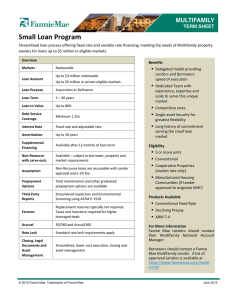

Selling Guide - October 22, 2013

advertisement