It/ vj - Foundation Center

advertisement

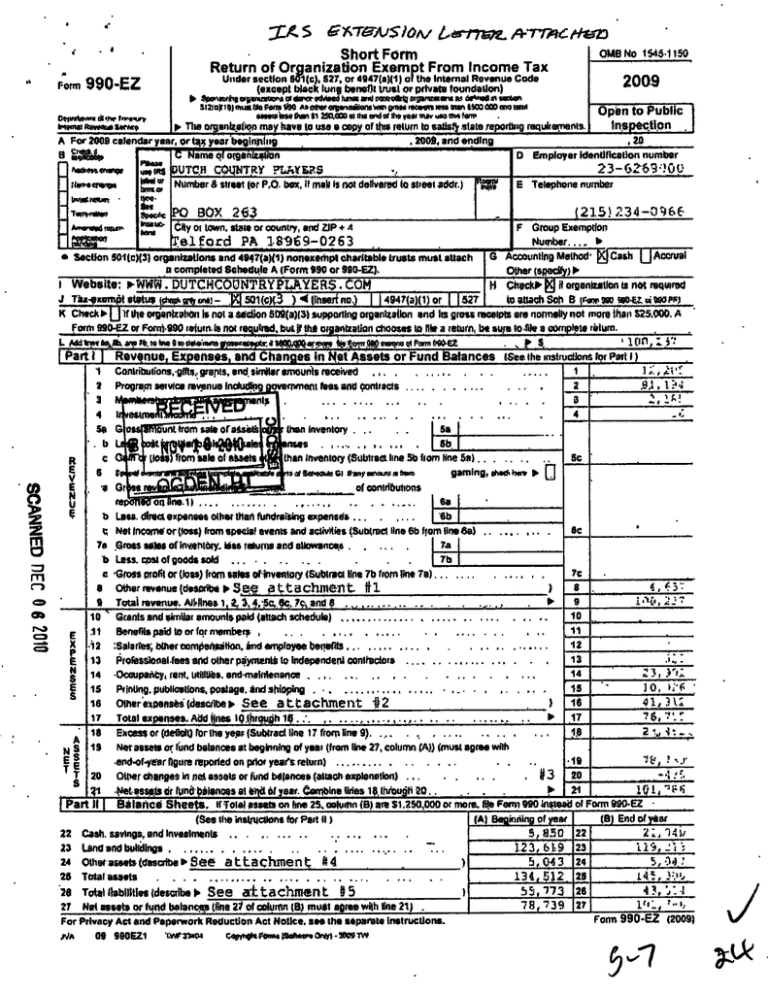

rorn^ 990-EZ

^

Short Form

Return of Organization Exemt From Income Tax

oM8 No 154.1150

Under section 1 (c), 627, or 4947(a)(1) o f the Internal Revenue Code

(except black lung benefit trust or private foundation)

200.9

e0 Naxs ar I re^llol^r10 tirsprr'we. m fs der^am sreha^

V5'1NIttsspu+inr4a^a atdw^nr,'0

sr2"aJ " q)irnsIMcerm*0 +^aaerordr^a"iua,. w,mp.nr''«.oisrer.o^+kSw000morona

M.S1, I »r Gen 11 lSC.EnO 01 no and er ft Var l rur wa ew'anr

OMwt.r dt.he rw"pv

O p en to Public

IRs etion

^ The orgeniz (son may have to use a copy of this return to salts state reporting requirements.

"Ml r_,v__ s "

A For 2009 calendar year, or Ia4 year begirrfting

. 2009. and ending

.20

8C Name o otgenisaiibn

D Employer Identification number

rwre.senxrgr

^3-G^'fla !UL

rwr

p DUTCH C{ NTRY PLhYSRS

;ramecr s,

E Telephone number

Wilt&' Number & street (or P,Q. box, it mak Is not delivered to street addr.)

mum-

k"

BOX 2$3

City of town , state or country, and ZIP + :t

(215).2-34-0;166

F Group Exemption

_

Number.... ^

.e1 ford PA 18969-0263

G Accounting Method - Fj Cash U Accrual

Other (s ,

)^

t Website ; R WKW . DUT CHCOUNTRYPLAYERS. COM

if organization to not required

H Check '

J Thx-*xumpt status i¢rr#

vAj - -Pq 501(c)(.3 ) +E (Inner[ no.)

4$47(x)(1) or

5527

in attach $oh B reran 09D c 04L, r,i WOI'M

K Check ^

if the cryaptrati0 n Is not a Mcdon 5D9(a)(3) supporting organization and Its gross receipts are normally not more than $25,000. A

Form 990•EZ or Fomi•990 ratum•Is not required , butt the organization chooses to file a return, be sufe to file a complete reium.

• Section 501tc)( 3) organizations and 494T(a)(1) nonexemps charitable trusts must attach

a completed Schedule A (Form 990 or 990-EZ).

k

i

i,Q34ent

(0e fiwm' W rwmrw pl Fbm 000-M

Ravanue . EYnene e . end Chances In Not Assets or Fund alances

L *dd finer eg $+ .vo i8. m Nne 9 "o

Part I

Contributions ,•gfft , grants, and. shatter amounts received

2

Program service revenue Indu^tq overnment fees ant! contracts ....

gnenis

I estme 1.

V

A

...

...

5a G a

punt tram sale oraSset's

then inventory . ..

Ifaip$., L

(los9 from sate of skeete

WIM1e

nees

, ..

bb,

, .

-

than Inventory (Subtraet line 5b from line 52) .. .

amt.

sat aanaaae Gr a•,ey.na ni is tam

gaming , ~. t,a. P.

6

CAI

E

n

U

E

v

•a tar

Mgdi

of contributions

-'

re

so

on ne. t I

....

,

. . .....

b Les. direct expenses Other than fundraising expenses .. ,

..

' Bb

0 Net ink or (loss) from special events and activities ( Subtract One fib ffom tine 6a) .....

7a

78 Gross sites of inverIbry.. Was rdurns and allowances .

7b

b Less. cost of goods sold

m

0

m

rv

0

0

^"d

Sc

..

E

B

D

E

X

E

13

Profasslonal .fees artd outer payments to independent conlhsciors

N

14

•t>oipanty, rent, utilities. and-mairdenance

15

Pr inting . publications, postage, arrd sh(t>ping

Grants and eirnllar amounts paid (alta h schedule) .............. . ..... .. ....

. .

.. .

.

.. . , ....

Benefits paid to or far members ,

:Salaries, bthercompedaation. Snd employee benefits ,

.

...

)

^

..

...

8 .

9

10

,r

..

_

i ^i+,

11 .

12

13

.... .. ....... ...

,.

e

Sc

7c

a 'Gross proM or (loss) from sales ofinventaly (Subtract line 7b from line 70). .. ....

Other revenue (dest»e ^ 3Pe . attachment tE 1

Tutai revenue. All4lnes 1 9.3.4, •5c, 6a_, 70, and 8

a

9

10

11

•i2

_ ^.

4

Sa

.

b

c

2

....

.....

I

R

v6

` 1f

L

tree the instructions for Part I I

.•

14

23, 3'

15

10,

Other e%pensbs (describe ^ See attachment 442

) 16

41, 3

17

7 6,

^

Total expenses. Add $nes IO,thraugh

18

2 •,,

Esscees or (de0alq for the year (Subtrad line 17 from Ina 9). •

• ..

'. .

A

Net assets or fund balances at beginning of year (from Ilne 27, column (A)) (must agree with

Ng

-end-of-year figure reported on prior year's return)

ES

" #' ' • .r

• 19

..

. •

20

•4 : `.

.

,

in

.

T S 20

net

explanation

)

.

.

..

.

Oilier changes

assets or land b8 (anoea (attach

,

03

j (1 ! ,

^

21

1 •(ret assp dr fund, beianods at 644 of year. Cambine Was 10, throu ' li 20. .

Fart tt

Baiafloe Sheets . If Total assets on fine 25. column (B) are $1.250.000 or more, fits Form 490 instead or Form 99o•te

inriln of dear

(B End of year

(A)

(See the instructions for part ii )

14 li

_ 22

2

5, 83 0

22 Cash . savings, and Investments

, ...

11 'i', 71

23 Wnu and buildings .

i.2 3, b is 9 23

....

..

, ...

S

16

17

18

19

24 otnar assets (desclea ^ 3ee a t L chmen t 44

25

Tatar assets

.. ,

....

Net assets or fund belancp (line 21 of eo(unln ( B) must agree with line 21) .

For Privacy Act and Paperwork Reduction Act Notice , see the separate Instructions .

'rwr3s"a+

cspngt Fae.a t +a'*,nrrs - WW IW

,+VR

09 990EZ1

5, G4 3 24

13 4 ^)

.. .. ....

70 To(a113abilities (describe b See attachment #5

21

)

1

26

5.14

1k1

;:" ",

55, 773 26

-18,-739

27

1 rr : + ? .•

Farm 990 -EZ (2009)

It/

vj^ -

990-Ez To09)

DUTCH COUNTRY PLAYERS

23-6269000

t II I Statement of Program Service Accomplishments (See the instructions far Part nil-)

what is the organiatlons primary exempt purpose? SEE STATEMPNT

Describe what was achieved In carrying out the organization's exempt purposes. In a dear end concise manner,

describe the serwrss provided . the number of persons benerted. 8 other relevant Information for each program tide.

20 See attachment.

2

Expenses

IRrryr drwa"An5CI(4e].

a^ ris

analAlt5x aar

Mewn4947r11x'•1rmIIF caL^a^

99WI

for

I

6

Grants $

J If this amount Includes foreign grants . check here

?Grants 5

It this amount includes foreign grants; check here

^

28a

3 "e., •_t

29

29a

30

4Grartts S

] it this amount includes tarepn 9lanta, check hera ^

31 Other program sertles (attach smatdulij

'-^

^Grents S

1. It',thls amount Includes foreig n grants. check here

a2 Total program service expenses add lines 289 Ovdtigh 318)

Part IV

L ist

fficers , Direc ors, Trustees , and Key Em p lo y ees .

(al Name and address

(b) Title and average

hork k^e r week

hlon

davolad to

.

30Y

^

31a

32

Lm wxhwM e,ont dpi ao^hp6o"mofd isis S's Ogr rtPst IV j

(c) Compensation

If not paid,

enter 4•

(,d) co*ismns b

amswraa mark Craw I.

aolur,ee raww^•+wu+

pensa

y

eCCq nt and

other aiiowances

gee attachment

ova

09 990ET1

Tw =4rA

cnWVs tram, ids 0"I - 2" Tw

Form 990-EZ (20091

Page 3

Forn990-EZ(2009)

23-6269000

DUTCH COUNTRY PLAYERS

Part V Other Information (Note the statement requirements in the instructions lot Part V )

34

Dtd the organization engage In any activity not previously reported to the IRS? If-yes.' attach a detailed

description of each edlvity

..

Were any changes maderto the organizing or governing deormients? If. Yes, ellach a conformed copy at the

35

changes

..

... ..... ... .. ..

....

,.

It the organization had income from business, sollyites, such as those regorlad on lines 2.6a, and 7a (among others), but

33

not reported on Form 990-T. attach a statement captaining why the organization did not report the income on Form 990-T

a Did the arganisatIon have unrelated business gross income of.i'1.000 or more or was it subject to section 6033(e) notice,

reporting. and proxy tax requirements' ..

. . . . ..

. _ .

..

. .

4 If "Yes' has it Blvd a tart return onForm 990-T for this year?. . ,

36

Old the organization undergo a liquidation, dissolution, termination. or significant disposition of not assets during

the year? If "Yes! complete abplltabis parts at Schedule N

....

37a Enter amount of political eapendilbras. diirect or Indirect. as described in the Instructions ^ 37e

b Did the organization file Form 1120-POL for this year'.

. ....

380 Did the organization borrow from, or make any loans to, any officer. director, trustee, or key employee or were

any such Ioansmede in a prior year and atnl outstanding at the end of the period covered by this return?

35b

b If "Yes." complete Schedule L, Part it and enter the talal amount involved.. ....

39

Section 501(0 7),ofganixat'runs. Wait.

If thillatibn (ee9 And capit*l.c6ntrlbutlbne included on line 9 , ........ ..

392

39b

b Grass receipts, lncluddd on'tl1w9. for pdbhc use of dub facilities .

.- , . , . ,

40a Section 301lc)(3) organizatlbns. Enter amount of tax "posed on the organization during the year under

section

: section 4912 ^

. section 4955 ^

b Section SO1(c)(3) and 601 c (4) organizations Did the organizaUDA engage In any section 4958 excess benefit transaction

during the year or is It aware that it engaged In an excess benefit transaction with a disquaffied person in e• prior year. and

that the trensealon has not been reported on any of the organization's priot Forms 990 or 990-EZ? It "Yes." complete

Schedule L Pan I ..... . ....

... ....

.... ..

.

c Seiilon 501(c)(3) and $04 tc)(A1 organizaliops. Enter amount of iex imposed on

organization Menggers,.or dls iuskrled persons during the year under sections

4912. ,4996, • and' 4958 .. ........ ....... . ...

a

, , ...... ... .. .. ......

d SgWon 501(c)t3) and SO FG)R41;or9ar+ite4wss Enter amount-of tax an fine 40c

o

41

42a

b

a

43

44

45

l x14

33

34

X

350

35b.

X

X

38

7.

371;

X

36e

2f

40b

Y.

40e

y:

reimbursed by the organic sttwr :....

^

.... .... - ...

AN orgtmlzations,.At any't'urn during the tsar year, was the organization a party to a prohibited tax shelter

transecuon? If' Y-es" complete Farm U8BT'. ..

Ust.ihe slates with which a copy of thrs,nrturn is riled. ^ NONE'

Telephone no ^

The organization's bdokit are in card of fis. See a c t a ehme n t 4-8

ZIP + 4 ^

Looted at ^

At oily time during the calendar year. did the organization have an interest In or a Oipneture or tither authority

over a financial eocaunt 10 a foreign country (such as a bank account. securities account, or other flnanaral

socoulltl!) ..

I "Yes." enter the name of the foreign country: ^

See the instnicilons for exceptions and filing

ing requirements for Form TO F 90.22.1, Report of Foreign Bank

_

e$

42b

a

Y.

-and Flnsn al Accounts.

a!eX

...... .. .......

At any time during the calendar year. did the organization maintain &n office outside of the U.S.?

country.-!

it'- Yes* enter the name of the toretgn

u

. .

Section 4947(a)(i) nonexerllpt charitable trusts filing Form 990-EZ In Ileu;ol Form 1041 •- Check here

. . . .. ^ I.43

and enter the amount or tsx exempt Interest redewed or accrued duiing the tax year

Did the organization maintain any donor advised funds? If "Yes," Form 890 must be completed Instead of

.. . .

Farm •990- EX

. .

. . .

.. ...

. .. ,

..

, ..

. ..

Is any misted organization a controlled entity of the organization within Die meaning of section 512(b)(13)? If "Yes,"

Form 990 must be cornpleledinstead of Form 99p•E2

, ,

, ,., .

,,

Form

T.w+er Farm, rso4iec ontr) • 76ea rw

09 990F.Z3

TM L4401

Pa e4

Form 990-SZ(2009)

DUTCH COUNTRY PLAYi<aRS

23-6269000

Section 501(c)(3) organizations and section 4947(a)(1) nonexempt charitable truss on y .allsection

Part. V1

50 1(c)(3) ofganixallons and sermon 4947( a)(1) nonexempt charitable trusts must answer questions 4649b and complete the tables

for lines 50 and 51.

198 nr

46 Did the organization engage. In direct or Indirect polllital campaign activities on behalf of or In opposition to candidates

46

X

for public office? It 'Yes.a complete Schedule C Part I ..... ......

..

47 Did the orgaruzalion engage in lobbying aotiviuas? if "Yes." complete Schedule C, Pan II

47

X

..................

48

48 Is the organ ation a school as described in section 1701b)(1)(A)(1l)? If "Yas.' complete Schedule E

X

, , .. , , . .

49a Did the wgenfzailon make any transfers to an exempt non-charitable related organization ? , . ,

.,

49s

R

b It -'Yes." was the related orgpnlzailon a section 527 organization?

4Bh

X

50 Complete this table lo'r the orgpniaahon's rive highest compensated employees (other then officers . directors , trustees and key employees)

who each received more than $100,000 of cornperualton from the organization. if there is none . enter " None."

(a) Name and address of each empkayse

paid more than 5100,000

T*°"'s"'°rap

(b)hm

IM

snow lo

(C) Colnoensoton

WGA

(d) cam tMOU to

e) WOO*

Mraby a Ou"fil .UM 8

aev+d a,"

*.,,et

„n

NONE

f Total number of other enmolovass cold over 31 00.000..

ti

Complete this table for the ptganrzation's live highest compensated independent contractors who each received more tear! 1100.000 or

compensation from the organization if theta is non6, enter -None."

51

(sl'Name and address ofbach Independent ooniretlor paid more then 5100.000

d Total number of other Independent contractors each receiving over S1

Under penalties of perjury. I declare that I have examined I

the best of dly knowledge and be'Nef. it is live, correct, add

Ay knowledge

(nfqrmerlon of which pr a

Sign

Here

Skina

of

r

GET Y4ROSCHAK

pe or print name and tills

Prepaure '

&V nature

Paid

Preparer's F,,,•s,,,,.,w,,,

4144"+o mdl

Use Only

Q . LZ4M-

MWOM AM all , 4

May, the IRS discuss this return with the preparer shown above? See ins

NA.

09 9Y0EZ4

'rvW+r7san

Ccplri 'l rams t$s

a4 wrr •

200 1W

1

(b) Type of service

I

(e) Cpmpanyatlnn

SCHEDULE A

lsdsoo^t7

^^^ g

Public CharityY Status and Public Support

(Form 990 or 9g.0-EZ)

Complete It the organization is a section 501(o)( 3) organization or a section

4947(al(1) nonexempt charitable trusts

Open to Public

Inspect ion.

^ See separate Instructions.

Employer idenliflcat(on number

3-62G9000

wn'megr. ne is,ver

^ Attach to Fbrr(r 990 or• Form 990•EZ.

Name of the organization

DUTCH COUNTRY PLAYERS

The organization is not a private foundation because it It (For lines I through 11, check only one bax.)

1

A church . convention of chur hes, or association of churches destnbed Irt section 1710(bNi MA)(1).

2

A school descnbsd in section 170(b)(4)(AKlil. jArtsch Schedule, E.)

A hospital or a cooperative hospital service w9snization described in section 170(b )(1)(A)iilf).

3

4

A tttadical research orgnnizalion operated in oonluncticn wish;s hospital described in ieslion 170(bl ( 1 KA)(11i). Fates the hosprtafs name,

city: ahd stale,

5 0 An oroanizallon Operrited for the benefit of a college or university owned or operated by S governmental unit deserlbed in section

1 T0(b)(1)(A)(Ivl. (Complete Pail 11.)

A federal , state. or local govenimeni or governmental unit described in section 170(b)(1)(A)(v).

An organization that normally rec6lvea a substantial past of Its support from a goaeunmenial unit or from the general public, described in

section 170(b)(1)(A)(vl ). (Oomplete Pan It.)

A oorl5fnunity busiLdp s cribed it1 s^scllon 170(b ) l1)(A•(vf}.(Complete Pail II.)

An arganrzallon that normally ra aivss:41) mars than 133 rr3 % of Its support from contributions. membership fees, and gross

raoslpta Rom adtlvitles related to its exempt functions--eubject ' ta certain exceptions, and (2) no more than 33 113 % of lit

support from gross investment income and unrelated businesirtaxable Income (less section 511 tax) from busineserrs

aoquirad by-the organization after June 30. 4975 See section 509(a)(2). (Complete Part Ill.)

b

7

S

9

10

11

e

D An organization organized and operated exclusively to test for public safety See section 509(aH4).

An organization organized and operated exclusively for the beneAl of, to perform the- function of, or to carry. out the

purpuses•of one or mbre publlaly supported organizations deswibod In section 509(a)(1) or section 5WIa1(21,'See section

509(x)(3). Check the box that. desorlbe* the type of supportllig .organisation and complete lines 1 I e through 11 h.

d (]Type Ill-Other

a a Tyr* I

b 0 Type M.

c 0 Type iii-Firnctionally lntdgratbd '

U (fy 0401119 this bbx ,i osflify that the arpanreation Is not controlled directly or Indiised(y by anew more disqusillied .

persons ether than foundation managers and other than one or more publicly supported organizations described In section

509(a )(1) or section 50(1(a)(2).

g

If the organization received a writtep dalsmunation from the IRS That it Is a Type 1. Type 11 or Type III supporting

.. .. ....

organixatlon, check this box . ... .

.. .. . . .

. ... . . .... ... ...

Stnbe August 17, 2006, has the organization aecepled any gili.orcontrbution From any of the

It

(1) A person who- directly of Indirectly controls, either alone or together with persons described In (II)

and (Iii) below. the governing body of the supported otganizzation?

'(Ii) A family member of•e parson dreribed In (1) above? . .. , .... ... , . ..

(Ill) A 35% controlled entity of a person described in (0 of (N) above? ,

Provide the followitro Information abou t. the supported organization(s).

I

.

.

.

11

following person's

(if Name of supported

(ii) EIN

ors, anization

(ill) Tyre

o'gunr4r'w , iv) rt Iro bi"newith

,AMSarr,.oarr+rsr-F

mo* W IRO "CIO

nmr (1) Iwxre,,ar

yarn g i *uus anti

Yes

... .....

... ,

(VI) t.uua

(v) Du eau a s, O.,

i,unr,r^ol (t)

aflsrr mnnmr (1) ^901tl

weeuiu d'n It.

oloO

has

No

No

X

X

(vii) Amount of

support

u8

(lee Instruotlbns))

Yae

1'19 1)

119111)

I l9((ii

Yes

No

Yes

No

Total

For prl'vacy Act and Paperwork Reduction Act Notlcp. see the Instructions for

Form 990 or 990#L

.NA

09 990A12

iwra4ae

ceg140 w,r.%6.:e

.ow"•1C0S1W

Sbhedule A (Form 990 or 990-EZ) 2009

A(Fonn990or990 -EZ)2809 DUTC H

COUNTRY

PLAYERS

Page3

23-6269000

^^.a r^^._^..^_ t.. r^___.__u _ ._ r^__ ^?^_3 >r Zi__a?__ endi_tr^•

Ie..^

(Complete only if you checked the box on loin 9 of Part I )

S ection A. P u bli c 3umort

Calendar year, (or fiscal year beginning in) ^

1

Gifts. pants , contributions, and

membership fee's received . (Do not

inciuce any "unusual grants,").

2

Gras receipts from admissions,

rltetchandso sold or services

performed . or feciflles • furnushed in any

aeevify []he! is related to the

orgspizati00 % tax•ellarool Gurow ...

3

0ini} fDOp44Mn EIIYiY4^ (he1015 i

wtMW 1mW ar 4Jf1iiui

4 ] -4

.

(b) 24013

(c) 2007

h6

(ol 2009

(1) Toia1

1469e

L4190

•1 ;.'.r

(d) 2008

31 __

5f'! ?

It$ SCI

$ _ r-2

I Mrr,

i

60643

51404

F9 9 616

85833

%E594

fan

Vnd, Wimn 5.1

4

Tax revenues ibvied for the'or9ernzalion's

benefit and either paid to.or expended an

its behalf . 1-1 ......... .....

b

the value of services or facilities

furnished Wj a governmental unit to the

oryanrzatlon without charge

Total. Add lines ) through 5 ...

...

8

(a) 2006

7a 'Amounts Included on Isles 1, 2, and 3

received from disqualified persons

b

ANVAU 10MUMM aiibff ll rmn 3ae11aN a gap

a4zrtnr+ ^IrauuAMdposersIrpt

Wasere

--

IIi

St Owa%YfNw m. ianMm18

c. Add .lines 7a and 7b , , , , , • . • ,

KIM support famma ti* re twn ito s !

8

aecuon cs. r.ozal buppors

Calendat yeir (or fiscal year beginning In) a

9 Amounts from Noe 6

104

b

c

11.

Gross income from internal. dividends.

paymenis received on securities loans.

tents. royalties and income from timgar

sources ...

. ..............

..

Unrelated business taxable Income (less

section 511 texas) from businesses

liMUtred afterJune 30,1915... .......

Add lines lea anti'lOb ..

... .. . .

Net income from unrelatgd business

aellvdlps not Included In One lob,

whether ornot the tiuilhsss is regularly

sarried on ..:

..^..,...... ....

(e) 2005

(b) 2000

(c) 2007

(d) 2008

(092009

If) Total

+if^o4^

5i4iM

5996E

9569)

5504

V4.1°?'

its

221

24

i

?I3

221

''_

Il

1G

12

Other Income. Oon(;t Include gain or

loss born the sale of capital assets

13

total support. awe atea a• roe + t mvj +a t

14

Fire[ five years. If the Form 990 Is fonthe orgeniaallon's first, second, third, fourth, or filth tax year as a section 501(c'1(3)

oroarliasiran.•check•Ihle box and atop here

... .

1 LI'7

844'r

3915

11.630

M'•

15Z6kb%

55Q3Z

72 9 1,

877+54

1t10e"1'

16 Pubic, uW4 percentage jai 2009 (line 8, dalwnin (I) divided by line 13. column (f))

it Pvt4tc uppbit•ps;centage rpm 2008 8ihedule 1, Part Ill. line 15. :.

Section D. Computation of Investment Income Percentag e

17 Investment Income percenlege for 2009 (line I Oc, column ff) divided by line 13, column (f))

•,• , ,

16 Investment lncarnap percentage from 2008 Schedule A. pail qt. tine it ... ..

.. .. .

194

:4L0

j,a7

15 1

96. id, '13

1 G r'-'-96T.^3^_r T °ie

--_._._ ...^ n%

17

b

331/3 9 support Lists - 2009. If the orga,iraibn did not check the box on one. 14. and Ike 15 is more than 33113 45, and line It is

not more than 33 103 %, chock this box and slop here. The organization qualifies as a publicly supported organization .. .. ,

! 0.

33 113 '% support tests .- 2008. It the orgaltizaton did not check a tlox on pile 14 or line l9gi,, and line 18 le more than 3.3113' . and Ime

20

irA

.

. ^ U

18 is no# mote than 33 1.13%, CIieft this box and..stop here. The organization quolllles as a publicly supported organization-.

Private fOundatfon, If Ihs orgdnizatib Aid not che* a box on One 14,19s, or 19b, check this box end see instructions

Schedule A (Form 990 or 990-EL) 2009

09 p80A34

fens p

stamen c7a l-acne rw

cnr^i

AtL•achment 1:

Open to Public

In

C00"

SCHEDULE OF OTHER REVENUE

p a g e 1- 990-EZ Pa g e 1 , Part I Line 8

For calendar year 2009 or tax period beg innir!g

Name of Organization

DUTCH COUNTRY

. and ending

Employer Identification Number

23-6269004

PLAYERS

,Descdplton of Other RetwIYa

INCOME' FROM YI $TBO AND

UP SH IR"

wnouht

i . •: • i

.SALES

Tot81

Jury

cynt Fonts (

+R Ori^y^

2Dd9 tW

um

^{EOElvtr4

'

Attac hment 2 :

pace 1 - 990-EZ Pane 1.

Part I,

Linty 16 ,

Open IQ Pubic

Inspection

For calendar year 2009 or tas period beginnin g

Name of Organization

and ending

Employer Identification Number

3-6269000

DUTCH COUNTRY PLAYERS

Amount

Description of Oltrer Expenses

4, S65

4,0(2

I, 3-79

ADVERTISING

CHILDREN SHOWS

CODIWJNTTY AWARENESS

!E4

COSTUMES

ENTGRTRINMENT

FOH REFRESHMENTS

1197`

roil SUPPLIES

348

LIGHTS AND SOUND

1,543

MEMORIAL SCHOLARSHIP FUND

MORTGAGE INTEREST

100

2,9-74

PLAYREADIWG

='-X15

1.121?

PROPS AND SUPPI.]'CS

.14, 883

11413

1, 130

RQ'ALrI:ES

SEI' CONSTRUCTION

SIGNS fOUTSI1E

205

108

491

15

SMI L E'FF crS

TECHNOLOGY

tl.C I ET OFF ICI ' EXPEN!"dE

'POOLS MD EQUIPMENT

115

USE TAX FOR ]?A

, 406

Dei;s.L'S^.ciation

Total

Ri 1, 31.

*j%.p "GYVLG Vr V I r7Grt 41"71"314VG^7 U\ 1\v- I

Attachment 3:

nacre 1 - 990-RZ Paar

1.

Parr

Open to PUblic

inspection

For calendar year 2009 or tax period beginning

Name of Organization

M^7^7G I Q Vrti

T.

Line 20

. and ending

Employer Idendficadon Number

DUTCH COUNTRY. PLAYER

3-6269000

Total Amount

Desufptron of Changes

SUFU 4D •0k' "CaOMPg:.E "

DEPOSIT - PREPAID 2 '008

EXPIENSE

TWO CHECKS NEWEL CASHED

- 3.) •

VtRTZON ADJUSTMENT

Total

-•?.J-'

Attachment 4:

a

1 - 990-EZ Pa g e

Part 1, Lire 24

Open 10 Public

Inspection

For calendar year 2009 or tax period beginning

Name of Organization

. and ending

Employer Identification Number

DUTCH COUNTRY PLAYERS

12 .3-620000

Descripllon of Other Asset's

PREPAID-EXPENSES

Totals

Beginning

End

EOY FMV

of Year

of Year

(940-PF Only)

5 r70

!I,1047

_ 1f

5 ,04

5, _ i 7

SCHEDULE OF OTHER LIABLILITIES

Attachment 5: p a g e 1 - 0O-EZ Pa E 1 ,

Part II ,

Line 26

Open to Public

Inspection

For calendar year 2009 or tax period beginning and ending

Name of Organization

DUTCH COUNTRI PLAYERS

Employer Identification Number

123-6269000

Beginning of Vent

Description of Liability

End of Year

MORTGAGE PAYABLE

40,1'0

,.>, 1 a.:

ACCOUNTS PAYABLE

DEFERRED INCOME

PERSONAL, LOANS

1.75

FBI 195

9.22

, t1.. i

^ ... a'

5),77 )

_ ; •^

Totals

NA

ce irc'i' Fem. {SNr^ws Ohb) • 7= TW

L0sl9F

76EQEIGPI

PROGRAM SERVICE ACCOMPLISHMENT

Attachment 6: pag e 1 - 990-EZ Pa g e 3,

Open tb Public

Inspecllpn

- -i For calendar year 2009 or [as period beginning

Name of Organliation

DUTCH COUNTRY PLAYERS

Part III - Statement of'rogram Senrlce Aocon pliahments

Grants •and t lIocabons

Part III

, and ending

Employer Wanlincation Number

123=6269000

Amountincludes•foreign grants

Progratn >Elrvkaexpenses

Exempt Purpose Achievements

COMMUNITY THEATRE PRODUCTION OF SIX A DULT SHOWS AND THREE CHILDRENS SHOWS

DCP CONTACTS LOCAL HIGH SCHOOLS. THE HIGH SCHOOLS SELECT THE STUDENTS THAT

QUALIFY. THE QUALIFIER IS THAT THE RECIPIENT MUST BE FURTHERING THEIR

EDUCATION IN THE ARTS. TWO, S 5D SCHOLARSHIPS WERE AWARDED IN 200J.

1VA

Cepyrg ,F"*twP*h.On'rl • 2004'rw

1.O29 F

00_ Ft)Elnel

3 •- 390-EZ

AL- tathment.

Open to Public

fnspsdlon

Pa e

3,

Part V,

Lille 42a

and ending

Fcr_ calendar year 2009 or Ilk period beginnln

Employer Identification Number

3-G269044

Name of Organization

DU'TCI1 COUNTRY PLAYERS

Part V-Urfa 42a

mdiyiduai Nair*

GEOFF YAROSCHAK

or

BusIIess Name-

StreetMdress .. ..

....... .. ..

791 HUNTER DRIVE

..

U.S. gtfdress;

-zip code

or

-City PENNS.BURG

1.80-73

state P1k

Foreign Address,

city

..

.......... ...

Province or State

...

..

..

. .... .

. .

Country

Postal code

. . .. ... ........

. . .

.

..

.

.

..

.

. ......... . ..

Phone IJumirer

Fox Number

.. ....... . ... . .. . ...

.. ... ..... .. .......

... .

. .

.. .

... .....

.....

.

Attact-iment 7:

Open to Public

Inspection

p a g e. 1__ - 99O-E

Page 2,

For calendar near 2009 or tax oerlod becinnino

Part

IV

and ondina

Maine of Organization

DUTCH COUNTRY PLAYERS

(A) Name and Address

Employer Identification lumber

3-6269000

(8) Title and Average

His. per Week

4Y

fMPSON

379 VALLEYBROOK ROAD

ID. 00

ICE

PRESIDENT

.00

-tECOR.DING

ECRETARY

SELLERSVILLE, PA 18960

.00

O.RRESPONDING

EC

SOUDERTONN,

.00

161.5 LOWER i^DC'KY' BALE

ROAD

GREEN LANE. PA 18054

BILL TMOMPSOM

2-84 -OLD ORCHARD DRIVE

POTTSTOWN, RA 19464

.VA

OmyVa Faj ISadws• OMVI -WM m

(D} Cont to Employee

(E I Expense Account

Ben Plans 8 De(. Comp

d Other Allowances

0

R CAMERON Pt RDY

5d9 CHERRY .ROAD

PA 18964

not , Id, antor 0)

Ea rD'ENT

GLEN MILLS, PA 19342

DERNT ]ONES

811 ,HARLEYSVILLE PIKE

HARLEYSVILLE, PA 19438

CANDICE RLMPHREY

234 BRIARWOOD DR

-

WESLEY HRABXNA

(0) Compensation (II

0

{)

0

0

0

0

0

0

6

0

0

0

REASURER

5.O'0

P*D

OARD NATOR

.0D

Lae1CR

0

aMB No 1545.0172

2009

Depreciation and Amortization

(Including Information on Listed Property)

Form 4562

t^ra^ tr we.tarR^s rneruy

AtlaChmelil

a,+aaw^ R^veswsa*es (99)

Name (s) Owen on return

DUTCH COUNTRY

^ See se

PLAYERS

uence No 67

Identifying number

123-6269000

rate instrUctions .

) Attach to your laft return.

Business or aatiVlly to Which this form retakes

FOR FORM 990-EZ LINO .16

Note: Iryou have any listed property, complete Part V before youticompletd Part I

I Malnlnurn amount. Seethe instructions for a higher limit for certain businesses ...

2 Total coat of.zectiof 17.9 propdrty placed in servl be (tee instructions) ..

3 Threshold cost of section 179 pl'operty beibre reduction in limitation (see instructions)

. .

4. Reduction in limitation. Subtract tine 3 from line 2. 1( zero or less, enter -0- , .

...... . .. ....

5 Dollar limsalfon for tax year. 9ubtlact Noe 4 from line I It zero or less, enter -0-. It marled tiling separately,

see irWotcilons

.,.

(a) poz;;l tkm of pnOpetlY

6

(b) Cost (bush. use only)

7 LWed properly Enter the amount from line 29 ......

. ...

..

1

2

3

4

$250, 000

5

2 50,

$800.000

(e) Elected cost

7

..

Total elected tort of,section 119 property, Add amounts in column (c), Ones 6 end 7

Tlntalive deduction . Shier the smaller of line 5 or Ina 8 ... ..............

Carryover ofdfaaNowed dedudion•Fram Nine 13 of ytur 2008 Form 4562

BU^ness income limitation, Lnter-the:emailer •o/business Income trot less then zero) or fine 5 (see inet,uctrons)

Seetlo 170 ettpe^se daduotton. Add lines Send 1 0. but do not enter• more.then tine 11

Carrytner of d1sa11cfred deduction to 2010. Add, lines 9 and 10, less-iiine 12 ... ^

Note: Do^no; use Part II or Pert Ill below for lilted property Instead, use Part V.

8

9

10

11

12

13

6

9

10

11

12

Part 11

S pecial Depreciation Allowance and Other De reciation (Do not include listed properly.

14 Specia( depreciation afowanee for qualified property (other than listed property) placed In service

during the tax year (see Instrucllons)....

16 Pnopsdy subject to seq[on 1 $80(4) 8leelbn ....

16 Other depredation Ripaludin AC )

Part 111 .1 MACRS Depr6diation ( bo not Indite listed property.) (See Ihstructlons.).

14

16

16

Section•A

17 MACRS deductions for aseeta•pl1 d In service in tax years beginning berora 20t)9

..

18 if you *re. electing to gr ouo any assets placed in sennce during the tax year Into one or more

yenaral asset accounts; checkMara . .. ,

' 1,

17

, ... ...

,

It

i 6

t

Section R,- Amens Placae in Swlca ourlno 2000 Tar Year llslna the Minera l Debreciation System

{U t:tdes>lication ohpraperty

i9a

3-

101

y

nth WW

laced In

se ice

(c) Bests for depr,

raven

- w.

eneM+su

try Method

(d) Recovery

(,)

period

Conrenlton

(g) Q6pusoa6on

deduction

r iliac.

b .' ^r earpjt edy

c 7-yea t property

d l0-year graindy.

--,+--- --

a ' 15- r'pt0 try

I' 20- leer protwrt

-.

SiL

9 2-5•yptr pr

h Residential rental

pi'rty

25 yrs.

27.6 yrs.

27.5 yrs

I

39 yrs. MM

NonreeigenU'at reel

pm"rty

20a

doss lire

SIL

_

SIL

--

S/L

MM

Sect16n'C +.A sets;Placid In Sanrigq during 2009 Tax Year Using the. Iterttaltvq Deprooiatlon 3 stem

SrL

b 12- eat

t3 rs•

c 40-

40 yrs

rarttv

MW IMM

ar

summa

SiL

MM

SiL

(See Inltructions)

21 Usted property. Enter amount trbm line 28

22 Toter. Add amounts from line 13,, lines 14 through V. Ones 10 and 20 in column (g), and line 21 . Etrter We

21

arid on the appropgake lines ofygur • rewrn. Partnerships and $ oorporationst - see In P409115

23 for assels •shown above and placed in service dun ng the current year, enter the

portion of the basis attrlbutablo to•seabn 263A costs

.

22.

F

For Paperwork Reduction Act Notice, see separate Instructions .

09 45821•

nw actsl7

ODOM" Per u ls41le Drtq) . em rww

JVA

... , ..

4

40 f

Form 4562 (2009)