The Riksbank`s inflation target – target variable and interval

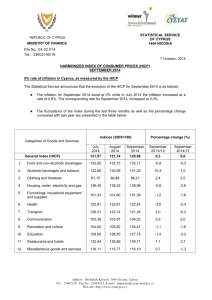

advertisement