Vantage Securities Pvt. Ltd.

advertisement

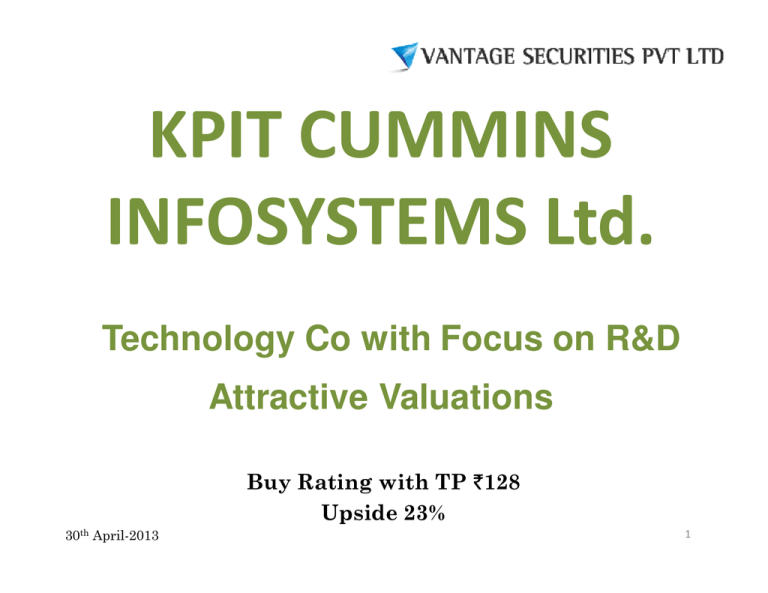

KPIT CUMMINS INFOSYSTEMS Ltd. Technology Co with Focus on R&D Attractive Valuations Buy Rating with TP `128 Upside 23% 30th April-2013 1 KPIT Cummins Infosystems Ltd Relative Performance Stock Data No. of shares : 19.28 cr Market Cap : ` 2004.3cr 52 week high : `142 52 week low : `84 Bloomberg code : KPIT.IN Reuter’s code : KPIT.BO Current Price : `104 TTM P/E : 10.1x Target Price : `128 Shareholding Pattern(%) Promoters FIIs DII Others March - 13 24.31 30.83 11.80 33.06 Performance Table Month 1 month 6 month 12 month Stock 7.2% -16.1% 1.0% Nifty 4.3% 5.5% 13.2% Source: Ace Equity 2 QUATERLY UPDATE Review of Q4’FY13 result • Revenue growth in Q4 in-line with our estimates KPIT has reported consolidated revenues of $105.5mn in Q4FY13 which was a 13% Y-o-Y and 2.0% Q-o-Q growth. In ` terms KPIT clocked revenues of ` 5,698.1mn in Q4FY13 which represents a Y-o-Y growth of 18.7% and Q-o-Q growth of 1.2%. The revenue growth in Q4FY13 was mainly due to the strong A&E SBU growth of 8.3% QoQ; with IES growing 1.7% QoQ despite softness in the Cummins account. SAP SBU declined 5.8% QoQ, with SYSTIME revenues growing 9.3% QoQ. The FY13 consolidated revenues stood at `22,385.8mn up 49.2% YoY. This was mainly led by robust 75.3% YoY growth in IES SBU, SAP and A&E SBU’s growing by 36.7% and 39.1% respectively. • EBITDA margins expand ~200bps on a sequential basis EBITDA for Q4FY13 stood at `1010mn as compared to `760mn in Q4FY12 which was a Y-o-Y growth of 32.9% and Q-o-Q growth of 14.5%. The EBITDA margin for Q4FY13 stood at 17.7% as against 15.8% in the same quarter of the previous year and 15.7% in Q3FY13. The rise in margins on a sequential basis was due to the change in business mix, with A&E and IES SBU’s garnering higher share of the total revenues. The utilization levels also showed an improvement in Q4FY13 on a sequential basis. The EBITDA for FY13 stood at `3,650mn as compared to ` 2181mn in the corresponding period of the previous year. The EBITDA margin for FY13 stood at 16.3% up 180bps YoY. For the full year FY13 A&E SBU & IES SBU recorded EBITDA margins of 24-25% and 173 18% respectively. QUATERLY UPDATE Review of Q4’FY13 result • FX loss in Q4FY13 as against a profit in Q3FY13 The other income profit/ (loss) for Q4FY13 stood at `(85.77)mn as compared to `76.72mn in Q3FY13. The forex loss in Q4FY13 was to the extent of ` (149.2)mn v/s ` 56.9mn profit in Q3FY13. The net impact of translation of foreign currency denominated assets and liabilities predominantly resulted in the loss on forex in Q4FY13. • Net Profit is Flattish on a QoQ basis The consolidated PAT after minority interest and share in associate profit/(loss) for Q4FY13 stood at `511.7mn as compared to `437.2mn in the same quarter of the previous year which was a Y-o-Y growth of 16.9% and Q-o-Q growth of 1.4%. The consolidated PAT after minority interest and share in associate profit/ (loss) for FY13 showed a YoY growth of 36.9% to touch `1,989.5mn. The EPS for Q4FY13 stood at `2.7 as compared to `2.3 recorded in the corresponding quarter of the previous year. The EPS for FY13 (post dilution) stood at `10.3 as compared to `7.5 recorded in FY12. 4 QUATERLY UPDATE Key Takeaway’s of Q4’FY13 Con Call • • • • • • • • • • • • • • KPIT’s o/s hedged position as at the end of 31.03.13 stood at $69.76mn. The largest client Cummins is expected to have a soft H1CY13 (Q1FY14E expected to be flat to marginally lower QoQ); with growth picking up in H2CY13. The SAP SBU could see growth momentum coming back in the next 1-2 quarters with better profitability. The management sees non-linear opportunities in the Automotive segment in areas of Infotainment, Safety, Powertrain etc. The trials on 40 vehicles are continuing in REVOLO. The management intends to take the non-linear revenues to 15% of total revenues by 2017. SAP has seen good growth in APAC region and muted in other geographies. The EBITDA margins are expected to improve in FY14E due to productivity gains and change in SBU composition. KPIT will make net additions of 1000 employees in FY14E KPIT management has planned a wage hike of 8-9% for offshore in FY14E. The Effective Tax rate is expected to be in the region of 28-28.5% in FY14E. The capex for FY14E is estimated to be ~$7-8mn. The Utilities segment is seeing good growth in the North America region. The S&M expenses in FY14E are expected to be at the same level of FY13. FINANCIAL SUMMARY FINANCIAL SUMMARY Year Consolidated FY11 FY12 FY13 FY14E FY15E Net Sales (`` mn) 9,870 15,000 22,386 25,724 29,840 EBITDA (`` mn) Rep.PAT (`` mn) 1,522 2,181 3,650 4,245 5,014 946 1,454 1,990 2,361 2,808 EPS (`` ) 4.9 7.5 10.3 12.2 14.6 ROCE (%) 16.1% 18.9% 21.8% 22.4% 22.9% Source: Company and Vantage Securities 5 Year CAGR Financials (In %) 20 18 16 14 12 10 8 6 4 2 0 Source: Company EBITDA Margins (In %) 30.0% Revenues EBITDA Profit 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% Source: ACE Equity 6 FINANCIAL SUMMARY FINANCIAL SUMMARY Revised estimates V/s Old Estimates –FY14E EPS estimates (post dilution) reduced by 17% to factor in lower top line growth Particulars ` Mn Actual FY13E Old Estimates New Estimates Introducing FY14E FY14E FY15E Revenues 22,386 28,409 25,724 29,840 EBITDA 3,650 4,621 4,245 5,014 EBITDA Margin (%) 16.3% 16.3% 16.5% 16.8% PAT 1,990 2,828 2,361 2,808 EPS* 10.3 14.7 12.2 14.6 * denotes: EPS calculated post dilution of 12.96mn shares Source: Company and Vantage Securities Quarterly Estimates V/s Actual No's – Margins and PAT above our estimates (`` Mn) Net Sales EBITDA EBITDA Margins (%) PAT (incl Exceptional Items) EPS (`) Q4FY13 A Q4FY13* E Variance (%) 5698.6 5767.5 -1.2% 1010.7 945.9 6.9% 17.7% 16.4% 130bps 511.7 465.6 9.9% 2.7 2.4 Source: Company and Vantage Securities 7 VALUATION PARAMETERS VALUATION THESIS • We reiterate “BUY” at current levels mainly due to better than Industry growth estimates and steady improvement in margins KPIT has shown robust YoY $ top line growth of 13% in Q4FY13 and has also guided for a $ revenue growth of 14-16% in FY14E. The management has also stated its PAT guidance at `2309-2388mn (YoY growth of ~16-20%). Though this is much lower than the high growth trajectory that KPIT has experienced previously, (PAT growth of 37% YoY in FY13) we believe it is better than NASSCOM industry estimates. KPIT has made investments over the last 4 quarters in non-linear initiatives (IP led revenues doubled during FY13) and focus industries which would help increase margins. KPIT intends to move its transformational deals from onsite to offshore which further aid the margins. KPIT has also had well rounded client additions in various verticals and geographies in Q4FY13 which diversifies its risk. We have reduced our EPS estimates for FY14E to `12.2 from `14.7 earlier and introduced our FY15E EPS at `14.6. We have factored in much lower growth levels for FY14E in-line with the management guidance due to concerns emanating from the Cummins account and continued sluggish growth in Europe. At the CMP of `104 the stock is trading at 8.5x revised FY14E EPS of `12.2 and ~7.1x FY15E EPS of `14.6. We have reduced our target price to `128 (earlier `154) on our FY14E EPS and have not considered REVOLO revenues to flow in FY14; though maintain our BUY rating on the stock. At our target price the KPIT stock would command a multiple of 10.5x FY14E EPS and 5.4x FY14E EV/EBITDA. 8 VALUATION PARAMETERS VALUATION THESIS 120 100 46.3 46.1 44.2 47.0 47.8 51.5 52.7 53.8 54.7 53.8 80 60 53.7 53.9 55.8 53.0 52.2 48.5 47.3 46.2 46.2 40 45.3 20 0 Offshore Onsite Source: Company 9 QUATERLY UPDATE Q4FY13 & Annual P&L Consolidated Financials Revenue Software Development Expenses Gross Profit Selling and Marketing Expenses General and Admin Expenses Total Expenditure EBITDA Depreciation Interest Expenses EBD Other Income Exceptional Item PBT Provision for Tax PAT Minority Interest Share of Associate in Profit/(Loss) Adjusted Net Profit EPS Source: Company Q4FY12 Q3 FY13 Q4FY13 QoQ Grth (%) YoY Grth (%) 4800.1 5633.0 5698.1 1.2 18.7 (3185.5) (3706.3) (3725.1) 0.5 16.9 1614.6 1926.7 1973.0 2.4 22.2 (304.6) (419.1) (346.3) (17.4) 13.7 (549.6) (625.4) (616.6) (1.4) 12.2 (4039.8) (4750.8) (4687.9) (1.3) 16.0 760.3 882.2 1010.2 14.5 32.9 (101.7) (117.7) (120.6) 2.5 18.6 (39.0) (41.5) (42.5) 2.3 8.9 619.6 722.9 847.1 17.2 36.7 (112.9) 76.7 (85.8) 211.8 -24.0 100.5 (94.5) 0.0 (1.3) 607.1 705.2 761.3 8.0 25.4 (149.8) (182.6) (206.8) 13.2 38.0 457.4 522.6 554.6 6.1 21.3 22.0 18.3 43.4 137.7 0.0 1.8 0.0 0.0 437.2 504.3 511.2 1.4 16.9 2.3 2.6 2.7 FY13 22,385.8 (14,639.8) 7,746.0 (1,538.0) (2,558.4) (18,736.3) 3,649.5 (466.1) (153.9) 3,029.5 (169.7) (13.1) 2,846.7 (765.6) 2,081.1 86.1 (5.4) 1,989.5 10.3 FY12 YoY Grwth (%) 15,000.1 49.2 (9,934.4) 47.4 5,065.7 52.9 (1,115.0) 37.9 (1,769.7) 44.6 (12,819.2) 46.2 2,180.9 67.3 (444.9) (4.8) (78.1) 97.0 1,658.0 82.7 128.0 (232.7) 100.5 1,886.4 50.9 (436.7) 75.3 1,449.7 43.6 31.5 173.8 35.3 1,453.6 36.9 7.5 10 QUARTERLY UPDATE Operating Metrics Segment Wise Revenue Mix – Auto, Manufacturing saw flat growth and Energy & Utilities de-grew in Q4FY13 Segment wise Revenue Mix Automotive, Transportation & Manufacturing Revenues Q-o-Q / Y-o-Y Growth % Energy & Utilities Revenues Q-o-Q / Y-o-Y Growth % Others Revenues Q-o-Q / Y-o-Y Growth % Q1 FY13 72.5% 3902 12.8% 13.7% 740 33.4% 13.8% 741.2 -5.8% Q2 FY13 71.2% 4041 3.6% 15.3% 868 17.4% 13.5% 762.9 2.9% Q3 FY13 74.3% 4185 3.6% 14.2% 800 -7.8% 11.5% 647.2 -15.2% Q4 FY13 73.8% 4206 0.5% 13.5% 768 -4.0% 12.7% 723.7 11.8% Strategic Business Unit Wise Revenue Mix – DFS & SSG divisions part of strategic business transfer SBU wise Revenue Mix Integrated Enterprise Solutions Revenues Q-o-Q / Y-o-Y Growth % Auto & Engineering Revenues Q-o-Q / Y-o-Y Growth % SAP Revenues Q-o-Q / Y-o-Y Growth % Semiconductor Solutions Group Revenues Q-o-Q / Y-o-Y Growth % Source: Company Q1 FY13 44.4% 2389 17.0% 23.7% 1276 16.0% 31.9% 1717 10.5% 0.0% 0 0.0% Q2 FY13 45.9% 2605 9.0% 24.4% 1384 8.4% 29.7% 1683 -2.0% 0.0% 0 0.0% Q3 FY13 48.7% 2743 5.3% 23.4% 1317 -4.8% 27.9% 1574 -6.5% 0.0% 0 0.0% Q4 FY13 49.0% 2790 1.7% 25.0% 1426 8.3% 26.0% 1483 -5.8% 0.0% 0 #DIV/0! 11 QUARTERLY UPDATE Operating Metrics Onsite-Offshore Revenue Contribution Mix Q4FY13 46.2% 53.8% Onsite Offshore Geography Wise EBIT margins 40 37.2 36.6 35 25.0 24.3 28.0 26.7 20 15 37.2 35.8 30 25 37.0 25.6 24.9 31.9 30.2 27.8 26.6 22.6 21.9 18.0 17.3 15.0 27.5 10 5 0 Q2FY12 Q3FY12 Q4FY12 US Source: Company Q1FY13 UK & Europe Q2FY13 Q3FY13 Q4FY13 ROW 12 QUARTERLY UPDATE Operating Metrics Client Contribution to Revenue – H1CY13 sees growth challenges to Cummins Client contribution to revenue Top Client - Cummins Rs in Mn QoQ growth YoY growth Top 5 Rs in Mn QoQ growth YoY growth Top 10 Rs in Mn QoQ growth YoY growth Q1FY13 20.6% 1108 18.4% 70.7% 36.3% 1951 23.1% 44.0% 44.0% 2369 16.9% 38.8% Q2FY13 19.7% 1117 0.9% -19.4% 35.2% 1997 2.4% -19.0% 43.7% 2478 4.6% -20.6% Q3FY13 19.1% 1076 -3.7% 18.8% 36.8% 2074 3.9% 46.4% 45.2% 2547 2.8% 43.1% Q4FY13 16.6% 945 -12.2% 1.0% 35.2% 2006 -3.3% 26.6% 44.0% 2507 -1.6% 23.7% Geography Wise Revenue Mix 90.0% 80.0% 70.0% 68.9% 68.5% 64.2% 68.1% 70.5% 73.3% 76.2% 76.4% 74.7% 76.3% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 20.9% 18.7% 21.0% 20.1% 19.0% 10.2% 12.8% 14.8%11.7% 14.6% 12.1% 13.9% 11.3% 14.4% 9.2% 11.6% 11.4% 12.3% 10.5% 12.3% 0.0% Q3FY11 Q1FY12 US Source: Company Q3FY12 UK & Europe Q1FY13 Q3FY13 Rest of the World 13 PROFIT & LOSS STATEMENT Consolidated P&L FY11 FY12 FY13 FY14E FY15E Revenues Expenditure 9,870 15,000 22,386 25,724 29,840 Software Development Expenses 6,248 9,934 14,640 16,823 19,485 Selling and Marketing Expenses 762 1,115 1,538 1,742 1,991 General and Admin Expenses 1338 1770 2558 2914 3351 8,348 1,522 45 411 12,819 2,181 78 445 18,736 3,650 154 466 21,479 4,245 214 522 24,826 5,014 264 653 1066 1658 3029 3509 4098 36 128 (170) (150) (125) Total Expenditure Operating Profit Interest Depreciation Profit After Depn. & Int Other income PBT Tax 1,103 155 1,786 437 2,860 766 3,359 907 3,972 1073 PAT EO 948 0 1,349 100 2,094 (13) 2,452 0 2,900 0 31 86 86 86 35 (5.4) (5.4) (5.4) MI Share of Asscoiate in Profit Net Profit EPS ( ` ) 2 0 946 4.9 1,454 7.5 1,990 10.3 2,361 12.2 2,808 14.6 Source: Company 14 BALANCE SHEET STATEMENT Consolidated Balance Sheet SOURCES OF FUNDS : Share Capital Total Reserves and Surplus Total Shareholders Funds Loan Funds Total Loan Funds Minority Interest Deferred Tax Liability (Net) Other long term Liabilities FY11 FY12 FY13 FY14E FY15E 176 356 386 386 386 5,854 6,032 6,768 7,125 9,975 10,362 12,101 12,488 14,629 15,016 931 9 2,139 326 3,213 270 3,213 270 3,213 270 57 8 0 0 0 107 264 1 1 1 Total Liabilities 7,135 9,862 13,846 15,971 18,500 APPLICATION OF FUNDS : Gross Block 2,941 3,822 4,440 4,990 5,540 1,678 2,155 2,621 3,143 3,795 Net Block Capital work-in-progress 1,263 316 1,668 185 1,820 185 1,848 185 1,745 185 Goodwill on Consolidation 1,300 3,623 4,423 4,423 4,423 477 2 582 35 2,154 69 2,154 69 2,154 69 27 34 32 32 32 Sundry debtors 2,288 4,233 4,673 6,132 7,521 Cash and Bank balances Other current assets 2,080 249 1,473 164 1,921 823 2,769 823 4,454 823 Less: Accumulated depreciation and amortisation Investments Net Deferred Tax assets Other assets Current Assets, Loans & Advances Loans and Advances 1,085 1,285 1,748 2,009 2,330 Total Current Assets Less : Current Liabilities and Provisions 5,703 7,154 9,165 11,732 15,129 Current Liabilities 1,701 2,755 3,164 3,649 4,217 Provisions 251 663 838 824 1,020 Net Current Assets 1,952 3,751 3,419 3,735 4,002 5,163 4,472 7,260 5,237 9,891 Total Assets 7,135 9,862 13,846 15,971 18,500 Total Current Liabilities Source: Company 15 CASH FLOW STATEMENT Consolidated Cash Flow PBT Depreciation and Amortisation FY11 1,103 411 FY12 1,886 445 FY13E 2,860 466 FY14E 3,359 522 FY15E 3,972 653 (47) (574) 894 (249) 645 (185) (870) 1,276 (268) 1,008 170 (570) 2,926 (766) 2,160 150 (1,249) 2,782 (907) 1,875 125 (980) 3,770 (1,073) 2,698 643 (422) 270 1,005 (609) 112 2,160 (618) (1,572) 1,875 (550) 0 2,698 (550) 0 Investing CF Repayment of term loan (Net) Dividends Paid (Incl corporatedividend tax) Proceeds from issue of share capital (675) (131) (64) 1,234 (2,828) (219) (72) 65 (2,254) 1,074 (145) 1,620 (623) 0 (170) (176) (623) 0 (202) (670) Financing CF Net Change Opening Cash Closing Cash 1,043 1,011 1,001 1,084 (739) 2,080 519 425 1,473 (382) 871 1,898 (390) 1,685 2,769 2,080 1,473 1,898 2,769 4,454 Other operating expenses/income Change in WC Operating CF after WC Direct taxes paid (net of refunds) Cash flow before exceptional items Net cash from operating activities after exceptional item Purchase of Fixed Assets Sale/ (Purchase) of investments Source: Company 16 RATIOS Consolidated Ratios Growth In % Net Sales (` ) Net Profit after minority interest FY11 FY12 FY13E FY14E FY15E 34.9 10.3 52.0 53.7 49.2 36.9 14.9 18.7 16.0 19.0 EBITDA EPS (5.7) 10.3 43.3 53.7 67.3 36.9 16.3 18.7 18.1 19.0 Valuation EPS (Rs.) CEPS (Rs.) PER (x) PEG (x) 4.9 15.2 21.2 2.1 7.5 11.2 13.8 0.3 10.3 12.6 10.1 0.3 12.2 14.9 8.5 0.5 14.6 17.9 7.1 0.4 EV /EBITDA (x) Debt/Equity (x) 12.1 0.2 9.2 0.3 5.3 0.3 4.3 0.3 3.3 0.2 Profitability ROCE (%) ROE (%) EBITDA Margin (%) EBIDTA Margin (%) (incl Other Income) 16.1 19.1 15.4 15.8 18.9 22.1 14.5 15.4 21.8 22.8 16.3 15.5 22.4 20.7 16.5 15.9 22.9 20.4 16.8 16.4 Net Profit Margin (%) Tax/PBT (%) 9.6 14.0 9.7 24.5 8.9 26.8 9.2 27.0 9.4 27.0 Turnover Avg. Collection Period (Days) Avg. Payment Period (Days) Net Fixed Assets (x) 84.6 85.3 6.2 103.0 97.3 8.1 76.2 78.0 11.2 87.0 76.0 12.7 92.0 77.0 15.5 1.4 1.5 1.6 1.6 1.6 2,556.5 29.1 2,055.1 11.5 4,075.0 21.1 4,923.1 25.5 6,608.0 34.3 Total Assets (x) Cash on B/S Cash per share (Rs) Source: Company 17 Important Disclaimer The Research team of Vantage Securities Pvt Ltd on behalf of itself has prepared the information given and opinions expressed in this report. The information contained has been obtained from sources believed to be reliable and in good faith, but which may not be verified independently. While utmost care has been taken in preparing the above report, Vantage Securities Pvt Ltd or its group companies make no guarantee, representation or warranty, whether express or implied and accepts no responsibility or liability as to its accuracy or completeness of the data being provided. All investment information and opinion are subject to change without notice. Also, not all customers may receive the material at the same time. This document is for private circulation and information purposes only. It does not and should not be construed as an offer to buy or sell securities mentioned herein. Vantage Securities Pvt Ltd shall not be liable for any direct or indirect losses arising from the use thereof and the investors are expected to use the information contained herein at their own risk. Vantage Securities Pvt Ltd and its affiliates and / or their officers, directors and employees may own or have positions in any investment mentioned herein or any investment related thereto and from time to time add to or dispose of any such investment. Vantage Securities Pvt Ltd and its affiliates may act as market maker or have assumed an underwriting position in the securities of companies discussed herein (or investments related thereto) and may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking or underwriting services for or relating to those companies. The investments discussed or recommended in this report may not be suitable for all investors. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advisors, as they believe necessary. Income from investments may fluctuate. The price or value of the investments, to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. The value of or income from any investment may be adversely affected by changes in the rates of currency exchange. This document is strictly meant for use by the recipient only. None of the material in this report shall be reproduced, resold or redistributed in any manner whatsoever without the prior explicit written permission from Vantage Securities Pvt Ltd. Atul Pandit, Research Analyst +91-20-2566 6080 Atul.pandit@vantageindia.co.in 18