a

MILITARY BANK (MB)

BankingTeam

Nguyễn Quang Huy

Email: huy.nguyenquang@tls.vn

Vũ Phương Hạnh

Email: hanh.vuphuong@tls.vn

Trần Thị Thanh Thảo

Email: thao.tranthithanh@tls.vn

Recommendation:

Target price: 16,800 VND

Military Bank is one of the strongest commercial banks in Vietnam with high growth and

high efficiency in operations, showing via both growth rates and profit ratio such as ROAA

and ROAE. MB will list shares on HOSE and increase its chartered capital up to VND

10,000 billion this year. EPS is expected to be about VND 2,660 (based on the chartered

capital at the beginning of the year). We forecast that the MB‟s stock price after listing

would be about VND 16,800 per share. After raising chartered capital, the price would be

about VND 15,500 per share.

COMPANY PROFILE

MB, which was established in 1994, is currently one of the leading joint-stock commercial

banks in Vietnam. MB‟s chartered capital by the end of 2010 was VND 7,300 billion,

increasing by 37.7% y-o-y. The total operating income in 2010 reached VND 4,088 billion,

climbing by 54% y-o-y. Net interest income reached VND 3,519 billion, increasing by

91.5% y-o-y, and Net services fee income achieved VND 588.84 billion, increasing by

54.7% y-o-y. In 2010, MB‟s total assets attained VND 109,623 billion, going up by 58.8%

y-o-y. Loans to customers and deposits of customers stood at respectively VND 48,797

billion and VND 65,741 billion, accounted for 2.5% and 3.3% of total banking market

share respectively.

UPDATES

Impressive operating results in 1H2011: The consolidated credit growth stood at

10.9% and the consolidated deposit growth reached 10.6%. Non productive loans

accounted for 17% of total outstanding loans.

On Aug 31, 2011: NPL of MB separately (not consolidated) increased slightly to 1.66%.

MB has also established over 23 transaction offices since the beginning of this year and

therefore MB possesses 163 offices recently.

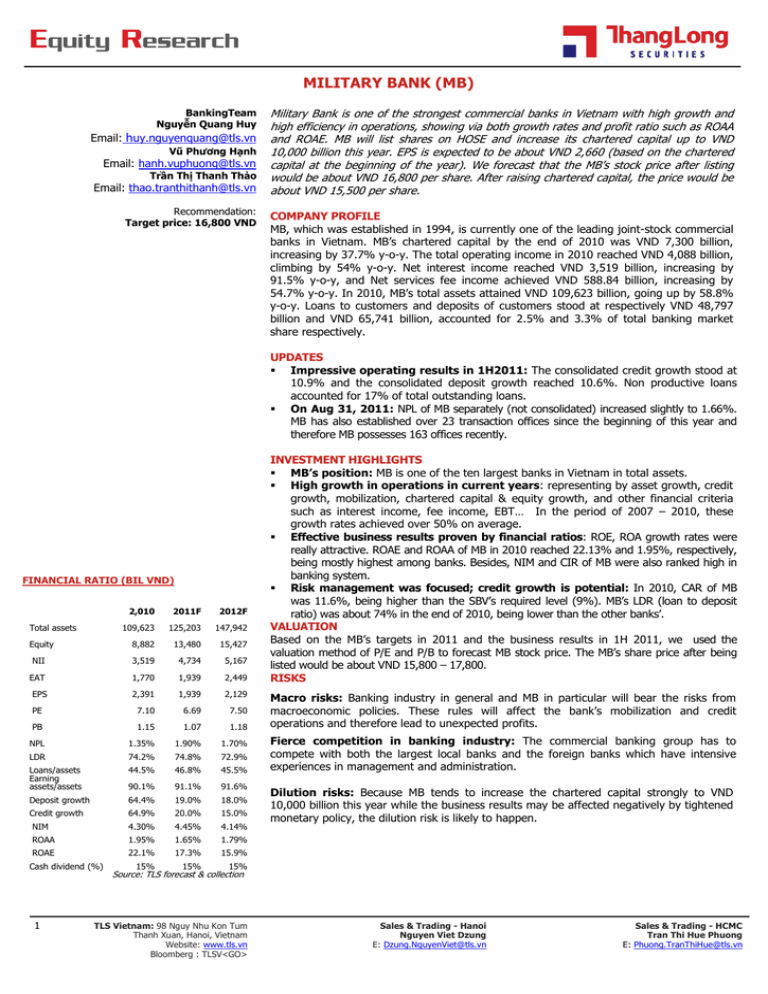

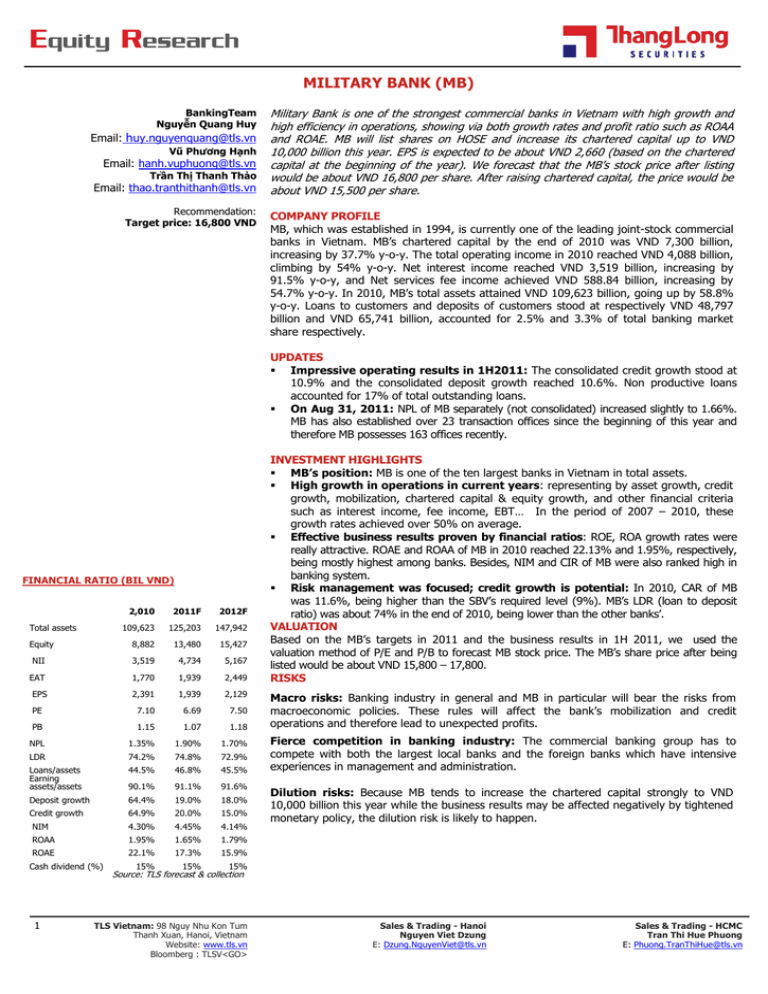

FINANCIAL RATIO (BIL VND)

Total assets

Equity

2,010

2011F

2012F

109,623

125,203

147,942

8,882

13,480

15,427

NII

3,519

4,734

5,167

EAT

1,770

1,939

2,449

EPS

2,391

1,939

2,129

PE

7.10

6.69

7.50

PB

1.15

1.07

1.18

NPL

1.35%

1.90%

1.70%

LDR

74.2%

74.8%

72.9%

Loans/assets

Earning

assets/assets

44.5%

46.8%

45.5%

90.1%

91.1%

91.6%

Deposit growth

64.4%

19.0%

18.0%

Credit growth

64.9%

20.0%

15.0%

NIM

4.30%

4.45%

4.14%

ROAA

1.95%

1.65%

1.79%

ROAE

22.1%

17.3%

15.9%

15%

15%

15%

Cash dividend (%)

1

INVESTMENT HIGHLIGHTS

MB’s position: MB is one of the ten largest banks in Vietnam in total assets.

High growth in operations in current years: representing by asset growth, credit

growth, mobilization, chartered capital & equity growth, and other financial criteria

such as interest income, fee income, EBT… In the period of 2007 – 2010, these

growth rates achieved over 50% on average.

Effective business results proven by financial ratios: ROE, ROA growth rates were

really attractive. ROAE and ROAA of MB in 2010 reached 22.13% and 1.95%, respectively,

being mostly highest among banks. Besides, NIM and CIR of MB were also ranked high in

banking system.

Risk management was focused; credit growth is potential: In 2010, CAR of MB

was 11.6%, being higher than the SBV‟s required level (9%). MB‟s LDR (loan to deposit

ratio) was about 74% in the end of 2010, being lower than the other banks‟.

VALUATION

Based on the MB‟s targets in 2011 and the business results in 1H 2011, we used the

valuation method of P/E and P/B to forecast MB stock price. The MB‟s share price after being

listed would be about VND 15,800 – 17,800.

RISKS

Macro risks: Banking industry in general and MB in particular will bear the risks from

macroeconomic policies. These rules will affect the bank‟s mobilization and credit

operations and therefore lead to unexpected profits.

Fierce competition in banking industry: The commercial banking group has to

compete with both the largest local banks and the foreign banks which have intensive

experiences in management and administration.

Dilution risks: Because MB tends to increase the chartered capital strongly to VND

10,000 billion this year while the business results may be affected negatively by tightened

monetary policy, the dilution risk is likely to happen.

Source: TLS forecast & collection

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

FINANCIAL RATIOS

INCOME STATEMENT

2010

2011F

2012F

2013F

Growth (%)

2010

2011F

2012F

2013F

Interest income

8,766

13,256

14,394

16,427

Growth of Deposit

64.4%

19.0%

18.0%

21.0%

(5,247)

(8,521)

(9,226)

(10,385)

Growth of Loan

64.9%

20.0%

15.0%

20.0%

3,519

4,734

5,167

6,042

Growth in NPL

31.1%

50.0%

12.0%

16.0%

736

846

1,057

1,322

Grth. Owners' equity

29.0%

51.8%

14.4%

19.9%

Service charge

(147)

(170)

(223)

(301)

Grth. Total assets

58.9%

14.2%

18.2%

19.4%

Net Service Inc

589

676

834

1,021

Grth of Interest income

91.5%

34.5%

9.1%

16.9%

1

(165)

8

9

Grth of Service inc

54.7%

14.8%

23.4%

22.4%

(236)

(9)

88

109

Grth o cost

59.9%

46.5%

29.3%

15.0%

-

(49)

24

53

Grth of net income

59.4%

11.1%

26.3%

28.1%

124

303

257

283

91

77

119

167

0

(420)

130

90

2,391

1,939

2,129

2,272

(1,254)

(1,836)

(2,374)

(2,730)

2,834

3,310

4,124

4,953

BVPS

Interest expenses

NII

Service fee income

Net FX gain

Net gain securities

Investment income

Other income

Income from JV

Provision for Investment

Admin & GE

Profit (pre-provision)

Per Share Data

EPS (on year end shares)

Dividend

Provision

(521)

(785)

(818)

(727)

Network

Profit before taxes

2,288

2,526

3,306

4,226

Branch

Income tax expense

(551)

(628)

(810)

(1,035)

Profit after taxes

1,737

1,898

2,496

3,190

Minority Profit

Staff

33

41

(48)

(55)

Net profit

BALANCE SHEET

1,770

2010

1,939

2011F

2,449

2012F

3,136

2013F

Cash & equivalents

869

968

1,042

1,044

Balance with SBV

746

1,134

1,246

1,508

Deposit of Banks

33,652

37,017

45,161

54,419

Trading Security

1,690

1,652

2,317

2,848

NPL ratio

LLR/Loan

Derivatives

Loans to customers

-

-

67,324

80,781

LLR/NPL

NPL/Equity

(3,068)

17,140

19,241

24,124

28,968

Property and equipment

1,224

1,595

1,835

2,110

Other assets

Total Assets

Liabilities and payable to

SBV

-

-

-

-

131

150

173

199

6,113

109,623

6,419

125,203

7,061

147,942

7,767

176,575

8,769

614

1,565

1,722

Deposits to banks

16,917

21,992

24,191

27,819

Customer deposits

65,741

78,232

92,313

111,699

-

-

-

-

Derivatives

Trust

Debt securities issued

CAR

-

(2,341)

Real estate

Asset quality / Capital

58,548

(1,523)

Other long-term assets

PE

PB

-

(738)

13,399

140

175

210

250

3,269

3,600

3,950

4,500

7.10

1.15

6.69

1.07

7.50

1.18

8.50

1.30

2010

2011F

2012F

2013F

11.60%

13.00%

12.50%

12.0%

1.35%

1.90%

1.70%

1.4%

2.6%

3.5%

3.8%

120.0%

125.0%

130.0%

6.90%

8.50%

7.40%

7.0%

2010

2011F

2012F

2013F

LDR

74.2%

74.8%

72.9%

72.3%

Loan to Asset

44.5%

46.8%

45.5%

45.7%

Inv securities/Assets

Deposit to total funding

Interbank deposit/interbank

loan

14.2%

67.8%

13.9%

73.8%

14.8%

73.4%

14.8%

74.6%

0.50

0.59

0.54

0.51

Equity/total asset

Interest-earning asset/total

asset

8.1%

10.8%

10.4%

10.5%

90.1%

91.1%

91.6%

92.3%

Balance Sheet Gearing

117

178

194

214

Revenues, cost

2010

2011F

2012F

2013F

5,411

5,059

7,588

8,347

NIM

4.3%

4.4%

4.1%

4.0%

NII/Total income

2,928

4,831

5,798

7,363

99,882

110,905

131,650

157,165

Stockholders' equity

8,882

13,480

15,427

18,491

CIR

Charted capital

7,300

10,000

11,500

13,800

-

-

-

-

Reserves

801

801

801

801

Retained earning

781

2,679

3,126

3,890

859

109,623

817

125,203

865

147,942

920

176,575

2

15%

13,415

1.5%

Total Liabilities

Minority interest

Total liabilities & equity

15%

13,480

120.4%

Other liabilities

Other Capital

15%

12,168

Valuation

48,797

Provision for credit losses

Inv securities & Cap

contribution

16.30%

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

86.1%

85.0%

79.5%

78.6%

14.40%

12.15%

12.84%

13.3%

30.7%

33.0%

36.5%

35.5%

Provision charge/loan

1.1%

1.3%

1.2%

0.9%

Return Ratio

2010

2011F

2012F

2013F

ROAA

2.0%

1.7%

1.8%

1.9%

22.1%

17.3%

15.9%

17.0%

Fees/ Total income

ROAE

SOURCE: TLS

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

INVESTMENT HIGHLIGHTS

MB’s position in financial market

Criteria

Total assets

Chartered capital

Equity

Outstanding debt

Mobilization

Earnings after tax

EIB

131,110

10,560

13,510

62,345

89,530

1,814

STB

152,560

9,179

13,983

83,042

80,528

1,905

ACB

205,102

9,376

11,375

87,195

106,936

2,334

VCB

307,496

13,223

20,669

176,972

210,339

4,235

CTG

367,712

15,172

18,170

238,494

214,826

3,414

HBB

37,987

3,000

3,533

18,704

16,322

476

SHB

51,032

3,497

4,183

24,375

25,633

494

MB

109,623

7,300

8,882

48,797

65,741

1,745

Source: Banks‟ FS 2010

At the end of 2010, MB was on the list of ten largest banks in term of total assets in

Vietnam. However, MB‟s asset size was ranked in the middle in compared with listed

JSCBs. Particularly, total assets of MB were considerably higher than the same figure of

HBB, SHB, but lower than that of VCB, CTG, ACB, STB, EIB. However, with high growth

in many indicators, the gap between MB and other leading banks in financial market is

gradually shrinking.

High growth of business results

Main data in MB‟s balance sheets and income statement during 2007-2010 were shown

in the following table. MB has achieved strong and stable growth in recent years.

Especially, tightening monetary policy in late 2008 and in 2010 strongly influenced the

economy in general and banks‟ operations in particular. However, most of financial

criteria of MB had annual growth rate greater than 50%.

Criteria

Total assets

Loan to customers

Total mobilization

Customer deposit

Chartered capital

Total operating

income

Interest income

Net service fee

income

EAT

2007

29,624

11,613

26,074

17,785

2,000

1,054

2008

44,346

15,740

39,669

27,163

3,400

1,638

2009

69,008

29,588

61,513

39,978

5,300

2,654

2010

109,623

48,797

99,882

65,741

7,300

4,088

1H2011

115,182

54,100

104,852

72,685

7,300

2,315

CAGR 2007-2010

54.68%

61.37%

56.47%

54.62%

53.97%

57.10%

633

192

1,421

191

1,838

381

3,519

589

2,410

335

77.12%

45.36%

492

703

1,095

1,745

721

52.54%

Source: MB‟s financial reports

In comparison with some listed commercial banks of group one and two, MB

achieved high and equivalent growth in most of main financial criteria. Growth rates

of many operations reached the highest level among compared banks. Specifically,

total operating income and net interest income climbed 57.1% and 77.12% per year,

twice as much as those of banks in group one like VCB, CTG, and higher than those

of banks in group two. Mobilization and credit growth stood at the highest level,

while total assets and EAT growth were only slightly lower than those of EIB but

much higher than the other banks‟.

3

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

Annual growth of some banks’ criteria during 2007-2010

Criteria

Total assets

Loan to customers

Deposit to customers

Chartered capital

Total income

Net Interest income

Net Fee income

Earnings after tax

VCB

15.9%

21.9%

13.1%

35.8%

26.0%

25.9%

33.1%

20.5%

CTG

30.3%

32.1%

22.3%

23.9%

30.6%

37.2%

62.5%

43.6%

ACB

33.9%

39.8%

24.6%

52.8%

22.0%

47.0%

45.0%

9.9%

STB

33.1%

32.4%

21.0%

34.9%

27.5%

50.0%

80.8%

11.7%

EIB

57.3%

49.7%

36.4%

29.3%

53.4%

61.5%

87.3%

57.6%

MB

54.68%

61.37%

54.62%

53.97%

57.10%

77.12%

45.36%

52.54%

Source: TLS collect

Business efficiency expressed by financial ratios

ROAE

ROAA

35.00%

2.500%

30.00%

2.000%

25.00%

1.500%

20.00%

15.00%

1.000%

10.00%

.500%

5.00%

.000%

.00%

2008

ACB

CTG

EIB

2009

HBB

SHB

2008

2010

STB

VCB

MB

ACB

CTG

EIB

2009

HBB

SHB

2010

STB

VCB

MB

Source: TLS collects

High ROE and ROA: thanks to efficiency in capital use and flexible administration, MB

has achieved good business results with high financial indicators. MB was also

categorized in the group of top banks with high ROA, ROE including ACB, CTG, VCB.

ROAE tended to increase slightly over the years. ROAE in 2010 remained at 22.13%.

ROAA of MB was high and stable over the previous years. MB‟s ROAA reached 1.95%

in 2010, being the highest among banks‟ at that time.

4

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

High NIM in compared with other banks

5.00%

- After nearly 17 years of operation, MB‟s trade name was well-known with high

prestige and relatively large network.

4.30%

4.16%

4.500%

4.00%

3.48%

- MB has tight relationship with military enterprises

3.500%

3.00%

2.500%

- The majority shareholders of MB have good potential for cooperation (Viettel,

Newport, Helicopter Corporation, the Company 28…)

2.00%

1.500%

1.00%

Therefore, regardless volatile macro factors, MB still attracted stable source of

capital with relatively low cost. These advantages led to high NIM over the

years. Besides, flexible-rate loan agreements also improved MB‟s net interest

income and NIM.

.500%

.00%

2008

ACB

CTG

EIB

2009

HBB

SHB

2010

STB

VCB

MB

Source: TLS collection.

Low operating costs

Thanks to efficient cost management, cost to income ratio (CIR) of MB remained

lower than that of other similar size banks and below the average figure of banking

sector. CIR of MB increased slightly within the last five years from 18.4% in 2006 to

30.7% in 2010 because the bank mainly developed in width. This ratio was higher

than that of Eximbank at 27.9% but lower than other banks‟.

Cost to income ratio of MB over

years

Cost to income ratio of some

banks in 2010

35%

60%

30%

25%

50%

20%

40%

15%

30%

10%

20%

5%

10%

0%

2006

2007

2008

2009

2010

0%

ACB CTG EIB STB VCB SHB HBB MB

Source: MB‟s FS.

Source: banks‟ FS, TLS

Better performance in terms of Net income/office or Net income/staff

Net income /office (Unit: bil

VND)

0,016

Nguồn: TLS tổng hợp

Net income/staff (Unit: bil VND)

0,001

0,014

0,012

0,001

0,010

0,000

0,008

0,000

0,006

0,000

0,004

0,000

0,002

-

-

2007

VCB

EIB

2008

ACB

SHB

2009

STB

MB

2007

2010

HBB

VCB

ACB

2008

STB

2009

HBB

EIB

2010

SHB

MB

Source: TLS collects

5

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

These ratios in 2007, 2008 were not prominent. However, in the last two years,

these figures were significantly higher than the other banks‟. Particularly in 2010,

they remained much higher than those of the other large banks such as VCB, ACB,

etc. In the coming years, we believe that MB will still achieve high performance

thanks to their strategy of development in both expansion and depth.

The ratio of short term capital for middle

and long term loan

30%

25%

20%

15%

MB focuses on risk management and its credit growth is potential. MB satisfied

the SBV‟s requirement about safety standards. CAR of MB was 12% in 2009, much

higher than 8% requirement. CAR of MB was 11.6% in 2010, still much higher than the

new regulation at 9%. In order to ensure safe operation and to prepare for

development opportunities, MB has planned to raise its chartered capital up to VND

10,000 billion in the near future. Thus, Capital adequacy ratio is expected to be

improved.

MB also focused on liquidity risk management, the ratio of short-term capital financing

middle and long-term loans for the years before 2008 was quite low. In 2009, MB

boosted lending via the Government‟s interest support campaign but this ratio was still

lower than 30%. In 2010, this rate dropped to 17.62%

10%

5%

0%

2006

2007

2008

2009

2010

Source: MB

LDR of some banks

120%

110%

100%

90%

74.2%

74.0%

80%

70%

60%

The loan to deposit ratio remained low. In 2008, this ratio was only 58%. In 2009 and

2010, MB boosted lending operation, leading this proportion to 74%. However, LDR of

MB was still much lower than those of other banks. Especially, LDR of MB in 2010 was

the lowest among five largest commercial banks listed on stock exchanges. This partly

reflects that MB focused on liquidity risk management as well as it implemented a

prudent policy on credit growth. It was expressed through credit growing policy as

“selective growth associated with quality management”. The lending procedures were

carried out prudently to minimize risks.

Until 1H2011, LDR of MB still remained at 74.4%. Without the impacts of the SBV„s

credit growth limitation, the credit growth of MB in the coming years is highly

potential.

57.9%

50%

2008

ACB

CTG

2009

EIB

STB

2010

VCB

MB

Source: TLS collects

6

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

Financial statement analysis

Assets

Assets structure of MB

through years

9.4%

Loan to customers accounted for the highest proportion in the asset structure and

22.1% 16.2% 17.2% 17.2%

38.7%

34.9% 42.2% 43.8% 46.1%

47.3%

2007

36.1% 34.9% 30.7%

28.7%

2008

2009

2010

tended to increase over the years. In 2008, this rate was only 35% of total assets. In

2009, it reached 42.2%, marking the boom in its credit growth. Until the end of

2H2011, this rate continued to rise up to 46.1%

Nevertheless, loan to customers over total assets of MB remained relatively lower in

compared with other banks. This ratio for other big banks were: VCB (56%), STB

(53%), CTG (63%). Along with ACB and TCB, the loan to customers/total assets of MB

was relatively low.

Credit and growth

1H2011

60,000

Deposits to banks

Loans to customers

Securities & long-term inv

Other assets

Fixed assets

Others

Loans to customer structure

54,100

48,797

50,000

70%

Source: MB

60%

29,588

30,000

40%

20,000

15,740

20%

10%

90%

18%

11%

17%

25%

50%

43%

63% 47%

21%

17%

60%

40%

56%

35%

20%

17% 14%

25%

2009

2010

1H 2011

Growth

Short-term loans

Mid term loans

Long-term loans

45%

26% 31% 31%

0%

ACB CTG EIB

0%

2008

Loans to customers

53%

14%

-

17%

30%

10%

67.1%

30%

10,000

70%

19.9%

50%

100%

80%

12.9%

80%

40,000

Banks’ assets structure

100%

90%

STB VCB TCB MB

Others

Fixed assets

Other assets

Investment securities

Loans to customers

Source: MB‟s FS

Source:MB‟s 1H2011 report

In recent years, MB had high credit growth with its outstanding debts rising strongly

from VND 15,474 billion in 2008 to VND 54,100 billion at the end of 2H 2011. Credit

growth remained high in 2009 and 2010, twice as much as that of the banking sector.

However, in 2011, MB had to adjust its credit growth plan to comply with the ceiling

credit growth stipulated by the SBV. In 1H 2011, credit growth of MB Corporation was

only 10.9%

The credit list of MB is always tightly controlled. In fact, over the year, MB has

Source: Banks‟ report 2010

maintained a high quality loan portfolio with controlled NPL, being under 1.90%. NPL

ratio of MB was lower than that of banking sector and tended to decline since 2008.

NPL of MB was 1.35% (not consolidated) and 1.26% (consolidated) in 2010.

NPL ratio of MB

In early 2011, unstable macro factors inside and outside the country have affected

2.00%

1.80%

1.60%

1.40%

1.20%

1.00%

0.80%

0.60%

0.40%

0.20%

0.00%

the solvency of customers, pushing up NPL of banking sector. The banking sector‟s

NPL increased sharply from 2.16% in late 2010 to 3.04% at the end of July 2011.

MB‟s NPL (not consolidated) went up slightly to 1.52% in 1H2011 and 1.66% in late

August 2011.

On Aug 31, MB had VND 521 billion of outstanding bond investment and VND 274

billion of outstanding guarantee for Vinashin. Currently, MB is coordinating with the

Government and Vinashin to find out debt recovery solutions. In terms of prudent risk

management, MB also actively set up provisions for Vinashin‟s bonds. For the offbalance sheet commitments, MB set up a general provisions at rate of 0.75% as

prescribed.

Source: MB

7

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

N

g

u

ồ

n

:

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

Deposits and loans to other banks: One of the large parts of MB‟s total assets is

located in the deposits and loans to credit institutions, accounting for about 30.7% of

total assets of MB Corporation in 2010 and dropping to 28.7% in mid 2011.

Loans to deposit ratio

Trading securities

2,000

Deposit & loans to banks

35,000

110%

30,000

100%

1,500

25,000

90%

20,000

80%

74%

74%

1,000

10,000

70%

58%

60%

500

5,000

-

50%

-

ACB

2007

2008

2009

2010

EIB

2009

STB

2010

VCB

MB

Source:banks‟ report, TLS

Provision

Net

Investment securities & long-term

investment

18,000

2,000

1,800

1,600

1,400

1,200

1,000

800

600

400

200

-

16,000

14,000

12,000

10,000

8,000

6,000

4,000

2,000

-

Deposits to banks

Source: MB

Investment securities and capital contribution: In 2010 and first half 2011, MB‟s

investment securities, trading securities and long-term investment capital contribution

accounted for 17.2% of total assets. In which, investment securities accounted for the

highest proportion with 14.2% of total assets and increased slightly to 14.54% by mid

2011. Held-to-maturity securities by mid 2011 valued VND 9187.7 billion, lower than

that in the beginning of the year.

Inv securities

Long-term investment

Source: MB

In the first half 2011, available for sale securities increased dramatically from VND

5542.7 billion to VND 8001.8 billion. In which, equity accounted for 8.85%,

Government bonds contributed 69.7%, 9.1% was credit institution bonds and the rest

was corporate bonds.

Long-term investment structure

36.06%

39.03%

Investment securities‟ data were presented below based on risk exposure

Unit: mil VND

Government bonds

Credit institutions bonds

Corporate bonds

Securities

Total

Provisions

Net

5.40%

19.52%

Invest

Invest

Invest

Invest

Loans of banks

MB operates strongly in the interbank market, and is always a net lending bank in this

market even when banking system‟s liquidity was low. Especially in 2009 and 2010, the

credit growth of MB in secondary market reached 50% and 40% respectively. The

operations on the interbank market bring both the liquidity reserve and substantial

income with low risk. Especially with market conditions in 2010 and early 2011,

mobilization racing has made many small banks face with liquidity risk, increasing

capital demand on secondary market, pushing up interbank rate sharply. In 2010,

income from interbank activities continued to achieve high result with VND 411.6

billion, climbing 161% in comparison with 2009. In the first half 2011, lending in

interbank market has slightly decreased to comply with MB‟s income diversifying

strategy. MB tends to reduce assets size and risk in this market in order to invest in

the other assets with high earnings and suitable liquidity.

Source: MB

in

in

in

in

economic ins

financial ins

Capital

long-term project

Source: MB

8

2008

CTG

1H2011

(500)

Trading securities

15,000

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

1H2011

9,793,691

3,876,309

2,811,332

708,191

17,189,523

(443,745)

16,745,778

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

N

g

u

ồ

Proportion

57.0%

22.6%

16.4%

4.1%

2010

8,293,881

3,676,775

3,121,975

609,031

15,701,662

(138,138)

15,563,524

Proportion

52.8%

23.4%

19.9%

3.9%

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

In 1H 2011, the structure of investment securities was changed considerably with

higher proportion of Government bonds and less corporate bonds. The structure of

investment securities of MB has helped both increasing interest income and actively

improving liquidity indicators, meeting the requirements of safety on banking‟s

operations

Trading securities: Trading securities grew strongly both in 2009 and 2010. By the

end of 2010, MB had the trading securities portfolio with the cost of VND 1,821 billion.

Long-term investment: Long-term capital contribution of MB accounted for about

1.52% of total assets by the mid 2011. This asset grows differently over the years,

declining in 2009 and rose sharply in 2010. In addition to invest in financial

institutions, MB also focuses on potential-income projects. By mid 1H2011, MB has

invested VND 665.4 billion in long-term investment projects, equivalent to 39% of

long-term investment.

Fixed assets: In recent years, particularly in 2010, MB was invested heavily in fixed

assets, increasing the long-term business capacity. Fixed assets increased by 96.4% to

VND 1,223 billion. MB is currently expanding its market share in the Middle and the

South areas. The increasing investment in fixed assets, software upgrades, technology

and network expansion require MB to increase investments. After raising chartered

capital, 28.5% of new capital increase will be invested in offices, technology and

equipment. By this time, the current fixed assets accounts for 1.27% of MB‟ total

asset.

9

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

Liabilities:

Mobilization structure

120%

100%

8.0%

5.4%

3.9%

5.4%

4.8%

70.7%

68.5%

65.0%

65.8%

69.3%

19.8%

21.5%

19.0%

16.9%

2007

2008

2009

2010

Mobilization structure of MB is relatively stable. Customers deposit is core mobilization

resource and is the most stable. Until the end of 2010, the ratio of customer deposit

per total mobilization was 65.8%. However, this ratio has improved continuously and

increased to 69.3% in mid 2011. Mobilization from economic organizations accounted

for 60.4% of total deposits and the rest came from individuals.

80%

60%

40%

20%

20.7%

0%

Comparison with other large banks, the ratio of customers deposit over total

mobilization of MB in 2010 stood high, just behind VCB and much higher than other

commercial banks.

Fund from interbank market slightly fluctuated and accounted for around 19% of total

mobilization.

1H2011

Other liabilitities

Entrusted Investment

bond & equivalents

Client

Financial Institution

Current accounts

Total mobilization

Source: MB

Customer deposit

120,000

70% 80,000

70%

100,000

60% 70,000

60%

50% 60,000

50%

80,000

40%

60,000

Liabilities structure 2010

3%

3%

13%

20%

0%

3%

18%

0%

6%

3%

1%

0%

21%

2%

11%

1%

2%

11%

5%

30%

3%

5%

0%

2%

59%

55%

71%

49%

57%

66%

57%

30%

30,000

20%

20,000

10%

-

45%

40%

40,000

40,000

5%

50,000

0%

2008

2009

Mobilization

2010

1H 2011

Growth

20%

20,000

10%

10,000

-

0%

2008

2009

2010

Customer deposit

1H 2011

Growth

31%

10%

15%

5%

12%

28%

2%

ACB CTG EIB

11%

4%

21%

4%

11%

20%

17%

6%

9%

Source: MB

STB VCB MSB TCB MB

Liabilities and payable to SBV

Deposits to banks

Customer deposits

Trust

Debt securities issued

Growth of total mobilization and customers deposit of MB from 2007-2010 was high,

with CAGR at 56.5% and 54.6% respectively.

Source:Banks‟ report 2010

This growth rate fell sharply in the first half 2011 because of tightening monetary

policy and low M2 growth. However, MB still achieved a growth of 10.6% in customer

deposits and 5% in total mobilization growth, relatively high figures among large

banks.

Along with high growth rate of total assets, equity and chartered capital have

increased correspondingly. The chartered capital of MB in 2007 was VND 2,000 billion;

until end of 2011, its chartered capital may reach VND 10,000 billion through two

times of issuance. Due to the difficulties in financial market in 1H 2011 and the

completion of procedures for MB to be listed in the HSX, until Q2, MB has not

increased chartered capital. But it expected to be able to implement the decisions of

the shareholders‟ meeting.

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

2007

Equity

2008

2009

2010

1H

2011

Chartered capital

Source: MB

10

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

Income statement analysis

Income structure

The average growth of total operating income for the period 2007-2010 remained

high, reaching 57.1% per year. In 2010, total operating income reached VND 4,088

billion, increasing by 54% over the year 2009. Interest income accounted for 81.4% of

total operating income. Fee income also had impressed growth and accounted for

13.6% of total operating income.

100%

13.6%

80%

11.7%

14.3%

14.5%

60%

40%

86.7%

In 1H 2011, total operating income of MB corporation reached VND 2,315 billion,

equivalent to 56.6% of the same figure in 2010. Especially, interest income and net

interest income grew significantly, equivalent to 76% and 68.5% of the figure in the

full year 2010 respectively.

81.4%

69.3%

104.1%

20%

0%

2008

2009

2010

-20%

Others

Securites trading

Sevice

1H2011

Capital contribution

Forex

Interest

Interest income from customer lending accounted for 61.4%, and interest income from

deposit accounted for almost 25% of total interest income. Clearly, interest income

from interbank market accounted for a considerable share of its interest income.

Interest income and NIM

Source: MB‟s report

Total operating income

4,500

64%

4,000

62%

3,500

60%

3,000

Interest income structure

10,000

5.00%

9,000

4.50%

8,000

4.00%

7,000

3.50%

6,000

3.00%

5,000

2.50%

4,000

2.00%

2,500

58%

3,000

1.50%

2,000

56%

2,000

1.00%

54%

1,000

0.50%

1,500

1,000

52%

500

-

50%

2008

2009

2010

Operating income

1H 2011

-

0.00%

2008

2009

Interest income

NIM

2010

1H 2011

Net interest income

1.23%

12.63

%

24.70

%

61.44

%

Deposit interest income

Lending interest income

Securities trading income

Other incomes from lending

Growth

Source: MB‟s report

Source: MB 1H2011‟s report

Source: Banks‟ report

NIM of MB remained high in previous years, fluctuating around 4%. In 2010, MB‟s NIM

reached 4.34%. In H1 2011, NIM was likely to be improved, pushing up net interest

income growth of MB.

Strong growth of service fee income also contributed to total income of MB. Especially

in 2009 and 2010, growth in net interest earnings and service fee income of MB

reached 99.1% and 54.7%, respectively.

In 1H2011 service fee income kept growing quite well in the slowing growth economy,

equivalent to 56.8% of 2010. Guaratee service operation grows strongly while income

from this segment reached VND 188.9 billion, equivalent to 90.56% of 2010, and

accounted for 50% of total fee income of MB in the first half 2011. Payment operation

has positive growth with its income equal to 59.2% of 2010. However, revenue from

securities services decreased sharply because stock market was gloomy and the cash

inflow was very weak in 1H 2011. The proportion of income from securities over total

service fee earnings fell from 33% to 11% in the first half of this year.

11

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

Incomes from investment operation

Service fee incomes

Fee income structure

800

700

300

19%

600

200

16%

500

100

400

2007

(100)

2008

2009

2010

1H

2011

200

(300)

100

(400)

11%

50%

300

(200)

33% 23%

20%

2007

(500)

(600)

2008

Fee income

Costs/operating incomes ratio (CIR)

36.9%

40%

35%

31.5%

33.9%

29.5%

30.7%

30%

25%

28%

2009

2010

1H 2011

Net fee income

Source: MB‟s report

Guarantee

Payment service

Securites service

Other services

Source: MB‟s report 2010 & 1H 2011

Buying and selling trading securities and investment are quite risky operations and are

sensitive to market changes. In 2007 and 2009 when the economy and the stock

market grew better, MB had positive income from these trading. On the other hand, in

2008 and 2010, the bank had loss while domestic and international financial market

turmoil occurred.

20%

15%

10%

5%

0%

2007

2008

2009

2010

1H2011

The first half of 2011 was a difficult time for the whole economy in general and for the

monetary and stock market in particular. Predicting that the stock market might be still

gloomy for quite a long time, MB executed net selling in trading securities portfolio,

reducing the cost of its portfolio by VND 183 billion, and had a loss of VND 65.8 billion

in trading securities. It also prudently and fully set provision for the depreciation of

trading securities.

In the 1H2011,MB recognized a provision of VND 497.5 billion for depreciation of

equity and fixed income securities. Of which, the bank set aside VND 230 billion

provision for Vinashin bonds‟ investment whose par value was VND 350 billion even

though this investment was not due (VND 250 billion will due in Dec 2011, VND 50

billion due in Nov 2012 and VND 50 billion due on 2017). Although MB along with

Vinashin and the Government are finding the solutions to restructure its business, this

early provision for Vinashin bonds represents the cautious view of MB. The provision

for Vinashin bonds was VND 305 billion on June 30, rising to VND 327.5 billion on Aug

31, 2011. For stocks investment, the bank also set aside provision based on current

circumstance.

Earnings after tax

2,000

1,800

1,600

1,400

1,200

1,000

800

600

400

Total operating income in 1H2011 reduced due to the investment business in 1H2011,

affecting the profitability ratios of MB.

200

2007

2008

2009

2010

1H

2011

Cost to operating income of MB fluctuated around 32%, relatively lower than other

commercial banks. However, this ratio has increased slightly in the first half 2011

because growth of operating expenses was greater than growth of operating income.

In the period of 2007-2010, MB achieved strong growth in total assets, credit and

equity. However, earning after tax growth always kept pace with the other growth

targets. CAGR in EAT was 52.5% for this period. By 2010, EAT of MB reached VND

1745.17 billion. In 1H 2011, the consolidated EAT grew slightly and reached VND

860.05 billion.

12

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

VALUATION

Based on optimistic growth of MB‟s activities in 2010 and in previous years at about

50% per annum and the bank‟s plan to expand its operations both in depth and in

width, we believe that MB probably achieves positive business results in the coming

years.

Along with the policies to control inflation and the ceiling credit growth at 20%, MB and

other credit institutions must adjust their growth targets. However, MB‟s flexible

interest rate policies may increase interest spread, which promises a strong

improvement in net interest income. The business results achieved in the first half year

was relatively positive: credit growth reached 10.87%, customer deposit growth

reached 10.56%. We believe that with those results, in the second half of 2011, MB

has the ability to control credit growth more closely to ensure growth target of this

year.

We value bank‟ stocks in general based on P/E and P/B methods. It is assumed that the

growth targets of MB is cautious under the circumstance that monetary policy may not

be eased in the coming years when SBV continues to apply the ceiling credit growth

for each bank‟s group.

Client Deposit

Mobilization growth of MB in recent years was relatively high, with its average annual

growth of 54.5% for the period 2007-2010, much higher than that of industry on

average. In 2010, deposit growth of total banking sector reached 27.2% while

customer deposit growth of MB was 64.4%. Based on the customers‟ deposit growth of

MB at 10.56% in 1H2011, the assumptions of moderate M2 growth and priority policies

for controlling inflation of the Government, total customer deposit growth of MB is

assumed at 19% for 2011 and about 22-24% for subsequent years.

Credit Operation

Credit growth largely depended on Government policies, then being different in the

previous years. In 2010, credit growth of MB was 64.9%, higher than that of banking

industry at 27.65% and higher than other banks with similar asset size

Although achieving high credit growth in 2010 and in the first half 2011, credit growth

of MB may be quite high if the ceiling credit growth have not been launched.

Cautiously, we keep credit growth this year as planned at about 20%. In 2012 the SBV

may continue to implement a tightened monetary policy in order to stably control the

inflation, It may also set a ceiling credit growth at 15% for the banking system. We

therefore assume prudently the credit growth for MB in 2012 at 15%. In 2013 we

expect the inflation surge may be control and the economy may be gradually stabilized,

we therefore assume a little higher credit growth of 20%.

We assume that NIM is not volatile and MB still maintains its advantage about NIM

higher than that of industry average.

Service Operation

Service growth was unstable with strongly growth in 2007 but slightly decline in 2008,

which was resulted from domestic and the world economy recession. However in 2009

and 2010, net service income growth remained high at 99.1% and 54.7%. In the first

half of 2011, regardless of the difficulties of economy, income from this segment still

13

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

reached 56.8% of the same figure in the full year 2010. The proportion of fee income

to total income increased from 6.13% at late 2010 to 14.5% in mid 2011.

MB plans to increase the proportion of income from services to 15% of total income by

2012, and continuously increase to 20% in subsequent years.

We do not expect high growth from service operation this year due to the difficulties of

economy, but we expect growth for the next year at 25% in the recovery period and

the expansion of MB.

Securities investment

Securities investments are more influenced by macroeconomic policy and the volatility

of the market.

In 1H2011, trading securities and investment also reported losses at VND 65.8 billion.

This loss is understandable in the context of stock market in gloomy at the first half

year. In addition, the bank had also to set provisions for securities depreciation of VND

187.7 billion, and that for securities investment was VND 306.7 billion, largely in this

provision was for devaluation of held-to-maturity securities of Vinashin bonds. These

provisions made total operating income and profit in 1H2011 go down.

We believe that when inflation declines and SBV tries to reduce the interest rate, the

stock market is likely to recover slightly, helping the banks to reduce the equity

securities‟ provisions. Therefore, this will improve the investment operation in 2011.

However, we expect profit from this segment may be improved better in subsequent

years as interest rate, inflation and stock market become more stable

NPL and provisions

NPL ratio of MB is pretty good controlled, tending to be stable and decrease over the

years. However, with the difficulties of the economy and the high lending rate in the

recent months, we believe that NPL of MB is likely to increase sharply, but still be

controlled below 1.90%. By 30/06/2011, the consolidated NPL of MB was 1.46%, just

slightly higher than that in the end of 2010. By Aug 31st 2011, the unconsolidated NPL

of MB was 1.66%. We assume the NPL in 2011 is likely to increase slightly to 1.90%

and decline slightly in subsequent years. We assume an increase in the provisions for

credit risk by nearly 26% this year to ensure full redundancy.

The operation of MB‟s subsidiaries negatively affect the bottomline earnings of the

bank in 1H2011, showing in Minority interests loss of VND 139.2 billion in the

consolidated statements in 1H2011 of MB. However, with the prudent provision for the

securities investments, and the consistent moves of the Government to stabilize the

economy, we expect that the profit of MB‟s subsidiaries may improve in the coming

time and would stably contribute to the development of the whole group.

Forward EPS

According to the shareholders‟ meeting in 2011, MB plans to increase its chartered

capital to VND 10,000 billion this year. Specifically, the bank will issue VND 1,700

billion for current shareholders and VND 1,000 billion for strategic partner(s). This

adding issuance will probably be carried out after MB is listed in stock exchange and

may be done at year end. We therefore assume that this new funding will support its

key business operations from 2012 while it contributes not much to business results of

MB in 2011

14

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

We forecast EPS in 2011 would be about VND 2,660 (with chartered capital of VND

7,300 billion), corresponding with its EAT at about VND 1,939 billion. BVPS forward is

determined on the last chartered capital at VND 14,770 per share.

Valuation

We value MB stock price with P/E and P/B valuation model. We calculate forward P/E

and P/B of 7 listed banks in the following table:

Price @3/10/2011

16,000

14,300

21,500

27,300

25,200

6,900

7,400

Average

EIB

STB

ACB

VCB

CTG

HBB

SHB

PE

6.72

6.65

6.87

10.11

8.69

5.52

6.43

7.29

PB

1.09

1.04

1.45

1.92

1.74

0.59

0.67

1.22

Source: TLS forecast

In terms of asset size and performance, we suggest that EIB and STB be the most

suitable banks to compare with MB. While VCB, CTG, ACB have greater asset size, and

HBB, SHB have smaller one. We therefore use average P/E and P/B of these two banks

for valuation

With P/E at 6.69 and EPS at VND 2,660, reasonable price of MB will be VND

17,800/share

With P/B at 1.07 and BVPS at VND 14,770, reasonable price of MB will be VND

15,800/share

Combining both methods, given 50/50 for each, we expect that the stock price will be

about VND 16,800/share after being listed. MB stock price after being issued at par

value to raise chartered capital from VND 7,300 billion to VND 9,000 billion is expected

to be adjusted down to VND 15,500/share. The issuance for strategic partners to

increase chartered capital to VND 10,000 billion depends on the agreed price that has

not been determined yet. However, we believe that there are not many effects on

market price of MB share after the issuance because strategic partners should hold for

long term strategy, along with bringing added value to MB‟s operations and corporate

governance.

15

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

RISKS

Macroeconomic risk

GDP's quarterly growth

7.488

6.784

6.520

6.114

5.826

5.570

5.430

5.324

6.4676.294

6.175

4.659

3.897

3.142

Actually, credit and mobilization growth of banks in the first half year was tightly

controlled with high lending interest rate. Up to 8 months of the year, credit growth

of the economy only reached 8.15% compared with the end of 2010, of which

outstanding loans in VND rose by 3.94%, outstanding loans in foreign currencies

increased by 23.91%.

08: 08: 08: 08: 09: 09: 09: 09: 10: 10: 10: 10: 11: 11:

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

CPI's quarterly growth

Until now, although macroeconomics risks still remain considerable such as high

inflation, decreasing GDP growth, we believe the economy is likely to be enhanced

with some positive signals. These should be a commitment to keep interest rates at

maximum 14%/year of banks, leading to a decrease in lending interest rate,

reducing pressure on the exchange rate.

3.32

2.170 2.210

2.09

1.98

1.86

1.740

1.96

1.36

1.31

1.050

0.75

The financial sector in general and the banking sector in particular will face potential

risks from changes in macro factors and policies from Government and the SBV. With

extremely high inflation in 2010, domestic currency depreciated significantly against

the U.S dollar, the economy was in chaos, creating direct impacts on business

activities and life. In 2011, with the targets to control inflation and to stabilize

economy, the Government and the SBV have implemented a series of tightening

monetary tools, starting with the Circular 01/NQ-CP on Feb 24th 2011. The first

solution is to set the annual credit growth below 20%, to reduce M2 to 15-16%

(instead of 21-24%).

1.17

1.09

0.93

0.27

0.23

0.14 0.22

0.06

Nevertheless, those macroeconomic targets have significant impacts on banking

operation directly and remarkably. With credit growth in 2010 of banking sector at

high level, even up to 40-50% at some banks, most of banks have to adjust credit

growth plan below 20% in 2011. These will impact significantly on profit targets of

the banks when credit growth often contributes mostly to operating income.

Source: TLS collection

Competitiveness among banks

The year 2010 and 1H 2011 have marked exciting activities and fierce competition

among banks. The ceiling deposit rate at 14% has not really solved the problem of

liquidity capital for banks, pushing competitive pressures, especially among smaller

banks. In order to retain customers and to ensure liquidity while still ensuring

compliance with regulations of the SBV, banks offered gift, reward, gift in kinds, gift

in interest, etc. to customers.

However, from mid 2011 until present, the tension in mobilizing competition was

partly cool down and interest rate on the interbank market also dropped

significantly. Nevertheless, the regulation about minimum chartered capital of VND

3,000 billion would have to make considerable pressure on smaller banks. The big

banks also plan to raise capital to ensure asset scale and operational efficiency.

Thus, the amount of capital raised for the entire banking sector will be pretty much ,

leading to fierce competition in credit and mobilization market share to ensure

efficient use of equity.

Along with WTO joining process, the operation of foreign banks in Vietnam will be

expanded in both size and efficiency. Besides foreign banks, the branches of foreign

banks are now up to 40. Many of them simultaneously increased the capital in the

end of 2010.

16

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

Dillution risk

MB has planned to increase its capital to VND 10,000 billion (currently VND 7,000

billion) to improve financial, operational capacity and the competitiveness. Capital

raising process is divided into two phases: raising VND 1,700 billion by offering

170,000,000 shares to current shareholders at par value; increasing capital by VND

1,000 billion by issuing 100,000,000 shares for strategic partners at agreed price

(not determined yet).

This capital raising wonders shareholders that the bank may face with risk of dilution

which declines EPS.

Network expansion

The number of branches of MB is still moderate compared to the other banks in the

group two, requiring MB to keep expanding its network.

Branches of some banks

400

Income structure by region was imbalanced while 80% of EBT came from the North

and HO while Southern market contributed only 17%. MB has planned to focus on

expanding to the south which is considered as an attractive market with great

potential. The expansion of network is not only to increase sales, attract customers,

but also shows the trade name and reputation of bank in the financial market.

350

300

250

200

150

100

50

0

VCB ACB STB HBB EIB SHB MB

2007

2008

2009

2010

By June 30, 2011, MB‟s network has a headquarter, a main transaction office, a

branch in Laos, 150 branches and transaction offices. It planned to have 207

transaction offices at the end of this year. The increase in the number of branches

may affect its performance shown by profit/branches in the short term.

Source: TLS

17

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

BUSINESS MODEL

MB was established in Nov 1994 with initial chartered capital of VND 20 billion. After

17 years of operation, MB develops strongly with its current chartered capital at VND

7,300 billion, planning to become a corporation with a parent commercial bank (one

of leading banks in Vietnam) and five subsidiaries.

SHAREHOLDERS BOARD

INTERNAL

AUDIT OFFICE

SUPERVISO

RY BOARD

NỘI BỘ

BOARD OF

DIRECTORS

BOARD OF

DIRECTORS OFFICE

SENIOR COMMITTEES

R&D DEPT

CEO

INVESTMENT URBAN

INTERNAL CONTROL BOARD

STRATEGY IMPLEMENTING

OFFICE

ACC & FINANCE BOARD

CEO OFFICE

HR BOARD

RISK MANAGEMENT BOARD

INVESTMENT & PROJECT

MANAGEMENT

CREDIT EVALUATION BOARD

Shareholders' structure

Institutions' shareholders

Individual shareholders

LARGE

CUSTOMER

SECTOR

SMALL &

MEDIUM

ENTERPRISE

SECTOR

INDIVIDUAL

CLIENT

SECTOR

TREASURY

SECTOR

DISTRIBUTION

& NETWORK

MANAGEMENT

SECTOR

OPERATION

SECTOR

I & T SECTOR

34.71%

65.29%

152 BRANCHES & TRANSACTION OFFICES

Big shareholders' structure

Vietcombank

Viettel

Helicopter corporation of Vietnam

Newport corporation Saigon

Others

11%

10%

By 30/6/2011, MB‟ operational system included: a headquarter, a main transaction

office, a branch in Laos, 150 branches and transaction offices, 327 ATMs, 1,328 POS

machines distributed in 24 provinces and cities around the country, 5 subsidiaries

and 3 associated companies.

7.24%

66%

5.71%

Source: MB

18

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

Subsidiaries

No

Name

Business scope

1

Thanglong Securities

2

3

MB capital

Debt & assets

management company

Ltd

MB property company

Ltd

Viet R.E.M.A.X

4

5

Brokerage

&

trading

securities

Asset management

Debt & asset management

Investment & trading real

estate

Investment in office for rent

Chartered

capital

1200

%

ownership

61.85%

100

514.28

61.78%

100%

571.48

65.26%

100

78.09%

Source: MB

Associated companies

No

1

2

3

Name

Business scope

Viet-Asset Company

Investment in construction

Long thuan loc

Constructions

company

Military insurance joint Non-life insurance

stock company

Chartered

capital

11.11

100

%

ownership

45%

29.37%

300

18.00%

Source: MB

Strategic partners

MB recognizes that building comprehensive partnerships in order to fully utilize the

strengths and competitive advantages of all sides is a necessary and essential goal.

MB currently has strategic cooperative partnerships with several important partners

such as Vietnam Helicopter Company, Tan Cang Sai Gon Company, Military

Telecommunications Corporation (Viettel) and Commercial Joint Stock Bank for

Foreign Trade of Vietnam (Vietcombank). Moreover, MB has signed numerous

comprehensive cooperative agreements with corporations and large enterprises like

Vietnam Machinery Erection Corporation (LILAMA), Vietnam National Petroleum

Corporation (PetroVietnam), Vietnam Coal and Mineral Industrial Corporation (TKV),

Song Da Company, Highland Coffee (Company), Military Petroleum Company and

many other private corporations.

The main operations and services of MB

Mobilization operation

With the advantage of the large and reputational commercial bank, MB‟s mobilizing

operation still achieved relatively positive results during 2008-2010, even though

these were the years when the financial crisis and the competition among banks was

extremely fierce. The ability of stable mobilization has helped MB controlling liquidity

risk.

MB received money deposits from economic institutions and individual via numerous

channels. Deposits that come from economic institutions through MB‟s network of

sales offices from CIBs (large enterprises and financial entities), SME (small &

medium enterprises) and individual investors have brought about favourable results.

MB has a diverse and flexible variety of means of deposit which serves well to meet

the deposit needs of corporate and retail clients.

Besides traditional mobilization, MB also implements modern banking service like

cash management and other financial advisory services that give MB a large stability

in capital.

19

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

According to the data of stockplus, we find that the deposit market share of MB was

3.3%.

Credit operation

With the participation of the Head Office Credit Committee to ensure the highest

quality of loans approval process, MB has minimized credit risk.

MB has always achieved good growth in both client number and the scale of

outstanding loan. The average growth rate of client number from 2008 to2010 was

15%. The CAGR of total loan during 2008-2010 was 61.37%.

The amount of loans to institutional clients usually accounts for over 80% of MB‟s

total outstanding loans.

MB has sponsored several economic corporations and companies, contributing to

important projects. These institutions include: Tan Cang Sai Gon Corporation,

Military Telecommunications Corporation (Viettel); Vietnam National Petroleum

Corporation; Vietnam Coal and Mineral Corporation (TKV); Song Da Corporation;

Energy project group of National Power Transmission Corporation, Vietnam

Helicopter Corporation; Northern / Central regions power project management

Commission, etc.

To meet the requirement of the SBV on reducing lending rates for non-productive

areas in 2011 under 16%, MB maintained this ratioat about 30% in 2010 and about

17% in 1H 2011. In which, property loans was 6% and consuming loans was 9%.

MB will ensure the rate of non-productive loans at 16% in late 2011.

By 2010, credit market share of MB was 2.5%.

Service operation

MB provides a wide range of guarantee services like bid security, contract

performance guarantee, refund in advance guarantee, guarantee of payment, tax

payment guarantee, etc.Total guarantee revenue in 2009 reached nearly VND 111

billion, increasing by 45% compared with 2008 and 2.4 times compared with 2007.

By the end of 2010, guarantee revenue of MB achieved VND 209 billion, increasing

by 88.29% over the year 2009. MB‟s bank guarantee operations have significantly

contributed to MB‟s sources of income and this is always efficient and prudent

without any substantial risk events.

The network of over 800 correspondent banks worldwide has helped MB‟s payment

operation being fast and accurate. In 2006, 2007, and 2008, MB was awarded

“excellent international payment operation bank” by Citigroup. In 2007, MB was

awarded “outstanding bank for implementing international transaction” by HSBC

group. In 2008, MB was awarded “bank with the highest rate of success of

settlement” by Wachovia N.Y Bank.

In 2010, despite the difficulties of import-export activities in the country, the

international payment service of MB still grew strongly over the previous years. By

2010, the total international settlement value of MB reached VND 5,3 billion,

increased by 71% of 2009. Fees from international payment operation reached VND

82,861 billion, increased by 7% compared with the same period last year

Investment & trearsury operations

Investment and trading on financial market are core businesses of MB, including

equity and fixed-income securities.

20

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

Securities trading operation include self investment, buying and selling securities of

the member units, mainly in TLS and MBCapital. Trading securities are maintained

with a small proportion of total investment portfolio.

MB cotributes long-term capital to implement a number of great potential projects

with high profitability, along with creating opportunities for cooporation and

providing banking products, such as mining project ICD Long Binh, Tan Cang-Cai

Mep, Thai An, Hua Na hydropower, Viettel postal,etc. In addtion, MB also made

some strategic investment and participation in foundation of some large number

financial institutions, such as Military Insurance Company, Song Da Finance,

Handico Finance, Vinaconex, Viettel,etc.

Card services

The bank successfully established connections with the card union system

SmartLink. Today MB has officially become a member of Master. Regarding the Visa

Card project, MB succeeded in launching an internal payment system on December

27, 2010.

On December 31, 2010, MB issued a total of 398,000 cards ; the number of POS

reached over 1,328, and there were 327 ATM machines in opearations in the

system. Visa Card and Master Card were issued in early 2011.

IT

MB is always a leader in developing information technology systems, aiming at

bringing to clients the best services in the shortest time. MB continues to invest in

information technology serving banking operations.

The data center upgrade and reserve center construction project: In order to

improve the capacity of the server system and the data storage system, ensuring

adequate infrastructure for the next 5 year-period of MB.

MB uses T24 core banking software provided by Temenos. The modern software

helps MB increasing transaction processing speeds and security capabilities. MB

plans to upgrade T24 from version R5 to R10 to improve business capacity.

21

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn

a

ANALYST DECLARATION

Conflicts of interest might exist as ThangLong Securities (“TLS”) and its clients might have stakes in the target firm through

investments and/or advisory services in the past, at present or in the future.

PRODUCT

This product covers the latest developments on the target firm. Details on the firm can be obtained by contacting our analyst(s) or

the sales persons named above. We thank clients for comments and feedbacks on our product. TLS publishes this product, but all

errors if any are the authors‟.

Analyst‟s opinion: BUY – expected to gain more than 15% compared to the price on report issue date; SELL – expected to drop more

than 15% compared to the price on report issue date; HOLD – expected to change between -15% to 15% compared to the price on

report issue date.

TLS RESEARCH TEAM

We offer economic and equity research. The Economic Research Team offers periodic reports on macroeconomics, monetary policies

and fixed income markets. The Equity Research Team offers reports on listed firms, private equities and sector reviews. TLS

Research Team also offers regular market commentaries - The Investor Daily.

THANGLONG SECURITIES (TLS)

Established in 2000, TLS was one of the first securities firms operating in Vietnam. TLS provides a full range

of services including brokerage, research and investment advisory, investment banking and capital markets

underwriting. With 500 employees located throughout an expansive network of offices in Hanoi, Ho Chi Minh

City, Hai Phong, Da Nang and other strategic locations, TLS is one of the best known securities firms in

Vietnam. Our client base consists of retail and institutional investors, financial institutions and corporations.

As a member of the MB Group, including MB Bank, MB Land, MB Asset Management and MB Capital, TLS is

able to leverage substantial human, financial and technological resources to provide its clients with tailored products and services

that few securities firms in Vietnam can match. Since its establishment, TLS has become widely regarded throughout Vietnam as:

A leading brokerage firm – ranked No.1 in terms of brokerage market share since 2009;

A renowned research firm with a team of experienced analysts that provides market-leading research products and commentaries

on equity markets and the economy; and

A trusted provider of investment banking services for corporate clients.

OFFICES

Headquarter: 98 Nguy Nhu Kon Tum,Thanh Xuan District, Hanoi. Phone: +84 4 37262600.

HCMC Office: Level 2, Petro Vietnam Tower, 1-5 Le Duan, District 1, Ho Chi Minh City. Phone: +84 8 39106411.

Research Office: Level 7, 98 Nguy Nhu Kon Tum, Thanh Xuan District, Hanoi. Phone: +84 4 44568668. E: research@tls.vn

DISCLAIMER

The views expressed in this report are those of the authors and not necessarily related, by any sense, to those of TLS. The expressions

of opinions in this report are subject to changes without notice. Authors have based this document on information from sources they

believe to be reliable but which they have not independently verified. Any recommendations contained in this report are intended for

general/public investors to whom it is distributed. This report is not and should not be construed as an offer or the solicitation of an

offer to purchase or subscribe for any investment. This report may not be further distributed in whole or in part for any purpose. No

consideration has been given to the particular investment objectives, financial situation or particular needs of any recipient.

Copyrights. TLS 2000-2010, ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a retrieval system, or

transmitted, on any form or by any means, electronic, mechanical, photocopying recording, or otherwise, without the prior written

permission of TLS.

22

TLS Vietnam: 98 Nguy Nhu Kon Tum

Thanh Xuan, Hanoi, Vietnam

Website: www.tls.vn

Bloomberg : TLSV<GO>

Sales & Trading - Hanoi

Nguyen Viet Dzung

E: Dzung.NguyenViet@tls.vn

Sales & Trading - HCMC

Tran Thi Hue Phuong

E: Phuong.TranThiHue@tls.vn