Forecastable Component Analysis - Journal of Machine Learning

advertisement

Forecastable Component Analysis

Georg M. Goerg

Carnegie Mellon University, Department of Statistics, Pittsburgh, PA 15213

E(X − EX)2 in (1); independent component analysis (ICA) recovers statistically independent signals

(Hyvärinen and Oja, 2000); slow feature analysis

(SFA) (Wiskott and Sejnowski, 2002) finds “slow” signals and is equivalent to maximizing the lag 1 autocorrelation coefficient.

Abstract

I introduce Forecastable Component

Analysis (ForeCA), a novel dimension reduction technique for temporally dependent

signals.

Based on a new forecastability

measure, ForeCA finds an optimal transformation to separate a multivariate time series

into a forecastable and an orthogonal white

noise space. I present a converging algorithm

with a fast eigenvector solution. Applications to financial and macro-economic time

series show that ForeCA can successfully

discover informative structure, which can be

used for forecasting as well as classification.

DR techniques are often applied to multivariate time

series Xt , hoping that forecasting on the lowerdimensional space St is more accurate, simpler, more

efficient, etc. Standard DR techniques such as PCA or

ICA, however, do not explicitly address forecastability

of the sources. For example, just because a signal has

high variance does not mean it is easy to forecast.

The R package ForeCA accompanies this

work and is publicly available on CRAN.

1. Introduction

With the rise of high-dimensional datasets it has become important to perform dimension reduction (DR)

to a lower dimensional representation of the data. For

simplicity we consider linear transformations W ∈

Rk×n , which map an n-dimensional X to a k ≤ n dimensional S = WX. Typically, the transformed data

should be somewhat “interesting”; there is no point in

transforming X to an arbitrary S that is less useful,

meaningful, etc. Let ι (S) measure “interestingness” of

S. DR can then be set up as an optimization problem

b j = arg max ι w> X , j = 1, . . . , k, (1)

w

subject to

w∈Rn×1

>

>

wj X ⊥ {w1> X, . . . , wj−1

X},

gmg@stat.cmu.edu

(2)

where (2) is a common DR constraint, which makes

Sj = wj> X orthogonal (uncorrelated) to previously

obtained signals.

For example, principal component analysis (PCA)

keeps large variance signals (Jolliffe, 2002) – ι (X) =

Proceedings of the 30 th International Conference on Machine Learning, Atlanta, Georgia, USA, 2013. JMLR:

W&CP volume 28. Copyright 2013 by the author(s).

Thus let’s define interesting as being predictable. Forecasting is not only good for its own sake (finance, economics), but even when future values are not immediately interesting, signals that do have predictive power

exhibit non-trivial structure by definition – and are

thus easier to interpret. For example, the time series

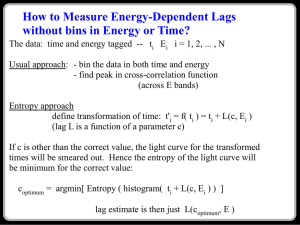

in Fig. 1 are ordered from least (S&P500 daily returns)

to most forecastable (monthly temperature in Nottingham) according to the ForeCA forecastability measure

Ω(xt ) I propose in Definition 3.1 below. And indeed

moving from left to right they exhibit more structure.

The main contributions of this work are i) a modelfree, comparable measure of forecastability for (stationary) time series (Section 3), ii) a novel data-driven

DR technique, ForeCA, that finds forecastable signals,

iii) an iterative algorithm that provably converges to

(local) optima using fast eigenvector solutions (Section 4), and iv) applications showing that ForeCA

outperforms traditional DR techniques in finding lowdimensional, forecastable subspaces, and that it can

also be used for time series classification (Section 5).

Related work will be reviewed in Section 6.

All computations and simulations were done in R (R

Development Core Team, 2010).

2. Time Series Preliminaries

Let yt be a univariate, second-order stationary time

series with mean Eyt = µy < ∞, variance Vyt = σy2 ,

Fahrenheit

30 45 60

-3000

-1000

1000

1920 1925 1930 1935 1940

Year

^ = 1.25%

Ω

0.1

0.0

0.1

0.2

ωj

0.3

0.4

0.5

ACF

0

20

60

lag

100

140

^ = 14.99%

Ω

0.0

0.1

0.2

ωj

0.3

0.4

0.5

0

^f (ω ) (log-scale)

j

80

-0.5

ACF

60

0.02 1.00

lag

^f (ω ) (log-scale)

j

40

0.0

0.0

ACF

0.6

0.5

Year (3435BC to 1969AD)

5

10

lag

15

20

^ = 34.37%

Ω

0.50

20

2500

Avg temperature in Nottingham

0.01

0

1500

Days

0.0

%

-6

500

0.6

0

0.5

f (ω j) (log-scale)

Mount Campito tree rings

0.6

0 4

S&P 500 returns

width in mm

Forecastable Component Analysis

0.0

0.1

0.2

ωj

0.3

0.4

0.5

Figure 1. Observations (top); sample ACF ρb(k) (middle); smoothed WOSA spectral density estimate (bottom). From

left to right: i) S&P 500 daily returns; ii) Mount Campito tree ring series; iii) monthly mean temperatures in Nottingham.

Data publicly available in R packages: SP500 in MASS; camp in tseries; nottem in datasets.

and autocovariance function (ACVF)

γy (k) = E(yt − µy ) (yt−k − µy ) ,

k ∈ Z.

(3)

The ACVF for univariate processes is symmetric in k,

γy (k) = γy (−k). Let ρ(k) = γ(k)/γ(0) be the autocorrelation function (ACF). A large ρ(k) means that

the process k time steps ago is highly correlated with

the present yt . The sample ACFs ρb(k) in Fig. 1 show

that, e.g., S&P 500 daily returns are uncorrelated with

their own past (stock market efficiency); yearly tree

ring growth is highly correlated over time with significant lags even for k ≥ 100 years; and intuitively

temperature in month t is highly correlated with the

temperature k = 6 (cold ↔ warm) and k = 12 (cold

→ cold; warm → warm) months ago (or in the future).

The building block of time series models is white noise

εt , which has zero mean, finite variance, and is uncorrelated over time: εt ∼ W N (0, σε2 ) iff1 i) Eεt = 0,

ii) Vεt = γε (0) = σε2 , and iii) γε (k) = 0 if k 6= 0. Only

if εt is a Gaussian process, then it is also independent.

For multivariate second-order stationary Xt with

mean2 µ ∈ Rn and covariance matrix ΣX the ACVF

>

Rn×n 3 ΓX (k) = E (Xt − µ) (Xt−k − µ) ,

(4)

is a matrix-valued function of k ∈ Z. In particular, ΓX (0) = ΣX . The diagonal of ΓX (k) contains

the ACVF of each Xi (t); the off-diagonal element

1

2

Iff will be used as an abbreviation for if and only if.

Without loss of generality (WLOG) assume µ = 0.

ΓX (k)(i,j) is the cross-covariance between the ith and

jth series at lag k:

γij (k) = E (Xi,t − µi ) (Xj,t−k − µj ) ∈ R.

(5)

Contrary to γy (k), ΓX (k) is not symmetric, but

ΓX (k) = ΓX (−k)> .

(6)

2.1. Spectrum and Spectral Density

The spectrum of a univariate stationary process can

be defined as the Fourier transform of its ACVF,

Sy (λ) =

∞

1 X

γy (j)eijλ ,

2π j=−∞

λ ∈ [−π, π],

(7)

√

where i = −1 is the imaginary unit. Since γy (k) is

symmetric, the spectrum is a real-valued, non-negative

function, Sy : [−π, π] → R+ . For white noise εt all

σ2

γε (k) = 0 if k 6= 0, thus Sε (λ) = 2πε is constant for

all λ ∈ [−π, π]. When γ(k) > 0 for k 6= 0 the spectrum has peaks at the corresponding frequencies. For

example, the spectral density of monthly temperature

series (right in Fig. 1) has large peaks at λ ≈ π/6 and

π/12, which represent the half- and one-year cycle.3

Vice versa, the ACVF can be recovered from the spec3

Frequencies λ are often scaled by π, λ̃ = λ/π. This

does not change results qualitatively, but simplifies interpretation since the corresponding cycle length equals λ̃−1 .

Forecastable Component Analysis

trum using the inverse Fourier transform

Z π

γy (k) =

Sy (λ)e−ikλ dλ, k ∈ Z.

noise, which is unpredictable by definition (using linear predictors). Consequently, for any stationary yt

(8)

−π

In particular,

Rπ

−π

fy (λ) =

Sy (λ)dλ = σy2 for k = 0. Let

∞

Sy (λ)

1 X

=

ρy (j)eijλ ,

σy2

2π j=−∞

(9)

be

R π the spectral density of yt . As fy (λ) ≥ 0 and

f (λ)dλ = 1, the spectral density can be inter−π y

preted as a probability density function (pdf) of an

(unobserved) random variable (RV) Λ that “lives” on

1

, which

the unit circle. For white noise fε (λ) = 2π

represents the uniform distribution U (−π, π).

Hs,a (yt ) ≤ Hs,a (white noise)

Z π

1

1

=−

loga

dλ = loga 2π,

2π

2π

−π

with equality iff yt is white noise.

Definition 3.1 (Forecastability of a stationary process). For a second-order stationary process yt , let

Ω : yt 7→ [0, ∞],

Ω(yt ) = 1 −

Hs,a (yt )

= 1 − Hs,2π (yt ),

loga (2π)

(12)

be the forecastability of yt .

Remark 2.1 (Spectrum and spectral density). In the

time series literature “spectrum” and “spectral density” are often used interchangeably. Here I reserve

“spectral density” for fy (λ) in (9), as it integrates to

one such as standard probability density functions.

Contrary to other measures in the signal processing

and time series literature, Ω(yt ) does not require actual

forecasts, but is a characteristic of the process yt . It

is therefore not biased to a particular – perhaps suboptimal – model, forecast horizon, or loss function; as

used in e.g., Box and Tiao (1977); Stone (2001).

3. Measuring Forecastability

Properties 3.2. Ω(yt ) satisfies:

Forecasting is inherently tied to the time domain. Yet,

since Eqs. (7) & (8) provide a one-to-one mapping between the time and frequency domain, we can use frequency domain properties to measure forecastability.

The intuition for the proposed measure of forecastability is as follows. Consider

√

yt = 2 cos (2πYt + θ) ,

(10)

θ ∼ U (−π, π), Y ∼ py (y) independent of θ.

One can show that Sy (λ) = py (λ) (Gibson, 1994).

If we have to predict the future of yt , then uncertainty

about yt+h , h > 0, is only manifested in uncertainty

about Y, since cos (2πYt + θ) is a deterministic function of t: less uncertainty about Y means less uncertainty about yt+h . We can measure this uncertainty

using the Shannon entropy of py (y) (Shannon, 1948).

It is thus natural to measure uncertainty about the

future as (differential) entropy of fy (λ),

Z

π

Hs,a (yt ) := −

fy (λ) loga fy (λ)dλ,

(11)

−π

where a > 0 is the logarithm base.

On a finite support [b, c] the maximum entropy occurs

for the uniform distribution U (b, c); thus a flat spectrum should indicate the least predictable sequence.

And indeed, a flat spectrum corresponds to white

a) Ω(yt ) = 0 iff yt is white noise.

b) invariant to scaling and shifting:

Ω(ayt + b) = Ω(yt ) for a, b ∈ R, a 6= 0.

c) max sub-additivity for uncorrelated processes:

p

Ω(αxt + 1 − α2 yt ) ≤ max{Ω(xt ), Ω(yt )}, (13)

if Ext ys = 0 for all s, t ∈ Z; equality iff α ∈ {0, 1}.

The three series in Fig. 1 are ordered (left to right)

b corby increasing forecastability and indeed larger Ω

respond to intuitively more predictable real-world

events: stock returns are in general not predictable;

average monthly temperature is.

We can thus use (12) to guide the search for optimal

w that make yt = w> Xt as forecastable as possible.

3.1. Plug-in Estimator for Ω

To estimate Ω(yt ), we first estimate Sy (λ), normalize

it, and then plug it in (11).

An unbiased estimator of Sy (λ) is the periodogram

T −1

2

1 X

IT,y1T (ωj ) = √

yt e−2πiωj t ,

T t=0

(14)

Forecastable Component Analysis

where ωj = j/T , j = 0, 1, . . . , T − 1 are the (scaled)

Fourier frequencies, and y1T = {y1 , . . . , yT } is a sample

of yt . It is well known that (14) is not a good estimate

(e.g., periodograms are not consistent). In the numerical examples we therefore use weighted overlapping

segment averaging (WOSA) (Nuttal and Carter, 1982)

Sby (ωj ) from the R package sapa: SDF(y, ’’wosa’’).

The bottom row of Figure 1 shows the normalized

by (ωj )

S

fbj,y = PT −1

b (ω ) along with the plug-in estimate

S

j=0

y

j

b 1T ) = 1 +

Ω(y

T

−1

X

fbj,y · loga=T fbj,y .

(15)

j=0

Remark 3.3. Typically, to estimate Eg(X) for X ∼

p(x) (here: g(X) = log p(X)) the sample average is solely over g(xj ) without multiplicative p(xj )

terms. This however assumes

Pn that each xj is sam1

pled

from

p(x)

(and

thus

i=1 g(xi ) → Ep g(X) =

n

R

g(x)p(x)dx by the strong law of large numbers).

While this is true in a standard sampling framework,

here the “data” are the Fourier frequencies ωj and the

fast Fourier transform (FFT) samples them uniformly

(and deterministically) from [−π, π] and not according

to the “true” spectral density f (λ).4

Eq. (15) can be improved by a better spectral density (Fryzlewicz, Nason, and von Sachs, 2008; Lees and

Park, 1995; Trobs and Heinzel, 2006) and entropy estimation (Paninski, 2003). Future research can also

address direct estimation of (11) – as is common for

classic entropy estimates (Sricharan, Raich, and Hero,

2011; Stowell and Plumbley, 2009). However, since

neither spectrum nor entropy estimation are the primary focus of this work, we use standard estimators

for Sy (λ) and then the plug-in estimator of (15).

b T ) in (15) is based on

It must be noted though that Ω(y

1

discrete rather than differential entropy. It still has the

intuitive property that white noise has zero estimated

b T ) ∈ [0, 1]; Ω(y

b T ) = 1 iff

forecastability, but now Ω(y

1

1

the sample is a perfect sinusoid. Applications show

that (15) yields reasonable estimates and we do not

expect the results to change qualitatively for other estimators. We leave differential entropy estimates of Ω

to future work.

Notice that Ω(yt ) relies on Gaussianity as only then

fy (λ) captures all the temporal dependence structure

of yt . While time series are often non-Gaussian, Ω(·) is

a computationally and algebraically manageable forecastability measure – similarly to the importance of

variance in PCA for iid data, even though they are

rarely Gaussian.

4. ForeCA: Maximizing Forecastability

Recall from Eq. (1) that we want to find a linear combination of a multivariate Xt that makes yt = w> Xt

as forecastable as possible. Based on the forecastability measure in Section 3, we can now formally define

the ForeCA optimization problem:

!

Rπ

f

(λ)

log

f

(λ)dλ

y

y

a

−π

,

max Ω(w> Xt ) = max 1 +

w

w

loga (2π)

(16)

>

subject to w ΣX w = 1,

(17)

where (17) must hold since (11) uses the spectral density of yt , i.e. we need Vyt = w> ΣX w = 1.

Property 3.2c seems to let (16) only have a trivial

boundary solution. However, it is intuitively clear

that combining uncorrelated series makes forecasting

(in general) more difficult, e.g., signal + noise. But if

Ext ys 6= 0 for some s, t ∈ Z then combining them

can make√ it simpler: for some α ∈ (0, 1) it holds

Ω(αxt + 1 − α2 yt ) > max{Ω(xt ), Ω(yt )}.

To optimize the right hand side of (16) we need to

evaluate fy (λ) = fw> Xt (λ) for various w and do this

efficiently. We now show how to obtain fy (λ) by simple

matrix-vector multiplication from fX (λ).

4.1. Spectrum of Multivariate Time Series and

Their Linear Combinations

For multivariate Xt the spectrum equals

SX (λ) =

∞

1 X

ΓX (k)e2πikλ ,

2π

λ ∈ [−π, π]. (18)

k=−∞

Contrary to the univariate case, (18) is in general

complex-valued. Yet, since ΓX (k) = ΓX (−k)> ,

SX (λ) ∈ Cn×n is Hermitian for every λ, SX (λ) =

SX (λ)> , where z = a − ib is the complex conjugate

of z = a + ib ∈ C (Brockwell and Davis, 1991, p. 436).

For dimension reduction we consider linear combinations yt = w> Xt , w ∈ Rn . By assumption Eyt =

w> EXt = 0 and γy (k) = Eyt yt−k = w> ΓX (k)w.

In particular, γy (0) = σy2 = w> ΣX w. The spectrum of w> Xt can be quickly computed via Sy (λ) =

w> SX (λ)w and consequently

4

Advances in “compressed sensing” (Jacques and Vandergheynst, 2010) might improve estimates; see also “nonuniform FFT” (Fessler and Sutton, 2003).

fy (λ) =

w> SX (λ)w

,

w > ΣX w

λ ∈ [−π, π].

(19)

Forecastable Component Analysis

Since fy (λ) ≥ 0 for every yt , w> SX (λ)w ≥ 0 for all

w ∈ Rn ; thus SX (λ) is positive semi-definite.

b ωj ), and then minimizing the quadratic form

`(w;

(i)

wi+1 = arg min w> SbU w,

4.2. Solving the Optimization Problem

Since Ω is invariant to shift and scale (Property 3.2b),

we shall not only assume zero mean, but also contemporaneously uncorrelated observed signals with unit

variance in each component. WLOG consider Ut =

−1/2

c

ΣX Xt ; thus EUt U>

t = In . Given WU for Ut ,

cX = W

cU Σ

b −1/2 .

the transformation for Xt becomes W

X

Problem (16) is then equivalent to

w∗ = arg min h(w)

(20)

w,kwk2 =1

where

Z

π

w> SU (λ)w · ` (w; λ) dλ,

h(w) = −

(21)

−π

is the spectral entropy (Eq. (11)) of w> Xt as a function of w. We use ` (w; λ) := log w> SU (λ)w =

log fw> U (λ) for better readability.

In practice we approximate (21) with SbU (ωj ) ∈ Cn×n

and thus obtain5

w∗ = arg min b

hT (w).

(22)

w,kwk2 =1

Here

1

b

hT (w) = −

T

T

−1 X

w> SbU (ωj )w · `b(w; ωj )

(23)

j=1

is the discretized version of (20), where `b(w; ωj ) =

log w> SbU (ωj )w. Notice that SbU (ωj ) ∈ Cn×n varies

with ωj while w ∈ Rn is fixed over all frequencies,

which makes it difficult to obtain an analytic, closedform solution. However, (22) can be solved iteratively

borrowing ideas from the expectation maximization

(EM) algorithm (Dempster, Laird, and Rubin, 1977).

4.2.1. A Convergent EM-like Algorithm

For every w ∈ Rn , kwk2 = 1, h(w) has the

form of a mixture model with weights π

b(j | w) :=

>b

b

w

R π SU (ωj )w ≥ 0 and “log-likelihood” ` (w; ωj ). Since

f > (λ)dλ = 1, π

b(j | w) is indeed a discrete prob−π w U

ability distribution over {ωj | 0 = 1, . . . , T − 1}.

Just as in an EM algorithm, the objective h(w) can

be optimized iteratively by first fixing w ← w(i) in

5

(24)

w,kwk2 =1

We use ‘‘wosa’’ estimates (sapa R package). However, any other estimate of SU (λ) can be used.

PT −1

(i)

where SbU = − T1 j=0 SbU (ωj ) · `(wi ; ωj ).

(i)

Proposition 4.1. SbU is positive semi-definite.

Thus (24) can be solved analytically by the last eigen(i)

vector of SbU – automatically guaranteeing kwk2 = 1.

The procedure iterates until kwi+1 − wi k < tol for

some tolerance level tol. For initialization we sample w0 from an n-dimensional uniform

hyper-cube,

qP

n

2

Un (−1, 1), and normalize to w0 = w0 /

j=1 wj,0 .

Theorem 4.2 (Convergence). The sequence {wi }i≥0

obtained via (24) converges to a local minimum

(∗)

(∗)

b

hT (w∗ ) = λmin ≥ 0, where limi→∞ wi = w∗ and λmin

(∗)

is the smallest eigenvalue of Sb .

U

T,(∗)

Corollary 4.3. The transformed data y1

w(∗) > XT1 satisfies

b yT,(∗) = 1 − λ∗ .

Ω

min

1

=

(25)

Proof of Theorem 4.2. The entropy of a RV taking

values in a finite alphabet {ω0 , . . . , ωT −1 } is bounded:

0≤b

hT (w) ≤ loga T for all w ∈ Rn . For convergence

it remains to be shown that b

hT (wi ) ≥ b

hT (wi+1 ) with

∗

equality iff wi+1 = wi = w . First,

1

b

hT (wi ) = −

T

T

−1

X

b i ; ωj )

wi> SU (ωj )wi · `(w

j=1

(i)

(i)

> b

SU wi+1

= wi> SbU wi ≥ wi+1

(26)

(i)

since wi+1 is the last eigenvector of SbU . Second,

(i)

> b

wi+1

SU wi+1 = −

≥−

T −1

1 X >

b i ; ωj )

w SU (ωj )wi+1 · `(w

T j=1 i+1

T −1

1 X >

b i+1 ; ωj )

w SU (ωj )wi+1 · `(w

T j=1 i+1

(27)

=b

hT (wi+1 ),

Pn

where (27) holds as Ep − log q = − j=1 pj log qj ≥

Pn

− j=1 pj log pj = Ep − log p for any q 6= p.

To lower the chance of landing in local optima we repeat (24) for several random starting positions w0 and

then select the best solution.

1351

1311

(b) biplots of ForeCA (top)

and PCA (bottom)

WATER

2

4

6

Component

8

b

(c) scree-plot of Ω(·)

40

0

10

20 30

ForeC 3

40

0

10

20 30

ForeC 4

40

0

10

-0.10 0.05

20 30

ForeC 2

0

10

20 30

ForeC 6

40

0

10

20 30

ForeC 7

40

0

10

20 30

ForeC 8

40

0

10

-0.05

10

20

30

0.10

1.0

CHINA

0

-0.05

0.2

-0.15

LATAM

-0.20 0.05

GOLD

MINING

0.0 0.2

PC3

0.05 -0.1

2.0

-20

20

^ (x ) (in %)

Ω

t

1.5

-60

0

ENERGY

1309

1310

1330

607

566

1149

218

644

1395

207

526

40

197

386

238

1163

341

308

130

620

103

956

618

153

1172

LATAM

633

986

936

636

849

143

44

128

441

596

14

1059

343

236

817

145

825

510

572

1002

49

6

135

916

830

216

182

632

891

1001

115

481

320

1078

41

507

661

429

773

150

31

48

712

126

113

353

952

514

1072

783

118

269

133

623

1281

593

28

266

1346

776

401

808

142

698

84

553

1154

958

168

1246

580

884

283

1190

1179

16

686

793

612

1177

54

1327

70

734

1103

766

575

330

864

602

461

899

578

951

155

163

211

291

771

1053

972

1056

1003

62

233

720

818

753

645

1171

7

969

964

557

707

1404

1124

640

658

862

653

234

1409

31100

351

430

601

1367

140

45

789

996

540

1289

1031

579

803

1348

801

747

562

547

559

166

185

810

360

1253

726

225

1329

190

331

1188

940

66

300

794

1319

665

504

210

364

990

23

539

1191

99

570

696

1227

1115

200

137

55

302

3

8

1321

1201

545

730

1081

37

282

980

1131

699

1392

669

462

754

1060

245

310

252

970

999

850

527

919

279

116

882

804

908

485

621

1200

973

543

193

740

12

369

995

309

714

905

791

4

416417

823824

896

466

976

59

202

454

213

1095

194

582

24

263

121

293

1140

551

199

1243

1088

922

1036

1158

71

47

901

1267

306

914

405

198

787

336

966

352

367

255

1145

643

209

1114

1237

78

335

92

388

231

866

112

328

1148

1401

161

325

254

1015

820

494

1236

1153

304

289

169

941

1313

1051

58

456

911

1352

1316

418

977

419

1184

715

1270

856

2

90

915

1084

903

480

1324

1299

677

272

345

1173

531

512

1357

1361

384

706

1023

589

1181

955

1118

939

344

1204

1055

842

838

1288

299

1213

676

260

682

530

120

948

743

148

723

96

359

165

522

503

906

642

495

46

1354

663

17

800

469

1257

968

785

285

662

685

680

318

1098

180

1268

1296

1075

610

53

1364

1308

319

721

878

673

846

390

1079

963

1336

1291

374

1287

1080

704

327

186

1249

1196

473

563

1142

571

1147

883

873

784

189

342

1022

881

1085

538

1050

458

1398

1089

1342

560

227

689

385

501

183

490

853

1244

934

1221

1383

178

489

894

502

1045

171

946

637

725

1317

691

845

201

893

1265

949

655

162

1112

670

561

569

435

424

1239

1086

1274

534

1210

1272

366

1024

412

765

453

1412

839

886

795

1070

1282

806

506

74

1323

1166

1183

1144

876

927

261

737

701

356

452

821

537

933

1019

590

1378

312

932

542

172

997

639

1189

100

1126

759

226

1116

241

175

301

1379

1242

1214

36

11

159

767

1013

1280

422

1058

717

1344

1403

1048

1125

376

98

807

1155

1198

395

913

924

887

587

1363

72

1037

1374

1286

981

108

954

605

1387

992

483

709

1010

1134

322

826

930

675

1018

591

812

1345

1362

393

666

822

1385

444

1194

154

1303

736

1377

617

660

280

204

1083

1109

295

1264

761

786

1284

1176

727

251

1238

1121

1137

3

63

619

413

1320

1370

455

554

1283

929

247

1069

1041

1209

1276

872

898

1046

219

1175

423

426

1006

230

80

297

442

630

1375

1011

926

656

333

323

1307

273

1301

432

1356

1208

1278

378

131

294

192

449

782

348

138

271

843

93

865

496

1016

1152

857

816

205

681164

1026

1402

755

910

760

3

57

890

1373

1365

1218

1314

584

516

1030

835

1337

90

1180

1076

459460

1168

1167

375

1333

859

848

1130

1195

69

147

749

362

262

1111

1044

814

1139

307

597

731

7

10

340

88

798

1391

1347

445

97

381

694

626

870

702

508

840

700

1101

1405

1376

697

917

64

1025

523

844

595

1040

518

1340

1222

347

889

1216

1410

229

546

1261

975

339

613

1266

311

288

1151

1251

950

257

1074

762

176

533

1256

1192

151

1305

1049

953

1259

1341

354

674

604

1119

1300

305

576

811

1203

1215

431

594

1038

841

1063

1102

1136

809

875

18

836

467

1255

1110

387

270

43

888

447

232

1304

667

991

931

1129

286

568

1262

1328

505

985

1012

852

19

355

421

565

1217

1229

1052

446

249

719

871

1042

79

519

1292

1298

1117

799

690

87

488

497

314

32

599

9

750

394

1223

1141

1202

52

1372

358

1156

558

681

657

744

1068

1027

780

334

627

650

1368

258

1406

535

989

1366

1369

1186

303

647

406

994

987

1226

170

457

513

105

945

851

683

409

1393

525

1384

439

1388

1

1182

792

777

959

1254

957

858

567

962

967

1065

1230

1358

912

892

778

1032

1322

1389

1258

1245

1020

181

191

228

918

757677

695

805

94

874

1211

436

221

815

1021

703

1386

1212

921

942

1028

751

1199

861

85

1339

938

615

109

411

646

748

1073

223

711

829

1250

1162

764

1353

1381

1097

281

15

897

22

529

338

772

867

404

935

745

770

1233

515

484

588

95

1047

235

1293

684

722

819

434

902

904

1228

389

827

586

1225

739

1294

474

264

693

136

1338

854

1033

414

34

1399

1132

598

82

250

521

337

1061

592

438

832

947

965

532

86

57

758

21

1122

847

214

276

101

1248

1220

397

855

259

275

1187

984

831

372

797

243

536

465

511

974

732

111

486

475

1411

796

574

573

925

1092

672

287

1113

1106

106

1231

332

256

380

600

1017

585

1007

392

1252

993

1290

500

134

1224

756

742

1334

1205

735

79

298

1285

678

443

1185

463

1128

407

705

609

1107

583

517

614

448

1325

1413

1359

1135

110

1277

774

651

428

1382

470

652

649

377

555

781

493

274

10

909

790

65

67

907

1035

1099

1039

1043

1133

1271

382

403

1093

1090

757

396

813

1326

775

1335

943

868

324

482

326

371

1004

606

164

1343

961

1064

1295

564

581

477

1360

729

437

900

346

552

960

860

292

179

296

479

738

63

1014

398

544

1247

114

119

923

802

220

265

1094

833

1057

1005

139

828

556

1169

1275

769

1062

415

1263

1355

1273

1279

244

129

5

550

648

1105

450

1104

196

349

188

733

746

1219

577

937

410

1150

321

141

498

1029

692

1235

13

39

224

402

713

1206

370

158

998

724

1193

928

625

1054

INDIA 146

1127

877

391

240

1108

728

2

1123

1371

160

671

1260

634

1407

1394

451

541

1315

379

1174

971

1332

1207

509

433

215

464

1306

222

528

668

471

1000

156

2930

73

1241

1397

51

1159

1408

664

195

895

1380

420

149

982

56

716

373

81

1096

979

659

246

1165

33

708

629

920

1067

427

91

688

122

368

1240

763

885

383

408

548

400

718

1297

1009

741

1120

167

880

679

978

1077

863

8

208

1318

752

1091

628

425

187

1034

125

117

83

468

638

1161

1390

157

315

1170

127

1312

611

1160

1071

478

284

1269

1082

788

242

399

152

608

20

1232

1349

177

440

329

203

524

313

267

641

277

50

654

132

350

487

879

35

1066

768

144

206

104

492

278

1400

472

1143

491

1302

1197

174

248

834

499

173

239

1157

365

317

1178

107

184

687

253

603

1234

123

1087

25

60

1138

124

102

89

944

26

217

316

616

61

237

520

268

361

MINING

635

622

27

624

869

631

42

983

1396

549

988

1008

837

476

1146

1331

212

GOLD CHINA

WATER

-0.2

EASTEU

ENERGY

20

1350

EASTEU

INDIA

ForeC 5

40

-0.05

620

0.00 0.15

PC1

0.00

ForeC3

-20

0

20

orig

PCA

SFA

ForeCA

-0.05

-0.15

155

-0.10

0 20 40

PC4

0.0 0.2

0

(a) daily returns in %

-0.15

WATER

1000

Time

-20

PC2

0.00 0.15

0 5 -8

-10

4

68

WATER

ForeC 1

20

150

MINING

118

558

206125476

1152

97

1135

146

49

1160

445

261

316

1147

365

89208

28

622

992

31

678

CHINA

537

1057

1162

351

46

193

614

950

543

613

367

395

624

1395

610

69

1143

467

267

67

113

508

559

1157

548

944

151

533

275

149

108

986

415

464

459

1139

1290

824

1335

835

1146

1351

188

18

204

128

123

716

1187

941

1234

422

928

1065

791

1253

451

194207

940

1145

931

920

240

842

270

370

77

1748

89

515

1094

396

1399

186

1144

411

1233

37

1076

195

816

723

496

109

92

792

649

852

474

292

1104

361

895

1347

1312

435

180

1112

5

1326

421

357

314

296

129

775

820

468

311

377

1314

135

182

534

532

693

167

1311

383

1319

132

94

1378

836

1189

544

1115

869

147

163

1172

574

166

988

929

657

458

818

586

867

975

837

162

877

1344

638

414

491

290

302

1370

1156

1161

1261

802

672

750

1022

536

666

589

1412

1170

853

1069

998

286

930

611

300

1397

628

916

1306

346

1082

608

84

1138

1392

795

1025

746

663

631

288

642

592

1186

1396

606

156

402

832

1200

1321

1029

484

838

671

694

691

279

524

30

187

191

201

1332

437

227

1014

142

506

1091

767

807

462

1386

1107

452

62

550

794

1113

720

76

1365

426

994

1357

478

1248

1219

1116

168

859

223

1353

873

503

1283

1368

744

787

124

465

114

47

1355

160

497

233

35

514

1133

106

9

522

777

1067

554

708

599600

454

228

1080

788

831

683

1071

1213

1247

1277

739

276

897

616

11021103

713

933

811

1179

1118

982

1054

710

756

460

911

757758

400

1291

840

1

180

1342

328

1266

79

581

1285

917

984

134

1099

404

1337

301

251

573

989

237

312

700

425

656

334

1360

246

1336

889

489

615

1194

502

937

115

1257

576

429

398

971

75

359

1250

1275

1036

1184

116

949

555

ENERGY

1056

505

796

782

172

1226

17

202

1004

1377

409

50

1120

854

1001

211

345

19

282

355

410

810

434

1366

121

768

957

500

96

1129

281

157

635

295

1024

1053

1196

224

152

278

1198

1376

1193

269

1039

306

1106

681

636

647

790

1322

629

833

1034

699

133

1021

1339

1413

1096

925

438

1031

1265

799

806

741

705

733

1359

894

511512

1181

329

416

74

254

379

221

70

952

479

1141

684

293

333

203

1340

562

9

26

585

1211

825

71

1140

1286

1389

1101

1232

310

378

1297

924

1003

977

33

801

604

222

20

1364

1394

1408

1331

697

1320

1131

448

1190

43

1343

170

650

1264

577

412

169

1215

566238

639

386

397

1251

1223

371

769

1016

1009

1083

303

196

898

1318

1315

903

712

1151

447

287

15

865

888

381

856

1382

1367

1407

1173

1163

1063

252

519

239

1292

1114

1400

1310

1241

531

179

264

241

481

256

510

324

936

1255

1124

327

470

1282

1048

735

1018

675

1245

446

1169

444

625

1333

1

206

701

513

742

891

1409

360

1092

375

1260

828

215

621

1238

175

51

504

14

715

1296

424

95

1287

1309

399

966

1086

217

91

885

784

1387

1406

362

1050

53

1254

876

1035

205

1046

1269

1403

66

1341

1345

1272

760

131

851

967

922

1278

210

774

364

725

1244

552

819

442

373

1205

1043

318

908

8788

1032

394

847

646

999

1273

1302

1372

881

1077

661

1237

740

1267

538

1358

882

1217

706

858

1153

1402

730

595

556

499

86

849

1230

590

291

962

348

1242

1262

956

652

487

1204

455

817

340

80

21

729

181

1028

65

93

571

1075

1183

734

305

453

779

72

1060

1274

1281

972

1301

953

284

632

219

863

1097

1201

1105

1276

321

38

283

36

570

1037

262

871

495

273

332

1125

766

594

1300

1119

1305

390

257

645

339

1410

5

18

1040

523

844

64

1391

1130

250

1209

7

212

829

630

1375

737

997

648

719

1246

389

609

1279

413

1349

1295

1294

234

1087

1374

1385

143

797

593

1371

161

668

1110

659

461

567

1023

1293

232

477

634

1010

258

255

907

602

915

507

695

130

728

214

1220

861

667

1166

517

899

225

754

45

839

1303

231

1033

521

1088

111

1

763

376

765

22

1134

664

304

979

289

545

564

884

3209

845

698

978

539

1089

868

372

1229

488

800

961

557

626

846

408

1325

1381

752

387

1178

1225

1117

272

1393

815

368

48

781

864

722

905

463

1288

55

563

1405

890

1228

259

1045

826

1098

896

356

641

320

1203

1171

1352

1398

393

560

1388

575

945

230

918

703

1324

480

1328

1384

780

535

822

1041

686

369

EASTEU

927

747

655

755

651

875

1052

549

1256

100

1177

1298

430

1158

159

921

1362

1329

1316

1007

1068

1258

1122

1005

1093

319

1346

235

798

1030

596

1208

702

158

99

335

669

939

904

1259

993

428

902

1338

1361

1390

313

1182

1055

914

880

1012

783

456

1079

711

298

607

778

1252

850

761

983

886

103

1239

405

724

1015

213

1081

665

5

9

277

879

220

1214

565

401

1373

307

803

814

834

1006

322

855

1216

403

1240

1212

271

58

964

354

974

112

1100

601

471

578

1042

690

1062

1155

138

1192

623

597

687

190

493

772

1148

268

677

317

901

658

1202

1011

243

685

1127

1231

990

199

526

955

676

1304

627

909910

776

679

1354

420

1284

336

417

498

323

923

366

516

1150

486

736

391

830

786

591

973

643

81

883

1026

935

1167

82

862

709

976

42

1380

1073

620

1084

745

1299

85

919

546

1195

943

704

6

1249

1058

29

101

688

718

110

34

11

198

384

178

265

753

696

1176

670

406

347

773

707

1070

1051

660

1017

959

144

39

349

541

553

947

299

689

1027

1224

841

423

1074

529

821

906

1008

587

1401

363

183

483

617

263

40

970

1207

331

551

731

274

436

996

1019

1221

848

1334

598

804

751

433

1356

640

785

1243

482

809

714

141

248

985

407

247

860

1085

1137

900

789

1123

542

958

344

78

57

749

1066

1222

771

870

229

1210

358

23

INDIA

1236

236

1327

1149

965

618

226

960

449

637

1271

427

1044

1411

954

682

297

1002

185

338

912

2

177

1383

738

1111

1263

68

980

153

995

582

991

350

443

579

1218

342

547

337

1061

440

981

823

717

385

1348

25

1

65

102

893

1095

54

1108

176

892

10

127

1317

98

727

469

583

104

759

540

644

1136

1280

805

1

40

1049

1142

492

588

457

1109

808

1268

139

501

528

119

812

872

1191

673

1165

1038

1363

164

285

509

1369

1308

44

680

987

1330

743

374

1121

1090

61

969

603

561

41

654

126

419

963

568

1227

1350

244

32

107

1047

1197

4

56

450

633

1126

948

1132

942

13

294

951

913

1313

105

674

485

762

117

946

441

16

662

827

24

619

1072

584

494

770

242

148

122

380

245

63

260

353

1168

726

1185

192

764

466

1199

136

525

1164

813

431

90

1000

1289

866

1379

392

60

197

1013

326

938

330

418

1174

878

472

1059

8173

843

1188

280

520

1020

732

475

1064

432

26

605

874

612

325

857

352

530

934

1159

692

388

932

1078

1270

309

793

184

887

653218

52

1128

1175

1323

1235

968

527

1154

308

382

200

1404

569

154

31527

580

572

12 266145

216

120

83

721

GOLD

341

73

490

439

253

171

LATAM

343

137

1307

174

249

473

-20

1351

0.00

ForeC1

-20 0 20 40

116

INDIA

150

CHINA

115

508 146147

622

402

528

738

524

1400

295

621

455

460

49

41

132 602

395

720

387

228

267

1075

88

193

346

128

452

204

1270

1031

281

153

613

539

1163 1353

1272

112

113

994

365

291

541

166

15

532

318

1164

763764

479

2

668

468

1224

182

312

1241

443

133

1274

1205

1142

1153

625

1227

1072

651

28

329

19

1202

1094

480

767

206

229

805

1190

97

129

1159

252

506

1386

678

692

496

1229

590

811

727

139

1338

254

596

801

311

607

157635

370

597

5

1308

988

1194

431

412

1388

1091

1295

369

947

330

38

454

555

389

422

1017

232

1187

316

202

708

1002

1009

413

288

863

1404

906

547

272

70

581

731

1135

513

879

742

1329

1302

400

1156

691

434

1225

161

1307

1071

397

130

868

549

744

637

285

563

186

437

470

808

1235

618

209

499

527

143

240

481

165

1207

429

1309

1090

1380

762

1033

741

1259

705

207

WATER

324

652

634

304

425

201

1299

1239

283

858

247

897

981

1216

535

1124

177

236

76

1074

123

45

1048

920

1242

507

718

567

3

857

328

867

924

35

632

1086

641

1173

13

515

10

1192

982

1172

54

235

264

577

757

319

1287

1233

1268

533

476

824

761

410

464

1198

494

953

362

802

583

785

44

77

1411

327

980

585

701

756

1101

1133

671

458

110

428

1276

1330

500

865

217

1061

11271128

156 1140

611

1087

451

1

385

1000

1076

81

1398

381

827

208

1226

638

46

463

1376

971

907

878

1282

854

1314

664

1084

889

1131

1209

357

772

554

1294

1001

1078

975

1384

415

1232

933

1362

588

778

1298

350

372

926

665

552

168

697

843

1120

922

751

771

1132

1070

163

786

320

956

194

1306

1085

66

86

503

929

1304

1355

379

432

914

932

244

873

1278

1286

804

543

587

1381

1360

582

356

1348

117

173

261

760

1058

871

1315

367

108

1319

710

271

486

1109

364

898

92

109

1004

47

1023

314

1214

1248

514

1342

1251

803

266

31

1201

474

386

700

457

167

531

1014

1035

1011

EASTEU

1333

1165

559

891

1037

842

233

1372

396

910

1100

696

1203

942

695

793

347

1020

649

954

781

896

564

72

1262

852

378

383

1005

666

50

1006

392

589

702

647

849

747

946

915

936

931

125

334

62

1183

834

1413

749

1220

737

1285

877

529

302

1363

234

495

1034

484

1139

1200

1007

847

465

375376

765

426

1082

1361

1326

1244

856

782

902

1032

1047

1292

925

592

282

1297

1316

894

974

923

178

795

1261

768

142

966

1063

1393

1332

561

1369

1177

540

1083

1204

30

159

1223

336

487

1401

1111

1217

289

420

322

398

978

895

1215

446

957

226

239

1012

687

323

775

222

1293

965

809

1256

504

774

1180

624

776

344

181

1254

53

276

960

170

4

1246

1267

337

197

377

237

LATAM

676

89

1303

275

930

218

766

810

121

273

1168

586

1366

1098

870

693

519

424

520

883

1178

1339

746

435

670

1354

608

544

1166

1317

603

1402

1147

313

1110

1409

459

393

522

905

243

414

881

1403

1277

1255

34

175

840

409

939

220

65

1219

37

246

399

1054

363

948

569

103

512

1378

1107

93

1064

1379

491

1114

326

876

345

850

614

807

300

1099

1231

1053

573

1390

864

851

1341

550

477

419

669

358

1377

55

1043

798

1069

1290

654

1050

1211

1046

1123

284

784

191

1364

1368

1406

1320

1188

516

517

872

14

348

657

1356

29

141

1022

256

1394

212

725

848

1213

1026

1230

829

1382

94

74

1392

565

558

753

1036

591

263

238

1113

1387

962

656

663

593

482

796

825

200

684

595

1365

698

659

822

1371

935

461

164

1030

490

87

213

343

475

340

11491154

908

601

681

1396

706

679

1057

748

1

604

447

1266

682

594

388

1300

1119

297

1305

826

257

1301

339

269

258

835

1410

48

1040

518

844

523

64

1284

636

321

816

780

21

831

1258

262

1189

1228

57

1130

1243

1081

667

688

439

1021

570

192

373

704

1375

1044

440

630

104

959

572

724

351

721

1405

1060

1018

650

779

740

149

368

880

977

134

1318

310

1408

736

874875

224

598

521

1117

215

1374

296

837

719

699

293

919

1273

1104

916

1106

286

853

23

1324

941

752

355

964

305

301

711

501

219

1222

648

498

912

979

1065

1125

1195

884

1391

59

1029

660

783

1322

686

1260

885

815

268

866

1265

1041

105

210

812

961

1283

1068

1080

1051

963

1019

1325

1206

1118

830

391

189

1092

556

418

1179

1045

1191

945

456

1263

1122

690

1373

1052

135

1175

36

241

1288

548

845

18

359

270

248

646

917

100

199

680

525

833

303

709

568

390

444

909

927

1025

1088

1247

723

789

628

1264

227

1397

777

758

991

888

126

694

1407

33

1351

427

407

394

1096

96

317

1345

1115

1357

675

677

726

84

717

770

943

1340

817

755

119

1252

1112

1249

828

886

183

653

6

674

1197

353

823

366

380

24

423

819

728

511

231

510

196

911

1337

1269

8

87

739

1095

937

1148

952

25

820

839

290

438

382

308

411

1221

1313

940

714

1237

992

306

478

1

7

707

1250

1155

1103

16

449

384

921

846

1049

361

1174 1328

575

799

672

98

645

1331

1323

436

1412

984

1193

1136

ENERGY

255

626

1024

1143615

469

335

1169

813

277

1280

900

1346

571

928

998

1186

557

792

404

1238

1042

821

534

1008

1389

82

352

421

934

832

627

1116

970

1240

599

1395

972

1028

841

950

67

1066

453

1208

838

1176

732

1182

899

309

623

1349

661

371

1016

51

859

1358

976

225

1271

759

790

7118

332

1150

913

639

298

754

433

536

73

610

918

901

734

560

1253

1077

467

987

250

292

1310

730

655

712

545

949

629

713

1067

955

1161

1279

221

999

502

806

405

773

958

1162

860

791

993

890

27

20

566

600

1102

140

32

1089

1167

574

1352

1383

938

1055

354

120

79

136

1056

71

138

1038

1181

861

493

1013

794

1218

729

188

642

11

441

1151

162

1171

892

211

1093

408

174

1062

83

1160

968

374

1105

673

497

360

703

797

1184

1289

1097

605

951

745

836

1015

1134

814

1129

190

9

97

537

1138

1367

198

1359

967

99

722

80

788

12

403

1039

1121

1059

869

1199

1170

986

385

483

341

750

1312

155

609

294

818

489

662

1027

855

60

631

1257

530

996

131

989

1234

983

1311

9633

214

259

485

1296

689

584

1141

466

1291

90

715

1399

299

1236

107

882

187

985

553

969

95

338

576

40

562

944

743

733

78

551

995

1144

462

1010

91

903

1196

52

223

579

505

769

1245

683

893

1370

1185

1321

1003

606

75

61

253

1335

616

416

342

331

185

1327

509

973

1212

1073

445

127

251

1334

401

658

612

471

203

287

862

716

904

643

1344

42

1511146

617

1347 1145

417

260

106

787

230

58

542

546

578

179

85

39

990

1336

1281

538

349

205

216

406

279

1137

43

278

195

307

800

1210

1108

265

1350

152

1152

450

488

176

735

1126

148

448

169

26

280

472473

315

245

63

1158

430

526

114

184

111

644

160

249

22

640

685

1343

1275

172

144

102

8274

124

442

492

171

MINING

158

1079

333

180

242

154 5801157

137

56

122

145

101

619

GOLD

325

69

0 400

-20

0 40

ForeC4

0.00

1311

-60

ForeC2

0.00

-0.10

-60

-0.10

-4

1000

Time

40

-0.10

4 -4

-2

0

0

4 -15

0

4-6

0

5 15-4

INDIA

-10

0 400

0

1350

1142 MINING

1395 622

993 1188

991 13094EASTEU

145

1100

1071

616

146

1164

981

1193 1174

678

1318

189

1135

1310

1222

1062

1273

409

92

68

1179

1073

91

959

589

1320

3

133

550

609

1330

1085

1182

75

553

1048

739

1125

128

1313

408

1241

1208

1139

1147

1116

13

747

954

976

17

680

922

982

167

416

1266

467

1323

374

345

1160

1358

986

946

1020

401

112

459

1228

1262

201

539

1059

1168

821

1108

452

1079

1080

1346155

1090

1024

525

683

1398

997

1411

70

686

506

644

1008

224

570

574

1027

661

1055

221

172

584

228

1356

1220

1328

331

1004

1029

202

581

1355

1053

1280

259

1303

1413

883

1198

927

966

62

500

1050

113

1171

907

162

1201

137

621

238

965

1283

74

1191

1294

848

843

435

267

1123

208

1216

1260

1114

461

817

502

985

1295

691

442

554

728

59

1035

1245

934

1237

1097

852

186

281

369

1110

559

462

1165

293

1010

190

1376

395

456

973

778

1001

1204

139

386

1377

1306

716

212

1338

928

286

200

328

1132

515

181

939

1337

1247

1322

742

210

799

1315

1103

1369

1286

429

545

770

670

1003

125

390

1316

746

1254

709

831

1353

1212

1238

656

26

279

1258

451131 1163

903

1077

478

810

1156 786

22

349

536

103

562

578

734

968969

971

1275

505

998

1068

72

791

117

766

776

565

1231

744

1018

763

1240

108

474

1067

958

510

365

379

543

825

58

1109

168

693

1361

177

227

947

136

1340

1154

109

730

1105

800

1113

1276

1332

805

360

937

1013

6

919

313

29

667

270

832

923

1335

142143

737

178

479

534

1151

260

593

264

468

381

819

1388

445

1089

23

488

414

11

292

183

1365

801

795

917

116

784

187

263

131

1251

192

16

1359

CHINA

302

115

234

894

84

522

1394

1291

290

882

375

724

880

718

941

203

1249

1406

1099

1400

384

1307

987

1007

1180

243

775

945

1176

707

1159

1345

636

410

915

833

1138

367

27

235

1297

1288

1134

251

625

289

566

1381

225

1205

422

1372

807

1039

874

196

623

1408

513

5627

14

1269

199

1093

653

165

782783

174

657

1263

8

5

406

310

1221

296

1380

1150

359

458

1057

1112

272

749

335

1211

914

920

37

485

869

1083

298

311

498

9

1244

705

751

233

1217

99

463

604

1284

171

1

214

1207

446

380

1371

95

364

648

1354

432

863

547

1402

449

649

393

1126

1074

652

1185

655

69

1243

1403

592

464

912

913

1349

230

1042

1005

806

1017

277

1088

694

32

INDIA

5

10

140

31

1014

48

979

676

897

503

448

389

854

347

38

901

216

635

118

1343

396

1034

495

645

908

684

144

856

700

773

400

90

394

834

1363

355

288

996

1405

483

858

1033

1287

217

860

7

556

857

397

890

731

415

930

44

723

752

665

845

211

161

326

761

711

579

1304

759

1299

46

8

524

830

892

871

557

612

663

1019

720

569

1265

480

1386

1195

268

526

236

241

497

179

321

861

529

788789

312

413

1285

849

49

1374

226

706

98

950

517

41

1218

823824

940

1148

816

275

1329

780

1082

925

21

423

695

1036

1246

601

1199

1397

1301

1043

1278

231

215

15

411

1177

1327

166

451

1196

1234

1047

424

674

1061

933

307

815

494

223

93

803

886

428

519

696

357

847

765

889

630

1375

1348

78

685

412

340

465

1382

303

111

1203

496

1041

1095

595

632

12

658

39

437

436

385

1393

781

702

637

3

30

33

80

120

134

962

188

647

123

576

611

1314

100

356

643

47

804

421

261

71

701

1385

628

511

141

354

1130

1391

688

618

392

664

585

184

314

453

1127

455

198

868

745

156

1032

794

246

650

1364

382

771

538

1373

1076

53

1045

910

785

14

721

64

558

50

523

844

96

1040

518

714

853

838

820

1293

1410

444

774

521

60

399

1341

207

851

1252

339

105

713

450

257

719

836

454

599

358

329

1305

924

337

362

855

333

417

466

811

764

974