (DomGas: A2 stable) is a wholly-owned subsidiary of Dominion Resources, Inc.

(Dominion: Baa2 stable) and is the holding company for Dominion's regulated natural gas operations, including

East Ohio Gas Company (East Ohio), a natural gas local distribution company (LDC) in Ohio, the FERC-regulated

interstate gas pipeline and storage company, Dominion Transmission Inc, (DTI, unrated) and an approximate 25%

limited partnership interest in the Iroquois Gas Transmission System, L.P. (A3 positive). DomGas was formed in

2013 to serve as a holding company for the gas businesses and has over time replaced virtually all inter-company

debt from Dominion with external debt. Moody's projects DomGas will represent approximately 15% - 20% of

Dominion's consolidated cash flows over the next 3-5 years, split approximately one-third / two-thirds between

East Ohio and DTI.

DomGas does not own certain gas assets that are, or will be, dropped into Dominion Midstream Partners (DM,

unrated), Dominion's MLP which went public in 2014. These include the Atlantic Coast Pipeline currently under

development and Dominion Carolina Gas Transmission LLC, a FERC-regulated pipeline that serves South

Carolina and which was acquired from SCANA in late 2014.

SUMMARY RATING RATIONALE

DomGas' A2 rating reflects its lower risk, rate regulated natural gas pipeline and LDC businesses, a wellpositioned, diversified asset base and a stable and predictable financial profile. DomGas enjoys a constructive and

supportive regulatory environment at both the pipeline (via the Federal Energy Regulatory Commission, or FERC)

and the LDC (via the Public Utility Commission of Ohio, or PUCO) businesses. There is significant ongoing capex

at DomGas, especially in expanding DTI's transmission network in the fast growing Marcellus shale region. We

expect that this will result in financial ratios weakening over the next few years. However, we expect DomGas'

financial profile to remain adequate for the rating. This includes Moody's adjusted CFO pre-WC coverage of

interest and debt at or above 10x and 22%, respectively for 2016-17. Moody's adjusted Leverage is expected to

remain modest at under 40% debt to total capitalization.

DETAILED RATING CONSIDERATIONS

LOW RISK BUSINESS AND SUPPORTIVE REGULATION

About two-thirds of DomGas' operations are associated with the low risk, FERC regulated interstate gas pipeline

and storage businesses. These pipeline operations provide strategic transportation and storage services to the

Mid-Atlantic and Northeast regions, and have a very strong market position in the fast growing Marcellus and Utica

shale plays in eastern Ohio and western Pennsylvania. Surging gas production in the region has led to very high

utilization rates for DomGas' pipelines. Firm transportation agreements generate about 95% of the transportation

revenues, and roughly 98% of its capacity is contracted long term. Moody's also views the shipper credit quality

as high.

DomGas is investing significantly in pipelines and storage facilities in Marcellus. Most of these are "producer outlet

projects" intended to serve the needs of producers who need to move gas out of Marcellus into the consuming

regions. Such pipelines necessarily carry greater counterparty and market risks than traditional pipelines that are

supported by long-term capacity contracts with regulated utilities. Although this is an increase in business risk, we

view it as being acceptable at current rating levels given the strong economics of Marcellus shale gas, and

DomGas' commanding market position. Dominion also seeks to manage its credit exposure by requiring more

stringent credit support terms than the broader market.

One-third of DomGas' business comes from the natural gas local distribution company operations at East Ohio

Gas (East Ohio). East Ohio is regulated by the Public Utility Commission of Ohio, which provides a robust suite of

timely recovery mechanisms for the LDCs operating in the state, which include a straight-fixed-variable rate

design, an accelerated pipeline replacement program, and a bad debt tracker.

ADEQUATE FINANCIAL PROFILE

DomGas has strong capex spending plan, with $1.9 billion in growth capex (Marcellus producer outlet projects and

East Ohio pipeline replacement) over and above maintenance capex. It will be able to finance this capex largely

out of operating cash flow and the increase in debt during this period is expected to largely be equal to the dividend

payments to Dominion.

Despite DomGas' strong capex program, we expect financial ratios to be adequate for the rating, with Moody's

adjusted CFO pre-WC coverage of interest and debt at or above 10x and 22%, respectively for 2016-17. Moody's

adjusted leverage is expected to remain modest at under 40% debt to total capitalization, although this is largely a

consequence of Moody's adjustments (we include deferred tax liabilities as part of book capitalization) and

DomGas is expected to maintain a regulatory approved capital structure with debt around the mid-high 40s

percent. There is no debt at the operating entities such as DTI and the East Ohio. Hence debt at DomGas does

not suffer from structural subordination.

PROSPECT OF INCLUSION INTO DOMINION'S MLP IS LONG-TERM

The inclusion of DomGas into Dominion Midstream Partners (DM), the newly created MLP, would be

consequential for the credit quality of DomGas as well as parent Dominion, especially if assets of DTI or the LDC

are moved to DM rather than equity in DomGas. In addition, partial ownership by an MLP may also pose

constraints on DomGas' financial policy.

While DomGas' assets are eligible to be transferred to DM, Moody's rating assumes that any such transfer will

take place only in the long term. The Cove Point LNG project, the Blue Racer subsidiary, the Atlantic Coast

Pipeline and Dominion Carolina Gas Transmission LLC provide enough EBITDA to support growth at DM into the

next decade. Any change to this position would cause Moody's to re-evaluate credit quality both at DomGas and

at Dominion.

Liquidity Profile

DomGas' liquidity profile is adequate. Parent company Dominion currently has two shared credit facilities (with

subsidiaries VEPCO and DomGas as co-borrowers) totaling $4.5 billion, maturing in April 2019. Dominion Gas

has a $500 million sub-limit under the first of these credit facilities, which is $4 billion in size. The sub-limit can be

increased or decreased multiple times per year, up to a maximum of $1.5 billion. At 9/30/15, Dominion reported

cash on hand of $238 million and $1.9 billion available under the credit facilities. The joint facilities contain no

material adverse change clause for borrowings but do contain a maximum 65% debt to capitalization covenant (as

defined in the credit agreements), and all three borrowers have reported that they remain comfortably in

compliance with this covenant restriction. DomGas has $400 million in notes maturing in Nov 2016.

Rating Outlook

The stable rating outlook assumes DomGas will maintain a stable financial profile, with Moody's adjusted CFO

pre-WC coverage of interest and debt at or above 10x and 22%, respectively, and that DomGas or its assets will

not be moved to the MLP for the foreseeable future.

What Could Change the Rating - Up

Upgrade potential at DomGas is limited in our view and would depend upon a significantly stronger financial profile

with cash flow to debt ratios in the high 20s percent range.

What Could Change the Rating - Down

Ratings could be downgraded if DomGas pursues a more highly levered capital structure resulting in cash flow to

debt ratios closer to the mid-teens percentage. A downgrade could also occur if DomGas creates structural

subordination risk for its debt by issuing secured debt or financing directly out of its operating subsidiaries or by

dropping assets of DTI or the LDC into the MLP.

Rating Factors

Dominion Gas Holdings, LLC

Regulated Electric and Gas Utilities Industry

Grid [1][2]

Factor 1 : Regulatory Framework (25%)

a) Legislative and Judicial Underpinnings of

the Regulatory Framework

b) Consistency and Predictability of

Regulation

Current FY

12/31/2014

Measure Score

[3]Moody's 12-18 Month

Forward ViewAs of 12/11/2015

Measure

Score

A

A

A

A

A

A

A

A

Factor 2 : Ability to Recover Costs and Earn

Returns (25%)

a) Timeliness of Recovery of Operating and

Capital Costs

b) Sufficiency of Rates and Returns

A

A

A

A

A

A

A

A

Baa

N/A

Baa

N/A

Baa

Baa

17.8x

Aaa

10x - 13x

Aaa

26.7%

16.2%

A

A

22% - 27%

12% - 17%

A

Baa

33.8%

Aa

36% - 38%

A

Factor 3 : Diversification (10%)

a) Market Position

b) Generation and Fuel Diversity

Factor 4 : Financial Strength (40%)

a) CFO pre-WC + Interest / Interest (3 Year

Avg)

b) CFO pre-WC / Debt (3 Year Avg)

c) CFO pre-WC - Dividends / Debt (3 Year

Avg)

d) Debt / Capitalization (3 Year Avg)

Rating:

Grid-Indicated Rating Before Notching

Adjustment

HoldCo Structural Subordination Notching

a) Indicated Rating from Grid

b) Actual Rating Assigned

Natural Gas Pipelines Industry Grid [1][2]

Factor 1 : Market Position (15%)

a) Demand Growth

b) Competition

c) Volume Risk & Throughput Trend

A2

A2

A2

Current

12/31/2014

Measure

Score

A

A

A

A

A

A

A

A

A

A

A

A

A

A

A

A

Baa

Baa

Baa

Baa

Baa

Baa

Baa

Baa

Baa

Baa

Baa

Baa

19.4x

26.8%

16.3%

Aaa

A

Baa

10x - 13x

22% - 27%

12% - 17%

Aaa

A

Baa

[3]Moody's 12-18 Month

Forward ViewAs of 12/10/2015

Measure

Score

Factor 2 : Quality of Supply Source (10%)

a) Supply Source

Factor 3 : Contract Quality (30%)

a) Firm Revenues

b) Contract Life

c) Shipper Quality / Recontracting Risk

Factor 4 : Financial Strength (45%)

a) (FFO + Interest) / Interest (3 Year Avg)

b) FFO / Debt (3 Year Avg)

c) (FFO - Dividends) / Debt (3 Year Avg)

Rating:

a) Indicated Rating from Grid

b) Actual Rating Assigned

A3

A2

A3

A2

[1] All ratios are based on 'Adjusted' financial data and incorporate Moody's Global Standard Adjustments for NonFinancial Corporations. [2] As of 12/31/2014; Source: Moody's Financial Metrics [3] This represents Moody's

forward view; not the view of the issuer; and unless noted in the text, does not incorporate significant acquisitions

and divestitures.

This publication does not announce a credit rating action. For any credit ratings referenced in this publication,

please see the ratings tab on the issuer/entity page on http://www.moodys.com for the most updated credit rating

action information and rating history.

© 2015 Moody’s Corporation, Moody’s Investors Service, Inc., Moody’s Analytics, Inc. and/or their licensors and

affiliates (collectively, “MOODY’S”). All rights reserved.

CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. AND ITS RATINGS AFFILIATES

(“MIS”) ARE MOODY’S CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES,

CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND CREDIT RATINGS AND RESEARCH

PUBLICATIONS PUBLISHED BY MOODY’S (“MOODY’S PUBLICATIONS”) MAY INCLUDE MOODY’S

CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS,

OR DEBT OR DEBT-LIKE SECURITIES. MOODY’S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY

MAY NOT MEET ITS CONTRACTUAL, FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY

ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT ADDRESS ANY

OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE

VOLATILITY. CREDIT RATINGS AND MOODY’S OPINIONS INCLUDED IN MOODY’S PUBLICATIONS ARE

NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. MOODY’S PUBLICATIONS MAY ALSO INCLUDE

QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND RELATED OPINIONS OR

COMMENTARY PUBLISHED BY MOODY’S ANALYTICS, INC. CREDIT RATINGS AND MOODY’S

PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND CREDIT

RATINGS AND MOODY’S PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO

PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. NEITHER CREDIT RATINGS NOR MOODY’S

PUBLICATIONS COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR

INVESTOR. MOODY’S ISSUES ITS CREDIT RATINGS AND PUBLISHES MOODY’S PUBLICATIONS WITH

THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS

OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR

PURCHASE, HOLDING, OR SALE.

MOODY’S CREDIT RATINGS AND MOODY’S PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL

INVESTORS AND IT WOULD BE RECKLESS FOR RETAIL INVESTORS TO CONSIDER MOODY’S CREDIT

RATINGS OR MOODY’S PUBLICATIONS IN MAKING ANY INVESTMENT DECISION. IF IN DOUBT YOU

SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER.

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO,

COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE

REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED,

REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN

WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON

WITHOUT MOODY’S PRIOR WRITTEN CONSENT.

All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable.

Because of the possibility of human or mechanical error as well as other factors, however, all information contained

herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the

information it uses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be

reliable including, when appropriate, independent third-party sources. However, MOODY’S is not an auditor and

cannot in every instance independently verify or validate information received in the rating process or in preparing

the Moody’s Publications.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors

and suppliers disclaim liability to any person or entity for any indirect, special, consequential, or incidental losses or

damages whatsoever arising from or in connection with the information contained herein or the use of or inability to

use any such information, even if MOODY’S or any of its directors, officers, employees, agents, representatives,

licensors or suppliers is advised in advance of the possibility of such losses or damages, including but not limited

to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial

instrument is not the subject of a particular credit rating assigned by MOODY’S.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors

and suppliers disclaim liability for any direct or compensatory losses or damages caused to any person or entity,

including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability

that, for the avoidance of doubt, by law cannot be excluded) on the part of, or any contingency within or beyond the

control of, MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers,

arising from or in connection with the information contained herein or the use of or inability to use any such

information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS,

MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH RATING OR OTHER

OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER

WHATSOEVER.

Moody’s Investors Service, Inc., a wholly-owned credit rating agency subsidiary of Moody’s Corporation (“MCO”),

hereby discloses that most issuers of debt securities (including corporate and municipal bonds, debentures, notes

and commercial paper) and preferred stock rated by Moody’s Investors Service, Inc. have, prior to assignment of

any rating, agreed to pay to Moody’s Investors Service, Inc. for appraisal and rating services rendered by it fees

ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain policies and procedures to address

the independence of MIS’s ratings and rating processes. Information regarding certain affiliations that may exist

between directors of MCO and rated entities, and between entities who hold ratings from MIS and have also

publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at

www.moodys.com under the heading “Investor Relations — Corporate Governance — Director and Shareholder

Affiliation Policy.”

For Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services

License of MOODY’S affiliate, Moody’s Investors Service Pty Limited ABN 61 003 399 657AFSL 336969 and/or

Moody’s Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended

to be provided only to “wholesale clients” within the meaning of section 761G of the Corporations Act 2001. By

continuing to access this document from within Australia, you represent to MOODY’S that you are, or are

accessing the document as a representative of, a “wholesale client” and that neither you nor the entity you

represent will directly or indirectly disseminate this document or its contents to “retail clients” within the meaning of

section 761G of the Corporations Act 2001. MOODY’S credit rating is an opinion as to the creditworthiness of a

debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to

retail clients. It would be dangerous for “retail clients” to make any investment decision based on MOODY’S credit

rating. If in doubt you should contact your financial or other professional adviser.

For Japan only: MOODY'S Japan K.K. (“MJKK”) is a wholly-owned credit rating agency subsidiary of MOODY'S

Group Japan G.K., which is wholly-owned by Moody’s Overseas Holdings Inc., a wholly-owned subsidiary of

MCO. Moody’s SF Japan K.K. (“MSFJ”) is a wholly-owned credit rating agency subsidiary of MJKK. MSFJ is not a

Nationally Recognized Statistical Rating Organization (“NRSRO”). Therefore, credit ratings assigned by MSFJ are

Non-NRSRO Credit Ratings. Non-NRSRO Credit Ratings are assigned by an entity that is not a NRSRO and,

consequently, the rated obligation will not qualify for certain types of treatment under U.S. laws. MJKK and MSFJ

are credit rating agencies registered with the Japan Financial Services Agency and their registration numbers are

FSA Commissioner (Ratings) No. 2 and 3 respectively.

MJKK or MSFJ (as applicable) hereby disclose that most issuers of debt securities (including corporate and

municipal bonds, debentures, notes and commercial paper) and preferred stock rated by MJKK or MSFJ (as

applicable) have, prior to assignment of any rating, agreed to pay to MJKK or MSFJ (as applicable) for appraisal

and rating services rendered by it fees ranging from JPY200,000 to approximately JPY350,000,000.

MJKK and MSFJ also maintain policies and procedures to address Japanese regulatory requirements.