Littelfuse, Inc.

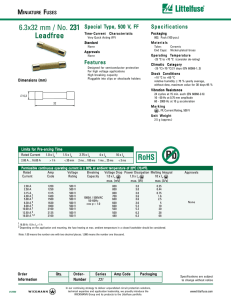

advertisement

Jefferies 2016 Industrial Conference August 9, 2016 1 Forward Looking Statements IMPORTANT INFORMATION ABOUT LITTELFUSE, INC. This presentation does not constitute or form part of, and should not be construed as, an offer or solicitation to purchase or sell securities of Littelfuse, Inc. and no investment decision should be made based upon the information provided herein. Littelfuse strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at investor.littelfuse.com/sec.cfm. This website also provides additional information about Littelfuse. SAFE HARBOR STATEMENT Certain statements in this presentation may constitute "forward-looking statements" within the meaning of the federal securities laws and are entitled to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include statements regarding the company’s future performance, as well as management's expectations, beliefs, intentions, plans, estimates or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as "believes," "expects," "may," "estimates," "will," "should," "plans" or "anticipates" or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy, although not all forward-looking statements contain such terms. The company cautions that forward-looking statements, which speak only as of the date they are made, are subject to risks, uncertainties and other factors, and actual results and outcomes may differ materially from those indicated or implied by the forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, risks relating to product demand and market acceptance, economic conditions, the impact of competitive products and pricing, product quality problems or product recalls, capacity and supply difficulties or constraints, failure of an indemnification for environmental liability, exchange rate fluctuations, commodity price fluctuations, the effect of the company's accounting policies, labor disputes, restructuring costs in excess of expectations, pension plan asset returns less than assumed, integration of acquisitions and other risks which may be detailed in the company's Securities and Exchange Commission filings, including those set forth under Item 1A. "Risk Factors" of the company's Annual Report on Form 10-K for the year ended January 2, 2016. The company does not undertake any obligation to update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise. This presentation should be reviewed in conjunction with information provided in the financial statements and the related Notes thereto appearing in the company's Annual Report on Form 10-K for the year ended January 2, 2016. USE OF NON-GAAP FINANCIAL MEASURES The information provided in this presentation includes certain non-GAAP financial measures, including “Adjusted Operating Margin” and “Adjusted Earnings per Share.” These non-GAAP financial measures should not be considered in isolation or a substitute for the comparable GAAP financial measures. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures is included in the appendix of this presentation. PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 2 Littelfuse: PROTECT | CONTROL | SENSE Designer, manufacturer, and seller of components and modules for circuit protection, power control, and sensing Focused on improving the safety, reliability and performance of our customers’ products and systems that use electrical energy LFUS Global footprint of sales, manufacturing and product development across 15+ countries LISTED On track for $1 billion of annual sales NASDAQ ® Strong operating margins and cash flow generation 10,000+ dedicated and innovative employees Headquartered in Chicago, IL PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 3 The #1 Brand in Circuit Protection Expanding Player in Power Control and Sensing Electronics (47%)* Semiconductor Passive Electronic Sensor Automotive (41%)* Automotive Sensor Passenger Car CVP Industrial (12%)* Custom & Relay Power Fuse Littelfuse has the broadest and deepest portfolio of circuit protection products serving three major market segments * Revenue 1H 2016 PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 4 Our Customers Are Global Market Leaders LEADING OEMs EMS/ODM PROTECT | CONTROL | SENSE TIER 1 AUTO DISTRIBUTION PARTNERS Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 5 Corporate Strategy: Target Growth Areas MEGATRENDS PROTECT CONTROL SENSE Value of Human Life Efficiency/Green Connected/Communication Predictive/Preventative Systems Globalization GROWTH AREAS STRATEGIC GROWTH AREAS TO ACCELERATE GROWTH BEYOND CORE Industrial Relays/ Controls Industrial Electronic Modules/Controls Sensors: Auto/General Industrial Commercial Vehicle Products PROTECT AND GROW THE CORE PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 6 Strong Company Financial Performance ($ in millions, except per share data) Revenue $1,000 $900 $800 $700 $600 $500 $400 $300 $200 $100 $0 Adjusted Operating Margin* $852 19.5% $868 19.0% 19.0% $758 18.5% $668 18.2% Organic margin expansion offset by initial lower margins from acquisitions 18.0% 17.5% 17.2% 16.8% 17.0% 16.5% 16.0% 15.5% 2012 2013 2014 2015 2012 2013 2014 2015 2012 - 2015 CAGR = 9.1% Adjusted Earnings Per Share (EPS)* Cash Flow from Operations $180 $160 $140 $120 $100 $80 $60 $40 $20 $0 $6.00 $5.00 $4.00 $4.46 $4.78 $5.05 $3.82 $3.00 $2.00 $1.00 $2012 2013 2014 2015 2012 - 2015 CAGR = 9.8% $153 $116 $117 2012 2013 2014 $166 2015 2012 - 2015 CAGR = 12.7% * See appendix for GAAP to Non-GAAP reconciliation PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 7 Electronics Segment ($ in millions) Growth Drivers: $450 30% $410 Global trend towards more sophisticated electronic products requiring circuit protection… drives content growth $405 $400 $367 $329 $300 21.2% 19.3% 19.0% Revenue 20% 20.6% $250 $231 15% 15.6% $200 $150 10% $100 5% $50 $0 0% 2012 2013 2014 2015 1H 2016 PROTECT | CONTROL | SENSE Operating Margin $350 25% Targeted growth niches such as sensor applications, LED lighting, and smart meters Distribution channel partners drive demand across diverse end markets Increasing focus on automotive electronics as more in-cabin electronics and motors need protection Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 8 Automotive Segment ($ in millions) Growth Drivers: 30% $400 Fuse content growth driven by more electronics and highcurrent circuits… electric/hybrid vehicles $340 $350 $325 25% $300 $267 Revenue $206 16.7% $203 $200 15.6% 14.5% 14.7% 15% 13.9% $150 10% $100 Operating Margin 20% $250 Double-digit sensor revenue growth driven by design wins and content growth Commercial vehicle products expansion outside of US 5% $50 0% $0 2012 2013 2014 2015 1H 2016 PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 9 Industrial Segment ($ in millions) Growth Drivers: $140 30% $132 $124 Core power (industrial) fuse business ~60% of segment, with strong margin profile $122 $117 $120 25% 24.8% $100 19.7% $80 15% 14.8% $60 $57 10% $40 9.2% 6.5% 5% $20 $0 Operating Margin Revenue 20% Solar business and distributor conversions are driving growth in power fuses Relay and Custom business still under pressure from weakness in mining and oil & gas. Focus on end market diversification 0% 2012 2013 2014 2015 1H 2016 PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 10 PolySwitch Acquisition Expands circuit protection portfolio and strengthens leadership position Additional revenue growth opportunities • Strong alignment with existing core businesses across electronics and automotive • Increases total addressable market as well as mind share with customers and channel partners • Addresses product gaps in battery protection and automotive motor protection • Strengthens our growing automotive electronics strategy • Increased Japan presence…scale and local manufacturing Current revenue trends • Battery market circuit protection transition… reduces annualized PolySwitch revenue run rate by ~10% – 15% • 2016 one-time distributor inventory alignment Long-term financial profile • Long-term revenue growth and margin expansion (excl. amortization) aligns to core business levels • Over $10 million in annualized synergies in 2nd half 2017 • Strong cash flow generation PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 11 Q2 2016 Highlights Record revenue of $271.9 million, 22% growth year over year – Excluding PolySwitch, 6% growth year over year Adjusted earnings of $1.44 per diluted share, representing an 8% increase year over year* Completed the acquisition of Menber’s S.p.A., an Italian-based designer and manufacturer of manual and electrical battery switches and trailer connectors for commercial vehicles, on April 4, 2016 – Menber’s had sales of approximately $23 million (€21 million) in 2015 Completed transfer of reed switch manufacturing from Lake Mills, Wisconsin to the Philippines Announced quarterly dividend increase from $0.29 per share to $0.33 per share on July 21, 2016 – 13.8% increase; sixth consecutive year of double-digit dividend increase *See appendix for GAAP to Non GAAP EPS reconciliation PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 12 Margin Improvement Initiatives Manufacturing footprint consolidation completed in early 2016…annualized savings ~$6.5m – Reed Switch (Hamlin sensors) Wisconsin and Suzhou manufacturing moved to expanded Philippines location – Relay business (SymCom) New York manufacturing moved to South Dakota Product mix for sensor business – New, differentiated products commanding higher margins – Wind-down of selected low-margin legacy business We continue to embrace Lean as a company-wide culture PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 13 Sales Growth Targets Sales Growth Prior to 2012 2013-2017 Targets 2013-2015 Actual* Organic 4% 5% 5% Acquisition 5% 10% 6% Total 9% 15% 11% * Adjusted for currency effects Close to 15% sales growth target with completion of PolySwitch and Menber’s acquisitions* PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 14 Cash Flow & Capital Structure Targets Cash Flow Model Uses of Free Cash (% of revenue) Operating Cash Flow 16-18% Capital Expenditures (4%) Free Cash Flow Acquisitions 65% Dividends 20% Share Repurchase 15% 12-14% Target Capital Structure Leverage = 1.0x – 2.5x EBITDA PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 15 Committed to Increasing Shareholder Value Grow organically faster than our markets – Take recently-acquired products into new geographies and end markets – Focus on faster-growing niches within core circuit protection Increased acquisition pipeline – Take advantage of strong balance sheet and free cash flow – Devote more resources to sourcing targets in our strategic growth areas Sustain high teens operating margin – 150 bps of margin expansion in 2016 in core business* – Focus growth investments in higher margin segments – Rationalize footprint / cost structure as necessitated by further acquisitions Improve return on investment – Drive higher inventory turns through lean activities – Optimize supplier payment terms – Reduce tax rate…24% in 2015, ~22% in 2016 Return excess cash to shareholders – Increase the dividend annually – Repurchase shares opportunistically *Core business includes legacy businesses and Menber’s acquisition; Excludes PolySwitch acquisition PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 16 Save the Date! 2016 Investor Day Friday, December 9, 2016 9:00am ET New York, NY Westin Grand Central Hotel PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 17 PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 18 Appendix – 2012 to 2015 Non GAAP measures ($ in millions, except per share data) PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 19 Appendix – Q2 ‘15 and ‘16 Non GAAP measures ($ in millions, except per share data) PROTECT | CONTROL | SENSE Confidential and Proprietary to Littelfuse. Littelfuse, Inc. © 2016 20