Name

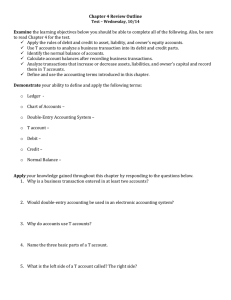

CHAPTER 4

Date

Class

Chapter Outline Notes

Transactions That Affect Assets, Liabilities, and Owner’s Capital

A. The Chart of Accounts

• chart of accounts—a list of all accounts used by a business

• a chart of accounts is organized as a table

• An account is a record of changes and balances.

• ledger—a group of accounts

• the ledger is often referred to as the general ledger

• A numbering system makes it easy to locate individual accounts in the ledger.

B. Double-Entry Accounting

• double-entry accounting—recognizes the different sides of a business transaction

as debits and credits

• debit—an entry on the left side of an account

• credit—an entry on the right side of an account

1. T Accounts

• T account—shows the increase or decrease in an account from a transaction

• A T account has an account name, a left side, and a right side.

• Accountants sometimes use DR for debit and CR for credit.

2. The Rules of Debit and Credit

• for each debit entry in one account, a credit of an equal amount must be made in

another account

• The left side is always the debit side; the right side is always the credit side.

• normal balance—an account’s usual balance; always on the side used to record

increases to the account

a. Rules for Asset Accounts

• increased () on the debit side (left side).

• decreased () on the credit side (right side).

• normal balance is the increase, or the debit side.

b. Rules for Liability and Owner’s Capital Accounts

• increased () on the credit side (right side).

• decreased () on the debit side (left side).

• normal balance is the increase, or the credit side.

Section 2: Applying the Rules of Debit and Credit

A. Business Transaction Analysis

1. Identify each account affected.

2. Classify the accounts affected.

3. Determine the amount of increase or decrease for each account affected.

4. Determine which account is debited and for what amount.

5. Determine which account is credited and for what amount.

6. Complete the entry in T account form.

B. Asset and Equities Transactions

1. Assets and Owner’s Capital

2. Assets and Liabilities

24 ■ Chapter

Spanish Outline

Language

Notes

Resources

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Section 1: Accounts and the Double-Entry Accounting System

Name

Date

CHAPTER 4

Class

Demonstration Problems

Transactions That Affect Assets, Liabilities, and Owner’s Capital

PROBLEM 4–1 Ordering and Numbering a Chart of Accounts

The following accounts are used by Gordan Enterprises.

Accounts Payable—

Custom Craft Inc.

Accounts Payable—

Sorenson Ltd.

Accounts Receivable—

Beisler Inc.

Accounts Receivable—

Hanover Company

Advertising Expense

Cash in Bank

Fees Income

Income Summary

Miscellaneous Expense

Office Equipment

Gail Gordan, Capital

Gail Gordan, Withdrawals

Supplies

Utilities Expense

1. Rearrange the accounts in the order in which they would be listed in the chart of accounts

for Gordan Enterprises.

2. Assign each account an account number.

Gordan Enterprises

Chart of Accounts

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Assets

(100–199)

Liabilities

(200–299)

Owner’s Equity

(300–399)

Revenue

(400–499)

Expenses

(500–599)

Demonstration

Chapter Outline

Problems

Notes ■ 25

Name

Date

Class

Demonstration Problems cont.

PROBLEM 4–2 Analyzing a Cash Purchase

On July 12, ABC Computers issued Check 602 for $4,700 for office equipment.

1. Which accounts are affected?

2. What is the classification of each account?

is a(n)

account.

is a(n)

account.

3. Is each account increased or decreased?

is

.

is

.

4. Which account is debited, and for what amount?

is debited for $

.

5. Which account is credited, and for what amount?

is credited for $

.

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

6. What is the complete entry in T-account form?

26 ■ Demonstration

Math Review forProblems

Accounting

Name

Date

Class

Demonstration Problems cont.

PROBLEM 4–3 Analyzing a Credit Purchase

On August 10, ABC Computers bought office supplies on account from Top Drawer Supplies

for $400.

1. Which accounts are affected?

2. What is the classification of each account?

is a(n)

account.

is a(n)

account.

3. Is each account increased or decreased?

is

.

is

.

4. Which account is debited, and for what amount?

is debited for $

.

5. Which account is credited, and for what amount?

is credited for $

.

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

6. What is the complete entry in T-account form?

Math

Demonstration

Review for

Lesson

Accounting

Problems

Footer

Plans ■ 27

Name

Date

CHAPTER 4

Class

Concept Assessment

Transactions That Affect Assets, Liabilities,

and Owner’s Capital

PART A

Accounting Vocabulary

Total

Points

Student’s

Score

81

(6 points)

Directions: Using terms from the following list, complete the sentences below. Write the letter of the

term you have chosen in the space provided.

A. normal balance

B. credit

E

C. debit

D. double-entry accounting

E. T account

F. ledger

G. chart of accounts

0.

1.

2.

3.

4.

A

is a tool used by accountants to analyze business transactions.

The

of an account is the same side used to increase the account.

The left side of the T account is the

side.

The

side is the right side of the T account.

is the financial recordkeeping system in which each business transaction

affects at least two accounts.

5. A

is a list of all the accounts a business uses.

6. Accounts are grouped together in a

.

Part B

The Rules of Debit and Credit

(15 points)

Directions: Read each of the following statements to determine whether the statement is true or false.

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Answer

T

T

F

F

T

F

T

F

T

F

T

T

F

F

T

T

F

F

T

T

T

F

F

F

T

F

T

F

0. Each account has a specific side that is its normal balance side.

1. Every business transaction affects at least two accounts that are on different

sides of the basic accounting equation.

2. For every debit entry made in one account, a credit entry must be made in

another account.

3. The T account is an inefficient method for analyzing many business

transactions.

4. Double-entry accounting is the recordkeeping system in which each business

transaction affects at least one account.

5. “Debit” means to increase an account balance.

6. The normal balance side of an account is the same side that is used to record

increases to the account.

7. Liability and capital accounts are increased on the debit side.

8. Debits and credits are used to record increases and decreases in each account

affected by a business transaction.

9. Asset accounts are increased on the credit side.

10. A credit is an amount entered on the right side of the T account.

11. If the accounting equation is not in balance after a transaction has been

recorded, one reason may be that the debit or credit part of the transaction was

not recorded.

12. When analyzing business transactions, you should ask yourself which accounts

are affected.

13. The normal balance side of an owner’s capital account is the debit side.

Concept Assessment ■ 1

Name

Date

Class

Concept Assessment cont.

PART C Analyzing Asset, Liability, and Capital Accounts

(20 points)

Directions: For each T account below, indicate the debit and credit sides, the increase and decrease

sides, and the normal balance side. The first account has been completed as an example.

Store Equipment

Debit

Increase

Balance

Accounts Payable

Cash in Bank

Credit

Decrease

Accounts Receivable

Abe Dunn, Capital

PART D Analyzing Business Transactions

(40 points)

Directions: Analyze the following transactions by answering the questions in the table below. Use

the account names that follow. The first transaction has been completed as an example.

Cash in Bank

Accounts Receivable

Office Equipment

Office Supplies

Accounts Payable

J. Adams, Capital

The business bought office supplies from Central Supply for $850 cash.

The business sold a used laser printer on account for $1,500.

Ms. Adams invested $75,000 of her personal savings in the business.

The business purchased word processing equipment for $9,500 on account from Northern

Office Equipment Company.

4. The business paid $3,500 on account to Northern Office Equipment Company.

5. Ms. Adams transferred an office file cabinet of her own valued at $375 to the business.

Trans.

No

Which acounts

are affected?

What is the

classification

of each account?

Is each account

increased or

decreased?

0

Office Supplies

Asset

Increased

Cash in Bank

Asset

Decreased

1

2

3

4

5

2 ■ Concept

Quick Quiz

Assessment

Which account is Which account is

debited and for

credited and for

what amount?

what amount?

$

850

$

850

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

0.

1.

2.

3.

Name

Date

CHAPTER 4

Class

Quick Quiz

Transactions That Affect Assets, Liabilities, and Owner’s Capital

PART A

True or False

Directions: Read each of the following statements to determine whether the statement is true or false.

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Answer

T

F

1. The normal balance side for an asset account is the

debit side.

T

F

2. “Debit” means the increase side of an account.

T

F

3. A credit to a liability account decreases the account balance.

T

F

4. Assets are increased on the debit side.

T

F

5. Capital is increased on the credit side.

T

F

6. Liabilities are decreased on the credit side.

T

F

7. The basic accounting equation may be expressed as

A L OE

T

F

8. The right side of a T account is always the debit side.

T

F

9. For every debit there must be an equal credit.

T

F

10. A debit to one asset account and a credit to another asset

account will result in the basic accounting equation being

out of balance.

T

F

11. The left side of a T account is always the credit side.

T

F

12. Credit means to decrease a liability.

Quick Quiz ■ 3

Name

Date

Class

Quick Quiz cont.

PART B

Identify the Normal Balance

Directions: For each T account below, indicate with an (N) the normal balance side.

Computer Equipment

Debit

(N)

Credit

Accounts Payable

Debit

Credit

Accounts Receivable

Abe Dunn, Capital

Debit

Debit

Credit

Credit

Cash in Bank

Debit

Credit

Office Equipment

Debit

Credit

PART C Complete the T Account

Directions: Analyze the transactions below and enter them in the T accounts provided.

1. Ms. Adams invested $12,000 cash in the business.

2. Bought office equipment for cash, $1,000.

3. Bought a computer on account, $3,000.

Office Equipment

Accounts Payable

J. Adams, Capital

4 ■ Quick

Chapter

Quiz

Quiz

Computer Equipment

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

Cash in Bank

Name

CHAPTER 4

Date

Class

Chapter Quiz

Transactions That Affect Assets, Liabilities, and Owner’s Capital

Short Answer

Directions: Complete the following questions with a short answer.

1. What is an account?

2. Describe the purpose of a ledger in an accounting system.

3. Explain double-entry accounting.

4. What is a debit?

5. What is a credit?

6. How does a debit affect an asset account?

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

7. How does a credit affect the owner’s capital account?

8. What is a normal balance?

9. Why must the accounting equation remain in balance after each transaction?

10. How would you decrease a liability account?

Chapter Quiz ■ 5

Name

CHAPTER 4

Date

Class

Math Review for Accounting

Using Tax Tables

This tax table can be used to compute yearly

federal tax for filers earning between $20,000

and $21,000.

• Earl Jones is the head of a household

and earned $20,553.

• $20,553 is between $20,550 and $20,600.

• Earl Jones’ federal income tax is $3,086.

Find the tax for each income and

filing status.

1. Sara Stein; $20,017; married filing

separately

2. Roberto Gonzales; $20,956; single

3. Li Goh; $20,834; head of household

Solve.

5. Which filing statuses pay the same tax for incomes between $20,000 and $21,000?

6. Which filing status pays the most income tax for income between $20,000 and $21,000?

7. Both Kathy Anderson and Max Gruen earn $20,947. Kathy is head of a household; Max is

married and filing separately. Who pays more tax? How much more?

8. Both Ed Antico and Sally Byrne are single. Ed earns $20,557 and Sally earns $20,594. Who

pays more tax? How much more?

28 ■ Math Review for Accounting

Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

4. Amir and Fara Mohau; $20,333; married filing jointly