News Release

Purchasing Managers’ Index®

MARKET SENSITIVE INFORMATION

EMBARGOED UNTIL 1000 (CEST) / 0800 (UTC) August 23 2016

Markit Flash Eurozone PMI

®

Eurozone Flash PMI edges up to seven-month high

Key findings:

(1)

Flash Eurozone PMI Composite Output Index

at 53.3 (53.2 in July). 7-month high.

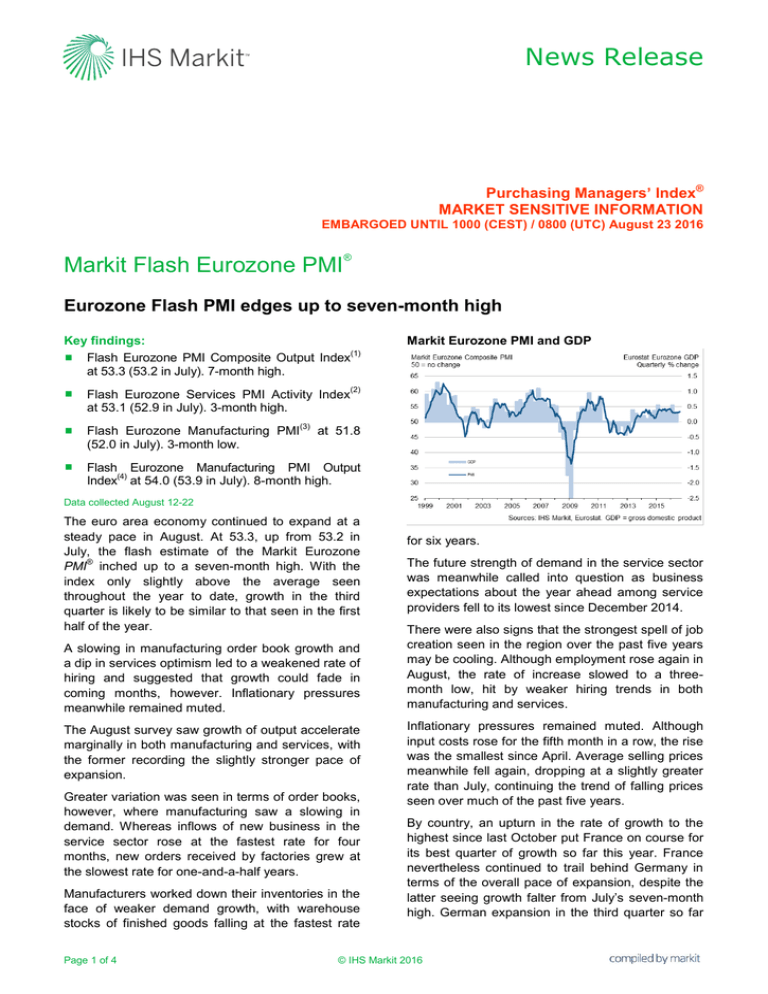

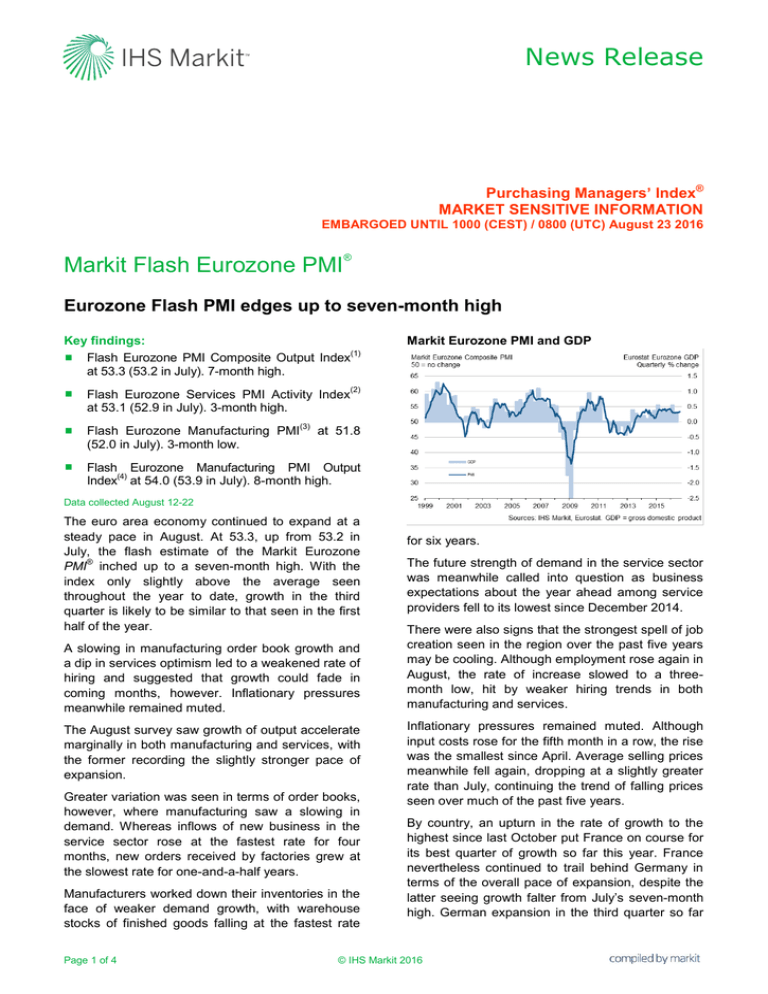

Markit Eurozone PMI and GDP

Flash Eurozone Services PMI Activity Index

at 53.1 (52.9 in July). 3-month high.

Flash Eurozone Manufacturing PMI

(52.0 in July). 3-month low.

(3)

(2)

at 51.8

Flash Eurozone Manufacturing PMI Output

(4)

Index at 54.0 (53.9 in July). 8-month high.

Data collected August 12-22

The euro area economy continued to expand at a

steady pace in August. At 53.3, up from 53.2 in

July, the flash estimate of the Markit Eurozone

®

PMI inched up to a seven-month high. With the

index only slightly above the average seen

throughout the year to date, growth in the third

quarter is likely to be similar to that seen in the first

half of the year.

A slowing in manufacturing order book growth and

a dip in services optimism led to a weakened rate of

hiring and suggested that growth could fade in

coming months, however. Inflationary pressures

meanwhile remained muted.

The August survey saw growth of output accelerate

marginally in both manufacturing and services, with

the former recording the slightly stronger pace of

expansion.

Greater variation was seen in terms of order books,

however, where manufacturing saw a slowing in

demand. Whereas inflows of new business in the

service sector rose at the fastest rate for four

months, new orders received by factories grew at

the slowest rate for one-and-a-half years.

Manufacturers worked down their inventories in the

face of weaker demand growth, with warehouse

stocks of finished goods falling at the fastest rate

Page 1 of 4

for six years.

The future strength of demand in the service sector

was meanwhile called into question as business

expectations about the year ahead among service

providers fell to its lowest since December 2014.

There were also signs that the strongest spell of job

creation seen in the region over the past five years

may be cooling. Although employment rose again in

August, the rate of increase slowed to a threemonth low, hit by weaker hiring trends in both

manufacturing and services.

Inflationary pressures remained muted. Although

input costs rose for the fifth month in a row, the rise

was the smallest since April. Average selling prices

meanwhile fell again, dropping at a slightly greater

rate than July, continuing the trend of falling prices

seen over much of the past five years.

By country, an upturn in the rate of growth to the

highest since last October put France on course for

its best quarter of growth so far this year. France

nevertheless continued to trail behind Germany in

terms of the overall pace of expansion, despite the

latter seeing growth falter from July’s seven-month

high. German expansion in the third quarter so far

© IHS Markit 2016

News Release

is running slightly ahead of the pace seen over the

first half of the year, acting as a key engine of the

eurozone’s overall expansion.

Core v. Periphery PMI Output Indices

The rest of the eurozone excluding Germany and

France registered further robust overall growth in

August, albeit at one of the weakest rates of

expansion seen over the past year-and-a-half.

Comment

Commenting on the flash PMI data, Chris

Williamson, Chief Business Economist at IHS

Markit said:

“The August flash PMI indicates that the eurozone

remains on a steady growth path in the third

quarter, with no signs of the recovery being derailed

by ‘Brexit’ uncertainty.

Core v. Periphery PMI Employment Indices

“The survey data are consistent with the region’s

GDP growing at a quarterly rate of 0.3% in the third

quarter, or 1.2% annualised, which is similar to that

seen on average over the first half of the year.

“A solid 0.5% pace of expansion in Germany is

being accompanied by a return to modest growth in

France in the third quarter, while the rest of the

region is also seeing growth pick up after slowing in

the second quarter.

“While the resilience of the PMI in August will add

to the belief that the ECB will see no need for any

immediate further stimulus, the weakness of the

overall pace of expansion and disappointing trends

in hiring, order books, business optimism and

prices all suggest that policymakers will keep the

door open for more stimulus later in the year.”

-Ends-

Page 2 of 4

© IHS Markit 2016

News Release

Output

Summary of August data

Output

New Orders

Composite

Strongest rise in output

since January.

Services

Services expansion at threemonth high.

Manufacturing

Output growth at eight-month

high.

Composite

New business growth littlechanged from July.

Services

New business increases at

fastest rate in four months.

Manufacturing

New order growth eases to 18month low.

Backlogs of Work Composite

Employment

Input Prices

Output Prices

PMI(3)

New business

Backlogs rise marginally.

Services

Outstanding business

increases fractionally.

Manufacturing

Backlogs rise at strongest rate

in eight months.

Composite

Jobs growth weakens to

three-month low.

Services

Slowest job creation since May.

Manufacturing

Employment rises at slowest

rate in five months.

Composite

Input price inflation hits fourmonth low.

Services

Slowest increase in costs since

April.

Manufacturing

Input prices rise for second

month running.

Composite

Charges fall for eleventh

consecutive month.

Services

Charges broadly unchanged.

Manufacturing

Output prices drop at fastest

rate in four months.

Manufacturing

PMI declines to 51.8, from 52.0

in July.

Employment

Input prices

Output prices

Source: IHS Markit.

Page 3 of 4

© IHS Markit 2016

News Release

For further information, please contact:

IHS Markit

Chris Williamson, Chief Business Economist

Telephone +44-20-7260-2329

Mobile +44-779-555-5061

Email chris.williamson@ihsmarkit.com

Rob Dobson, Senior Economist

Telephone +44-1491-461-095

Mobile +44-782-691-3863

Email rob.dobson@ihsmarkit.com

Joanna Vickers, Corporate Communications

Telephone +44207 260 2234

E-mail joanna.vickers@ihsmarkit.com

Note to Editors:

Final August data are published on September 1 for manufacturing and September 5 for services and composite indicators.

The Eurozone PMI® (Purchasing Managers' Index®) is produced by Markit and is based on original survey data collected from a

representative panel of around 5,000 companies based in the euro area manufacturing and service sectors. National manufacturing data

are included for Germany, France, Italy, Spain, the Netherlands, Austria, the Republic of Ireland and Greece. National services data are

included for Germany, France, Italy, Spain and the Republic of Ireland. The flash estimate is typically based on approximately 85%–90% of

total PMI survey responses each month and is designed to provide an accurate advance indication of the final PMI data.

The average differences between the flash and final PMI index values (final minus flash) since comparisons were first available in January

2006 are as follows (differences in absolute terms provide the better indication of true variation while average differences provide a better

indication of any bias):

Index

Eurozone Composite Output Index1

Eurozone Manufacturing PMI3

Eurozone Services Business Activity Index2

Average

difference

0.0

0.0

0.1

Average difference

in absolute terms

0.2

0.2

0.3

The Purchasing Managers’ Index® (PMI®) survey methodology has developed an outstanding reputation for providing the most up-to-date

possible indication of what is really happening in the private sector economy by tracking variables such as sales, employment, inventories

and prices. The indices are widely used by businesses, governments and economic analysts in financial institutions to help better

understand business conditions and guide corporate and investment strategy. In particular, central banks in many countries (including the

European Central Bank) use the data to help make interest rate decisions. PMI® surveys are the first indicators of economic conditions

published each month and are therefore available well ahead of comparable data produced by government bodies.

Markit do not revise underlying survey data after first publication, but seasonal adjustment factors may be revised from time to time as

appropriate which will affect the seasonally adjusted data series. Historical data relating to the underlying (unadjusted) numbers, first

published seasonally adjusted series and subsequently revised data are available to subscribers from Markit. Please contact

economics@markit.com.

Notes

1. The Composite Output PMI is a weighted average of the Manufacturing Output Index and the Services Business Activity Index.

2. The Services Business Activity Index is the direct equivalent of the Manufacturing Output Index, based on the survey question “Is the level of business activity at your company higher,

the same or lower than one month ago?”

3. The Manufacturing PMI is a composite index based on a weighted combination of the following five survey variables (weights shown in brackets): new orders (0.3); output (0.25);

employment (0.2); suppliers’ delivery times (0.15); stocks of materials purchased (0.1). The delivery times index is inverted.

4. The Manufacturing Output Index is based on the survey question “Is the level of production/output at your company higher, the same or lower than one month ago?”

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive

economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and

government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit

has more than 50,000 key business and government customers, including 85 percent of the Fortune Global 500 and the world’s leading

financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

IHS Markit is a registered trademark of IHS Markit Ltd. All other company and product names may be trademarks of their respective owners

© 2016 IHS Markit Ltd. All rights reserved.

About PMI

Purchasing Managers’ Index® (PMI®) surveys are now available for over 30 countries and also for key regions including the eurozone. They

are the most closely-watched business surveys in the world, favoured by central banks, financial markets and business decision makers for

their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends. To learn more go to

www.markit.com/product/pmi.

The intellectual property rights to the Flash Eurozone PMI® provided herein are owned by or licensed to IHS Markit. Any unauthorised use, including

but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without IHS Markit’s prior consent. IHS

Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies,

omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall IHS Markit be liable for any special, incidental, or

consequential damages, arising out of the use of the data. Purchasing Managers' Index ® and PMI® are either registered trade marks of Markit

Economics Limited or licensed to Markit Economics Limited. IHS Markit is a registered trademark of IHS Markit Ltd.

If you prefer not to receive news releases from IHS Markit, please email joanna.vickers@ihsmarkit.com. To read our privacy policy, click here.

Page 4 of 4

© IHS Markit 2016