inspiring minds - Informatics Education

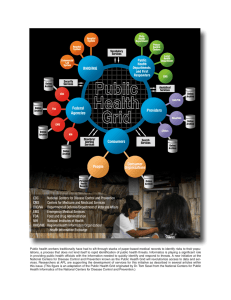

advertisement