Oppenheimer Rochester® Fund Municipals

Q2 2016 Fact Sheet

(A/C/Y) RMUNX, RMUCX, RMUYX | As of 6/30/16

Calendar Year Total Returns % (Without Sales Charge)

2007

Morningstar Rating™

2008

2009

2010

2011

2012

2013

2014

2015

YTD

★★★★★

A Shares -1.59

-30.84

45.07

3.63

11.50

12.94

-10.84

14.43

1.94

8.15

Y Shares -1.44

-30.74

45.18

3.84

11.64

13.10

-10.72

14.60

2.09

8.22

Y shares are not available for all investors. See the prospectus for details.

Class Y Shares rated 5 stars by Morningstar among 89

Muni New York Long funds for the 3-,5- and 10- year

periods ended 6/30/16¹ based on risk-adjusted

performance.

Average Annual Total Returns and Expense Ratios %

Strategy Focus

1-Year

A Shares w/o Sales Charge

A Shares w/Sales Charge

Y Shares

Bar Municipal

10-Year

15-Year

20-Year

Life

The Strategy typically invests in New York municipal

bonds.

3-Year

5-Year

11.56

4.96

6.33

4.40

5.14

5.44

6.40

6.26

3.27

5.30

3.90

4.80

5.19

6.23

Portfolio Characteristics

11.73

5.11

6.47

4.55

5.29

—

5.68

Portfolio Inception

7.65

5.58

5.33

5.13

5.10

5.46

—

Annual Expense Ratio: Gross: A shares: 0.86% / Y shares: 0.71%. Net: A shares: 0.79% / Y shares: 0.64%. Class A inception date is 5/15/1986. Class Y

inception date is 4/28/2000.

The performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an

investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Current performance

and expense ratios may be lower or higher than the data quoted. For performance data current to the most recent month-end, visit oppenheimerfunds.com.

Class A returns include changes in share price and reinvested distributions, and a 4.75% maximum applicable sales charge except where "without sales

charge" is indicated. Class Y shares are not subject to sales charge. Returns do not consider capital gains or income taxes on an individual’s investment.

The net expense ratio represents the Fund's gross expense ratio less certain interest and related expenses from the Fund's investments in inverse floaters,

as reported in the latest prospectus. Under accounting rules, the Fund recognized additional income in an amount that offsets these expenses; the Fund's

total returns and net asset values are not affected by those offsets. The net expense ratio is not the result of a fee waiver or expense reimbursement. Please

refer to the disclosure statements for definition of the indices.

Lipper Peer Ranking*-New York Municipal Debt Funds²

A Shares

1-Year

3-Year

5-Year

10-Year

15-Year

20-Year

Percentile

4th

73rd

9th

57th

7th

5th

Ranking

3/97

69/94

7/85

37/64

4/57

2/44

Y Shares

1-Year

3-Year

5-Year

10-Year

15-Year

20-Year

Percentile

3rd

65th

6th

40th

4th

—

Ranking

2/97

61/94

5/85

26/64

2/57

—

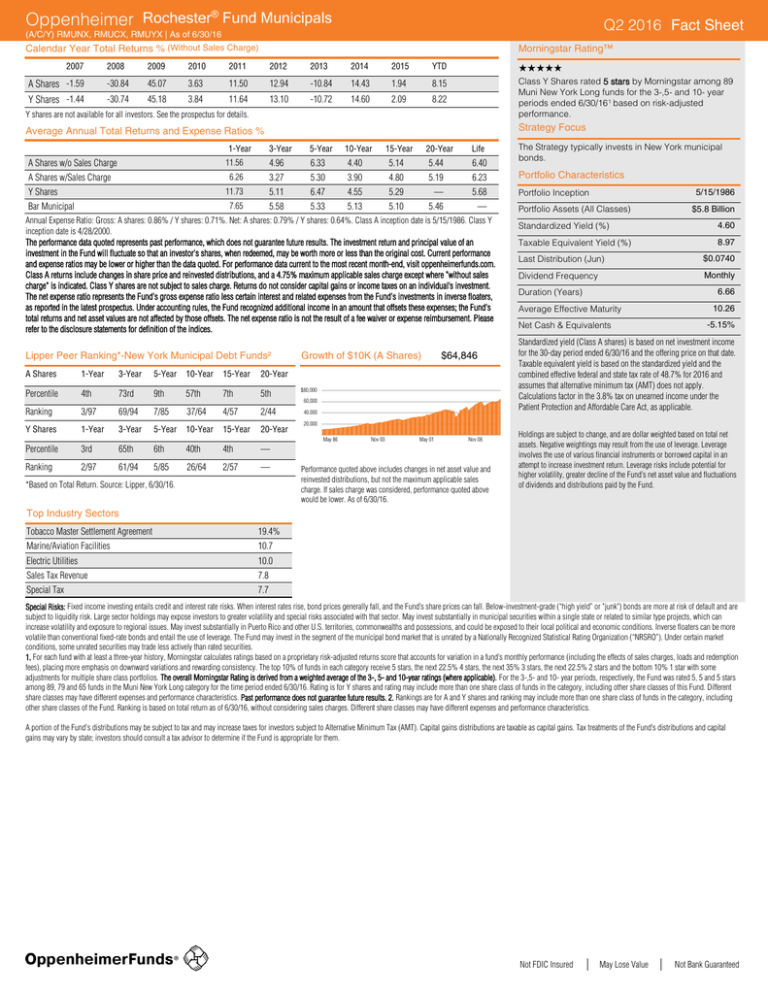

Growth of $10K (A Shares)

$80,000

60,000

40,000

Portfolio Assets (All Classes)

$5.8 Billion

Standardized Yield (%)

4.60

Taxable Equivalent Yield (%)

8.97

Last Distribution (Jun)

$0.0740

Dividend Frequency

Monthly

Duration (Years)

6.66

Average Effective Maturity

Net Cash & Equivalents

10.26

-5.15%

Standardized yield (Class A shares) is based on net investment income

for the 30-day period ended 6/30/16 and the offering price on that date.

Taxable equivalent yield is based on the standardized yield and the

combined effective federal and state tax rate of 48.7% for 2016 and

assumes that alternative minimum tax (AMT) does not apply.

Calculations factor in the 3.8% tax on unearned income under the

Patient Protection and Affordable Care Act, as applicable.

20,000

May 86

*Based on Total Return. Source: Lipper, 6/30/16.

$64,846

5/15/1986

Nov 93

May 01

Nov 08

Performance quoted above includes changes in net asset value and

reinvested distributions, but not the maximum applicable sales

charge. If sales charge was considered, performance quoted above

would be lower. As of 6/30/16.

Holdings are subject to change, and are dollar weighted based on total net

assets. Negative weightings may result from the use of leverage. Leverage

involves the use of various financial instruments or borrowed capital in an

attempt to increase investment return. Leverage risks include potential for

higher volatility, greater decline of the Fund’s net asset value and fluctuations

of dividends and distributions paid by the Fund.

Top Industry Sectors

Tobacco Master Settlement Agreement

19.4%

Marine/Aviation Facilities

10.7

Electric Utilities

10.0

Sales Tax Revenue

7.8

Special Tax

7.7

Special Risks: Fixed income investing entails credit and interest rate risks. When interest rates rise, bond prices generally fall, and the Fund’s share prices can fall. Below-investment-grade (“high yield” or "junk") bonds are more at risk of default and are

subject to liquidity risk. Large sector holdings may expose investors to greater volatility and special risks associated with that sector. May invest substantially in municipal securities within a single state or related to similar type projects, which can

increase volatility and exposure to regional issues. May invest substantially in Puerto Rico and other U.S. territories, commonwealths and possessions, and could be exposed to their local political and economic conditions. Inverse floaters can be more

volatile than conventional fixed-rate bonds and entail the use of leverage. The Fund may invest in the segment of the municipal bond market that is unrated by a Nationally Recognized Statistical Rating Organization (“NRSRO”). Under certain market

conditions, some unrated securities may trade less actively than rated securities.

1. For each fund with at least a three-year history, Morningstar calculates ratings based on a proprietary risk-adjusted returns score that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads and redemption

fees), placing more emphasis on downward variations and rewarding consistency. The top 10% of funds in each category receive 5 stars, the next 22.5% 4 stars, the next 35% 3 stars, the next 22.5% 2 stars and the bottom 10% 1 star with some

adjustments for multiple share class portfolios. The overall Morningstar Rating is derived from a weighted average of the 3-, 5- and 10-year ratings (where applicable). For the 3-,5- and 10- year periods, respectively, the Fund was rated 5, 5 and 5 stars

among 89, 79 and 65 funds in the Muni New York Long category for the time period ended 6/30/16. Rating is for Y shares and rating may include more than one share class of funds in the category, including other share classes of this Fund. Different

share classes may have different expenses and performance characteristics. Past performance does not guarantee future results. 2. Rankings are for A and Y shares and ranking may include more than one share class of funds in the category, including

other share classes of the Fund. Ranking is based on total return as of 6/30/16, without considering sales charges. Different share classes may have different expenses and performance characteristics.

A portion of the Fund's distributions may be subject to tax and may increase taxes for investors subject to Alternative Minimum Tax (AMT). Capital gains distributions are taxable as capital gains. Tax treatments of the Fund’s distributions and capital

gains may vary by state; investors should consult a tax advisor to determine if the Fund is appropriate for them.

Not FDIC Insured

May Lose Value

Not Bank Guaranteed

Oppenheimer

Rochester Fund Municipals

(A/C/Y) RMUNX, RMUCX, RMUYX

Investment Approach

The portfolio managers invest in municipal bonds that offer attractive, tax-free yield, within

prospectus parameters. Their investment process employs a bottom-up, research-oriented

approach to generate long-term, income-driven total return.

Duration (Years): Duration measures interest rate sensitivity; the

longer the duration, the greater the volatility as rates change.

The Barclays Municipal Bond Index is an unmanaged index of a broad range of investment-grade municipal bonds that measures the performance of the general municipal bond market.

Index performance is shown for illustrative purposes only and does not predict or depict performance of the Fund. Past performance does not guarantee future results.

Visit Us

oppenheimerfunds.com

Call Us

800 225 5677

Follow Us

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks,

including the possible loss of the principal amount invested.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges

and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained

by asking your financial advisor or visiting oppenheimerfunds.com. Read prospectuses and summary prospectuses carefully before

investing.

Oppenheimer funds are distributed by OppenheimerFunds Distributor, Inc.

225 Liberty Street, New York, NY 10281-1008

©2016 OppenheimerFunds Distributor, Inc. All rights reserved.

IF0365.002.0616 June 30, 2016