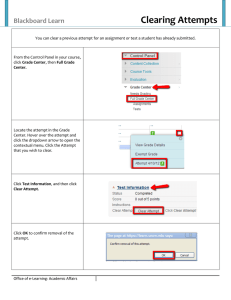

Schedule A

advertisement