Transocean leads

Brazil rigs race

CIMC Yiulian eyes

Noble semisub job

Page 4

Page 8

THE INTERNATIONAL OIL & GAS NEWSPAPER

upstreamonline.com

VOL 19 • WEEK 9 • 28 FEBRUARY 2014

Teams battle for Ophir’s FLNG prize

Two consortia are battling to secure a prized design, engineering and construction contract for Ophir Energy’s

multi-billion dollar Block R floating liquefied natural gas project off Equatorial Guinea.

Page 5

Eyes on Kiev

Players keeping close

watch on Ukraine’s

gas market plans.

Pages 12 &13

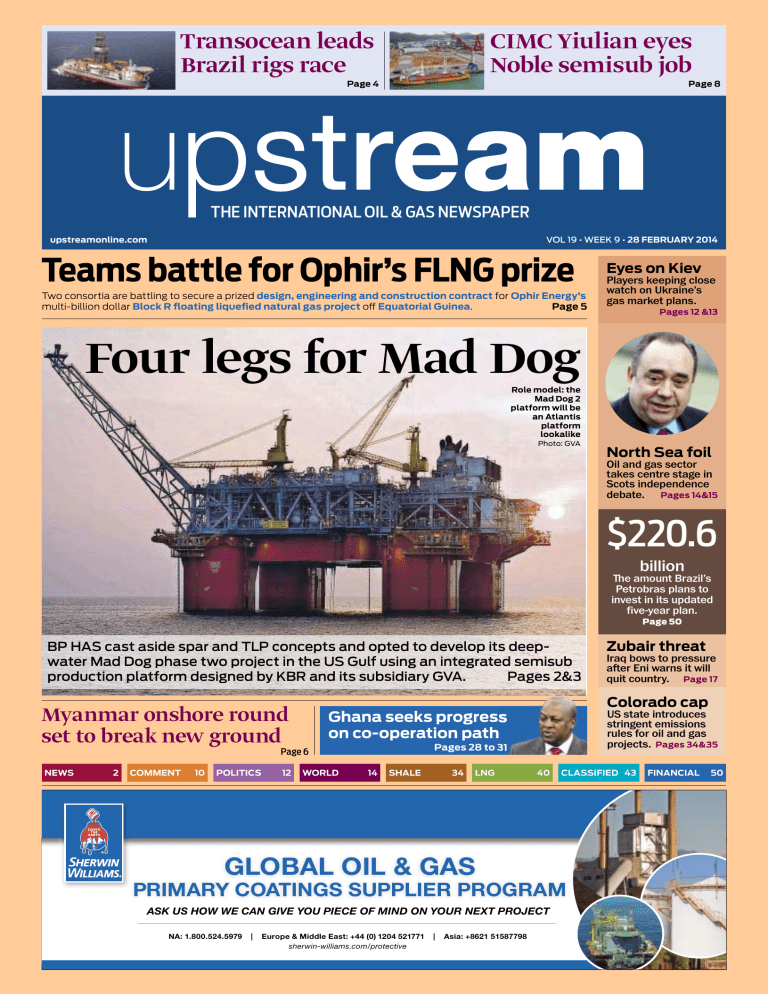

Four legs for Mad Dog

Role model: the

Mad Dog 2

platform will be

an Atlantis

platform

lookalike

Photo: GVA

North Sea foil

Oil and gas sector

takes centre stage in

Scots independence

debate. Pages 14&15

$220.6

billion

The amount Brazil’s

Petrobras plans to

invest in its updated

five-year plan.

Page 50

BP HAS cast aside spar and TLP concepts and opted to develop its deepwater Mad Dog phase two project in the US Gulf using an integrated semisub

production platform designed by KBR and its subsidiary GVA.

Pages 2&3

Myanmar onshore round

set to break new ground

NEWS

2

COMMENT

10

POLITICS

12

WORLD

US state introduces

stringent emissions

rules for oil and gas

projects. Pages 34&35

Pages

ages 28 to 31

14

SHALE

34

LNG

40

GLOBAL OIL & GAS

CLASSIFIED 43

PRIMARY COATINGS SUPPLIER PROGRAM

ASK US HOW WE CAN GIVE YOU PIECE OF MIND ON YOUR NEXT PROJECT

NA: 1.800.524.5979

|

Europe & Middle East: +44 (0) 1204 521771

sherwin-williams.com/protective

|

Asia: +8621 51587798

Iraq bows to pressure

after Eni warns it will

quit country. Page 17

Colorado cap

Ghana

hana seeks progress

on co-operation path

Page 6

Zubair threat

FINANCIAL

50

2

28 February 2014

NEWS

BRIEFS

UGANDA

Albertine

acreage offer

UGANDA will launch an

acreage offering later this

year focused on the

Albertine graben.

Fred Kabagambe-Kaliisa,

permanent secretary at the

Ministry of Energy &

Mineral Development,

said: “Invitations to

prospective companies will

go out later this year...

especially for relinquished

areas where data exists and

has been upgraded, such as

Semliki and Taitai.”

Tullow Oil has

relinquished the Taitai

discovery area in Block 2 in

the Lake Albert area.

SINGAPORE

Marco Polo

books rigs

SINGAPORE’S Marco Polo

Marine has ordered up to

three newbuild jack-up rigs

at compatriot Sembcorp

Marine’s PPL Shipyard.

The owner ordered one

firm unit for $214.3 million

and left two optional

contracts at the yard.

The Pacific Class

400-design rig will be

equipped to operate in

water depths of up to 400

feet and to drill to depths

of up to 30,000 feet.

IRAQ

Weatherford

cuts back

WEATHERFORD plans to

sell off four non-core

businesses and wind down

operations in Iraq as part

of a larger plan to cut costs.

The global services giant

said it will divest its

pipeline and specialty

services, testing and

production services,

drilling fluids and

wellheads business units.

The company will

complete contracts in Iraq

“and exit the early

production facility

business for good,” it said.

The Mad Dog 2 semisub is dubbed “an

Atlantis look-alike”, with reference to the

large floater chosen by BP to develop its

deep-water Atlantis field in the US Gulf.

GULF OF MEXICO

BP opts to develop Mad D

UK giant in talks

with US engineer

while South

Korean yard

likely to take on

fabrication job

ERIK MEANS and

ANTHONY GUEGEL

Oslo and Houston

UK SUPERMAJOR BP has decided

to develop its challenging Mad

Dog phase two project in the

Green Canyon area of the deepwater Gulf of Mexico using an integrated semi-submersible production platform designed by KBR

and its Swedish subsidiary GVA.

BP is now understood to be negotiating a major front-end engineering design contract with

Houston-based KBR, with work

likely to start in the second quarter of this year and last 12 months.

BP’s timetable had previously

pegged FEED work to start in August, but sources now reckon it

will probably get rolling by May or

June.

A full engineering, procurement and construction contract

for Mad Dog 2 is expected to be

tendered towards the end of the

FEED contract period, and KBRGVA will be in an enviable position, potentially together with a

fabrication yard, for this lucrative

award.

The three major South Korean

shipbuilders — Hyundai Heavy

Industries, Daewoo Shipbuilding

& Marine Engineering and Samsung Heavy Industries — are already regarded as the natural contenders to carry out the

fabrication work on the giant

semisub.

If all goes according to plan, the

new platform could be completed

and installed by 2018.

Sources told Upstream that BP

gave notice late last week to rival

contractors Aker Solutions and

Decision made: BP chief executive Bob Dudley

Houston Offshore Engineering —

both of which had proposed tension-leg platform designs for Mad

Dog 2 — that it had decided instead to go for the semisub solution, with KBR designing the topsides and GVA handling the hull.

All three of these groupings —

Aker, HOE and KBR-GVA — had

performed pre-FEED work for BP

on their respective solutions late

last year after BP, in a bid to

achieve major cost savings, jettisoned its original plan to develop

Mad Dog 2 using a huge spar platform.

Sources said BP did not invite

GULF OF MEXICO

Houston

New

Orleans

TEXAS

LOUISIANA

RUSSIA

Licence for

Rosneft

RUSSIAN authorities have

signed a resolution

granting an exploration

and development licence to

Rosneft for the KayganskoVasyukanskaya-more

offshore structure northeast of Sakhalin Island.

Rosneft will have to pay

about $23.7 million for the

licence.

Atlantis

U S A

Green Canyon

Garden Banks

Main map

Holstein

Mad Dog

MEXICO

Keathley Canyon

Walker Ridge

bids for the FEED contract, choosing instead to make its preferred

choice based on the pre-FEED

work by the three camps.

The Mad Dog 2 semisub is

dubbed “an Atlantis look-alike”,

with reference to the large floater

chosen by BP to develop its deepwater Atlantis field in the US Gulf.

That unit has a nameplate topsides capacity of 27,000 tonnes,

whereas one source said the Mad

Dog 2 topsides is currently

planned to be “in the ballpark of

25,000 tonnes”.

This is considerably lower than

the 33,000-tonne topsides envis-

aged for the original spar platform

solution on Mad Dog 2.

Some of this weight reduction

could be attributable to KBR and

GVA being said to be working

closely together to design the

semisub as an integrated unit

from the outset.

Observers added, however, that

the size of the new semisub could

still change, with some sources

questioning whether dimensions

might rise again due to the extra

facilities needed to carry out BP’s

ambitious water-flood programme

on Mad Dog.

“It’s Atlantis with waterflood-

Na Kika 3 gets under way

SUPERMAJOR BP has started

production from the initial well

on its two-well Na Kika phase

three project in the deep-water

Gulf of Mexico, writes Blake

Wright.

The aim is to have the second

producer coming on stream by

the middle of this year. The Na

Kika 3 project included the

drilling and completion of the

Ariel-5 and Kepler-4 wells, and

subsea infrastructure to

tieback to the existing Na Kika

platform.

“The Na Kika phase three

project demonstrates BP’s

ongoing commitment to the

deep-water Gulf of Mexico,”

said Richard Morrison, BP Gulf

of Mexico regional president.

Initial production from Na

Kika, which is a series of subsea

fields tied back to a central

processing facility in

Mississippi Canyon Block 474,

began in November 2003.

The facility, which has a

throughput capacity of around

130,000 barrels per day of oil and

550 million cubic feet per day of

natural gas, is moored in more

than 6000 feet of water.

BP operates Na Kika with a

50% working interest and Shell

holds the remaining 50%.

28 February 2014

3

25,000

THE ESTIMATED

weight in tonnes of the

topsides for BP’s Mad Dog 2

semi-submersible.

Dog 2 with KBR semisub

Photo: REUTERS/SCANPIX

ing,” said one source. “What they

tried to jam on the spar they will

put on the semisub.”

BP is believed to be pleased with

the performance of the Atlantis

semisub in the US Gulf, which

may explain why it leaned in that

direction and away from the rival

TLP proposals.

Once convinced by KBR — after

months of review — that it could

squeeze the topsides onto another

GVA design, the contractors were

greenlighted to proceed.

BP’s trademarked LoSal waterflood technique — short for low

salinity — and associated equipment could push the total topsides

payload beyond 30,000 tonnes,

one industry source suggested.

LoSal has membranes to reduce

salt content, which helps to lessen

the swelling of the clays, thereby

flushing out more oil.

The technology is not so much

the challenge as ensuring there is

enough real estate for the kit. The

initial total number of wells

planned — 33, including 14 water

injectors capable of pumping

280,000 barrels of water per day

— may end up being scaled back.

Each well costs around $250

million to drill and complete,

sources said, so it becomes an easy

target for savings.

BP could resort to a phased ap-

additional finds such as Mad Dog

South will also be developed by

the new semisub.

When BP was studying the spar

it had envisaged production capacity of 120,000 to 140,000 barrels

of oil equivalent per day.

The entire Greater Mad Dog area

is believed to hold up to 4 billion

barrels of oil equivalent.

Danger of fatigue prompts riser rethink

BP IS studying alternative riser configurations

including a steel lazy-wave riser design for

mitigating fatigue from ocean currents and the

anticipated motions of the Mad Dog phase two

floating production semi-submersible in the

deep-water Gulf of Mexico.

The platform is expected to be moored on the

edge of the Sigsbee Escarpment in about 5000 feet

of water. Conventional catenary risers may be

ruled out, according to sources.

The concern is the potential for fatigue, not

only from normal platform movements, but also

from the mid and subsea currents — some of

Offshore Crane Technology

facebook.com/LiebherrMaritime

offshore.crane@liebherr.com

www.liebherr.com

proach to control costs, but the UK

supermajor is keen now on getting the platform built and on location in order to boost oil production from the existing Mad Dog

field.

Pressure is declining and the

longer BP waits to initiate waterflooding the less effective the programme could turn out to be. The

which approach five knots or more in velocity

— and eddies pinched off the Loop Current

phenomenon found in the deep-water US Gulf.

The only installation of a steel lazy-wave riser

in the US Gulf was carried out by Anadarko for the

Caesar-Tonga subsea tie-back to the Constitution

spar. The riser was outfitted with buoyancy

modules and strakes and fairings to help shed

vortex-induced vibration.

Technip was contracted for the design and

installation of that riser in 2012 and could be

called upon by BP to revisit the technology for

Mad Dog 2.

Bids for

ONGC

seismic

INDIA’S state-owned Oil & Natural Gas Corporation (ONGC)

has issued revised bid documents for a major 3D broadband seismic campaign valued

at more than $100 million.

Sources said ONGC has floated expressions of interest for a

shoot to take place off India’s

west coast and suggested

Petroleum Geo Services, Dolphin Geophysical, CGG and

WesternGeco will likely respond to the market inquiry.

The planned survey will cover 3925 square kilometres in

the western part of ONGC’s prolific Mumbai High asset and is

due to take place between October this year and May 2015.

Upstream reported this

month that ONGC cancelled its

previous 3D seismic invitation

to tender — then covering 2000

square kilometres — because

the lowest bidder, CGG, declined to negotiate on price.

Paris-based CGG had bid $67

million to $68 million to secure

the work but ONGC wanted the

company to lower its offer.

Under the revised tender exercise, ONGC almost doubled

the size of the 3D campaign and

wants it completed in a single

shooting season with the data

ready by February 2016.

This seismic survey will cover ONGC’s B-46, B-48, B-105 and

B-188 marginal fields in the

Mumbai High North-West area

as well as the WO-24-1, B-45

and B-192 discoveries in the

Cluster 7 region, currently being developed.

Most of these fields are in water depths of about 80 metres.

New Zhao

Dong plan

ROC Oil has submitted a new

plan to the Chinese authorities

that seeks to extend production out to 2023 at the Zhao

Dong oil complex in Bohai Bay,

writes Russell Searancke.

The “incremental development plan” was submitted in

late 2013 and Roc said it maximises production from the

fields until 2018.

After that, it proposes a detailed plan to enhance oil recovery from the fields until 2023.

This latter part of the plan will

require an extension of the production sharing contract.

NEWS

4

BP sends

drillship

to the US

UK SUPERMAJOR BP is mobilising the drillship Ensco DS-4

from Brazil to the Gulf of

Mexico to finish the last two

years of its contract, writes

Fabio Palmigiani.

The rig was originally chartered by BP to operate in the US

Gulf, but was later assigned to

Brazil following the Macondo

disaster in April 2010.

BP had been using the rig in

Brazil since mid-2011, when it

received approval to purchase

the Brazilian assets of US independent Devon Energy.

BP has drilled a total of eight

wells in Brazil over the last two

and a half years — Itaipu-2 and

Itaipu-3 in Block BM-C-32,

Talhamar, Grazina, Anu-1,

Benedito and Anu-2 in Block

BM-C-34 and the Pitanga duster

in Block BM-CAL-13.

The company had plans to

spud Itaipu-4 and Itaipu-5 in

BM-C-32 this year, and had the

option to carry out full assessment of BM-C-34 with a drillstem test at Anu-2 and the

drilling of five wildcats until

early 2018.

“The rig was contracted and

delivered to BP in the Gulf of

Mexico, so it’s just returning to

work where it was originally

chartered. There is nothing

magical about it and we are

getting full rate,” said Ensco

chief executive Daniel Rabun.

The Ensco DS-4 is chartered

for a dayrate of about $550,000

to BP until July 2016.

The decision to mobilise the

drillship to operate in the US

suggests that BP is taking a

break from its exploration programme in Brazil to focus on

promising acreage in the Gulf

of Mexico.

“The Ensco DS-4 going to the

Gulf of Mexico for drilling activity is a positive indicator for

demand in the region,” wrote

research company Cowen.

Ensco 7500

on market

ENSCO is seeking opportunities for the ultra-deepwater

semi-submersible rig Ensco

7500 following a series of

problems during its contract in

Brazil.

The drilling rig is chartered

to Petrobras until August 2014

for a zero dayrate — in January

both parties reached a mutual

understanding after the oil

company realised the unit was

not the best fit to drill development wells at the Papa Terra

field in the Campos basin.

“The Ensco 7500 is currently

idle as we market the rig, but

there are opportunities in

Brazil as well as some other

geographies around the world,”

said Ensco chief executive

Daniel Rabun.

With the drillship Ensco

DS-4 mobilising to the Gulf of

Mexico and the Ensco 7500

possibly heading to another

country, the UK-headquartered

drilling contractor will be left

with only five semisubs operating in Brazil.

28 February 2014

BRAZIL

On offer: the Transocean drillship Dhirubhai Deepwater KG1

Photo: TRANSCOCEAN

Transocean to the fore

in Petrobras rig tender

Drilling giant submits lowest bid as state-run Brazilian

player makes its return to the international market

FABIO PALMIGIANI

Rio de Janeiro

DRILLING contractor Transocean

has submitted the lowest bid and

emerged as the frontrunner in a

tender to supply Brazilian oil

giant Petrobras with one or more

rigs capable of operating in water

depths of 2400 metres.

Transocean easily beat the

competition after it proposed the

drillship Dhirubhai Deepwater

KG1 for a dayrate of $440,000.

According to a source, the

Transocean bid was 9.5% lower

than second place when factoring

in all the criteria.

The double-hulled, dynamically-positioned rig is presently contracted to Reliance Industries in

India until July 2014 for a dayrate

of $510,000.

The tender marked the first

time Petrobras has returned to the

international rig market after an

absence of more than two years,

as the company tries to secure

ultra-deepwater units in the short

term to cover possible delays on 28

newbuilds due to be delivered by

Sete Brasil from 2015 to 2020.

Queiroz Galvao Oil & Gas (QGOG)

finished second in the tender with

the newbuild drillship Brava Star

for a dayrate of $530,000, followed

by Seadrill with the cylindrical

semi-submersible rig Sevan

Developer for $490,000.

Despite a lower dayrate proposed for the Sevan Developer,

formerly known as Sevan 4, QGOG

ended up ahead in the competition with a cheaper mobilisation

fee and the fact that the Brava Star

is a dual-derrick rig, offering reductions in drilling time and costs

for both exploration and development wells.

“When Petrobras put everything on the balance to equalise

all proposals, the dual-activity

was one of the reasons that catapulted the Brava Star to the second spot,” said another source.

He said QGOG proposed the lowest mobilisation fee in the tender,

at about $30 million for the Brava

Star, while Transocean proposed

a mobilisation rate of more than

$50 million for the Dhirubhai

Deepwater KG1.

Seven other rigs were offered in

the tender, including three from

Ensco, another two from Seadrill

and one from Maersk Drilling.

Pacific Drilling finished last

with the drillship Pacific Meltem,

currently under construction at

Samsung Heavy Industries in

South Korea, for a dayrate of

$634,000.

Petrobras asked companies to

present only units with modern

DP-2 or DP-3 dynamic positioning,

either semisubs or drillships,

with planned start-up in the

fourth quarter of 2014.

All 10 bids submitted in the tender were for periods of three years,

with options to renew the contracts for the same time.

Petrobras relaxed some of the

bidding rules in the middle of the

process after contractors complained that plans to remove a key

clause would have exposed them to

extra risks in the event of well kicks

and blowout spill situations. Petrobras then relented and kept the

relevant clause in for the tender.

“Companies were afraid at first,

but then Petrobras listened to contractors and made the bidding

more attractive to rig players,”

said one source.

He also said the results of the

tender put additional pressure on

four contractors seeking the

extension of charters on six ultradeepwater rigs. Negotiations

between Petrobras and contrac-

tors have been going on for almost

a year now and have revolved

mainly around dayrates.

The rigs for which Petrobras is

seeking renewal terms are Pacific

Drilling’s drillship Pacific Mistral,

Diamond Offshore’s semisub

Ocean Valor, Seadrill’s semisubs

West Eminence and West Taurus,

and Ocean Rig’s drillships Ocean

Rig Corcovado and Ocean Rig

Mykonos.

All six contracts are due to

expire in 2015. The rigs are chartered on dayrates ranging from

$440,000 to $460,000, with the exception of the West Eminence and

West Taurus, contracted for

$615,700 and $647,500, respectively.

The source also revealed that

Petrobras received bids early in

February in a market enquiry to

assess the possibility of chartering rigs capable of drilling off Brazil in water depths of 1000 metres.

Companies that participated in

the tender for ultra-deepwater

rigs were also said to have submitted offers in the market enquiry,

but the outcome is unknown at

this point, as Petrobras has not

disclosed the results yet.

NEWS

28 February 2014

5

EQUATORIAL GUINEA

Consortia head to head

for Ophir’s FLNG project

Bumi-Keppel-IHI in face-off against Excelerate and

Samsung Heavy Industries for multi-billion dollar prize

TAN HWEE HWEE

and IAIN ESAU

Singapore and London

TWO consortia are facing off to

secure a prized design, engineering and construction contract

from London-listed independent

Ophir Energy, covering its multibillion dollar Block R floating liquefied natural gas project off

Equatorial Guinea.

Industry sources said a consortium of Kuala Lumpur-listed Bumi

Armada, Singapore-based Keppel

and Japan’s IHI is doing battle

with a pairing thought to consist

of Texas-based Excelerate and

South Korean giant Samsung

Heavy Industries.

The operator aims to select its

preferred bidder — under a memorandum of understanding — by

the third week of March, with one

source close to Ophir tipping

Bumi-Keppel-IHI as having an

edge.

The contract is expected to cover pre-front end engineering and

design and FEED studies, plus an

eventual build, own and operate

order.

Bumi and Excelerate have

signed separate letters of intent

with Ophir and the Malabo-based

government to indicate their commitment to working on the FLNG

scheme.

A final investment decision is

expected to be made on the project

by mid-2015, with first LNG exports starting in 2018, ahead of

gas exports from East Africa and

the US.

Excelerate and Samsung have

proposed a newbuild FLNG vessel.

However, their rivals have pitched

a converted unit, which sources

suggested is attractive to Ophir

and carries a price tag of about $2

billion.

In terms of liquefaction technology, Bumi is understood to be

offering a self-supporting prismatic type B (SPB) containment

system, with Excelerate focused

on a membrane process.

As Upstream went to press,

sources indicated Excelerate had

not asked for either price indication or a delivery slot for its proposal, pointing out that it is not

necessarily a given that Samsung

would build the vessel.

Ophir is understood to be eyeing a 2 million to 2.5 million tonne

per annum FLNG unit which will

be fed with gas from seven subsea

wells. The vessel’s minimum ca-

Cardona

success

for Stone

US INDEPENDENT Stone Energy has logged new drilling success at its Cardona discovery in

the Mississippi Canyon area of

the Gulf of Mexico with the latest well encountering 84 feet of

net oil pay.

The Block 29 number-4 hit

the pay in the previously-discovered zone.

The company currently is

running casing to protect the

sand while drilling the exploration section of the well.

The success extends the productive zone of the Block 29

TB-9 well to the adjacent fault

block to the north.

Plans are to flow the Cardona

well to the company’s Pompano platform, with first production in early 2015.

The current well is expected

to complete drilling operations

in next month.

Following the current well,

Stone plans to drill its Cardona

South prospect, also in Block

29.

Double-up for

Zola resource

CONTINGENT resources at the

Apache-operated Greater Zola

complex off Western Australia

have nearly doubled, according

to joint venture partner Tap

Oil.

Tap said the gross proven

and probable contingent resource at the Zola, Antiope and

Bianchi gas discoveries in

Block WA-49-R had been newly

assessed at 638 petajoules (601

billion cubic feet of gas).

The addition was due mainly

to the inclusion of resources

from the July 2013 Bianchi discovery.

These contain nearly 160 Bcf

of proven and probable contingent resources.

Three-well campaign: Vantage Drilling’s drillship Titanium Explorer

pacity is based on about 2.6 trillion cubic feet of gas so far discovered in Block R, and a feedstock of

about 400 million cubic feet per

day.

The upper capacity limit

depends on the success of a threewell drilling campaign which is

due to start in May or June, which

aims to add a further 2 Tcf of resource.

Vantage Drilling’s Titanium Explorer drillship will first spud the

420 billion cubic foot Silenius East

exploration probe, followed by

appraisal wells at the Fortuna and

Tonel North discoveries.

Block R’s gas is biogenic and

needs minimal processing, which

will reduce the cost of an FLNG

vessel. Ophir plans to lease the

FLNG vessel to reduce its capital

spending commitments, which

are expected to run to about $1 billion to first gas, rising to perhaps

$1.5 billion later on.

Petrofac is putting together an

overall Block R development plan.

Ophir has an 80% stake in Block

R and will begin to seek farminees

in mid-2014, when it will also start

to make inquiries for long-term

offtakers to underpin the project.

As well as buying Block R’s output, Ophir will look favourably on

them taking equity in the

upstream asset.

Ophir could potentially tap Singapore-based Pavilion Energy for

marketing support. As a new LNG

Photo: VANTAGE DRILLING

player backed by Singapore’s sovereign wealth fund, Temasek

Holdings, Pavilion Energy is

building up a portfolio of gas-rich

assets, including interests picked

up from Ophir in three blocks off

Tanzania.

Pavilion is expected to play a

key role in securing the LNG imports needed for Singapore to become a major LNG trading hub in

the Asia Pacific region.

A site selection study is underway for a second import terminal

earmarked for the eastern part of

Singapore while SLNG, the country’s first LNG terminal, looks set

to be expanded to boost its capacity to 9 million tpa from 6 million

tpa.

Output boost

for Shoreline

NIGERIAN independent Shoreline Natural Resources and its

technical partner Heritage Oil

have boosted output from OML

30 in Nigeria’s Delta State by

17% over the past year, with

net production running at

15,600 barrels per day.

Heritage’s chief executive

Tony Buckingham said OML 30

will be “a platform to grow and

obtain additional interests in

Nigeria and in other core

areas.”

OML 30 was one of four

blocks sold by Shell in 2011 as

part of its ongoing Niger Delta

divestment programme.

NEWS

6

Offshore

winners

face delay

THE announcement of the

winners of offshore blocks

offered in Myanmar’s first

licensing round is still some

way off, and there are signs that

some of the industry heavy

hitters that submitted bids

might be getting cold feet, writes

Amanda Battersby.

Some within industry had

been hoping the announcement

would coincide with this week’s

Myanmar Oil & Gas Week, but

sources close to the government

said it would likely not be until

April at the earliest — one year

after the round was launched.

“Don’t ask me when it will be

announced,” said Wah Wah

Thaung, executive officer at the

planning department of

state-owned Myanma Oil & Gas

Enterprise (MOGE).

Ken Tun, chief executive of

Myanmar company Parami

Energy, said this delay could

harm Myanmar’s investment

attractiveness.

He noted that neighbour

Bangladesh had launched its

offshore round after Myanmar,

yet had already announced

winners.

Despite the initial high level

of interest and bids being made,

several operators have told

MOGE that they do not consider

six months to be sufficient time

to prepare the environmental

and social impact assessments

as required under existing

production contract sharing

terms.

Wah Wah Thaung admitted

this to delegates at ITE’s

Myanmar Oil & Gas Week

adding that she had conveyed

these concerns to the Ministry

of Energy.

Another “huge concern” is a

clause in the model PSC that

affords Myanmar certain

“unalienable rights” as this

effectively undermines the now

revised Foreign Investment Law

that affords companies the right

to international arbitration for

dispute resolution, according to

Jean Loi, managing partner at

law firm VDB Loi in Myanmar.

Another issue is that bidders

are only allowed to bid for a

maximum of three blocks from

the 30 tracts that compromise

the maiden offshore licensing

round.

On a positive note, Loi said

she knows of operators that

requested amendments to some

contract terms during contract

negotiations with MOGE and

the national outfit responded

favourably.

MOGE is also said “not to be

unreasonable” with regard to

companies relinquishing

acreage after disappointing

initial exploration without their

completing the entire

commitment work programme.

Another factor is that MOGE’s

expectation of the signature

bonus for deep-water

exploration blocks might not be

“that high” because of the

exploration risk, added Loi.

MOGE received 64 proposals

from 30 companies for its 2013

offshore offering — 42 for

shallow-water blocks and 22 for

deep-water blocks.

28 February 2014

MYANMAR

On the rise: a hot air balloon flies over a temple in Mandalay, Myanmar

Photo: AFP/SCANPIX

Myanmar onshore round

set to break new ground

Licensing exercise may feature acreage for unconventional exploration,

with energy authorities planning to learn from Thai contract models

AMANDA BATTERSBY

Yangon

MYANMAR plans to launch an

international onshore licensing

round this year that for the first

time could include acreage being

offered for unconventional exploration.

Much debate is going on regarding whether to offer some of the

onshore blocks that were historically reserved for Myanma Oil &

Gas Enterprise (MOGE) but where

the national company has either

been unsuccessful in its exploration forays or has reached a technological impasse.

Such blocks could be included in

the third onshore round as Nay

Pyi Taw is keen to maximise upstream activity, said MOGE executive geologist Kyaw Kyaw Aung.

Blocks PSC-P (Myaungmya),

PSC-Q (Payagon), MOGE-6 (Indaing) and MOGE-7 (Myanaung East)

are reserved for MOGE until this

year but these could be offered

with unconventional production

sharing contracts in the 2014 onshore round.

MOGE and other government

energy officials plan to visit Thailand to learn the contract model,

terms and conditions for uncon-

ventional exploration. “Once the

managements come to know

about the PSC model and terms

and conditions of unconventional

exploration, the blocks occupied

by MOGE could probably be released with an unconventional

PSC contract in 2014,” said Kyaw

Kyaw Aung.

However, there will be no tender invitations for enhanced oil

recovery or improved petroleum

recovery contracts on MOGE’s

blocks RSF-1, 6, 8, MOGE-2, 5 and

IOR-1 in the upcoming onshore

bid round.

“As the Ministry of Energy is

quite interested in unconventional exploration and production

nowadays, foreign companies

should pay attention in presenting [such] new techniques,” said

Kyaw Kyaw Aung.

The government wants such

technologies to be transferred to

the national oil and gas company,

he said.

MOGE earlier signed a landmark

memorandum of agreement with

Daewoo to perform a feasibility

study into unconventional exploration, said to be shale gas, on on-

shore blocks RSF-7 and MOGE-8.

Kyaw Kyaw Aung took pains to

explain it did not mean MOGE

would be awarding without international tender two production

sharing contracts to Daewoo —

the agreement only covers the

feasibility study.

Australian company Tamboran

has applied to carry out a feasibility study into unconventional exploration in the HtaukshabinKanni areas but to date has not yet

received permission from the

Ministry of Energy.

Eight blocks — PSC-C2 (ShweboMonya), PSC-L (Sittwe), PSC-M

(Kyaukphyu), PSC-S (Hsipaw-Lashio), PSC-T (Lashio East), PSC-U

(Kalaw), PSC-V (Loikaw) and IOR-3

(Tetma) — that were without takers in the 2013 second onshore bid

round will definitely be included

in the third round, added Kyaw

Kyaw Aung.

It is not yet known whether all

or how many of the 30 offshore

blocks offered in the April 2013

round for which bids are still

being evaluated will ultimately be

awarded.

If all 30 are taken up this

will leave just three shallowwater blocks — A-2, M-1 and M-10,

the last of which was relinquished

by China National Offshore Oil

Corporation (CNOOC) — still available.

Kyaw Kyaw Aung said Block

M-10 is “the most interesting” of

these three shallow-water tracts

because it is located near to Block

M-9 where PTTEP will soon begin

flowing gas from the Zawtika

project.

CNOOC drilled six wells to

depths of between 6000 and 7000

feet, but the structures hit were

not commercial and the Chinese

operator was also unable to farmdown the block.

Essar drilled one well on Block

A-2 but did not perform production testing.

Rimbunan drilled one exploration well without testing on

Block M-1, then acquired additional 2D seismic data before relinquishing the acreage without

sinking a second well.

Government officials said they

expected the second offshore

licensing round would be possible

in early 2015.

Passion speaks louder than words

Here’s a generation defining question: how can North America’s energy supply be secured in a safe and

efficient manner? We believe the answer lies in having the right people implement the right technologies.

Our history has been built by highly skilled and imaginative individuals with the passion to go the extra

mile. These innovators are now working relentlessly to develop our onshore and offshore assets, and

are tasked with a hugely important mission: to keep raising the bar.

Explore more at neversatisfied.statoil.com

Always exploring

Never satisfied

NEWS

8

Change

on way for

Petronas

A SUCCESSION plan is being

lined up at Petronas’ twin towers for Shamsul Azhar Abbas,

the chief executive of the Malaysian national oil company,

whose contract is due to expire

by 2015, writes Tan Hwee Hwee.

Shamsul has recently taken

more of a back seat, handing

over day-to-day operations to

Wan Zulkiflee Bin Wan Ariffin,

who was appointed as chief

operating officer in 2013, sources said.

Wan Zulkiflee, who also

serves as executive vice president of downstream, is among

those seen as a candidate to potentially succeed Shamsul in

the top job.

Anuar Taib, who joined as

president of upstream unit

Petronas

Carigali

from

Sarawak Shell, is also considered a strong contender.

The third candidate more recently identified within Malaysian circles is Ahmad Nizam

Salleh, who until recently was

chief executive of South Africabased Engen.

Two other previously named

potential contenders are Petronas’ vice president of corporate

strategic planning, Arif Mahmood, and Petronas Lubricants

chief executive Amir Hamzah.

Arif orchestrated the acquisition of Canada’s Progress

Energy Resources.

Shamsul has already announced his intention to retire

when his contract expires in

2015.

However, recent movements

made by Petronas’ board have

sparked speculation his retirement could be brought forward

to the first half of 2014.

A new face at Petronas’ top

office will likely herald a major

reshuffle within the management team, including the executive vice presidency for exploration and production

business presently held by Wee

Yiaw Hin.

Wee, a former Shell and Talisman executive, was brought

in by Shamsul to lead the challenge of reversing falls in domestic oil and gas production.

Buyers line

up for deal

MALAYSIA’S Petronas is set to

sell a 25% share of its Canadian

shale-liquefied natural gas

position to Indian and other

Asian buyers, according to

chief executive Shamsul Azhar

Abbas.

“I am pleased to announce

that we have just finalised a

further 25% equity participation from an Indian party and

an established Asian LNG buyer,” Shamsul said, according to

Reuters.

Shamsul said he could not

name the companies before the

signing of the deal, which is

planned for next week.

However, Indian Oil Corporation has been cited as a

potential buyer of a 10% stake

since last year.

28 February 2014

RIG MARKET

Options: Huisman’s production facility in Zhangzhou, China

Photo: HUISMAN

CIMC Yiulian tipped for

Noble semisub contract

Chinese yard emerges as frontrunner to build unit for US player,

while drilling equipment package goes to Dutch specialist Huisman

XU YIHE

Singapore

CHINESE yard CIMC Yiulian is in

pole position to secure a landmark

contract from drilling contractor

Noble Drilling Services to build a

semi-submersible rig for $200 million to $250 million.

Sources said that although a final contract is still pending, Noble

has agreed terms with Shenzhenbased Yiulian after having floated

a tender last year that also drew

participation from China’s Cosco

Shipyard, Shanghai Waigaoqiao

Shipbuilding and Singapore’s

Jurong Shipyard.

The deal could be finalised soon

after Noble signs a charter agreement, which many sources said is

one of the key parameters for

Noble to start the project.

They added that Yiulian

emerged as a strong contender by

offering a very competitive price

and has agreed to be the lead contractor on a turnkey basis.

Yiulian’s offer does not include

the drilling equipment package,

which will be supplied by Dutch

heavy lift equipment specialist

Huisman.

Other bidders including Cosco

would prefer to act as a subcontractor with a workscope of

building only the hull, while leaving the integration and completion

to be carried out by Huisman.

Noble is keen to commission

Yiulian as the lead contractor responsible for project financing,

which other yards considered

harbours excessive financial risks.

Sources also pointed out that another possible option is to complete

integration in Zhangzhou in Fujian

province, where Huisman owns

and operates offshore fabrication

facilities.

Once a deal is signed, Yiulian is

expected to complete the unit in 33

months, sources said, adding that

Yiulian is currently carrying out

workshop design. The newbuild

Eva Plus, a Zentech-Noble design

rig, will be classed by ABS and be

able to work in water depths of

1500 feet (457 metres) with drilling

depths of 30,000 feet (9754 metres).

The unit will have three lifting

cranes, with two on deck having a

capacity of 100 tonnes each.

The living quarters are built to

accommodate 154 people.

Upstream earlier reported that

Noble had been doing the rounds

presenting the concept to oil companies and was unlikely to place

speculative orders, preferring instead to first line up charters with

oil companies.

Including the Paul Wolff, Noble

has five EVA-design rigs in its fleet.

All were built in the early-1980s as

three-column submersibles for operations in shallow water.

However, during the 1990s

Noble, reacting to a surge in demand for deep-water rigs, opted to

spend billions of dollars converting

the five EVA rigs to semisubs capable of operating in maximum

depths of between 1200 and 2800

metres of water.

Yiulian has so far specialised in

jack-up rigs, especially of the CJ46

design.

The yard has booked deals to

build up to 18 jack-ups, including

12 CJ46, four CJ50 and two JU2000E

design rigs.

Noble contracted China’s Dalian Shipbuilding Industry Offshore (DSIC Offshore) to upgrade

a semi-submersible drilling rig in

2008.

DSIC Offshore delivered the unit

upon mechanical completion for

integration and overall completion

at a yard in Brazil in 2009.

The Chinese yard in Dalian also

built and delivered three JU2000E

jack-up rigs to Noble — Noble

Roger Lews, Noble Hans Duel and

Noble Scott Marks, respectively, in

2007, 2008 and 2009.

Heerema Marine Contractors takes out Liwan 3-1 award

ITALY’S Saipem is understood to

have awarded Dutch oilfield services provider Heerema Marine

Contractors a lump-sum deal for

pipeline installation at the Husky

Energy-operated Liwan 3-1 deepwater gas development in the Pearl

River Mouth basin of the South

China Sea, writes Tan Hwee Hwee.

A letter of intent is was issued

to the Dutch player for the installation of about 37 kilometres of 22inch deep-water pipeline in 1500

metres of water at the Liwan 3-1

project using Heerema’s newbuild

J-lay vessel Aegir.

Aegir will take over from

Saipem’s pipelay crane vessel

FDS-2, which is said to have demobilised from Liwan for other

commitments.

Aegir is due to mobilise towards

the end of May for the

Liwan job from Anadarko’s Lucius

field in the Gulf of Mexico.

The deep-water J-lay vessel is

expected to arrive at Liwan in

early June for an offshore installation campaign lasting through

early August.

The scheduled pipeline installation at Liwan will be Aegir’s first

campaign in Asia.

Aegir will next move on to the

Inpex-operated Ichthys gas development off Australia’s Northern

Territory.

The deep-water construction

vessel will transport and install

subsea pipelines and moorings for

the planned floating production,

storage and offloading vessel and

central processing facility at the

Ichthys project.

The lump-sum deal for Liwan is

Aegir’s third contract win in the

Asia Pacific region, after earlier

awards from Inpex and Shell for

work on the Ichthys project and

the Malikai tension-leg platform

development off Australia and

Malaysia, respectively.

NEWS

28 February 2014

9

MIDDLE EAST

New tender for NEB 3 project

Adco launches exercise for offshore Al-Dabbiya field

— part of North East Bab 3 development that aims

to boost company’s output by 110,000 bpd by 2018

VAHE PETROSSIAN

London

ABU Dhabi Company for Onshore

Operations (Adco) has received

technical proposals in a tender for

the offshore Al-Dabbiya field as it

finalises its selection of a contractor for the onshore Rumaitha and

Shenayel fields that make the up

rest of the $1 billion North-East

Bab 3 (NEB 3) development.

The Al-Dabbiya technical bids

will be evaluated over the next

two months and price offers will

be invited in May or possibly later

if there is an extension of the

schedule, a source said.

Al-Dabbiya covers a series of

low-lying islands in an environmentally sensitive coastal region

of Abu Dhabi.

The key facilities will require

construction of artificial islands.

The third phase of the NEB

development, for which Mott

MacDonald is acting as management consultant, aims at raising

Abu Dhabi’s production capacity

by 110,000 barrels per day by 2018.

MacDonald earlier this year

helped evaluate and select the winning proposal for the Rumaitha

and Shenayel fields — following

technical and price submission by

eight bidders late last year.

The selection has yet to be confirmed and announced by Adco.

The package for the onshore

Rumaitha and Shenayel fields, 30

kilometres south of Al-Dabbiya,

covers a new processing plant and

a new gathering system involving

17 clusters and injection facilities.

Technip carried out the frontend engineering and design studies for both the onshore and off-

shore facilities. A partnership of

France’s Technip and Abu Dhabibased National Petroleum Construction Company (NPCC) built

facilities in 2006 for an existing

110,000 barrel per day capacity in a

$600 million contract.

The NEB 3 development is part

of Adco’s plan to increase overall

output to 1.8 million bpd from

1.4 million bpd by 2018.

The overall expansion plan

involves North East Bab, Bab

itself, Qusahwira, Ruwais and

Bida al-Qemzan.

The emirate’s total capacity is

being increased to 3.5 million bpd

by Adco’s parent company Abu

Dhabi National Oil Company.

Search the archive:

Adco

Teaming up

for Kepodang

INDONESIA’S state-owned gas

utility Perusahaan Gas Negara

(PGN) is reportedly teaming up

with local conglomerate Bakrie

Group on building the planned

export pipeline connecting the

Petronas-operated Kepodang gas

development to Tambak Lorok.

PGN could not be reached for

confirmation over media reports

about the partnership for the

210-kilometre pipeline, but Bakrie

Group was long known to be

struggling to put together the

necessary funding for the project.

PGN’s involvement will breathe

fresh hope into the stalled pipeline project widely considered as

holding back progress towards the

targeted first gas production at

the Kepodang development before

the end of 2014.

Citing a SKK Migas official, an

Indonesian business daily said

work on the Kepodang export

pipeline will begin in March 2014,

with the aim of completing installation in mid-2015.

However, Upstream understands PGN and Bakrie Group are

still working towards securing a

pipelay vessel for the Kepodang

export pipeline.

The Kepodang gas development

also includes a wellhead platform

and a central processing platform,

which its field operator has awarded separately to McDermott of the

US.

Calgary

Houston

London

Jakarta

February 27th and 28th

One on one meetings and

data room availability

March 3rd through March 6th

One on one meetings and data

room availability

March 6th Road Show presentation

March 17th and March 18th

One on one meetings and data

room availability

April 4th Road Show

presentation

Hilton Américas

1600 Lamar St, Houston,

TX 77010, USA

Grosvenor House,

JW Marriott Hotel

86-90 Park Lane, London

(Open to the general public)

(Open to the general public)

Calgary Marriott

Downtown Hotel,110 9th

Avenue SE, Calgary,

Alberta, Canada

JW Marriot Hotel Jakarta

Jalan DR Ide Anak Agung

Gde Agung Kav E.1.2 No

1&2, Kawasan Mega Kiningan

Jakarta 12950 Indonesia

Shedule your meeting today: rondacolombia2014@anh.gov.co - www.rondacolombia2014.com - 018000953000

10

28 February 2014

COMMENT

Scotland forces focus

on oil and gas sector

T

HE UK political

establishment in

London has

suddenly discovered

Scotland and North Sea oil, it

seems.

This week UK Minister

David Cameron held his first

Cabinet meeting in Scotland

and used the occasion to

promise a £200 billion ($333

billion) energy revolution

— a far cry from the £10

billion windfall tax grab this

time three years ago.

Both Scotland and oil have

received less than their fair

share of attention in the past

and the new focus is

welcome.

The reason for this

awakening largely stems

from the sudden realisation

that later this year Scotland

could vote for independence.

The UK government is now

desperate to prove that it

takes oil and gas — largely

located in Scottish waters

— very seriously.

A political schism between

the two nations — joined

politically since the Act of

Union in 1707 — would have

a dramatic impact on the UK

as a whole, currently also

made up of Wales and

Northern Ireland.

A secession by Scotland

would certainly reinvigorate

a Welsh nationalist party,

and what then for the once

mighty Great Britain? Would

that seat on the United

Nations Security Council

still be available?

The political and economic

implications are profound,

but few believed in recent

times Scotland would go it

alone.

The latest opinion polls

also suggest it is still

unlikely, as the practical

obstacles mount for

Scotland’s First Minister and

Scottish National Party

leader Alex Salmond.

However, the polls also

show that support for

independence is gaining

ground and Cameron is

becoming aware that he has

a serious fight on his hands.

The key to Scottish

economic independence is

centred on oil and gas

reserves, with more than

90% generally considered to

fall inside Scottish waters.

There may be little room

for bickering between the

two newly-separated

nations if independence does

happen, but the oil industry

has already expressed

concerns about the added

bureaucracy and the

potential for restructured

and separate tax regimes.

Would an independent

Scotland be more

sympathetic to the needs of

the hydrocarbons sector?

You might have thought

so, but what if its shrunken

tax and business base was

strapped for cash?

Could it kill the golden

goose in a rash tax grab

itself?

In the meantime, the UK

government has belatedly

woken up to the need for

The key to

Scottish

economic

independence

is centred on

oil and gas

reserves, with

more than

90% generally

considered to

fall inside

Scottish

waters.

political attention to focus

on the North Sea’s falling oil

and gas production.

Last summer, Energy

Secretary Ed Davey

commissioned former

oil-services leader and Wood

Group founder Ian Wood to

review the sector.

His report was also out

this week and the £200

billion promise from

Cameron was based on

Wood’s findings.

Wood is basically calling

for a new regulator to

co-ordinate more

collaboration and

integration between

government and industry.

He had no brief to

investigate fiscal issues, but

the new regulator is

specifically tasked with

advising the Treasury.

Equally, the Wood Report

is heavy on oil company

obligation, but is light on

incentives.

There will also be

questions about where the

new regulator will recruit

the relevant skilled staff in

times of shortages.

However, this kind of

attention can only be good.

It is only a pity it took a

wider political threat to

bring it about.

Russia’s tough rhetoric against

Ukraine’s new leaders... may quickly

break the historic ties between these

two Slavic countries.

Russia must heed

voice of Ukraine

Populist ousting

of Yanukovich

irks Moscow, but

its opposition

now risks loss

of goodwill for

many years

T

HE abrupt ousting of

Ukraine’s President

Viktor Yanukovich and

the imminent

formation of a new government

and administration in Kiev is

quickly becoming another bone

of contention between Russia

and the West.

With relations between the

two sides already tense because

of Russia’s support for Syria,

the opposition victory in

Ukraine has dealt a blow to

Russian hopes of turning its

neighbour into a full political

and economic ally, if not a

subordinate.

Russian government officials

and experts had failed to

predict the wide popular

support for the opposition in

Ukraine and the sharp reaction

from ordinary Ukrainians to

tough police actions in the

streets of Kiev, which are often

seen in Moscow these days.

The Kremlin responded by

turning to the usual rhetoric of

blaming the West and accusing

its intelligence agencies of

masterminding and financing

opposition protests in Ukraine.

While the West welcomed the

change of power in Kiev,

Moscow has repeatedly

questioned the legitimacy of

Ukraine’s new leaders, led by

interim President Aleksandr

Turchinov, describing events in

the country as an “armed

mutiny”.

Earlier this week, Moscow

suspended financial assistance

and recalled its ambassador

from Kiev, refusing to

acknowledge allegations of the

economic harm that

Yanukovich and his circle of

relatives and friend had done to

Ukraine and its economy.

Russia’s Duma lower chamber

of parliament has also called for

authorities in Ukraine’s

Crimean Peninsula to hold a

referendum on whether the

region should become a part of

Russia, fuelling separatism

claims that are dividing

New order: anti-government protesters in Kiev

Photo: REUTERS/SCANPIX

Ukrainian society. However,

the Kremlin has stopped short

of using another traditional

weapon against Ukraine — gas

supplies.

So far, Russian gas exports to

Europe via Ukraine have been

uninterrupted, while a recent

slump in gas sales in Ukraine

has been explained by warm

weather, with temperatures in

February above normal.

A sharp contrast to the

Kremlin’s pronouncements on

Ukraine’s power shift was seen

in the reaction from European

Union officials and the US.

German Chancellor Angela

Merkel was reported to have

called opposition leader Yulia

Tymoshenko, released from a

prison cell over this past

weekend, and urged her to

work for unity of the country.

Meanwhile, Poland has risen

as a regional political and

diplomatic power, acting as a

mediator between Kiev and

other European countries, also

to the displeasure of Moscow.

On the economic front, the

EU Commissioner for Economic

Affairs, Olli Rehn, said that

substantial financial aid for

Ukraine could be on the agenda.

US Treasury Secretary Jacob

Lew said that the best approach

would involve “international

support through the

International Monetary Fund

and bilateral support”.

Ukraine’s finance ministry

said that $35 billion may be

needed over the next two

years, with Turchinov calling

for a quick financial support to

assist authorities in stabilising

its domestic currency, the

hryvna.

Russia’s tough rhetoric

against Ukraine’s new leaders,

its apparent public support of

separatist movements, the

refusal to provide earlier agreed

financial assistance and its

criticism of the West, however,

may quickly break the historic

ties between these two Slavic

countries.

From here on in, Russian

President Vladimir Putin is

losing more than he is gaining

by refusing to acknowledge the

choice of the majority of the

Ukrainian population.

If the Kremlin continues to

pursue the same approach

towards Ukraine, this country

may become lost to Russia for

many years.

28 February 2014

11

$35 billion

THE AMOUNT of

financial aid Ukraine says

it may need over the next

two years.

Chevron’s

pizza PR

problem

SIDETRACK

I

Battle of Britain: North Sea oil and gas reserves are at the heart of the debate over Scottish independence from the UK

UPSTREAM/RYTIS DAUKANTAS

Scaroni’s outburst gets results in Iraq but

time will tell if the change is permanent

B

YZANTINE bureaucracy

has long stifled the

growth of Iraq’s oil

industry, to the chagrin

of international oil companies

which embraced tough terms to

develop its giant fields.

Some companies, such as

Statoil and ExxonMobil, have

left or reduced their exposure to

a country that has failed

miserably to cut red tape and

create a secure environment for

foreign investors.

The more patient are having

second thoughts about their

commitments to oilfield

developments, and are voicing

their anger publicly.

A normally sober-headed

Paolo Scaroni, chief executive

of Italy’s Eni, could hardly hide

his emotions earlier this month

in denouncing persistent

bureaucratic hurdles in the way

of approving key contracts.

Eni is running far behind

with the development of the

Zubair field because the Iraqi

Cabinet takes a painfully long

time to sanction expenditures.

Eni can no longer take it and

would be happy to quit Iraq,

Scaroni warned. “We are asking

ourselves, is it worth it to stay

in Iraq?” Scaroni said.

“Either you remove the

obstacles, or we remove

ourselves,” he says he told Iraqi

officials, including powerful

Deputy Prime Minister for

Energy Hussein Shahristani.

Scaroni’s outbursts seem to

have finally found a sympathetic

ear in the Iraqi Cabinet, which

moved to approve two Zubair

packages worth $1 billion.

“We respect Eni and take their

opinions seriously. We want

them to stay,” said an Iraqi

official.

Eni is not the only company

faced with long delays in

rehabilitating Zubair, where

expansion has progressed at a

snail’s pace since 2009.

BP also had to lay off contract

workers at its Rumaila field

because the Oil Ministry has

failed to approve contracts

aimed at expanding production.

Companies complain of

numerous delays in the

approval of visas for

expatriates, as the Iraqi

government pressures them to

employ poorly-trained locals.

It remains to be seen if the

latest step by the Cabinet to

approve contracts for Eni is the

beginning of a new era — or

simply a move to stave off the

departure of yet another major

company from Iraq.

LETTERS TO THE EDITOR

THE INTERNATIONAL OIL & GAS NEWSPAPER

Editor-in-chief: ERIK MEANS

News editor: MARK HILLIER

Chief sub-editor: ANDREW KEMP

Upstream wants to hear from its readers, and all comments are welcome.

Send to: letters@upstreamonline.com

Address: PO Box 1182, Sentrum, N-0107 Oslo, Norway.

Phone: (+47) 2200-1300

E-mail: editorial@upstreamonline.com

Marketing director: Sidsel Norvik

EDITORIAL OFFICES

• LONDON: 11th Floor, 25 Farringdon Street, London EC4A 4AB, UK. Phone: (+44) 207-029-4150

Fax: (+44) 207-029-4197. • HOUSTON: 5151 San Felipe, Suite 1440, HoustonTX, 77056, USA. Phone: (+1) 713-626-3117

Fax: (+1) 713-626-8134. • SINGAPORE: The Riverwalk #04-04, 20 Upper Circular Road, Singapore 058416.

Phone: (+65) 6557-0653 Fax: (+65) 6557-0900. • ACCRA: Phone: (+233) 224-310-103.

• BEIRUT: Phone: (+961) 1360-091. • CALGARY: Phone: (+1) 403-455-0405.• MOSCOW: Phone: (+7) 926-203-2233.

• NEW DELHI: Phone: (+91) 981-085-9920. • PERTH: Phone: (+61) 412-577-266.

• RIO DE JANEIRO: Tel: (+55) 21-2285-9217. • WELLINGTON: Phone: (+64) 4-976-9572.

(Email to our reporters: firstname.lastname@upstreamonline.com)

SUBSCRIPTIONS & ADVERTISEMENTS:

• OSLO: PO Box 1182, Sentrum, N-0107 Oslo, Norway.

Phone: (+47) 2200-1300 Fax: (+47) 2200-1310.

• STAVANGER: Phone: (+47) 5185-9150

Fax: (+47) 5185-9160.

• HOUSTON: 5151 San Felipe, Suite 1440, Houston, TX77056,

USA. Phone: (+1) 713-626-3113 Fax: (+1) 713-626-8125.

• SINGAPORE: Phone: (+65) 6557-0600

Fax:(+65) 6557-0900

Upstream is published by NHST Media Group, Christian Krohgs gate 16, PO Box 1182, Sentrum, N-0107 Oslo and printed by Mortons Print Ltd, Horncastle, Lincs UK. Stock Information produced the day before printing.

T HAS not yet been

determined what

caused Chevron’s

Lanco-7H well in

Pennsylvania in the US to

blow out and burn for days,

killing one worker. However,

the fallout from an ensuing

public relations blunder was

almost entirely the

company’s own doing, writes

Luke Johnson.

It was a well-intentioned

mistake. In the days

following the blowout,

Chevron representatives

went door-to-door to check

in with local residents, give

an update on the stillburning well and answer

questions.

As a “token of appreciation”

to locals put out by the traffic,

noise and inconvenience of a

gas-fed well fire in their back

yards, Chevron offered their

“neighbours” coupons for a

free large pizza and a large

drink.

It was a nice enough

gesture, intended to not only

placate angry residents but to

express gratitude to Bobtown

Pizza, which had provided an

operational headquarters for

Chevron during its response

to the blast.

Unfortunately for

Chevron, a local blogger got

hold of one of the 100 or so

vouchers and posted it

online with a headline about

a peace offering that seemed

paltry and frivolous given

the gravity of the situation.

Days later, Chevron was

being pilloried around the

world, excoriated for a move

that struck many as

shockingly tone deaf.

Everyone loves free pizza,

but Chevron probably should

have been more aware of the

stakes. Anti-frackers keep a

close eye on industry

missteps — real and

perceived — and this is one

that could have been easily

avoided.

The fires are out and the

wells are capped, but public

resentment will likely

smoulder for some time.

© All articles, pictures and graphics

appearing in Upstream are

protected by copyright.

Any unauthorised reproduction is

strictly prohibited.

ID statement: Upstream (ISSN# 0807-6472)

(USPS# 016-132) is published weekly by

NHST Media Group, PO Box 1182 Sentrum,

0107 Oslo, Norway.

Annual subscription rate is US$995.

Periodicals postage paid at Summit, NJ 07901

and at additional mailing offices. USA agent is

SNI, PO Box 1409, Summit NJ 07902.

POSTMASTER: Send USA address changes to

Upstream Houston, 5151 San Felipe, Suite 1440,

Houston TX 77056

This edition was printed on 26 February 2014

12

28 February 2014

POLITICS

Nigeria in

financial

turmoil

NIGERIAN Minister of Finance

Ngozi Okonjo-Iweala has demanded a full independent investigation into claims of unaccounted oil funds misplaced

by the Nigerian National Petroleum Corporation (NNPC),

writes Barry Morgan.

The move highlights anxiety

at the highest levels of government over last week’s suspension of Bank of Nigeria Governor Lamido Sanusi.

Iweala said she understood

her own ministry’s efforts at

reconciling accounts had demonstrated a shortfall in remittances of $11 billion, but conflicting claims by Sanusi

suggested discrepancies of

some $20 billion.

“I therefore want to see the

truth from an investigation by

the auditor general as a matter

of extreme urgency undertaken by independent external

auditors.”

The controversy is the latest

in a series of blows to the

credibility of Nigeria’s financial system at a time when local and foreign lenders are being asked to bankroll

development ventures in the

wake of Shell’s ongoing divestment programme.

The debt-equity markets are

already saturated with applications from indigenous players

angling to shore up financial

credibility ahead of bid submissions, and the current turmoil makes their task harder,

according to the chief executive of one UK-based explorer.

NNPC group managing director Andrew Yakubu this

week vigorously defended the

state company before the

House Committee on Upstream

Petroleum against charges that

officials had connived with

Swiss oil traders to market

crude below market price and

pocket the difference.

The Nigerian Extractive Industries Transparency Initiative (NEITI) earlier hinted that

about $8 billion was lost annually through crude swaps

whereby oil was lifted in exchange for refined products.

Yakubu defended local and

international traders, several

of which are currently bidding

for strategic acreage under

Shell’s latest divestment exercise in the eastern Niger Delta.

Against this backdrop, lawmakers bemoaned delays to the

reforming Petroleum Industry

Bill, designed to restructure

the sector and impose transparency.

Rivers State Governor Rotimi

Amaechi this week blasted the

federal government for refusing to allow his office to import

two US helicopters for deployment in illegal oil bunkering

surveillance, hinting at official

collusion in oil theft.

The oil workers will be on the

streets to defend the revolution.

We do not fear fascism.

Venezuelan Energy Minister Rafael Ramirez

UKRAINE

Aftermath: a memorial for the victims of the recent violence in Kiev

Independent gas players on

With former president Yanukovich apparently on the run and

protesters still in the streets, the country’s interim energy minister

is facing some major decisions regarding Ukraine’s gas supply

VLADIMIR AFANASIEV

Moscow

DRASTIC political changes in Kiev

and the resumption of rapprochement between Ukraine and Europe have already invoked cautious hopes that the nation’s

state-dominated energy sector

will open up to independent players.

Ukraine’s interim Energy Minister Eduard Stavitsky expressed

hope that the new authorities will

foster the liberalisation of the domestic gas market to reduce the

country’s exposure to fluctuations

in Russian gas prices.

Speaking to the Kiev-based

Kommersant Ukrainy daily,

Stavitsky said the new government should promote the arrival

of independent gas suppliers to

the domestic market.

In addition, the opening of

Ukraine’s vast underground gas

storage facilities in the west of the

country to European gas players

could create a new gas hub.

This would in turn reduce the

monopolistic role of state-owned

gas operator Naftohaz Ukrainy to

just co-ordination and supervision, according to Stavitsky.

He added that the emergence of

independent gas suppliers in

Ukraine’s domestic market would

increase their bargaining power

in negotiations with Russia’s state

controlled monopoly Gazprom.

Despite the Kremlin’s negative

feedback on the opposition seizing

power in Kiev, Stavitsky expressed the belief that economic

reason between Ukraine and

Gazprom will prevail over politics.

Ukraine hopes that Gazprom

will extend the discount on gas

supplied to Ukraine into the second quarter, he said.

Naftohaz is currently importing

Russian gas at about $269 per thousand cubic metres, compared with

last year’s average price of $410 per

thousand cubic metres under the

agreement between the company

and Gazprom.

The agreement was signed in

December after the refusal of thenpresident Viktor Yanukovich to

sign an association agreement

with the European Union. The discounted Russian gas price will

have to be re-confirmed in March

in negotiations between the two

companies, otherwise it will automatically return to last year’s level.

However, government officials

in Moscow have indicated this

week that they have yet to recognise any legitimate power in Kiev

with whom they can hold talks.

Stavitsky revealed that despite

a wave of domestic non-payments

for supplied gas and uncertainty

about the state’s financial reserves, Naftohaz has been able to

pay $1.68 billion to Gazprom to reduce its $3.3 billion debt in the

Foreign oil workers evacuated as South Sudan peace talks fail

TALKS in the Ethiopian capital

Addis Ababa designed to hammer

out a peace accord between South

Sudan’s warring factions have

broken down, writes Barry Morgan.

Regional pressure to accept an

arrangement that excluded both

President Salva Kiir and former

vice president Riek Machar from

power was rebuffed. Fighting continued in Jonglei State with the

South Sudan Liberation Army

(SPLA) claiming to have killed 200

rebels loyal to Machar at Gadiang,

and to have retaken the town.

In Upper Nile State, aid workers

fled the town of Malakal as factions vied for control of the strate-

gic capital. The SPLA this week

admitted to conducting a “tactical

retreat” from Malakal while the

government evacuated foreign

technical engineering workers

from the oilfields.

Upper Nile State Minister for

Mining and Petroleum Francis

Ayul insisted that not all oil work-

ers had been evacuated and that

trained local workers would remain to maintain production operations.

Output from the Upper Nile’s

Adar Yale fields as well as Unity

State’s Heglig field complex has

dropped off significantly since

conflict erupted in mid-December.

28 February 2014

13

$269

THE AMOUNT per thousand cubic

metres that Ukraine is currently paying for

Russian gas under a deal signed by ousted

president Viktor Yanukovich last December.

Current model unviable says Moily

in defence of Indian gas-price rise

Photo: REUTERS/SCANPIX

on Kiev watch

INDIA’S Petroleum Ministry has

written to Prime Minister Manmohan Singh justifying the increase in gas prices from 1 April

and has claimed the government

cannot terminate the contract for

Reliance’s D6 deep-water block.

Indian Petroleum Minister

Veerappa Moily cited arbitration

as the primary reason for the ministry’s inability to cancel Reliance’s contract in his letter to

Singh on 14 February.

“In view of the contractual provision under the PSC (production

sharing contract), the government will not be able to terminate

the contract on account of a shortfall in production as the matter is

pending before the arbitral tribunal,” Moily wrote in his letter to

Manmohan Singh.

The United Progressive Alliance

(UPA) government led by Singh is

facing heat from opposition parties over the issue.

With elections due in a few

months, the government fears gas

pricing is likely to spiral in to a

major poll issue.

The Aam Aadmi Party (AAP) led

by anti-corruption activist Arvind

Kejriwal has demanded that gas

prices should not be increased.

Kejriwal has alleged a “gas scam”,

claiming the government is favouring Reliance.

Responding to Kejriwal’s allegations, Moily said that the existing

contract does provide for termination if there’s a default by the contractor. However, in 2012 the pe-

‘GAS SCAM’

ALLEGATIONS

Claims Reliance contract

cannot be cancelled

NISHANT UGAL

New Delhi

troleum ministry fined Reliance

$1.005 billion for lower gas output

from the D6 block in the Krishna

Godavari basin, which is presently under arbitration.

In his letter, Moily explained

the rationale behind the price

rise, claiming it was economically

unviable for companies such as

Reliance and Oil & Natural Gas

Corporation (ONGC) to produce gas

at the current price of $4.2 per

million British thermal units.

The AAP has claimed that the

cost of gas production works out

at $1 per million Btu but Moily

countered that ONGC’s average

production cost in the previous

financial year was $3.6 per million

Btu and the latest deep-water

finds would cost more than $4.2

per million Btu to produce.

Moily added that state-owned

players such as ONGC and Oil

India contribute close to 80% of