Luminaire Level Lighting Controls Market Baseline

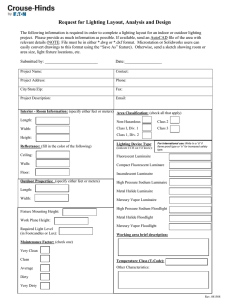

advertisement