View online - Phoenix Beverages

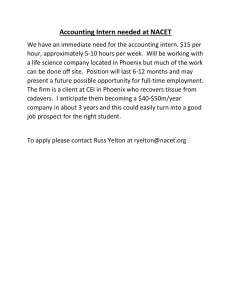

advertisement