Residential Gas Bill Calculation Information

advertisement

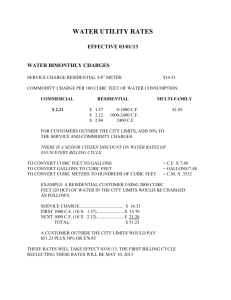

Residential Gas Bill Calculation Information Residential Gas bills are calculated with several factors. These include the Thermal Factor, the Purchase Gas Adjustment, County surcharge and the rates. To calculate a bill you need all of this information. The thermal factor is listed on your bill along with the purchase gas adjustment (PGA). The thermal factor and the PGA can vary from month to month. You will see them on your bill in the same section as your usage. These are the rates for the current year. Tier Rate Cost per Tier Monthly charge $10.00 First 3,000 cu. ft./1,000 cu. ft $10.6256 3 x $10.6256 = $31.88 Next 3,000 cu. ft./1,000 cu. ft $9.9881 3 x $9.9881 = $29.96 Next 144,000 cu. ft./1,000 cu. ft $8.9255 144 x $8.9255= $1285.27 Over 150,000 cu. ft./1,000 cu..ft $8.7130 Cost varies by usage $10.00 As you can see, the rates vary depending on the amount of gas used. Below is how we would calculate a bill for 9100 cubic feet of gas for a City residential customer. Multiply the consumption by the thermal factor on your bill. 9100 cubic feet x 1.0510 (thermal factor example) = 9564 9564 is the adjusted consumption to be used in the calculation. Use 9564/1000(adjusted consumption) x 0.2263- (PGA factor per 1000 cubic feet used) = -$2.16* *Note the PGA can be a positive or negative number. In this example the PGA is negative so you would subtract this from your cost. If the PGA is positive, you would add the amount to your bill. Now go to the rate chart to determine the rate level. Consumption per Tier Cost per tier Other Charges $10.00 Monthly Charge st 9564 cubic feet – 3000 cubic feet for the 1 tier = 6564 $31.88 6564 cubic feet – 3000 cubic feet for the 2nd tier = 3564 $29.96 3564/1000 cubic feet x rate ($8.9255) for 3rd tier Total Cost $31.81 -$2.16 $101.49 PGA Customers who live in Albemarle County pay an 8% surcharge on their bills. $101.49 x .08 = $8.12. $101.49 + $8.12 = $109.61 is the county bill total. Taxes on Gas City and Albemarle County customers pay a different tax rate. Albemarle County residential customers pay a flat $2.00 tax. City customers pay a tax based on consumption. Using the above example for a City customer, here is the tax calculation. Customer has an adjusted consumption of 9564 cubic feet. The tax rate for residential City customers is $0.638 per 1000 cubic feet. There is a basic charge for every customer of $0.80. 9564/1000 x $0.638= $6.10 + $0.80 basic charge = $6.90 City tax amount City total with gas and tax is $101.49 + $6.90 = $108.39 Albemarle total with gas and tax is $109.61 + $2.00(county flat tax) = $111.61 Commercial Gas Customers may have a correction factor on their meter that will affect their actual total consumption figure. In addition the consumer utility tax rate will be different for higher usage. Please call our office at 434 970-3211 for assistance calculating your bill.