AST Advanced Strategies Portfolio

advertisement

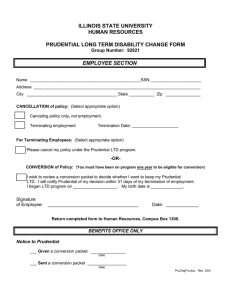

Prudential Annuities AST Advanced Strategies Portfolio Prudential Premier® Retirement Variable Annuity B SeriesSM Inception Date: 03-20-06 Net Assets: 7491.4363 ($mil, as of 01-31-16) Index: S&P 500 Composite Style & Strategy Performance As of 08-31-16; Standardized as of 06-30-16 Specialty Large Cap Value Large Cap Blend Large Cap Growth Domestic Hybrid Int'l Equity Mid Cap Value Mid Cap Blend Mid Cap Growth Fixed Income Asset Alloc. Balanced Small Cap Value Small Cap Blend Small Cap Growth Money Market 200% 0 -200% -400% -600% -800% To seek a high level of absolute return Notes Certain elements of the Portfolio, including the name and investment objective, policies, strategy(ies), and/or subadvisor changed as of the date shown in the relevant footnote below. As a result, the performance figures furnished above for periods prior to that date reflect the investment performance of the former Portfolio and/or subadvisor and may not be representative of the Portfolio's current structure and/or subadvisor. Effective January 5, 2015, Prudential Investment Management Inc. became subadvisor to the Portfolio. Management Lead Manager Advisor Sub-Advisor Marcus Perl Edward L. Campbell Joel Kallman Josepf Lakonishok Menno Vermeulen Puneet Mansharamani Greg Sleight Guy Lakonishok Kenneth Stuzin Aziz Hamzaogullari Scott Mather Mihir Worah Michael Collins Richard Piccirillo Gregory Peters Robert Tipp Brian Rogers Mark Finn John Linehan Heather McPherson Simon Fennell Kenneth McAtamney Standardized Non-Standardized Index 1 Mo 3 Mo YTD 1 Yr 1 Mo 0.19% -6.81% -6.65% 3 Mo 3.32% -3.68% -7.14% YTD 6.18% -0.82% -5.07% 1 Yr 8.08% 1.08% -7.23% -4.01% 3 Yr 5 Yr 10 Yr ITD 3 Yr 6.41% 4.62% 8.77% 5 Yr 7.37% 6.60% 3.44% 8.74% 10 Yr 4.57% 4.57% 3.18% 4.22% ITD 4.46% 4.46% 2.82% 4.28% Category Average -3.65% -4.73% -3.65% -2.62% 5.21% 6.19% 0.00% Inception Date: 03-20-06 | Standardized Inception Date: 03-20-06 NonStd NonStd w/CDSC Std Index World Allocation Cat. Avg. as of 12-31-15 Portfolio Analysis Statistics (as of 08-31-16) Alpha Beta Standard Deviation Capitalization Price to Earnings Price to Book Earnings Per Share Composition (as of 08-31-16) -0.38 1.2 8.07 33780.17M 18.8857x 2.2219x N/A Top 10 Holdings (as of 08-31-16) Prudential Core Invt SPDR® S&P 500 ETF Lch Irs Usd 1.78695 12/31/21 Pay Fix; 30/ Lch Irs Usd 1.78695 12/31/21 Pay Fix; 30/ iShares Core US Aggregate Bond iShares MSCI EAFE (S) Cme Irs Gbp 1.50% 2y Sellreceiver; N (S) Cme Irs Gbp 1.50% 2y Sellreceiver; N Trs Dwrtft Trs Equity 1ml+42.5 Boa Trs Dwrtft Trs Equity 1ml+42.5 Boa Rec Id # of Equity Holdings # of Bond Holdings Total # of Holdings 6.82% 2.66% 2.46% 2.45% 2.34% 1.91% 1.78% 1.77% 1.42% 1.38% STOCKS 54.04% BONDS 34.22% CASH 11.08% OTHER 0.66% Sectors (as of 08-31-16) Basic Materials Consumer Cyclical Financial Services Real Estate Consumer Defensive Healthcare Utilities Communication Services Energy Industrials Technology 3.60% 13.80% 18.80% 2.60% 8.90% 12.40% 3.30% 1.80% 4.80% 12.30% 17.90% 411 1420 2607 AST Investment Services/Prudential Investments LLC Quantitative Management Associates, LLC. LSV Asset Management, Brown Advisory, LLC Loomis, Sayles & Company, L.P. Pacific Investment Management Company, LLC (PIMCO) Prudential Investment Management, Inc. T. Rowe Price Associates, Inc. William Blair & Company, LLC The performance data quoted represents past performance which does not guarantee similar future results. The investment return and principal value of an investment will fluctuate and when redeemed, an investor's units may be worth more or less than their original cost. Current performance may be lower or higher than the past 0162568-00048-00 Ed.performance 10/2015 retirementB data quoted. Performance information as Page of the 1 ofmost 3 recent month end is available at www.prudentialannuities.com. This report is authorized for use only when preceded or accompanied by a current prospectus containing complete information, including fees and Growth of $10,000 (Non-standardized) Regional Exposure $16,000 $15,000 $14,000 $13,000 $12,000 $11,000 $10,000 $9,000 $8,000 $ I 07 08 I - Inception (3/20/2006) Best 3 Months Worst 3 Months 21.57% -27.10% 09 10 11 12 13 14 15 16 Mar 01, 2009 thru May 31, 2009 Sep 01, 2008 thru Nov 30, 2008 As of 08-31-16 United States Canada Latin America United Kingdom EuroZone Europe ex-Euro Europe Emerging Africa Middle East Japan Australasia Asia Developed Asia Emerging 63.1% 1.5% 0.0% 6.8% 9.7% 4.8% 0.0% 0.2% 0.8% 7.4% 1.4% 1.3% 2.9% Miscellaneous Expense Ratio (as of 07-01-15) Annual Turnover (as of 12-31-14) 0.95% 140.00% Definitions Composition - of a sub-account represents the apportioning of investment assets among stocks, bonds and cash. Portfolio composition is subject to change. There can be no assurance that the portfolio's objectives will always be achieved. is a sub-account's return above its appointed benchmark index. measures a sub-account's sensitivity to changes in the overall market. The overall market is designated by the sub-account's category benchmark. is a statistical measurement that depicts how widely returns varied over a certain time period. The measurement is generally used to understand the range of returns that are most likely for a given sub-account. When a sub-account has a high standard deviation, the range of performance may be wider, implying greater volatility. is the value of a corporation as determined by the market price of its issued and outstanding common stock. or P/E is the price of a stock divided by its earnings per share. or Price/Book Value is the price of a stock divided by the stockholder's equity per share. or EPS is the portion of a company's annual profit allocated to each outstanding share of common stock. The profit figure is calculated after paying taxes and after paying preferred shareholders and bondholders. Holdings of the sub-account are subject to change and may not be a representation of the current holdings. are the 10 largest holdings of the sub-account as of the end of the stated period. The performance figures for these holdings do not reflect the performance of the sub-account. All holdings of the sub-account are subject to change and may not be a representation of the current holdings. represent different types of issuers which may be impacted by changing economic conditions. reflects how the portfolio's assets generally are invested as of the date indicated. For certain portfolios with broad investment objectives, style may change over time. 0162568-00048-00 Ed. 10/2015 retirementB Page 2 of 3 Important Information Concerning Annuity Performance Fees and Charges Assessed By Prudential Premier® Retirement Variable Annuity B Series SM Insurance Charge: 1.30% Maintenance Fee: $50 Contingent Deferred Sales Charge: 7.0%, 7.0%, 6.0%, 6.0%, 5.0%, 5.0%, 5.0% (For years, 1, 2, 3 and so on, respectively as indicated.) Variable annuities deduct all management fees and expenses of the underlying subaccounts, insurance charges, administration fees, and other charges automatically from the assets in each subaccount. For purposes of this document, insurance (mortality & expense risk) and administration charges are assumed to be the amount shown. The insurance charge is the combination of the mortality & expense risk charge and the administration charge. The charge is intended to cover the cost of providing the insurance benefits under the annuity, the administrative costs associated with providing those annuity benefits, and the risk that our assumptions about the mortality risks and expenses under the annuity are incorrect. A contingent deferred sales charge, or CDSC, may be assessed if you surrender your annuity or when you make a partial withdrawal. The CDSC reimburses us for expenses related to sales and distribution of the annuity, including commissions, marketing materials, and other promotional expenses. The CDSC is calculated as a percentage of your purchase payment being withdrawn during the applicable annuity year. The stated CDSC represents the maximum possible withdrawal charges under the annuity. State variations may apply. Please refer to your current prospectus for more information. The maintenance fee is deducted annually on the anniversary of the issue date of your annuity or, if you surrender your annuity during the annuity year, at the time of surrender. Because past performance is intended to depict the experience of a hypothetical investor over the measuring period, and because the hypothetical investor could effect a purchase only on a business day, we assume in these calculations that the purchase was effected the business day prior to the start of the measuring period, if that start day was not itself a business day. Performance of Underlying Subaccounts - Performance of underlying subaccounts is calculated using the actual fees and charges of the product as if such product were available since the inception of the subaccount. Underlying funds may have existed prior to the inception of their corresponding subaccounts. Standardized performance is calculated from the adoption of the subaccount in the applicable separate account. Non-standardized performance is calculated from the underlying fund's inception date, which may be different from, and predate, its adoption in the applicable separate account. Non-standardized performance that predates the adoption of the subaccount in the applicable separate account is hypothetical. Non-Standardized Returns - Non-standardized returns are net of all underlying charges but do not reflect deduction of the annual maintenance fee and the contingent deferred sales charges, except where noted. Standardized Returns - Standardized returns are calculated, in accordance with SEC Rules, from inception of the subaccount assuming a $1,000 investment made at the beginning of the applicable period. Standardized returns reflect deduction of all underlying fund fees and insurance charges (excluding any charges for optional benefits), maintenance fees and CDSC, where applicable. Investors should consider the contract and the underlying portfolios' investment objectives, risks, charges and expenses carefully before investing. This and other important information is contained in the prospectus, which can be obtained from your financial professional. Please read the prospectus carefully before investing. For more information, please call your financial professional. A variable annuity is a long-term investment designed for retirement purposes. Investment returns and the principal value of an investment will fluctuate so that an investor's units, when redeemed, may be worth more or less than the original investment. Withdrawals or surrenders may be subject to contingent deferred sales charges. Withdrawals and distributions of taxable amounts are subject to ordinary income tax and, if made prior to age 59 1/2, may be subject to an additional 10% federal income tax penalty, sometimes referred to as an additional income tax. Prudential Premier ® Retirement Variable Annuity B SeriesSM or certain of its investment options may not be available in all states. Annuity contracts contain exclusions, limitations, reductions of benefits, and terms for keeping them in force. Your licensed financial professional can provide you with costs and complete details. Variable annuities are issued by Pruco Life Insurance Company (in New York, by Pruco Life Insurance Company of New Jersey), Newark, NJ (main office) and distributed by Prudential Annuities Distributors, Inc., Shelton, CT. All are Prudential Financial companies and each is solely responsible for its own financial condition and contractual obligations. Prudential Annuities is a business of Prudential Financial, Inc. Prudential Annuities and its distributors and representatives do not provide tax, accounting, or legal advice. Please consult your own attorney or accountant. © 2015 Prudential Financial, Inc. and its related entities. Prudential Annuities, Prudential, the Prudential logo, the Rock symbol, and Bring Your Challenges are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide. Issued on contract P-BLX/CRT(2/10) et al. or a state variation thereof. 0162568-00048-00 Ed. 10/2015 retirementB Page 3 of 3