4 IPSAS 3 and 6

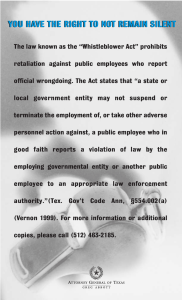

advertisement