Contents

•

Crib Sheet

•

How much can happen

in 1 ms?

•

How fast is fast enough?

•

What makes a quote

“accessible”?

•

Oh Canada!

For questions or further

information on this report,

please contact Phil Mackintosh

at pmackint@kcg.com or

201.963.2724

May 2016

The Need for Speed V:

How Important is 1 ms?

by Phil Mackintosh and Ka Wo Chen

Crib Sheet

In our recent Speed IV report, we highlighted that the SIP differed from our

direct feeds for just a fraction of every day. For most stocks, they are

identical 99.9% of the time—that’s all but 23 seconds of the day.

But how important is that millisecond when prices change?

The answer is: very.

In fact, our data show that around 30% of all volume trades in the

millisecond around when the quote ticks up and down.

And this, in turn, has significant implications for minimizing fulfillment and

adverse selection as well as hinting at what “de minimis” intentional delays

really mean.

KCG | The Need for Speed V: How Important is 1 ms? | May 2016 1

.

How much can happen in 1 ms?

In our recent Speed IV report, we highlighted that the SIP differed from our

direct feeds for just a fraction of every day. For most stocks, they are

identical 99.9% of the time—that’s all but 23 seconds of the day.

We also found that the SIP is typically less than 1 ms slower than the direct

feeds—even after we add back the extra distance the SIP needs to cover to

get to our servers.

But how important is that millisecond?

The answer is that it matters a lot more than you’d think.

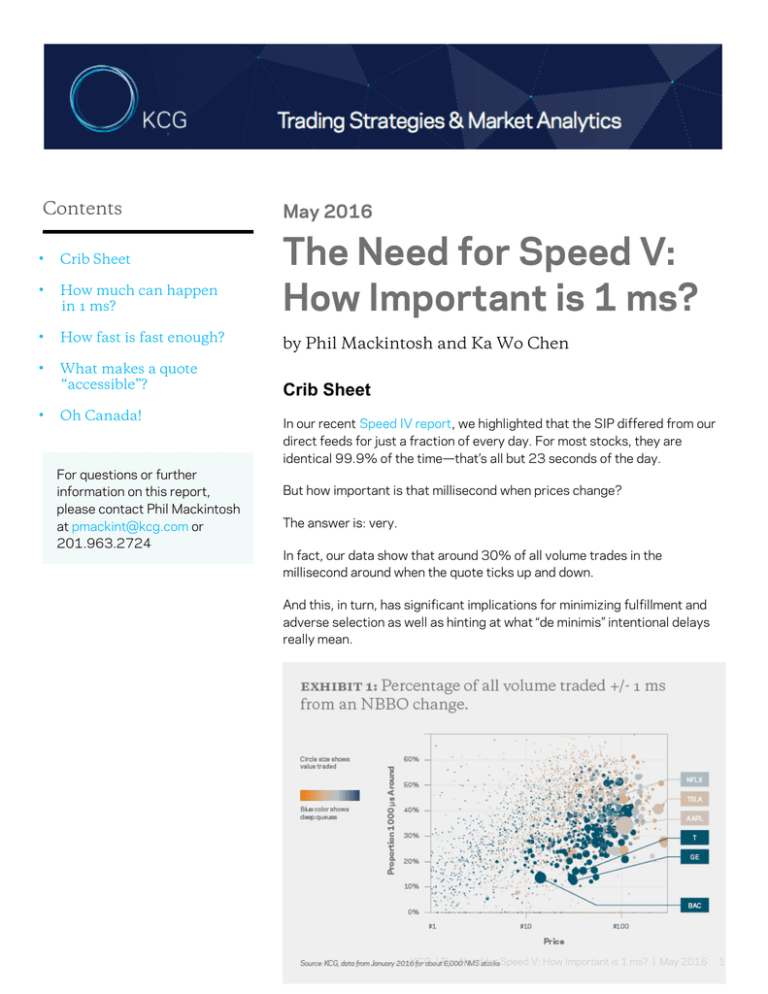

Around 30% of all trading happens as quotes change

Although it represents less than 0.1% of the day for most stocks, the time

when quotes are changing represents an average of 29.4% of all value

traded (Exhibit 1).

Avoiding adverse selection is hard

From the perspective of the liquidity provider, the fills that cause a quote

change also result in adverse selection—something we talked about in

Speed I. Adverse selection is often measured by the mark-out—or the change in the

mid price after the trade. As Exhibit 2 shows, the mid-point AFTER the trade

is actually at a better price than the fill you just received. Considered another way—you would have been better off to not have been

on the offer at that time as:

•

•

The worst price you would expect now is the price of your fill.

There is a chance to capture the new spread—and improve your fill

prices by a whole cent.

Unless you have perfect foresight into the market, using it in venue analysis

can give misleading results.

KCG | The Need for Speed V: How Important is 1 ms? | May 2016 2

Higher stock prices increase adverse selection

The data also shows that adverse selection happens more often for higherpriced stocks, which makes sense because the 1-cent spread represents a

smaller return (in bps). Consequently, the return from posting liquidity is

lower, which, in turn, reduces the depth of book.

KCG | The Need for Speed V: How Important is 1 ms? | May 2016 3

Fade hurts too

The only way we could allow traders to avoid adverse selection—the ability

to back away from the touch before liquidity takers can trade—is to say that

slowing down takers, to allow fade, is OK.

But even if we did that—our data shows that fading will significantly reduce

the liquidity you interact with as a liquidity provider—which may, if the stock

moves adversely, increase the total costs of a trade. How fast is fast enough?

Is 1 ms enough to affect executions?

The short answer is: yes.

The long answer is: only if traders operate at different speeds.

Fade and adverse selection are both bad for investors

Both fade and adverse selection detrimentally affect trade prices for longterm investors.

•

To avoid adverse selection a liquidity provider needs to fade faster

than anyone else can route.

•

To avoid fade, a liquidity taker needs to route faster than anyone else

can fade.

Note that fade and adverse selection are opposites—you can’t artificially fix

both at once.

An equal market is fair

Both fade and adverse selection require a difference in trading speed. This

means the fairest market should be one where nobody has a speed

advantage. Where all trades happened in the order that decisions were

made.

This would be possible if everyone could trade at the actual speed of

light—with no processing times—as we showed in our routing visualization.

To achieve this both takers and providers need to calibrate their systems to

process at equal speeds.

Equal is impossible

But processing is required in multiple places—and as we saw for the

SIP—something as simple as the level of trading activity can slow a

processor down.

KCG | The Need for Speed V: How Important is 1 ms? | May 2016 4

A while ago, Matt Levine wrote a thought-provoking comment on how this

makes the idea of “fair” a relative concept.

How different is important

In theory, a difference as small as just 25 µs may be important—as this

represents the difference in our routing visualization between the takers'

direct route to Nasdaq versus a message traveling to Nasdaq via BATS.

However our own fulfillment data suggest even larger differences might not

matter. We use proprietary fiber to route orders, instead of microwave, as it

has higher fidelity and bandwidth. Despite the fact this is around 65 µs

slower between NYSE and BATS, we still see almost no fade on any

exchanges.

Two IEX data points provide evidence of what level of delays are important:

1. In a recent IEX op-ed, they found that switching from slower FIX to

faster binary routes between their Weehawken-based ATS and the

NYSE increased their fulfillment materially. Note that this did nothing to

change the 114 µs distance between the two venues, as it was a

software change that sped up order processing. NYSE data suggests

this results in a speed improvement of around 1 ms.

2. Although the IEX POP is just 350 µs, it is in fact designed to allow peg

orders (which use direct feeds) to fade aggressive takers (who need to

traverse the POP).

KCG | The Need for Speed V: How Important is 1 ms? | May 2016 5

SEC proposal to define “immediate”

As we were writing this report, the SEC proposed a new

interpretation of the term “immediate” in Reg NMS, for the purposes

of determining an automatic quote.

Specifically, they propose that:

“…delays of less than a millisecond …may be … de minimis

…[and] would not impair…ability to access a quote.”

What makes a quote “accessible”?

Essentially, an accessible quote is one that can’t be faded.

As we’ve detailed, this depends on the difference in routing times between

takers and providers, not the length of time.

KCG | The Need for Speed V: How Important is 1 ms? | May 2016 6

For example:

*See a NJ-based example of this in our routing visualization.

How will a speed bump impact the market

There has been plenty written about IEX and its exchange approval. Based

on what we’ve covered in this and recent reports—it seems fair to say:

•

The POP itself, adding 350 µs to route times and 700 µs to fill times,

will probably create locked markets for longer times each time a marketwide quote change occurs—provided IEX has lit orders at the NBBO

(click on our SIP Visualization).

•

However as all limit orders also need to be canceled via the POP—they

should be accessible.

•

IEX peg order types, with a 350 µs head start on limit orders, are

designed to have enough time to fade a taker.

•

However, these orders are currently dark (see first bullet above)—so

they wouldn’t be protected anyway.

Given this, the potentially imminent approval of IEX, on its own, may be less

problematic than some suggest.

It depends if speed bump orders are lit

The real issue is that inaccessible quotes might end up “protected.”

KCG | The Need for Speed V: How Important is 1 ms? | May 2016 7

•

•

Reg NMS defines a protected quote as: a bid or offer…that…is

displayed (a lit quote) by an automated trading center.

Rule 611 specifically prevents “trade throughs” of protected quotations.

Consequently, routers cannot ignore any lit NBBO shares—even if they

knew that venue was inaccessible in a market-wide sweep route.

Other exchanges already have lit-peg order types—and IEX approval would

seem to create a precedent for a speed bump in those markets too.

If NYSE or Nasdaq or BATS (or IEX) combined a speed bump with a lit-peg

order type—those quotes could become inaccessible—even though they will

still be “protected.”

The result would be reduced fulfillment for takers, which most participants

seem to agree is bad.

Oh Canada!

Canada has been progressive with its own market structure since the credit

crisis. They restructured exchange ownership, reduced fragmentation,

added trade-at requirements and even approved speed bumps.

But what the US should take most notice of is a recent IIROC decision to

unprotect all speed bump quotes, “where an intentional order processing

delay results in the inability to provide an immediate execution against

displayed volume.”

Perhaps a similar solution would work in the US. Approve IEX, but be clear

that intentional delays on accessing lit orders will result in the loss of

protected status. Over time, that might even reduce speed-based order

types like Day-ISO.

How did we do this?

We use our tick level trade data, and summed all trades within +/- 1

millisecond of our timestamps on a SIP quote change.

Why did we use 1 ms around a quote change?

We know from our Speed III and Speed IV reports that:

•

It takes around 800 µs for the SIP to update.

•

All the trades that cause the NBBO to change occur BEFORE

the SIP updates.

•

Dark pool trades most likely take even longer to report, as they

need to post trades via the TRF.

KCG | The Need for Speed V: How Important is 1 ms? | May 2016 8

Going backward 1 ms before the SIP change, should capture most

of the trades on exchanges.

Going forward 1 ms allows extra time for slower dark pools to post

trades—as these have lower standards of immediacy and also have

to post via the TRF.

What we actually see in Exhibit 5 is that dark pool reports may take

even longer than 1 ms to get from the dark pool, to the TRF, to the

SIP and then back to us.

Disclaimer

This material is not research and is not intended as such. It has been produced by personnel

employed within the Trading Strategy Department and/or by Sales and Trading personnel of KCG

Americas LLC (“KCGA”). This material is intended only for clients of KCG Holdings, Inc. and its

subsidiaries (collectively “KCG”). It is not intended for further dissemination in its present form or

any other and may not be further disseminated beyond the initial recipient without express consent

from KCG. This material is not intended to constitute an offer, or solicitation of an offer, to

purchase or sell any security or financial instruments or to participate in any investment strategy.

The securities and strategies referenced in this material are not intended as recommendations and

may not be suitable for you. KCGA believes that the information contained herein is accurate but

does not warrant that is accurate, complete or up to date. The views expressed herein are based on

assumptions. Any of those assumptions may be incorrect. KCG does not guarantee the

performance or success of any opinion or idea expressed in the information. KCG assumes no

liability to anyone as a result of the use of this material. This material provides the observations and

views of the persons who prepared the material. These observations and views may be different

from, or inconsistent with, the views of KCG or other Departments or persons within KCG. The

observations and views expressed in this material may change at any time without notice. KCGA

makes markets and trades for its own account and may hold positions in any of the securities of the

issuers referred to herein or in related financial instruments. The persons who prepared this

material may also advise our trading desks.

In the US, products and services are offered by KCGA, member FINRA/SIPC. In Europe, products

and services are offered by KCG Europe Limited (“KCGEL”) which is authorized and regulated by the

Financial Conduct Authority. KCGA and KCGEL are affiliates and are indirect subsidiaries of KCG.

For additional information about KCG (NYSE: Euronext: KCG) please visit www.kcg.com .

© 2016 KCG Holdings, Inc. All rights reserved.

KCG | The Need for Speed V: How Important is 1 ms? | May 2016 9