Industry Outlook

Aerospace and Defense

FEBRUARY 2016

FEATURE REPORT

2015: Year-End Review

2015 established a new record year for aerospace and

defense (“A&D”) merger and acquisition (“M&A”)

activity (based on total deal value). Several notable

transactions, including Berkshire Hathaway’s purchase

of Precision Castparts for $37.2 billion, and Lockheed

Martin’s $9.0 billion acquisition of Sikorsky Helicopter

from United Technologies, helped drive M&A totals in

the aerospace and defense sector to new heights.

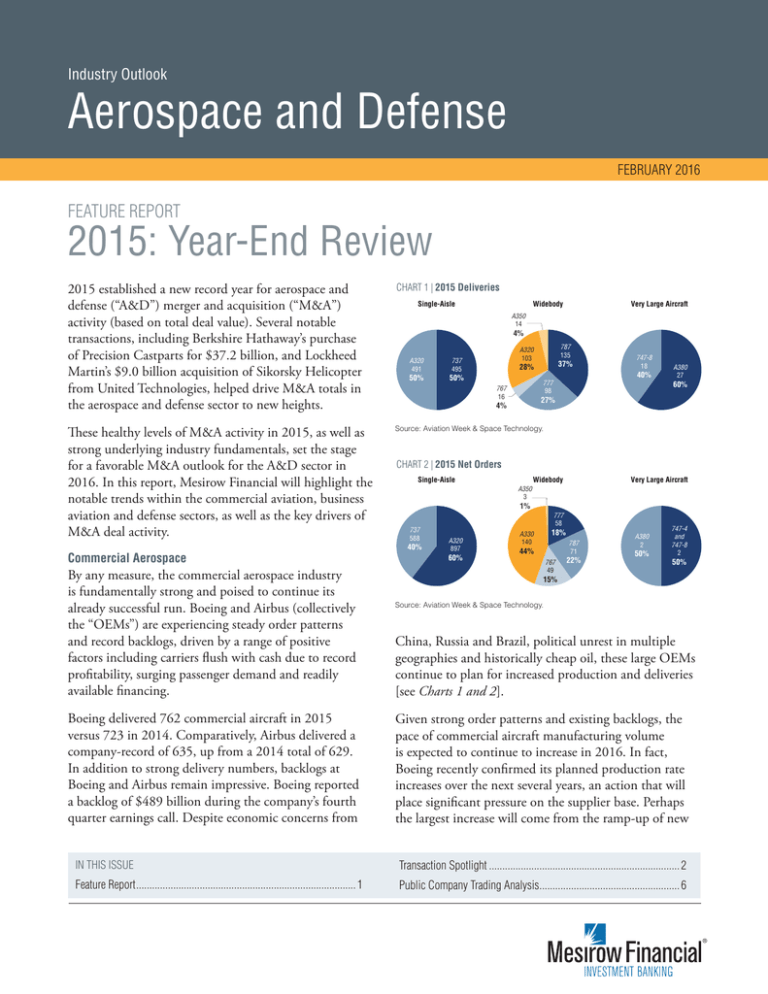

CHART 1 | 2015 Deliveries

These healthy levels of M&A activity in 2015, as well as

strong underlying industry fundamentals, set the stage

for a favorable M&A outlook for the A&D sector in

2016. In this report, Mesirow Financial will highlight the

notable trends within the commercial aviation, business

aviation and defense sectors, as well as the key drivers of

M&A deal activity.

Source: Aviation Week & Space Technology.

Commercial Aerospace

By any measure, the commercial aerospace industry

is fundamentally strong and poised to continue its

already successful run. Boeing and Airbus (collectively

the “OEMs”) are experiencing steady order patterns

and record backlogs, driven by a range of positive

factors including carriers flush with cash due to record

profitability, surging passenger demand and readily

available financing.

Boeing delivered 762 commercial aircraft in 2015

versus 723 in 2014. Comparatively, Airbus delivered a

company-record of 635, up from a 2014 total of 629.

In addition to strong delivery numbers, backlogs at

Boeing and Airbus remain impressive. Boeing reported

a backlog of $489 billion during the company’s fourth

quarter earnings call. Despite economic concerns from

Single-Aisle

Widebody

Very Large Aircraft

A350

14

4%

A320

491

50%

787

135

A320

103

737

495

37%

28%

50%

40%

777

98

767

16

747-8

18

A380

27

60%

27%

4%

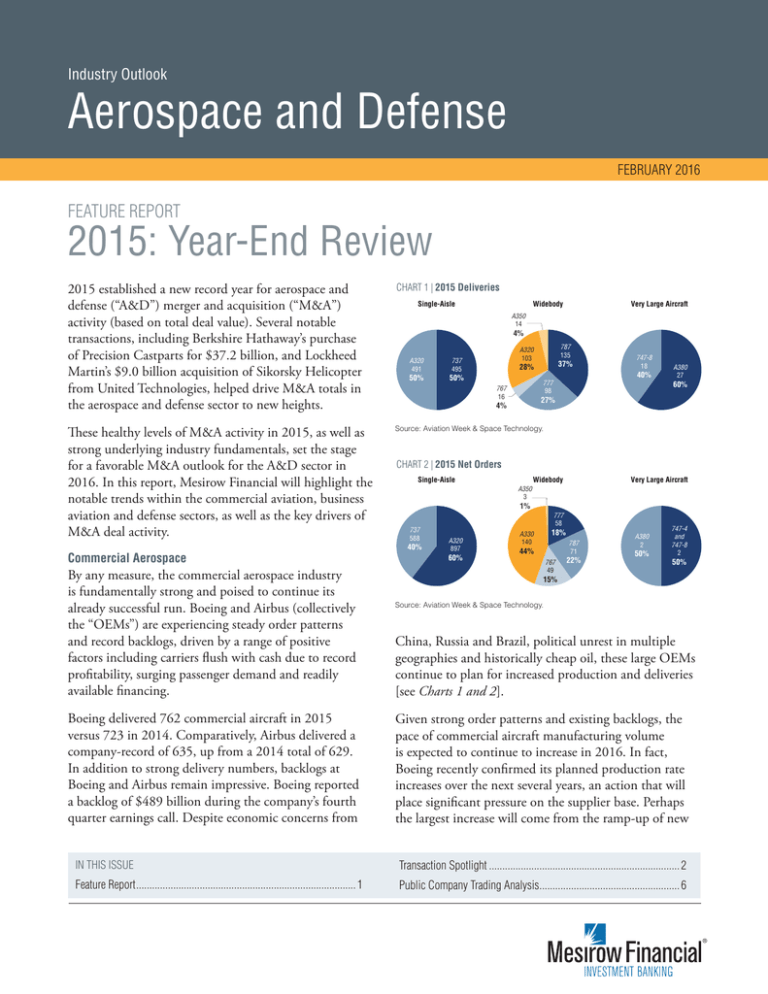

CHART 2 | 2015 Net Orders

Single-Aisle

Widebody

Very Large Aircraft

A350

3

1%

737

588

40%

777

58

A320

897

60%

18%

A330

140

787

71

44%

767

49

22%

A380

2

50%

747-4

and

747-8

2

50%

15%

Source: Aviation Week & Space Technology.

China, Russia and Brazil, political unrest in multiple

geographies and historically cheap oil, these large OEMs

continue to plan for increased production and deliveries

[see Charts 1 and 2].

Given strong order patterns and existing backlogs, the

pace of commercial aircraft manufacturing volume

is expected to continue to increase in 2016. In fact,

Boeing recently confirmed its planned production rate

increases over the next several years, an action that will

place significant pressure on the supplier base. Perhaps

the largest increase will come from the ramp-up of new

IN THIS ISSUE

Transaction Spotlight......................................................................... 2

Feature Report.................................................................................... 1

Public Company Trading Analysis...................................................... 6

TRANSACTION SPOTLIGHT

Berkshire Hathaway’s Purchase of Precision

Castparts Corp.*

Deal Value $36.9 Billion

Enterprise Value / Revenue 3.72x

Enterprise Value / EBITDA 13.9x

In August 2015, Berkshire Hathaway announced

the purchase of Precision Castparts, a Portland,

OR-based manufacturer of investment castings,

forged components and airfoil castings for

use in the aerospace, industrial gas turbine

and defense industries. The deal represents

Berkshire Hathaway’s largest takeover ever and,

on the face, seems to be a departure from CEO

Warren Buffet’s reputation as a value investor.

The transaction, however, demonstrates

Buffet’s view that there are long-term value

opportunities within the aerospace sector, as

approximately 75% of Precision Castparts’ sales

are aerospace-related.

* Mesirow Financial did not represent any of the acquirers or targets in

connection with the transactions noted on this page, and is not currently

representing any of the listed acquirers or targets.

CHART 3 | Airline Net Post-Tax Profit by Region (2010 – 2016)

Africa

$40

North America

Middle East

Europe

Asia-Pacific

Latin America

$35

($ in billions of USD)

$30

$25

$20

$15

$10

$5

$0

($5)

2010

2011

2012

2013

2014

Source: IATA.

2015

2016E

narrowbody production, with the Airbus A320neo,

while the Boeing 737 MAX enters testing. The sharp

increase in planned production has forced suppliers to

make significant decisions with respect to commitments

and timing. Some larger suppliers (General Electric and

Safran) have publicly stated the need to confirm a steep

rise in output before committing to even higher targets.

Meanwhile, the OEMs continue to introduce second

source suppliers wherever possible in order to reduce

the risk of disruption given the anticipated production

volumes.

However, not all aircraft OEMs are enjoying the same

positive momentum demonstrated by Boeing and

Airbus. Bombardier continues to struggle with the

development of its C-Series commercial jet, which

is two years past its original schedule and over $2

billion above budget. In an attempt to increase profits

through direct sales, Bombardier recently announced

that the company is terminating third party distributor

agreements. This announcement led to the restructuring

of customer agreements and multiple order cancellations,

as well as a $278 million financial charge in 2015. In

addition to its own financial woes and a sinking share

price, Bombardier’s recent struggles have continued

to negatively impact its supply base. As an example,

Triumph Group announced a $229 million non-cash

impairment charge in Q4 2015 due to the impact of

declining revenues from production rate cuts, the slower

than projected ramp on the Bombardier Global 7000

program and the timing of associated earnings.

As anticipated, the airline industry set a record for

collective profit in 2015, and the industry appears

primed to increase profits further in 2016. According to

the International Air Transport Association (“IATA”),

collective net profits reached $33 billion supported by

sustained low oil prices, 6.5% passenger growth and load

factors in excess of 80% [see Chart 3]. North American

carriers account for a significant portion of the rise in

net profits, while Latin American and African carriers

struggled in 2015.

The industry’s return on capital is expected to exceed the

cost of capital, a significant milestone. However, despite

the continued momentum, operating margins within the

airline industry are not exceptional as compared to other

large segments of the broader economy, with net margins

of approximately 4.6% in 2015. Further, multiple signs

point to the potential for airline profitability growth

to slow beyond 2016. Rising interest rates and full

2

|

AEROSPACE & DEFENSE | FEBRUARY 2016

MESIROW FINANCIAL INVESTMENT BANKING

realization of the maximum positive impact of low fuel

costs, as well as the cyclical nature of the global airline

industry, are among the most notable.

CHART 4 | Business Aviation Delivery Forecast

Very High Speed – Ultra Long Range

Ultra Long Range

Long Range

Large

Medium-Large

Medium

Light-Medium

Light

Very Light

1,200

1,000

Aircraft Units

The most attractive M&A targets will continue to

be the companies providing proprietary products or

services to customers through exclusive or sole source

relationships. In particular, Mesirow Financial has

identified the in-flight entertainment (IFE) and in-flight

connectivity (IFC) segments as highly attractive due to

a range of factors. Both segments are growing quickly

as airlines continue to differentiate themselves through

enhancements to the passenger experience. Further,

both segments require innovation and technology,

allowing suppliers to differentiate themselves on multiple

dimensions. Other technology-focused segments, such as

tracking and surveillance, are also highly attractive given

the upcoming mandates surrounding aircraft tracking

and crash site identification.

800

600

400

200

0

2000

Opposite North America, emerging markets such as

Brazil, Russia, China and South Africa have seen a

slowdown in business aviation purchases given economic

uncertainty [see Chart 6].

Recent guidance from Gulfstream underscores these key

trends. In General Dynamics’ fourth quarter earnings

release, the company detailed a modest revenue increase

of 2.3% for Gulfstream in 2015, with strong operating

margins and order intake. During 2015, Gulfstream

received more orders for in-production aircraft than

2014 and reported that “order activity going into the

first quarter of this year is quite good.” Gulfstream did

note some changes to production planning, including

an increase in rates for the G650 and G650ER to reflect

the current demand and sizable backlog and a slight

downward change for the G450 / 550.

3

|

AEROSPACE & DEFENSE | FEBRUARY 2016

2010

2015

2020

2025

CHART 5 | North American Fleet Growth Forecast (2013 – 2033P)

(units in actuals)

Light

Medium

Large

4,885

15,225

Business Aviation

The business aviation market continued its revival in

2015 with another strong year of deliveries. Growth is

expected to continue in 2016 and beyond with North

America serving as the primary driver of demand [see

Charts 4 and 5]. According to Honeywell International,

over 9,000 new business jets worth $270 billion will be

delivered worldwide in the next decade. New programs

make-up a critical component of projected business

aviation growth as OEMs continue to leverage new

technologies to differentiate their aircraft and attract new

buyers to the market.

2005

Source: Honeywell.

3,875

12,430

(1,225)

9,780

Fleet 2013

(2,090)

Deliveries

Retirements Fleet 2023

Deliveries

Retirements Fleet 2033

Source: Bombardier Business Aircraft Report, 2013 – 2033.

CHART 6 | Fleet Growth Forecast by Region (2013 – 2033P)

(units in actuals)

2013

2033

15,225

9,780

5,785

4,685

3,305

1,440

North

America

Europe

2,252

1,790

330

Latin

America

China

375

925

Africa

1,485

ROW

Source: Bombardier Business Aircraft Report, 2013 – 2033.

MESIROW FINANCIAL INVESTMENT BANKING

In addressing the large cabin business jet market,

Gulfstream stated that demand has remained “reasonable”

and that there is no evidence of a cyclical decline. Further

to the above, Gulfstream confirmed that order activity in

North America is particularly good, accounting for more

than 50% of placed orders. Despite reports of weakness

abroad, Gulfstream noted that orders from Asia-Pacific

improved by more than 60% over 2014.

Conversely, Dassault Aviation took only 45 orders for

Falcon business jets in 2015, approximately half of the

prior year. Shipments fell short of Dassault’s goal as well,

driven by a large NetJets order cancellation and softening

economic conditions in emerging markets. Such varying

performance underscores the presence of some isolated

choppiness within the business aviation market.

Defense

The recent two-year budget deal between Congress and

the White House provides clarity around anticipated

U.S. defense spending, which is expected to reach $581

billion, or an estimated 3.3% of GDP in 2016. These

budgetary dollars will need to be allocated strategically

given the multiple conflicts and threats facing the U.S.

today. Moving to 2017, the defense budget is expected

to grow modestly to $584 billion. This figure is slightly

lower than what the Pentagon had requested, which may

impact some anticipated modernization programs.

Defense spending in Europe, including the United

Kingdom, France and Germany, is expected to increase

in 2016 as a result of the Paris attacks, the refugee crisis

and assertiveness by Russia. Such planned increases,

while notable, are more of a reflection of a regional

downward defense spending trend over the past six

years. Elsewhere, Brazil is expected to cut defense

spending sharply given economic and political instability.

Meanwhile, Russia continues to spend heavily on

defense, although such aggressive spending will likely

need to be curtailed going forward in order to allow

other areas of the economy to develop.

4

|

AEROSPACE & DEFENSE | FEBRUARY 2016

As always, the wildcard for the defense industry is the

geopolitical environment and the potential for conflict.

Any sustained volatility could materially impact defense

spending, both in the U.S. and abroad.

With respect to M&A, the defense market has seen an

uptick in activity over the past 18 months and remains

poised for a continued increase in transactions in 2016.

Strategic acquirers, including the prime contractors,

appear focused on smaller deals that address technology,

product or customer gaps, rather than blockbuster

transactions. In particular, emerging niche market

segments, such as cybersecurity, surveillance and UAVs,

are expected to continue to attract M&A attention.

Large prime contractors have increasingly been sellers,

as opposed to actively pursuing consolidation strategies,

due in part to signals from the Pentagon. Further, larger

industry participants are focused on their most profitable

product segments and are willing to divest lower margin

or non-core assets. As an example, Lockheed Martin

(NYSE: LMT) has entered into a definitive agreement to

separate and combine its realigned Information Systems

& Global Solutions (IS&GS) business segment with

Leidos Holdings, Inc. (NYSE: LDOS). In addition to

generating significant tax benefits and $1.8 billion in

proceeds to Lockheed Martin, the transaction is highly

complementary to the strategic objectives of both

corporations with substantial synergies and potential to

enhance value for both sets of stockholders.

MESIROW FINANCIAL INVESTMENT BANKING

2015 M&A Activity

2016 A&D OUTLOOK

CHART 7 | Number of A&D Transactions by Buyer Type

(% of Total Deal Count): 2015

The outlook for aerospace and defense M&A in

2016 remains positive.

Financial

13.1%

Commercial Aerospace Based on current

information and market insights, Mesirow

Financial believes that 2016 will be another

strong year for M&A in the commercial

aerospace segment. Deal activity will likely be

driven by significant liquidity and the presence

of several active consolidators. Additionally,

leaders with respect to technology and

innovation will continue to be most heavily

pursued as M&A targets. While M&A activity is

expected to remain strong beyond 2016, our

view is that valuations are likely to moderate

beginning next year.

Strategic

86.9%

Source: S&P Capital IQ.

CHART 8 | Number of A&D Deals by Transaction Range

(% of Total Deal Count): 2015

$500MM – $1B

3.1%

>$1B

3.1%

<$500MM

23.1%

Undisclosed

70.6%

Source: S&P Capital IQ.

CHART 9 | Aggregate A&D Deal Volume by Transaction Range (2010 – 2015)

>$1B

$500MM–$1B

<$500MM

No. of Deals

350

$70.0

$60.0

254

279

244

$64.9

$40.0

160

$35.0

$30.0

100

$16.6

$10.6

$10.0

50

$0.0

0

2010

2011

2012

2013

2014

Source: S&P Capital IQ.

1. Includes deals with disclosed deal value.

2. Includes deals that are announced.

5

|

200

150

$22.7

$16.0

300

250

215

$50.0

$20.0

240

AEROSPACE & DEFENSE | FEBRUARY 2016

20152

No. of Deals (1)

Enterprise Value ($ in billions)

$80.0

Business Aviation Similar to commercial

aviation, Mesirow Financial expects the

most attractive M&A targets in the business

aviation segment to be companies providing

proprietary products or services to customers

through exclusive or sole source relationships.

In particular, cabin interior products and

technologies driving improved or differentiated

passenger experiences, such as the in-flight

entertainment (IFE) and in-flight connectivity

(IFC) segments, are highly attractive due to a

range of factors.

Defense The defense M&A market continues to

show signs of life, a trend that Mesirow Financial

expects to continue through 2016 and beyond.

M&A remains a key avenue not only for strategic

acquirers to address technology, product or

customer gaps, but also to divest non-core or

lower margin businesses. Further, M&A serves

as an attractive alternative to stock buy-backs

or dividends amidst a market increasingly

focused on growth. For private equity buyers,

timing appears attractive as multiples continue

to climb from the trough levels experienced

over the last few years. Additionally, divestiture

opportunities from larger companies remain

a key part of the private equity strategy in the

defense market.

MESIROW FINANCIAL INVESTMENT BANKING

PUBLIC COMPANY TRADING ANALYSIS – SELECTED AEROSPACE SUPPLIERS

CHART 11 | Enterprise Value / LTM Revenue

CHART 10 | Enterprise Value / LTM EBITDA

3.12x

16.0x

Median 10.4x

11.8x

11.6x

10.8x

10.5x

2.45x

2.23x

10.2x

8.3x

8.1x

Median 1.42x

1.73x

1.52x

7.9x

6.1x

ZC

BEAV

AME

COL

ESL

LMIA

KAMN

DCO

B

TGI1

1.32x

1.06x

AME

COL

BEAV

B

ESL

ZC

Source: Bloomberg, S&P Capital IQ.

Source: Bloomberg, S&P Capital IQ.

CHART 12 | Enterprise Value / NTM EBITDA

CHART 13 | Enterprise Value / NTM Revenue

11.4x

10.1x

0.71x

TGI1

KAMN

0.79x

0.71x

TGI1

KAMN

0.60x

DCO

3.12x

Median 8.5x

10.1x

LMIA

0.79x

9.8x

8.8x

8.2x

2.45x

7.6x

2.23x

7.3x

5.7x

Median 1.35x

1.73x

1.52x

5.0x

1.32x

1.06x

AME

ZC

BEAV

COL

ESL

LMIA

KAMN

Source: Bloomberg, S&P Capital IQ.

B

DCO

TGI1

AME

COL

BEAV

B

ESL

ZC

LMIA

0.60x

DCO

Source: Bloomberg, S&P Capital IQ.

AME: Ametek Inc., B: Barnes Group Inc., BEAV: B/E Aerospace Inc., DCO: Ducommun Inc., ESL: Esterline Technologies Corp., KAMN: Kaman Corporation, LMIA: LMI Aerospace Inc.,

COL: Rockwell Collins Inc., TGI: Triumph Group, Inc., ZC: Zodiac Aerospace

1. Adjusted pro forma for Triumph’s forward losses on 747-8 long term contract.

6 |

AEROSPACE & DEFENSE | FEBRUARY 2016

MESIROW FINANCIAL INVESTMENT BANKING

PUBLIC COMPANY TRADING ANALYSIS – SELECTED DEFENSE AND PRIME CONTRACTORS

CHART 15 | Enterprise Value / LTM Revenue

CHART 14 | Enterprise Value / LTM EBITDA

Median 10.5x

11.8x

11.2x

10.8x

10.6x

10.4x

1.78x

1.60x

9.9x

Median 1.41x

1.49x

1.47x

9.1x

1.35x

1.22x

7.3x

1.01x

0.81x

RTN

LMT1

LLL2

NOC

BA.

OA3

GD

BA4

Source: Bloomberg, S&P Capital IQ.

RTN

NOC

LMT1

OA3

GD

LLL2

BA.

BA4

Source: Bloomberg, S&P Capital IQ.

CHART 17 | Enterprise Value / NTM Revenue

CHART 16 | Enterprise Value / NTM EBITDA

Median 10.4x

11.2x

11.0x

10.9x

1.70x

10.9x

1.58x

9.9x

9.0x

Median 1.40x

1.52x

1.47x

9.0x

1.34x

1.26x

7.5x

1.03x

0.83x

RTN

LMT1

LLL2

NOC

OA3

GD

Source: Bloomberg, S&P Capital IQ.

BA.

BA4

RTN

NOC

LMT1

OA3

GD

LLL2

BA.

BA4

Source: Bloomberg, S&P Capital IQ.

BA.: BAE Systems plc, BA: The Boeing Company, GD: General Dynamics Corp., LLL: L-3 Communications Holdings Inc., LMT: Lockheed Martin Corporation, NOC: Northrop Grumman

Corporation, OA: Orbital ATK, Inc., RTN: Raytheon Co.

1. Adjusted pro forma for the acquisition of Sikorsky Aircraft.

2. Adjusted pro forma for the spin-off of National Security Solutions, Inc.

3. Adjusted pro forma for Orbital Sciences merger.

4. Adjusted pro forma for KC-46 Tanker and 747 charges.

7 |

AEROSPACE & DEFENSE | FEBRUARY 2016

MESIROW FINANCIAL INVESTMENT BANKING

Thought Leadership from Mesirow Financial Investment Banking

Dedicated M&A Advisor to the

Aerospace and Defense Sector

Mesirow Financial Investment Banking is consistently focused on elevating

the experience for our clients. With extensive sector-specific expertise and

deep long-standing relationships, our dedicated aerospace and defense team

has a proven track record of completing highly complex and successful

transactions. Our highest priority is helping individuals and organizations

achieve their financial and strategic goals.

CONTACT US

Jeffrey Golman

Vice Chairman

Direct–312.595.7880

jgolman@mesirowfinancial.com

Andrew Carolus

Managing Director

Direct–312.595.7802

acarolus@mesirowfinancial.com

Adam Oakley

Director

Direct–312.595.6692

aoakley@mesirowfinancial.com

Mesirow Financial refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow Financial name and

logo are registered service marks of Mesirow Financial Holdings, Inc. © 2016, Mesirow Financial Holdings, Inc. All rights reserved.