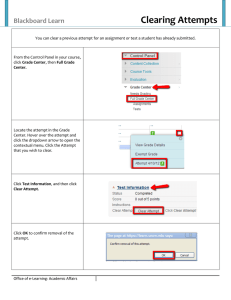

Report of the Committee on Clearing Corporations

advertisement