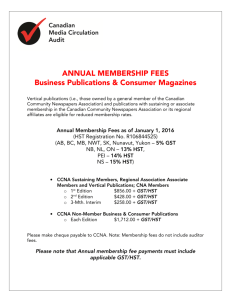

GST/HST Public Service Bodies` Rebate

advertisement