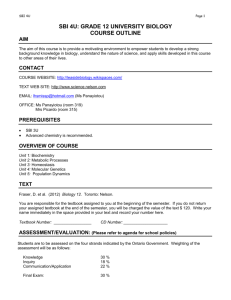

ANNEXURE-64 - Directorate General of Supplies and Disposal

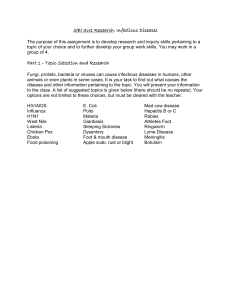

advertisement

ANNEXURE-64 (c.f.para-16.15.7( c) FORM: OF SANCTION LETTER FOR THE PURPOSE OF PAYMENT OF TIME BARRED CLAUSE To The Chief Controller of Accounts, Department of Supply, New Delhi Sub: Sir, I am directed to convey the sanction of the President of India to the condo nation of time bar under Rule 85 read with Rule 83 of the General o Financial Rules and to the payment of a sum of Rs.---------- in respect of ----------- bills details of which are shown in the enclosed statement received from ----------------------------for the supplies made against the respective bills. The competent authority has verified the claim as required in Government of India decision under Rule 85 of GFR and has certified that the bills are genuine and correct and that the claimants (supplier) have not gained any advantage or any unintended benefits by the delayed submission of the claim. 2. The amount is debitable to the Head of Accounts shown in the statement and it to be met from the budget grant for the year ** 3. This issues with the concurrence of the integrated Finance Wing vide their U.O. No. dated------------------- Yours faithfully, (Under Secretary to the Government of India) Copy to: a) b) c) d) DGS&D Integrated finance Wing(2 copies) Name of supplier to be inserted here. Appropriate financial year to be shown. APPENDIX -1 WHERE LETTER OF CREDIT IS TO BE OPENED AGAINST CONTRACTS PLACED ON OVERSEAS SUPPLIERS IN COUNTRIES OTHER THAN USA/UK/EUROPE. The following documents should be furnished by the Purchase Officer to the Accounts Officer to enable him to opened the necessary letter of Credit with the SBI though RBI. (a) Letter of authority to the Controller of Accounts to open the letter of credit with State Bank of India. This should inter-alia give the name and complete address of the party in whose favour L/C is to be established, the amount and period of validity of letter of credit. (b) Application form No.2 in duplicate duly signed by the Director of Supplies (c) Three copies of the contract duly attested by the Assistant Director(Supplies) besides one copy of the A/T through authentication cell. (d) Three copies of the letter addressed to RBI for opening letter of credit signed by AD(S) (e) An undertaking regarding assurance in favor of SBI in duplicate duly signed by the Director of Supplies. (f) Performa certificate in duplicate duly signed by Assistant Director(Supplies) Purchase Officers should clearly mention in the letter forwarding documents prescribed above to the Accounts Officer as well as in the appropriate column of the prescribed application form to the SBI for establishing letter of credits the designation and full address of the Port shipping Officers to whom the shipping documents are to be forwarded. The Accounts Officer will in his communication to the SBI, specifically mention that the relevant shipping documents are to be surrendered to the concerned port shipping officer direct for clearance t of the consignment. In case of contract where the goods are not insured, the State Bank of India require that the following undertaking should also be furnished” “ We hereby unequivocally undertake to retire the documents drawn under this credit notwithstanding total or partial loss of goods during voyage and or py general average if declared: (1) The contents of the L/C applications should not be at variance with the contracts. If any change in the terms of the L/C is required, this should be brought to the notice of the SBI immediately(by wire wher3 necessary) failing which they will presume that the L/C is in order. In case of doubt or difficulty the nearest office of the SBI dealing in foreign exchange should be contacted. (2) The SBi are claiming 100% margin plus an amount representing 10% of L/C value towards currency fluctuation. The bill amount and the balance, if any, will be refunded to or recovered from the DGS&D, as the case may be . Forms for opening of L/C and check points etc. are given in Annexure (1) to (6). In order to avoid legal complications involved in the documents attracting provision of Article 299 of the constitution , attestation of corrections in the documents by PAO appears to be not in order. It has, therefore, been decided to adopt the following procedure: a) All the Purchase Directorates should adopt ,standard uniform application form with a view to avoiding additions/deletions carried out by the P&AO. The normal corrections/additions be appended separately. b) A fresh set of Form No.2 should be sent if the corrections are required. c) All such papers subsequently should be sent along with a demi-official letter instead of routing through authentication cell to avoid delay in transmitting papers. The following documents which are in the nature of an assurance by the DGS&D to the State Bank of India and also in the nature of indemnity, attract the provisions of Article 299 of constitution. As such, these will be signed by the concerned director of Supplies. (i) (ii) Application form(Form No.2) meant for State Bank of India Undertaking regarding assurance required by the State Bank of India. The documents other than those mentioned above, could be signed by another Gazetted Officer subordinate to Director of Supplies. SPECIAL PROCEDURE OF PAYMENT AGAINST THE CONTRACTS PLACED BY DGS&D ON FOREIGN SUPPLIERS IN USA/UK AND EUROPE. In such contracts on foreign suppliers where the contract provides the payment through the L/C, it will not be necessary to seek approval of RBI either from their Foreign Exchange Control Department or from their Public Accounts Department for opening with SBI, New York and SBI London. It will not be necessary for the DGS&D to make any application for opening of the L/C either to RBI or to SBI or to CCA, Department of Supply. Application for opening of the L/C in SBI, New York/London directly will be made by the CCA, Department of Supply, on the basis of stipulation in this regard made in the contract. However, DGS&D will furnish to CCA, Department of Supply, New Delhi, the following documents to enable the CCA, Department of Supply, New Delhi to make application for opening of the direct L/C with SBI, New York London. (1) 2 copies of the relevant contract. (2) An undertaking to retire the documents, not withstanding total or partial loss of goods during voyage and pay general average , if declared. (3) List of documents against which payment is to be released to the foreign suppliers. (4) Certificate to the effect that the amount of the L/C would be sufficient for payment of stores ordered. (5) Information about the period up to which the L/C is to remain valid. © In such contracts where the payment is to be made to the foreign suppliers through L/C, a specific indication will be given regarding the foreign exchange release by quoting the number and date of the sanction letter issued by the Indentor, Ministry of Finance. d) Chief Controller of Accounts on receipt of required documents from the DGS&D and also copies of the contracts as received through the Authentication Cell, ill take further action for opening of the L/C with the SBI, New York/London directly under intimation to the mai9n Branch of the State Bank of India, New Delhi and under intimation to the DGS&D. e) The State Bank of India ,New York/London will make the payment on the basis of the L/C subject to such conditions and documents as are indicated in the application for the L/C contract received from the Chief Controller of Accounts Department of Supply. f) After the payment against the L/C has been made by the SBI, New York /London the intimation will be sent by a telex message to the State Bank of India(Main Branch) ,New Delhi,who will arrange to obtain the reimbursement in rupee equivalent to the payment made to the foreign suppliers through UM-LO. The telex message from the SBI, New York/London will be received by the SBI(Main Branch), New Delhi. The SBI (Main Branch),New Delhi which will be the accredited bankers of the Department of Supply for foreign exchange payments will forward immediately after receiving the reimbursement through UMALO, all the retired documents along with scroll to Chief Controller of Accounts, Department of Supply for further action at this end. The exchange rate applied for the reimbursement will be indicated by the SBI in the scrolls sent to CCA, Department of Supply. g)The charges of the SBI, as may be finally incorporated in the agreement between DGS&D and State Bank of India will be claimed by the SBI(Main Branch) New Delhi along with the each reimbursement claimed by them through UMALO and detailed break-up of the charges shown in the scroll, while forwarding the same to the CCA, Department of Supply, New Delhi. The above revised procedure of the payment for direct opening of the L/C etc. will be applicable too the SBI,(main Branch) New Delhi and SBI, New York/London and will not apply to other State Bank Branches at Bombay/Calcutta and Madras for opening of the L/C against contracts placed by Regional Directorates will be made to the Chief Controller of Accounts, Department of Supply, New Delhi and not to the Controller/Deputy Controller of Accounts stationed at Bombay, Calcutta and Madras. In such contracts /supply orders where the payment is not required to be made through the L/C, the paying authority may be shown as CCA, Department of Supply. It should, however, be specifically indicated in the relevant contact/supply order that payment will be made by SBI, New York/London as the case may be. The Contract/supply order will also indicate the documents required to be produced by foreign suppliers for receiving payment from SBI, London/New York. The procedure to be followed for payment of reimbursement in such cases will be essentially the same as indicated above in regard to L/C payment. In such cases i.e. cases where payment will be made by SBI, London /New York only after issue of authority by CCA, Department of Supply, New Delhi to SBI, New York/London on the basis of stipulation made in this regard in the contract, SBI New York/London will make the payment merely on the basis or provision in the contract, unless the authority is endorsed by CCA, Department of Supply, New Delhi. CCA, Department of Supply, New Delhi will furnish every months a statement to the Foreign Exchange Department/Public units Department of Supply, Reserve Bank of India, SBI,DGS&D and Department of Supply the information regarding payment rel3eased for the above procedure for foreign suppliers in USA/UK/Europe and charges paid to the SBI on this accounts. Complete address of the State Bank of India, New York/London are as follows: State Bank of India, 460,Park Avenue, New York,NY-10022(USA) Cable: INDTHISTLE,NEWYORK TELEX: WUT-62146, III 424807 TELE(212) 371-5600 State Bank of India, 1,Milk Street, London EC 2 P J P Cable: HANDEE LONDON TELEX: 884589 Tele: 01-600-6444 The CCA, Department of Supply will issue the authority for opening the letter of credit or the authority for payment other than through L/C etc. by post to the SBI, London/ New York over the signatures of the designated officers. In order to sort out the problems which are being faced by the Controller of Accounts, New Delhi and DGS&D with regard to decisions have been taken in the joint meeting attended officers of DGS&D and CCA, New Delhi. (i) (ii) (iii) To affix a rubber stamp ”L/C papers/urgent” on all papers connected with opening of L/C and amendment to L/C too enable Chief Controller of Accounts, Department of Supply, New Delhi to identify such papers and take necessary action immediately. In some of the contracts for imported stores where payment of final 10%/5% to the foreign suppliers is payable after satisfactory installation of the equipment on production of certificate to that effect from the consignee. L/C will be opened for the full amount with SBI, London/New York with the instructions that final 10%/5% payment as the case may be shall be made by the L/C opening bankers on the basis of authorization by the Chief Controller of Accounts, Department of Supply, New Delhi against consignee certificates duly confirmed by the purchaser/DGS&D. The specimen application form for opening of letter of credit along with specimen undertaking is at Annexure(7) to (8) A copy of letter of credit application addressed to the CCA shall be endorsed to the indentors Indian agent and foreign supplier for their information, ordinarily, the letter of credit should provide for payment to suppliers in UK and Europe in Pound Sterling and DGS&D would persuade the suppliers of negotiations to accept payment in Pound Sterling. In case, where the suppliers insist on payment being made in currency other than Pound Sterling the Letter of Credit will still be opened on State Bank of India, London in Pound Sterling indicating that the supplier has to be paid so much in such and such currency and that the letter of credit has been opened in Pound Sterling indicating the exchange rate applied for such concession. State Bank of India, London would make payment to the suppliers of the amount mentioned in the currency demanded by the supplier and would raise debit against DGS&D at the exchange rate prevailing on the date of payment. (Annexure (i) to Appendix –I) FORM FOR THE OPENING OF LETTER OF CREDIT ETC> NO Directorate General of Supplies & Disposals Dated: To The Controller of Accounts, Department of Supply (Through Authentication Cell) Sub: Immediate opening of Letter of Credit in respect of this Office A/T No. dated placed on M/s The following documents are sent herewith for opening the necessary letter of credit by cable against the subject A/T as per terms of this contract: 1) Letter No. dated------------------------addressed to the Reserve Bank of India( 5 copies) 2. Application form (Form No.2) duly filled in duplicate addressed to M/s ---------------------------( 4 copies) 3. 4. Undertaking regarding assurance required by State Bank of India( 4b copies) Attested copies of the subject A/T ( 4 copies) Please ensure hat necessary instructions are given to the Reserve Bank of India for opening the Letter of Credit by State Bank of India and also ensure that this is established within least possible time so that the shipment could be effected without delay as provided in the contracts. ( Director of Supplies For Director General of Supplies & Disposals ) Encl: as above Copy to: 1. Indentor/Consignee 2. Firm/Foreign Principal,05/1 Annexure (2) to Appendix 1. FORM FOR THE OPENING OF LETTER OF CREDI ETC> No. Dte. General of Supplies & Disposals Dated To The Manager, Reserve Bank of India, (Public Accounts Department) Dear sirs, The Directorate General of the DGS&D, New Delhi ha be entered into the following contract with M/s ---------------------------------for supply of ---------------------- As per clause of this contract, 100% value of the C&F/FOB price i.e -----------------is to be paid by an irrevocable sight letter of credit in currency of the country opened by the Department of Supply thorough any Indian Bank and reconfirmed by --------------------------------Bank in favour of M/s ----------------------------Confirmation charges will be to buyers account. The letter of Credit should remain open for a period upto ------------------------------. The present shipment period mentioned ------------------------------ in this contract is ----------------The validity period of the relevant letter of credit will correspond to the delivery period for each shipment given in this contract. Ne3edcessary amount of the foreign exchange in this case has been sanctioned by Ministry of Finance, Department of Economic Affairs Office Memorandum No. ----------------------dated------------------Attested copy of the said contract is enclosed with a request to please send the necessary documents to the State Bank of India for immediate opening a Letter of Credit by cable for the amount in ----------------------- After opening the letter of Credit in --------------------------for ----------------------------it is confirmed that this amount will be sufficient for payment of stores ordered and freight charges in this case(in case of C&F). Kindly note that as a matter of policy, Government goods are not to be insured. 4.The usual undertaking regarding assurances as required by the State Bank of India is also enclosed. 5. Please authorize the State Bank of India to open a Letter of Credit as aforesaid for the amount in Letter of Credit as aforesaid for the amount in ------------------as shown in the application form No.2 by cable ,authorizing them to debit to the Reserve Bank of India, New Delhi with the amount of the bill honored there under along with their charges and Foreign Bank charges. The following documents are enclosed. 1) Application form (Form No.21) duly filled in duplicate. 2) Undertakings regarding assurance as required by State Bank of India. Yours faithfully, For Director General of Supplies & Disposals Encl: as above. Copy to: 1. 2. Controller of Accounts, Ministry of Supply, New Delhi . He may please authorize immediately the Reserve Bank of India through a letter of authority for 100% value of the contract. One copy of the said contract is enclosed. The Reserve Bank of India may please be informed that the amounts are to be debited to the accounts of P&AO, Ministry of Supply. Please see that the Letter of Credit reaches to the beneficiary by----------------or earlier. The State Bank of India Please open a Letter of Credit immediately by cable on receipt of instructions from the Reserve Bank of India. Necessary correspondence in this connection may also pleas43 be endorsed to the P&AO, Ministry of Supply, New Delhi. The Letter of Credit is to be authorized in favour of : 3. 4. M/s ---------------------------------------------------------------------------------------A copy of Annexure is attached. This is without prejudice to the terms and conditions of the contract. Encl: As above ( ) Director of Supplies For Director General of Supplies & Disposals Annexure (3) to Appendix -1 NO GOVERNMENT OF INDIA DIRECTOR GENERAL OF SUPPLIES & DISPOSALS PARLIAMENT STREET,NEW DELHI DATED TO THE MANAGER, RESERVE BNAK OF INDIA, (Public Accounts Department) Dear Sir, The Directorate of the DGS&D, New Delhi have entered into the following contract with M/s -----------------------------------------Representing M/s-----------------------against A/T No. For the supply of stores as per clause 20 of the A/T(copy enclosed). As per clause 16(a) of the contract, 100% value of the net F.O.B/C&F price i.e. --------------------------is to be paid by an irrevocable letter of credit in currency of the country opened by the Accounts Officer, Foreign Exchange Division ,Parliament Street, New Delhi and reconfirmed by Foreign Bank in favour of M/s --------------------Confirmation charges will be at buyer’s account. The letter of credit should remain open for a period of ….. up to ---------------------------The present shipment period mentioned in this contract is subject to DGS&D Majoure Clause. The validity period of the relevant Letter of Credit will corresponds to the delivery period for such shipment given in this contract. Necessary amount of Rs.-------------------------of the Foreign Exchange in this case has been sanctioned by Ministry of /Department of --------------------------------. 2.Attested copies of the said contract are enclosed herewith with a request to please send the necessary documents to ------------------- for immediate opening of Letter of Credit by cable for the amount in ---------------3.After opening of the letter of credit in ------------------------for ---------------------. It is confirmed that this amount will be sufficient for payment of stores ordered. . Kindly note that as a matter of policy, Government goods are not to be insured 4.The usual undertaking regarding assurance as required by the State Bank of India---------------------------------------------is also enclosed. 5.As shown in the application form No.2 by cable authorizing the debit to the Reserve Bank of India------------------------with the amount of the Bill honored there under along with their charges and foreign Bank charges. The following documents are enclosed:(i) (ii) Application for (Form No.2) duly filled in quadruplicate(4 copies) Undertaking regarding assurances as required by State Bank of India----------------------------------(4 copies ) Yours faithfully, ( ) Director of Supplies For Director General of Supplies & Disposals Copy to: 1.The Controller of Accounts, Department of Supply-----------------------. He may please authorize immediately the Reserve Bank of India---------------------------through a letter of authority for 100% value of the contract. One copy of the contract is enclosed. The Reserve Bank may please be informed that the amounts are to be debited to the account of the Controller of Accounts, Department of Supply. Please see that the Letter of credit reaches the beneficiary immediately. Director of Supplies For Director General of Supplies & Disposals 3. The State Bank of India(Foreign Exchange Division) New Delhi . Please open a Letter of Credit immediately by cable on receipt of intimation from the Reserve Bank of India-----------------------. In this connection a copy of Letter of Credit opening may please be endorsed to the Controller of Accounts, Department of Supply-----------------------------------------credit to be authorized in favour of M/s -------------------------------------Director of Supplies For Director General of Supplies & Disposals Annexure(4) to Appendix I No. Government of India Directorate General of Supplies & Disposals (Coordination Section) Parliament Street, New Delhi-110001. Dated To The State Bank of India (Foreign Exchange Division) -------------------------------Sub: Opening of Letter of Credit by cable in favour of M/s ------------------Dear Sir, In terms of this office letter No.----------------------------dated--------------------you have requested to open a Letter of Credit immediately by cable for -------------------------“ We undertake to make payment by cheque drawn in favour of State Bank of India--------------------on receipt of documents drawn under the Letter of Credit as well as any incidental charges as and when claimed irrespective of any an admissibility claim on grounds of defective documents or goods under the credit”. Shipping documents/Airway Bill along with other documents may be sent direct to the consignee/Port consignee and shall be made in their name under intimation to this Office. In case of contracts where the goods are not insured the following undertaking is also applicable: “ We hereby unequivocally undertake to retire the documents drawn under this credit not withstanding total or partial loss of goods during voyage and or pay general average if declared”. Yours faithfully, Director of Supplies For Director General of Supplies & Disposals ANNEXURE (5) to Appendix I To The Superintendent, Foreign Exchange Department, State Bank of India ---------------------Through: The Chief/Deputy Chief Controller of Accounts, Department of Supply Dear Sir, I/We request you to establish with Branch correspondent in -----------------------------------for my/our account by Air Mail/Sea Mail /Cable a Letter of Credit reading as follows: To M/s FOREIGN EXCHANGE DEPARTMENT STATE BANK OF INDIA -------------------------------Confirmed letter of Credit No.----------------------------Irrevocable without recourse o to Drawers. Dear Sir, You are hereby authorized to draw on the Chief Controller of Accounts, Department of Supply --------------------------------on behalf of the DGS&D, New Delhi. For sum not exceeding ------------------------------------------------------available by your drafts on them are ------------------------------------------sight drawn for 100% net FOB of the invoice value and accompanied by :(i) Complete set of clear Bills of lading/Airway bill to order and blank endorsed . Bills of lading/Airway Bill must show that the goods have been shipped/Air freighted and freight pre paid / to pay ----------------------------------------- BILL of LADING SHALL BE AIRWAY BILL. ii) Consigned to -------------------------------------------insurance if necessary, will be arranged by the indenter viz. In case of non payment of the Bill(s), the Bank has the right to crystallize our foreign currency liability into Indian Rupees on the 10th day of receipt of documents payable on demand or due date of issuance draft/bill (as the case may be) at the Banks prevailing bill selling rate and to charge interest prescribed penal rate(s) Insurance policies or certificate ( 4 copies ) to covering marine and war risks, also riots, strikes, civil commotion and malicious damage for the CIF value. OR Insurance Policies or certificate( 4 copies ) covering Marine Insurance as pre Institute Cargo clauses (FPA/WA/ALL RISKS) and perils as pre Institute strikes. Riots and Civil commotion clauses War risks as per Institute cover or the CIF value. 4. Signed Invoices showing the names of consignees and value. 5. 6. Evidence shipment/Air freightment of ------------------from Port/Airport of loading to Port/Air Port of unloading(name of -------------------Port/Airport should be given. Transshipment ----------------------Prorata shipment------------------------------credit is valid until-------------------------------------------------Credit expiry date. This credit is irrevocable valid in drafts drawn under this credit are to be negotiated without recourse to the drawers and are to bear the following clauses drawer under State Bank of India-------------------------------------------Dated--------------------Purchaser are to note the amounts of the Drafts regerenately on the back hereof. Drafts drawn under this Letter of Credit are negotiable by the State Bank of India-----------------------only. We hereby guarantee to protect the drawers, endorsers bonafide holders from any consequences which may arise in bonafide holders from any consequences which may arise in the event of the non acceptance or non payment of drafts drawn in accordance with the terms of this credit. In consideration of your opening a Letter of Credit above I/We hereby undertake to accept and pay in due course all drafts drawn within the terms thereof and or to take up and pay for all documents negotiated thereunder on presentation and in default or my/our so doing you may see the goods before or arrival and I/We undertake to reimburse you for any shortfall that may occur and I/We hereby undertake to reimburse you for on demand made by you in writing to deposit with you such sum of security or further sum of security as you may from time to time specify as security for the due fulfillment of our obligations hereunder and any security so deposited with you may be sold by you on your giving reasonable notice of sale to us and the sum or the proceeds of sale of the security may be appropriate by you towards satisfaction of our said obligations and any liability of such arising out of the non-fulfillment thereof. “ You are to have a lien on all goods documents and policies proceeds thereof for nd obligations or liabilities present or future inures by you under arising out of this credit. “ I/We approve of the negotiation of drafts drawn under this credit being confined to your branches. The relative shi8pping documents have to be surrendered to me/us. The Assistance Director (Shipping) DGS&D-----------------------------------against payment. The transmission of instructions under the above credit and the forwarding of documents are entirely at my/our risk. You are not to incur any liability beyond seeing that the drafts and documents purpose to comply with the terms and conditions of this credit. If hereafter at our request letter of credit value is enhanced or any of its terms and conditions amended them our liability will for entire amount of Letter of Credit so enhanced/amended notwithstanding the terms and conditions/mount sanctioned in the Application and guarantee form for Letter of Credit. Yours faithfully, ( ) Director of Supplies For Director General of Supplies & Disposals Place: DGS&D,New Delhi N.B. All alteration and additions to this Letter of Credit are to be initiated by the applicant. Delete as necessary on both application form and credit form. Annexure (6) to Appendix I Check points for preparation of Letter of Credit Application Details of documents number of copies required. Required OC CCA Letter Performa 1 addressed to CCA enclosing documents 1 Certificate of foreign 1 exchange in the following Performa 3 RBI SBI - - 3 Others for Total OSD/E&S 1 - 3 - 7 Necessary foreign Exchange to the (Rupees-------------Only has been released under Ministry of Finance U.O. No.----------Dt.-----------Further certified that provision for additional foreign exchange to meet the fluctuations in exchange rates will be met by the Department” c. Letter Performa for 1 making request to RBI for opening L/C . 1 3 3 8 (one each to indentor/firm/ firm/Indian agents) d. Letter Performa giving undertaking to SBI that payments will be made e. Performa in duplicate for application and guarantee for L/C for 1 3 2 - 1 7 Remarks to be given by CCA/RBI submission to SBI(in form No.2) F. Form A-1 in duplicate duly completed and signed by applicant and counter signed by their bankers (for direct remittance) - 2 2 - - 4 Note:1. 2. 3. In case of import from bilateral group countries the letter of credit should be opened in convertible rupees. Three attested copies of A/T and identical number of A/L whenever issued, should be forwarded to the concerned Controller of Accounts. While forwarding letter of credit papers to COA a Para may be added stating that authenticated copy of A/L A/T have already been sent under List No.-------------------------and SL. No.-------------------------------------on ----------------------------- 4. All papers as at (b) to (f) mentioned in the heck list and SL. No.(2) and (3) above will be forwarded to the concerned Controller of Accounts under authentication. CHECKS POINTS FOR DOCUMENTS (B) ON PAGE (*) i. ii. iii. Foreign currency amount for which Letter of Credit is to be given in figures as well as in words. Letter of Credit should be opened with the guaranteed D.P. stipulated in the contract for shipment as the validity period. Two copies of foreign exchange sanctioned letter should be enclosed duly attested. (Annexure (7) to appendix I) No.-------------------------------Government of India Directorate General of Supplies and Disposals, Parliament Street, New Delhi-110001. To The Chief Controller of Accounts, Department of Supply, New Delhi. (Through Authentication Cell) Sub: Opening of letter of credit against contract vide A/T No.-------------------------------------- placed on M/s -----------------------------------1. You are requested to arrange for opening of letter of credit for the net amount payable to foreign principals as per clause 10 and 20 of the schedule to subject contract. Following are enclosed:- (a) Two signed copies of the A/T. (b) Letter addressed to the State Bank of India, New York/London(in duplicate) 2. Letter of Credit will remain valid up to ---------------------months from the date of its opening. 3.List of documents against which payment is to be released to foreign suppliers will comprise of: a)Complete set of clear Airway Bill /Bill of lading consigned to the port consignee evidencing dispatch of goods on freight to pay basis also showing letter of credit and contract number with dates. b) Certified copy of cable sent by beneficiary to indenter and port consignee giving full particulars of dispatch viz. name of carrier, date of dispatch , date and No of airway Bill or Bill of Lading, place of loading and unloading quantity and description of goods, enabling indenter/port consignee to arrange insurance/clearance of goods. c)Beneficiary’s signed invoices in quadruplicate also showing name(s) of consignee(s) and value. d)Packing list in triplicate. e) Certificate of origin stating that goods are of -------------------origin. f) Manufacturers works test certificate g) Manufacturer’s Guarantee/warranty certificate. h) Certificate from the beneficiary that one set of documents has been sent to the port consignee direct. 4. Special instructions applicable to Letter of Credit will be:- a) Pro-rata shipment: Allowed/prohibited. b) Trans-shipment: Allowed/prohibited d) Goods are to be air freighted/shipped by Air India/Indian Flag, vessels only. e) F.E released vide letter/U.O.-----------------dated---------------by -------------5. It is confirmed that sanctioned funds are sufficient for the stores ordered. Sd/Asstt. Director(Supplies) For Director General of Supplies & Disposals Copy to: 1. Indenting Officer 2. 2. Contractor/Foreign Principals (Annexure 8 to Appendix I) No. Government of India Directorate General of Supplies & Disposals Parliament Street,New Delhi-110001. Telex: To The State Bank of India, 460, Park Avenue, New York,NY-10022 USA The State Bank of India 1,Milk Street, London(U.K) Sub: Opening of Letter of Credit against contract vide A/T number-----------------Dear Sirs, 1.With reference to opening of subject letter of credit details for which will be sent to you by the Chief Controller of Accounts, Department of Supply, New Delhi:a)We hereby unequivocally/undertake to retire the documents under this credit notwithstanding total or partial loss of goods during voyage and or pay general average ,if declared. b) It is further certified that the amount of L/C would be sufficient for payment of stores ordered. 2. Complete details of letter of credit may also be intimated to this office immediately after the L/C is established by you. Yours faithfully, Director of Supplies For Director General of Supplies & Disposals P.S. Please invariably quote above stated A/T number and date while making reference(s) to this office on the subject. Appendix II Copy of Letter F.No.380/B/72-IT(B) dated 22.1.1973 from the Ministry of Finance (Central Board of Direct Taxes) to all the Commissioners of Income Tax. Subject: Budget opening of head of Accounts Part I of the firm schedule to the Finance Act 1972 levies a surcharge on income tax for purpose of Union calculated with reference to the Income Tax payable by local authority Life Insurance Corporation and Companies . Two new sections viz. Section 194-B and 194-C have also been introduced in the Income Tax Act. Section 194Bprovides for deduction of Income Tax from payment made to contractors and sub contractors. The Board have decided in consultation with the controller and Auditor General of India that the following minor and subheads of Accounts should be opened. III. Corporation Tax. (a) Minor Head Surcharge Subheads: i)Surcharge on Income Tax. ii) Surcharge on advance payment of Tax. iii) Deduction refunds. (b) Minor Heads Income Tax on companies (already existing) Sub-Heads i)Deduction from prize winnings in lotteries and crossword puzzles under Section 194-B of the Income Tax Act 1961. ii)Deductions from payments to contractors under Section 194-C of the Income Tax 1961. IV Taxes on income other than Corporation Tax. Minor Heads: Income tax (already existing) Sub Heads: a) Deductions from prize winnings in lotteries and crossword puzzles under Section 194-B of the Income Tax Act 1961. b) Deductions from payment to contactors and sub-contractors under section 194-C of the Income Tax Act,1961. 2. Necessary corrections slips to appendix -2 to Accounts code Vol.1 are being issued by the Controller and Auditor General of India separately. Suitable changes may please be made in India forms ITNS,38 (Challan form) ITNS-71(form of Budget estimates) and the form prescribed for submitting monthly additional information regarding collection of Income Tax and Corporation Tax. OFFICE OF THE CHIEF CONTROLLER OF ACCOUNTS Department of Supply New Delhi STATEMENT SHOWING THE REQUIREMENT OF DOCUMENTS TO BE ENCLOSED WITH THE APPLICATION FOR LETTER OF CREDIT: Details of document s No. of copies required by CCA RBI Total SBI a)Letter Performa addressed to Controller of Accounts enclosing documents 1 - - 1 b)Certificate of foreign exchange in the prescribed Performa 1 3 - 4 c) Letter Performa for making request to RBI for opening of Letter of Credit 1 3 1 5 d) Letter Performa giving undertaking to SBI that payment will be made 1 2 1 4 e)Performa for application and guarantee for L/C for submission to SBI 1 2 1 4 f)Form A-1 duly completed and signed by applicant and countersigned by their Bankers (for direct Remittance) 1 2 1 4 . Further the Controller of Accounts will require 4 attested copies of the related A/T (in addition to the one routed through channel of Authentication) to be sent to RBI/SBI with the application to meet their requirements. The import is covered under CL.II(eleven) of import Central Order,1965(Saving Clause) and therefore no import license is necessary. Goods will be shipped without Insurance. We will retire bills under relative credit notwithstanding a total or partial loss of the goods during the voyage and/or pay general average in declared. In terms of clause---------------------of the A/T security deposit for Rs.---------------has already been received. CCA/RBI