Robery Noyce and Fairchild Semiconductor, 1957-1968

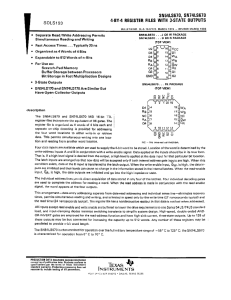

advertisement