New York City Life Sciences

advertisement

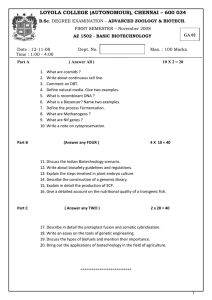

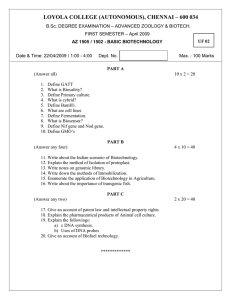

CBRE Global Research and Consulting New York City Life Sciences Focus on Biotechnology Research Space Summer 2013 Introduction Spring 2013 New York City has emerged as a recognized hub in the global biotechnology industry, and its commercial research laboratory real estate footprint continues to grow as companies increasingly choose the city to reap the benefits of its academic medical centers, incentive programs and innovative environment. New York City Life Sciences | Focus on Biotechnology Research Space There is already an estimated 1.7 million sq. ft. of existing biomedical research space in New York City, with an additional 1.1 million sq. ft. in the development pipeline. These totals are expected to only increase as incentives and funding continue to lure companies to the city. Incentives for companies and developers range from tax credits and awards of up to $250,000, to programs that allow for as much as $1.0 million in financing. Biotechnology venture capital funding to the area also increased 25% year-over-year during 2012. The most recent statistics from the New York City Economic Development Corporation (NYCEDC) indicate that biotechnology employment in New York City increased 3.2% over the previous year, compared to the 0.6% national growth rate for the industry. The Department of Labor reported that employment for Life Scientist occupations in the U.S. is expected to grow 20% by 2020, compared to an average of 14% for all occupations, which could translate into thousands of additional jobs for the city. Audubon Biomedical Science and Technology Park • 166th Street and Broadway, Manhattan • Mary Woodard Lasker Biomedical Research Building, 60,000 sq. ft., built in 1995 Courtesy of Columbia University • 46 companies started • 600 jobs created New York City’s academic medical research environment spins around 20 start-up biotech companies out of the city’s universities each year, according to Mayor Michael Bloomberg. In the past, these firms chose markets such as San Francisco or Boston because of the lack of affordable incubator space and a life sciences community in the city. However, over the past several years this trend has begun to change. Although most of the Audubon Biomedical Science and Technology Park will be used by Columbia University, the Mary Woodard Lasker Biomedical Research Building was built specifically for commercial use. Among the 15 biotech tenants in the building are Exosome, Intra-Cellular Therapeutics, The New York Stem Cell Foundation, Oligomerix and PIN Pharma. Research Facilities Brooklyn Army Terminal (BioBAT) Although commercial laboratory facilities are sparse in New York City, some key projects have helped shape the footprint of the industry. Alexandria Center for Life Science | New York City • Developed by Alexandria Real Estate Equities, Inc. • 1.1 million sq. ft. total planned • Sunset Park, Brooklyn • Former WWII armory renovated in 2008, originally built in 1919 • 500,000 sq. ft. total planned • 38,000 sq. ft. completed, 85,000 sq. ft. under construction • East River Science Park, East 29th Street, Manhattan Source: NYCEDC • $60 million in city and state funding Courtesy of Alexandria Real Estate Equities, Inc. • First Tower, 310,000 sq. ft., built in 2010 • Second Tower, 410,000 sq. ft., under construction 2 Click above to watch Pamela Murphy, Senior Vice President, Eastern and Central U.S. Research, discuss the emergence of New York City as a competitive biotechnology industry hub. The Alexandria Center for Life Science serves as an incubator for the life sciences community. Construction on the second tower began after Roche agreed to an 11-year lease for 60,000 sq. ft., where it will house its Translational Clinical Research Center. Other tenants include Lilly Oncology and ImClone Systems (both subsidiaries of Eli Lilly), Firmenich, Kadmon Pharmaceuticals, NYU Langone Medical Center and Pfizer Centers for Therapeutic Innovation. Life Sciences: Companies in the fields of biotechnology, pharmaceuticals, biomedical technologies, life systems technologies, biomedical devices and organizations and institutions that devote the majority of their efforts in the various stages of research, development, technology transfer and commercialization. —Empire State Development Corporation Biotechnology: Any technological application that uses biological systems, living organisms, or derivatives thereof, to make or modify products or processes for specific use. —United Nations Convention on Biological Diversity © 2013, CBRE, Inc. Advanced Biotechnology Park at SUNY Downstate Medical Center 1.7 million sq. ft. of biomedical research space (with an additional 1.1 million sq. ft. planned or under construction) 11 major academic medical research institutions 5 biology Ph.D. programs • Flatbush, Brooklyn 535 biomedical engineering graduates per year • Built in 2004 Source: SUNY Downstate Medical Center 118 Nobel Laureates The Biotechnology Incubator contains lab sizes varying between 400 and 1,200 sq. ft. There are 15 biotech space users in the park, including BioSignal Group. 115 biotech companies New York Genome Center $1.3 billion of NIH funding annually (#2 in U.S.) • 101 Avenue of the Americas, Manhattan 72 hospitals Source: New York City Economic Development Corporation, 2013. • 170,000 sq. ft. total, 60,000 sq. ft. of lab space • Construction began July 2012 Source: CBRE Research • Labs projected to open late 2013 Since 101 Avenue of the Americas was built in 1992, traditional office users have occupied a majority of the Hudson Square tower. In 2011, the New York Genome Center (NYGC) signed on to be the anchor tenant. Brooklyn Navy Yard - Building 77 • Wallabout Bay, Brooklyn • 1.0 million-sq.-ft. renovation to be completed in late 2014 • $80 million raised through private and public investment Courtesy of Beyer Blinder Belle Architects & Planners LLP The Brooklyn Navy Yard Development Corporation raised $60 million through the federal EB-5 program to create a biomedical technology hub in Building 77. Shiel Medical Laboratory invested $20 million for 240,000 sq. ft. in the project, 60,000 sq. ft. of which will be used for its medical labs with the remaining 180,000 sq. ft. to be leased out to other companies in the sector. Development Considerations In New York City, developers are confronted with two key issues when considering the construction of modern laboratory space: zoning laws and capital costs. Zoning Laws Zoning laws require research laboratory space to be in manufacturing districts. Specifically, work done in this industry requires Use Group 17 (which permits chemical compounding and packaging, creation of pharmaceutical products and medical appliances, laboratories, research, experimental or testing facilities) and is permitted in manufacturing districts. These are most common in the outer boroughs, although they exist within Manhattan in areas such as the Garment District, SoHo and Clinton/Hudson Yards. Although it’s © 2013, CBRE, Inc. 130 venture capital funds investing in healthcare possible for the City Planning Commission to rezone nonmanufacturing districts, the process has additional political, demographic and economic considerations. Capital Costs Depending on the type of space being developed, the cost of constructing research lab space can range from $300 to $600 per sq. ft. (excluding the cost of equipment, architectural and design services, permits and legal fees), compared to $50 to $150 per sq. ft. for traditional office space build-outs. Although renovations usually cost less than new construction, they present their own obstacles. Buildings must have proper ventilation, ceiling heights and structural support, and unforeseen costs may accrue as the project progresses. There are also strict requirements by the Food and Drug Administration on air delivery, ventilation, process control systems, etc. Renovation of existing space into laboratory space has the added economic benefit of bringing new life to commercial properties that may otherwise have low desirability among traditional users. New York City Life Sciences | Focus on Biotechnology Research Space • 24,000 sq. ft. completed, 26,000 sq. ft. under construction Figure 1: New York City Biotechnology Quick Facts Spring 2013 Building A of the Brooklyn Army Terminal was redeveloped with the biotechnology industry in mind. The International AIDS Vaccine Initiative signed as the anchor tenant when the project opened. Speculative-built lab space is under construction, with the remaining space available to be leased. The areas of the city that have already seen development, such as Brooklyn and the east side of Manhattan, should continue to attract developers because of the existing presence of the biotechnology community. Additional areas for potential future development may include sites in existing manufacturing districts, or close to major academic institutions and healthcare facilities. Academic Medical Institutions One of New York City’s most attractive features for biotech companies is the city’s world-class academic medical research institutions. Nine of the top 50 universities on the American Research Universities Report, published by The Center for Measuring University Performance, are located in New York City. Also, New York City has three of the country’s top 15 hospitals on the U.S. News and World Report Best Hospitals 2013 list. With the exception of Boston, which has 3 Figure 2: New York City Biotechnology Incentives Program Description Spring 2013 Biotech companies with fewer than 100 employees (75% or more must work in NYC) that meet certain financial limitations can claim a $250,000 refundable tax credit per year to be used for facilities, operations and training. Tax Credit expiration is January 1, 2016. Can be claimed for three consecutive years. NYC Biotech Tax Credit New York City Life Sciences | Focus on Biotechnology Research Space Partnership Fund for New York City and NYCEDC Investment Fund – BioAccelerate NYC Prize A citywide competition that awards up to $250,000 in grant funding to those whose work has proven potential, but has not reached the point of commercialization. A loan funding program designed to aid bioscience companies interested in establishing their operations and building out lab space at the East River Science Park. The $15 million fund allows for loans up to $1 million per firm at attractive terms. NYCIF East River Science Park Lab Space Loan Fund A New York Academy of Sciences initiative that connects scientists working within biotech and related fields with venture capitalists to fund their research. Life Sciences Angel Network (LSAN) Source: New York City Economic Development Corporation, City of New York, Partnership Fund for New York City, New York Academy of Sciences. two hospitals on the list, no other metropolitan area has more than one. Five New York City medical schools also landed on its Best Medical Schools for Research top 50 list. This environment creates research that spins start-up biotech companies out of the city’s academic medical institutions. Contrary to Boston and San Francisco, where dozens of private companies are often associated with each academic center, companies in the city have the opportunity to be the dedicated partner of an academic medical institution because of the lower volume of candidates for partnership. Incentives/Funding Sources New York City provides a range of credits and incentives to support biotech companies, including the recently extended Biotechnology Tax Credit, which awards an estimated $2 million in credits annually. All of the programs specific to the city for the industry are summarized in Figure 2. In addition to these local industry-specific programs, there are broader city, state and federal incentives that can be taken advantage of. Also, the NYCEDC creates new programs and initiatives to stimulate the biotechnology sector, which contributed to the completion of the Alexandria Center for Life Science and BioBAT. Funding from venture capital sources for the industry also remains active in the area. According to PricewaterhouseCoopers, there was $262 million in biotechnology venture capital activity reported in the New York metropolitan area during 2012, up from $209 million in 2011 and $177 million in 2010. This 25% year-overyear increase trailed only the Midwest region (30%) for the largest annual increase last year, while the larger, more established regions of Silicon Valley and New England posted declines in biotechnology investment of 14% and 24%, respectively. New York City is one of the annual leaders in funding received from the National Institutes of Health (NIH). According to the NYCEDC, the city receives $1.4 billion annually in NIH funding, ranking it #2 in the country. Moving forward, the NIH estimates its budget to be cut by $1.5 billion, or 5.1%, pending the result of the 2013 federal budget sequestration cuts, although the extent and impact of the potential cuts on funding in the city is yet to be determined. Figure 3: Biotechnology Venture Capital Funding Total (Billions) 2011-2012 % Change 2012 $1.4 2011 2010 Midwest $1.2 $1.0 NY Metro $0.8 $0.6 San Diego $0.4 $0.2 NY Metro Midwest San Diego Silicon Valley New England $0.0 Silicon Valley 4 New England -30% -20% -10% 0% 10% 20% 30% 40% Source: PricewaterhouseCoopers MoneyTree, 2013. © 2013, CBRE, Inc. – Marc Tessier-Lavigne, Ph.D., President, Rockefeller University The continuation of city and state initiatives and incentive programs are crucial to promote the city as a viable destination for biotechnology research, along with additional creative solutions that minimize the challenges to develop suitable space. Recent history indicates that existing challenges are not impossible to overcome, and the city’s evolving commercial real estate landscape is becoming more accessible to the sector. Increased supply of new laboratory space, whether through continued development of new buildings or renovation of existing space undesirable to other industries, will further attract biotech companies to the city. Summary Growth of the biotechnology industry and the demand for space it creates would have a positive economic impact on New York City. It would attract higher-paying jobs to the city and help drive an increase in construction activity, leading to a more modern, dynamic and diversified commercial real estate market. The city’s entrepreneurial spirit is evident in the New York metropolitan area’s high volume of patent activity each year. According to the U.S. Patent and Trademark Office, an average of 4,920 patents were filed annually over the last five years in the area, ranking slightly ahead of San Francisco, at 4,890, and significantly ahead of Boston, at 3,400. The New York area also outperformed the other two regions in biotechnology-specific patents, with an average of 1,040 filings over the last five years, compared to 850 in San Francisco and 720 in Boston. With an entrepreneurial environment and a large concentration of universities and medical centers that attract some of the world’s best talent, New York City is well positioned to become a national leader in biotechnology research and development. Figure 5: New York City Biotechnology Industry Organizations Figure 4: Patent Filings Biotechnology Patent Filings, 5-Year Average New York Academy of Sciences (NYAS) New York NewYorkBIO, formerly New York Biotechnology Association (NYBA) New York City Life Sciences | Focus on Biotechnology Research Space Patent Information Spring 2013 “New York City is an emerging biotechnology market, and key seeds have been planted for further growth. The industry looks to the city as an option because of the mass of excellent research in its academic medical centers and the breadth of its medical facilities, as well as demographic factors such as the high education level of the talent pool and affordable housing in the region. The city is a ripe new territory for biotechnology, and a wider range of commercial lab space, additional incentives and funding sources, and a unified front from the academic medical centers would make it an even more attractive market, with the potential of becoming a major bioscience hub alongside Boston and San Francisco.” Center for Biotechnology (CFB) San Francisco LabToWallStreet (L2WS) New York State Foundation for Science, Technology and Innovation (NYSTAR) Boston New York Structural Biology Center (NYSBC) 0 200 400 600 800 1,000 1,200 New York Structural Genomics Research Center (NYSGRC) Source: U.S. Patent and Trademark Office, 2013. NYC Bio Source: CBRE Research, 2013. 5 © 2013, CBRE, Inc. Figure 6: Academic Medical Institutions and Biotechnology Research Centers Spring 2013 City College of New York - Structural Biology Center Sophie B. Davis School of Biomedical Education - CUNY Columbia University Medical Center 89 Convent Avenue New York, NY 160 Convent Avenue New York, NY 630 West 168th Street New York, NY New York City Life Sciences | Focus on Biotechnology Research Space Mount Sinai Icahn School of Medicine Audubon Biomedical Science and Technology Park 1428 Madison Avenue New York, NY 3960 Broadway New York, NY Memorial Sloan-Kettering Cancer Center Albert Einstein College of Medicine 1275 York Avenue New York, NY 1300 Morris Park Avenue Bronx, NY The Rockefeller University Hospital for Special Surgery 1230 York Avenue New York, NY 535 East 70th Street New York, NY Alexandria Center for Life Science | New York City Weill Cornell Medical College 450 East 29th Street New York, NY 445 East 69th Street New York, NY New York Genome Center Cornell New York City Tech 101 Avenue of the Americas New York, NY Roosevelt Island, NY NYU School of Medicine / NYU Langone Medical Center 550 First Avenue New York, NY College of Staten Island - CUNY 2800 Victory Boulevard Staten Island, NY Advanced Biotechnology Park at SUNY Downstate Medical Center 760 Parkside Avenue Brooklyn, NY KEY Academic Medical Institutions 6 Brooklyn Army Terminal (BioBAT) Brooklyn Navy Yard - Building 77 140 East 58th Street Brooklyn, NY 63 Flushing Avenue Brooklyn, NY Biotechnology Research Centers Source: CBRE Research, 2013. © 2013, CBRE, Inc. Spring 2013 For more information regarding this local report, please contact: Matt Maison Manager, Research and Analysis t: +1 212 984 8154 e: matt.maison@cbre.com Enkeleda Gjeci Research Analyst t: +1 212 656 0531 e: enkeleda.gjeci@cbre.com Michael Slattery Research Analyst t: +1 212 656 0583 e: michael.slattery@cbre.com New York City Life Sciences | Focus on Biotechnology Research Space contacts +FOLLOW US GOOGLE+ FACEBOOK TWITTER Global Research and Consulting CBRE Global Research and Consulting is an integrated community of preeminent researchers and consultants who provide real estate market research, econometric forecasting, and corporate and public sector strategies to investors and occupiers around the globe. Disclaimer Information contained herein, including projections, has been obtained from sources believed to be reliable. While we do not doubt its accuracy, we have not verified it and make no guarantee, warranty or representation about it. It is your responsibility to confirm independently its accuracy and completeness. This information is presented exclusively for use by CBRE clients and professionals, and all rights to the material are reserved and cannot be reproduced without prior written permission of the CBRE Global Chief Economist. **1WTC photo courtesy of The Port Authority of New York & New Jersey. © 2013, CBRE, Inc. 7