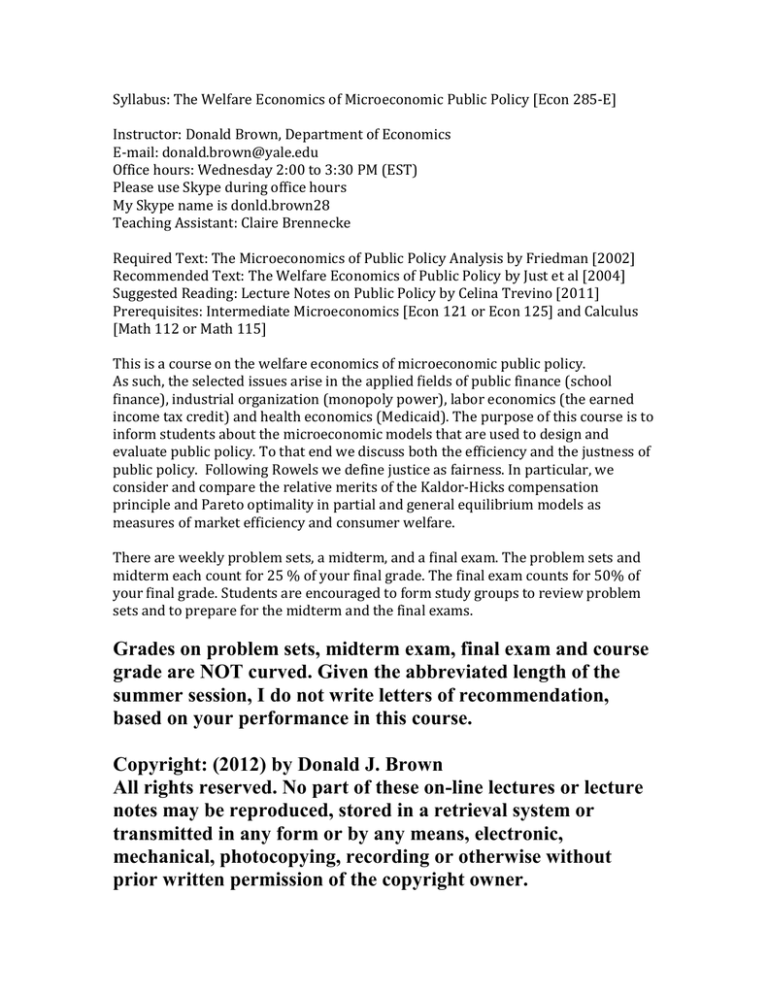

Syllabus: The Welfare Economics of Microeconomic Public Policy [Econ 285-E]

Instructor: Donald Brown, Department of Economics

E-mail: donald.brown@yale.edu

Office hours: Wednesday 2:00 to 3:30 PM (EST)

Please use Skype during office hours

My Skype name is donld.brown28

Teaching Assistant: Claire Brennecke

Required Text: The Microeconomics of Public Policy Analysis by Friedman [2002]

Recommended Text: The Welfare Economics of Public Policy by Just et al [2004]

Suggested Reading: Lecture Notes on Public Policy by Celina Trevino [2011]

Prerequisites: Intermediate Microeconomics [Econ 121 or Econ 125] and Calculus

[Math 112 or Math 115]

This is a course on the welfare economics of microeconomic public policy.

As such, the selected issues arise in the applied fields of public finance (school

finance), industrial organization (monopoly power), labor economics (the earned

income tax credit) and health economics (Medicaid). The purpose of this course is to

inform students about the microeconomic models that are used to design and

evaluate public policy. To that end we discuss both the efficiency and the justness of

public policy. Following Rowels we define justice as fairness. In particular, we

consider and compare the relative merits of the Kaldor-Hicks compensation

principle and Pareto optimality in partial and general equilibrium models as

measures of market efficiency and consumer welfare.

There are weekly problem sets, a midterm, and a final exam. The problem sets and

midterm each count for 25 % of your final grade. The final exam counts for 50% of

your final grade. Students are encouraged to form study groups to review problem

sets and to prepare for the midterm and the final exams.

Grades on problem sets, midterm exam, final exam and course

grade are NOT curved. Given the abbreviated length of the

summer session, I do not write letters of recommendation,

based on your performance in this course.

Copyright: (2012) by Donald J. Brown

All rights reserved. No part of these on-line lectures or lecture

notes may be reproduced, stored in a retrieval system or

transmitted in any form or by any means, electronic,

mechanical, photocopying, recording or otherwise without

prior written permission of the copyright owner.

Here is the reading list and schedule of lectures:

Week 1: Introduction to Microeconomic Policy Analysis

Readings: Chapter 1 in Friedman

1 Lecture

Week 1: Demand, Supply and Cost-Benefit Analysis

Readings: Chapter 2 in Friedman

2 Lectures

Week 1: Utility Maximization, Efficiency and Equity

Readings: Chapter 3 in Friedman

2 Lectures

Week 2: Analysis of Welfare Programs

Readings: Chapter 4 in Friedman

2 Lectures

Week 2: The Analysis of Equity

Readings: Chapter 5 in Friedman

2 Lectures

Week 2: The Compensation Principle

Readings: Chapter 6 in Friedman

1 Lecture

Midterm Exam: Chapters 1-5: Monday

Week 3: The Compensation Principle

Readings: Chapter 6 in Friedman

2 Lectures

Week 3: Market and Government Failures:

Readings: Chapter 13 in Friedman

2 Lectures

Week 4: Externalities

Readings: Chapter 17 in Friedman

2 Lectures

Week 4: Public Goods

Readings: Chapter 16 in Friedman

2 Lectures

Week 5: Wiliness to Pay

Readings: Chapter 6 and Appendix in Just et al.

2 Lectures

Week 5: Aggregation and Economic Welfare Analysis

Readings: Chapter 8 and Appendix in Just et al.

2 Lectures

Final Exam