Al-Hokair Group

Investment Update

May 2015

Please read Disclaimer on the back

Favorable view, recently added to Saudi Arabia MSCI small

cap Index. Concerns over delays

Joint Venture with Rezidor Hotel Group improves hospitality segment

outlook for the company: The agreement includes adding and renovating

around 30 hotels. Latest developments in the agreement include the opening

of 3 new hotels during 2017 and 2018 (Park Inn Bay Radisson Dubai, Park Inn Bay

Radisson Jubail, and Radisson Blu Khobar) and the renovation of one hotel for

2017 (Golden Tulip Jubail to Park Inn Bay Radisson). Announced plans includes

4 more hotels for the next few years, two of which are in Jeddah and one in

Makkah and Riyadh, all of which will be under the Radisson Blu brand name. The

joint venture will support RevPAR growth for current hotels under renovation.

Expansion in Entertainment segment: Al Hokair Group is planning on

opening 7 new entertainment centres across the kingdom in 2015 along with

2 entertainment centres that were pushed from 2014 to 2015 in Riyadh and

Dammam to add to its current portfolio of 52 centres.

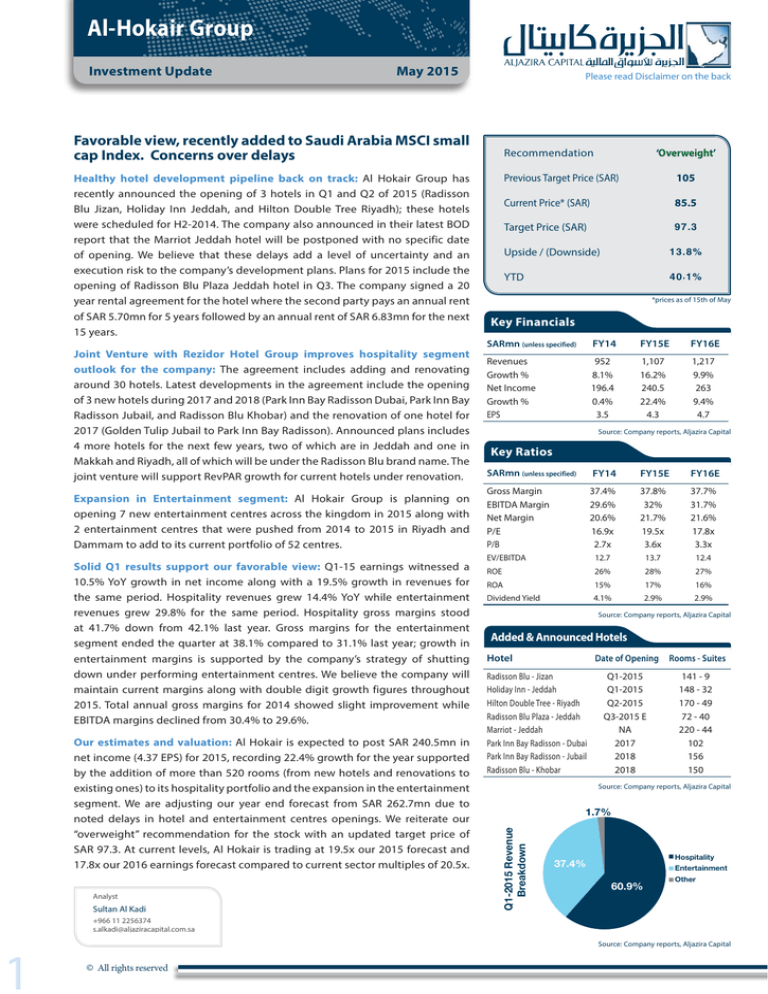

Solid Q1 results support our favorable view: Q1-15 earnings witnessed a

10.5% YoY growth in net income along with a 19.5% growth in revenues for

the same period. Hospitality revenues grew 14.4% YoY while entertainment

revenues grew 29.8% for the same period. Hospitality gross margins stood

at 41.7% down from 42.1% last year. Gross margins for the entertainment

segment ended the quarter at 38.1% compared to 31.1% last year; growth in

entertainment margins is supported by the company’s strategy of shutting

down under performing entertainment centres. We believe the company will

maintain current margins along with double digit growth figures throughout

2015. Total annual gross margins for 2014 showed slight improvement while

EBITDA margins declined from 30.4% to 29.6%.

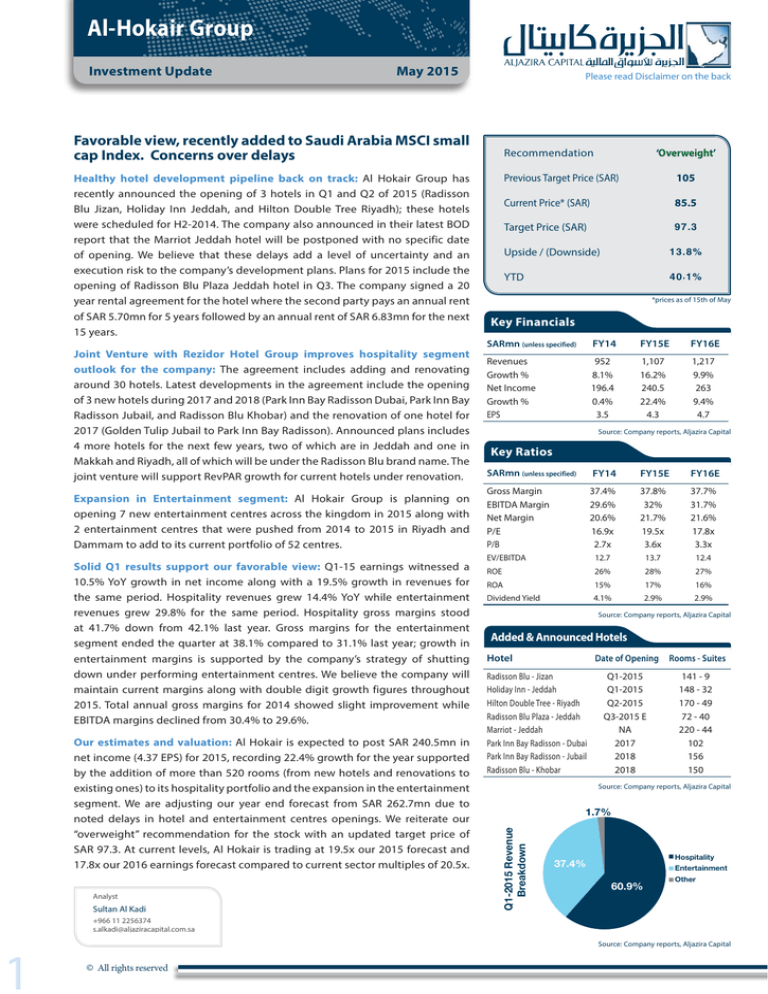

Our estimates and valuation: Al Hokair is expected to post SAR 240.5mn in

net income (4.37 EPS) for 2015, recording 22.4% growth for the year supported

by the addition of more than 520 rooms (from new hotels and renovations to

existing ones) to its hospitality portfolio and the expansion in the entertainment

segment. We are adjusting our year end forecast from SAR 262.7mn due to

noted delays in hotel and entertainment centres openings. We reiterate our

“overweight” recommendation for the stock with an updated target price of

SAR 97.3. At current levels, Al Hokair is trading at 19.5x our 2015 forecast and

17.8x our 2016 earnings forecast compared to current sector multiples of 20.5x.

Analyst

Sultan Al Kadi

Previous Target Price (SAR)

105

Current Price* (SAR)

85.5

Target Price (SAR)

97.3

Upside / (Downside)

13.8%

YTD

40٫1%

*prices as of 15th of May

Key Financials

SARmn (unless specified)

FY14

FY15E

FY16E

Revenues

Growth %

Net Income

Growth %

EPS

952

8.1%

196.4

0.4%

3.5

1,107

16.2%

240.5

22.4%

4.3

1,217

9.9%

263

9.4%

4.7

Source: Company reports, Aljazira Capital

Key Ratios

SARmn (unless specified)

FY14

FY15E

FY16E

Gross Margin

EBITDA Margin

Net Margin

P/E

P/B

37.4%

29.6%

20.6%

16.9x

2.7x

37.8%

32%

21.7%

19.5x

3.6x

37.7%

31.7%

21.6%

17.8x

3.3x

EV/EBITDA

12.7

13.7

12.4

ROE

26%

28%

27%

ROA

15%

17%

16%

Dividend Yield

4.1%

2.9%

2.9%

Source: Company reports, Aljazira Capital

Added & Announced Hotels

Hotel

Radisson Blu - Jizan

Holiday Inn - Jeddah

Hilton Double Tree - Riyadh

Radisson Blu Plaza - Jeddah

Marriot - Jeddah

Park Inn Bay Radisson - Dubai

Park Inn Bay Radisson - Jubail

Radisson Blu - Khobar

Date of Opening

Rooms - Suites

Q1-2015

Q1-2015

Q2-2015

Q3-2015 E

NA

2017

2018

2018

141 - 9

148 - 32

170 - 49

72 - 40

220 - 44

102

156

150

Source: Company reports, Aljazira Capital

1.7%

Q1-2015 Revenue

Breakdown

Healthy hotel development pipeline back on track: Al Hokair Group has

recently announced the opening of 3 hotels in Q1 and Q2 of 2015 (Radisson

Blu Jizan, Holiday Inn Jeddah, and Hilton Double Tree Riyadh); these hotels

were scheduled for H2-2014. The company also announced in their latest BOD

report that the Marriot Jeddah hotel will be postponed with no specific date

of opening. We believe that these delays add a level of uncertainty and an

execution risk to the company’s development plans. Plans for 2015 include the

opening of Radisson Blu Plaza Jeddah hotel in Q3. The company signed a 20

year rental agreement for the hotel where the second party pays an annual rent

of SAR 5.70mn for 5 years followed by an annual rent of SAR 6.83mn for the next

15 years.

‘Overweight’

Recommendation

Hospitality

Entertainment

37.4%

60.9%

Other

+966 11 2256374

s.alkadi@aljaziracapital.com.sa

1

Source: Company reports, Aljazira Capital

© All rights reserved

Al-Hokair Group

Investment Update

May 2015

Please read Disclaimer on the back

Key Financials

Income Statement in SAR mn

REVENUES

Hotels

Entertainment

Others

TOTAL REVENUES

% Growth

DIRECT COSTS

Hotels

Entertainment

Others

TOTAL DIRECT COSTS

GROSS PROFIT

EXPENSES

Selling and marketing

General and administrative

TOTAL EXPENSES

INCOME FROM MAIN OPERATIONS

Share in net results of associates

Financial charges

Other income, net

INCOME FROM CONTINUING OPERATIONS

INCOME BEFORE ZAKAT

Zakat

NET INCOME FOR THE YEAR

% Growth

Balance Sheet in mn SAR

ASSETS

CURRENT ASSETS

Bank balances and cash

Accounts receivable

Prepayments and other current assets

Inventories

Amounts due from related parties

TOTAL CURRENT ASSETS

NON-CURRENT ASSETS

Investments in associates

Projects under construction

Property and equipment

Goodwill

Other assets

TOTAL NON-CURRENT ASSETS

TOTAL ASSETS

LIABILITIES AND SHAREHOLDERS’ EQUITY

LIABILITIES

CURRENT LIABILITIES

Accounts payable

Accrued expenses and other current liabilities

Bank borrowings and term loans

Current portion of obligations under

TOTAL CURRENT LIABILITIES

NON-CURRENT LIABILITIES

Term loans

Employees’ terminal benefits

TOTAL NON-CURRENT LIABILITIES

TOTAL LIABILITIES

SHAREHOLDERS’ EQUITY

Share capital

Statutory reserve

Retained earnings

TOTAL SHAREHOLDERS’ EQUITY

TOTAL LIABILITIES AND EQUITY

2012A

2013A

2014A

2015E

2016E

2017E

483

273

14

770

6.6%

553

310

17

880

14.2%

592

341

19

952

8.1%

714

373

20

1,107

16.3%

799

396

22

1,217

9.9%

863

432

24

1,319

8.4%

(297)

(172)

(6)

(475)

295

(342)

(206)

(6)

(554)

326

(356)

(233)

(6)

(595)

356

(440)

(242)

(7)

(689)

418

(492)

(259)

(8)

(759)

458

(531)

(281)

(9)

(820)

499

(30)

(112)

(142)

153

28

(4)

7

183

183

(5)

179

1.7%

(33)

(123)

(156)

169

26

(9)

12

198

198

(3)

196

9.4%

(37)

(137)

(174)

182

29

(12)

2

201

201

(5)

196.4

0.4%

(42)

(146)

(188)

231

26

(13)

2

245

245

(5)

240.5

22.4%

(46)

(159)

(206)

253

26

(16)

6

268

268

(5)

263

9.4%

(50)

(169)

(220)

280

26

(18)

5

293

293

(5)

287

9.3%

47

35

50

22

4

158

135

40

108

23

23

329

57

47

106

26

31

268

157

53

86

32

31

359

323

60

104

37

31

555

502

67

119

42

31

760

89

15

672

39

27

843

1,001

107

79

660

39

886

1,215

96

144

755

39

1,034

1,301

107

164

746

39

1,056

1,415

107

174

745

39

1,065

1,620

107

179

743

39

1,068

1,828

62

116

69

2.7

250

47

117

105

0.2

269

52

137

125

0.0

314

57

132

138

0.2

326

61

138

170

0.2

370

65

142

191

0.2

399

130

42

173

423

147

40

187

456

190

48

239

553

196

40

237

563

232

40

273

643

262

40

303

701

408

86

85

578

1,001

550

20

120

759

1,215

550

39

160

749

1,301

550

63

238

852

1,415

550

90

338

977

1,620

550

118

459

1,127

1,828

Source: AlJazira Capital *for years 2015 & onwards we used closing price of 20th May 2015

2

© All rights reserved

Al-Hokair Group

Investment Update

May 2015

Please read Disclaimer on the back

Key Financials

Cash Flow in SAR mn

2012A

2013A

2014A

2015E

2016E

2017E

Net cash from operating activities

Net cash used in investing activities

Cash flow from Financing Activity

Changes in Cash

Opening Balance of Cash

Closing Balance of Cash

194

(130)

(26)

37

10

47

196

(239)

39

(3)

47

45

294

(119)

(162)

13

45

57

362

(134)

(128)

100

57

157

368

(142)

(59)

167

157

323

405

(148)

(79)

179

323

502

Liquidity Ratio

Current Ratio(x)

Quick Ratio (x)

0.6

0.5

1.2

1.1

0.9

0.8

1.1

1.0

1.5

1.4

1.9

1.8

Efficiency Ratios

Receivables Days Turnover

Inventory Days Turnover

Payables Days Turnover

16.4

10.4

47.6

16.7

9.5

30.9

17.0

10.0

32.0

17.5

10.5

30.0

18.0

11.0

29.5

18.5

11.5

29.0

Profitability

ROE

ROIC

ROA

31%

23%

18%

26%

19%

16%

26%

18%

15%

28%

20%

17%

27%

19%

16%

25%

18%

16%

Margins

Gross Margins

EBITDA Margins

EBIT Margins

Net Margins

38%

33%

20%

23%

37%

30%

19%

22%

37.4%

29.6%

19.2%

20.6%

37.8%

32.0%

20.8%

21.7%

37.7%

31.7%

20.8%

21.6%

37.8%

32.2%

21.2%

21.8%

Leveraging Ratios

Debt to Equity

Debt to Capital

35%

17%

33%

17%

42%

20%

39%

19%

41%

20%

40%

20%

Valuations

Dividend Yield

Book Value Per Share (BVPS)

Market Capitalization(in SAR Mn)

Enterprise value (in SAR Mn)

PE (x)

PB (x)

EV/EBITDA (x)

EPS (diluted)

NA*

30

NA*

NA*

NA*

NA*

NA*

3.25

NA*

25

NA*

NA*

NA*

NA*

NA*

3.56

4.1%

22

3,328

3,586

16.94

2.74

12.72

3.57

2.9%

24

4,703

4,880

19.55

3.61

13.78

4.37

2.9%

26

4,703

4,782

17.88

3.32

12.40

4.78

2.9%

29

4,703

4,654

16.37

2.90

10.97

5.22

Ratios

Source: AlJazira Capital *for years 2015 & onwards we used closing price of 20th May 2015

3

© All rights reserved

RESEARCH DIVISION

AGM - Head of Research

Abdullah Alawi

+966 11 2256250

a.alawi@aljaziracapital.com.sa

Analyst

Sultan Al Kadi

+966 11 2256115

t.nazar@aljaziracapital.com.sa

+966 11 2256374

s.alkadi@aljaziracapital.com.sa

General manager - brokerage services and sales

AGM-Head of international and institutional

AGM- Head of Western and Southern Region Investment Centers & ADC

Ala’a Al-Yousef

brokerage

Brokerage

+966 11 2256000

a.yousef@aljaziracapital.com.sa

Luay Jawad Al-Motawa

Abdullah Q. Al-Misbani

+966 11 2256277

lalmutawa@aljaziracapital.com.sa

+966 12 6618400

a.almisbahi@aljaziracapital.com.sa

AGM-Head of Sales And Investment Centers

AGM-Head of Qassim & Eastern Province

AGM - Head of Institutional Brokerage

Central Region

Abdullah Al-Rahit

Samer Al- Joauni

Sultan Ibrahim AL-Mutawa

+966 16 3617547

aalrahit@aljaziracapital.com.sa

+966 1 225 6352

s.alJoauni@aljaziracapital.com.sa

Jassim Al-Jubran

+966 11 2256248

j.aljabran@aljaziracapital.com.sa

BROKERAGE AND INVESTMENT

CENTERS DIVISION

RESEARCH

DIVISION

Talha Nazar

Analyst

+966 11 2256364

s.almutawa@aljaziracapital.com.sa

AlJazira Capital, the investment arm of Bank AlJazira, is a Shariaa Compliant Saudi Closed Joint Stock company and

operating under the regulatory supervision of the Capital Market Authority. AlJazira Capital is licensed to conduct

securities business in all securities business as authorized by CMA, including dealing, managing, arranging, advisory,

and custody. AlJazira Capital is the continuation of a long success story in the Saudi Tadawul market, having occupied

the market leadership position for several years. With an objective to maintain its market leadership position, AlJazira

Capital is expanding its brokerage capabilities to offer further value-added services, brokerage across MENA and

International markets, as well as offering a full suite of securities business.

1.

RATING

TERMINOLOGY

Senior Analyst

2.

3.

4.

Overweight: This rating implies that the stock is currently trading at a discount to its 12 months price target.

Stocks rated “Overweight” will typically provide an upside potential of over 10% from the current price levels

over next twelve months.

Underweight: This rating implies that the stock is currently trading at a premium to its 12 months price target.

Stocks rated “Underweight” would typically decline by over 10% from the current price levels over next twelve

months.

Neutral: The rating implies that the stock is trading in the proximate range of its 12 months price target. Stocks

rated “Neutral” is expected to stagnate within +/- 10% range from the current price levels over next twelve

months.

Suspension of rating or rating on hold (SR/RH): This basically implies suspension of a rating pending further

analysis of a material change in the fundamentals of the company.

Disclaimer

The purpose of producing this report is to present a general view on the company/economic sector/economic subject under research, and not to recommend a buy/sell/hold for

any security or any other assets. Based on that, this report does not take into consideration the specific financial position of every investor and/or his/her risk appetite in relation

to investing in the security or any other assets, and hence, may not be suitable for all clients depending on their financial position and their ability and willingness to undertake

risks. It is advised that every potential investor seek professional advice from several sources concerning investment decision and should study the impact of such decisions on

his/her financial/legal/tax position and other concerns before getting into such investments or liquidate them partially or fully. The market of stocks, bonds, macroeconomic or

microeconomic variables are of a volatile nature and could witness sudden changes without any prior warning, therefore, the investor in securities or other assets might face

some unexpected risks and fluctuations. All the information, views and expectations and fair values or target prices contained in this report have been compiled or arrived at by

Aljazira Capital from sources believed to be reliable, but Aljazira Capital has not independently verified the contents obtained from these sources and such information may be

condensed or incomplete. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on the fairness, accuracy, completeness

or correctness of the information and opinions contained in this report. Aljazira Capital shall not be liable for any loss as that may arise from the use of this report or its contents or

otherwise arising in connection therewith. The past performance of any investment is not an indicator of future performance. Any financial projections, fair value estimates or price

targets and statements regarding future prospects contained in this document may not be realized. The value of the security or any other assets or the return from them might

increase or decrease. Any change in currency rates may have a positive or negative impact on the value/return on the stock or securities mentioned in the report. The investor might

get an amount less than the amount invested in some cases. Some stocks or securities maybe, by nature, of low volume/trades or may become like that unexpectedly in special

circumstances and this might increase the risk on the investor. Some fees might be levied on some investments in securities. This report has been written by professional employees

in Aljazira Capital, and they undertake that neither them, nor their wives or children hold positions directly in any listed shares or securities contained in this report during the

time of publication of this report, however, The authors and/or their wives/children of this document may own securities in funds open to the public that invest in the securities

mentioned in this document as part of a diversified portfolio over which they have no discretion. This report has been produced independently and separately by the Research

Division at Aljazira Capital and no party (in-house or outside) who might have interest whether direct or indirect have seen the contents of this report before its publishing, except

for those whom corporate positions allow them to do so, and/or third-party persons/institutions who signed a non-disclosure agreement with Aljazira Capital. Funds managed by

Aljazira Capital and its subsidiaries for third parties may own the securities that are the subject of this document. Aljazira Capital or its subsidiaries may own securities in one or more

of the aforementioned companies, and/or indirectly through funds managed by third parties. The Investment Banking division of Aljazira Capital maybe in the process of soliciting

or executing fee earning mandates for companies that is either the subject of this document or is mentioned in this document. One or more of Aljazira Capital board members or

executive managers could be also a board member or member of the executive management at the company or companies mentioned in this report, or their associated companies.

No part of this report may be reproduced whether inside or outside the Kingdom of Saudi Arabia without the written permission of Aljazira Capital. Persons who receive this report

should make themselves aware, of and adhere to, any such restrictions. By accepting this report, the recipient agrees to be bound by the foregoing limitations.

Asset Management | Brokerage | Corporate Finance | Custody | Advisory

Head Office: King Fahad Road, P.O. Box: 20438, Riyadh 11455, Saudi Arabia، Tel: 011 2256000 - Fax: 011 2256068

Aljazira Capital is a Saudi Investment Company licensed by the Capital Market Authority (CMA), license No. 07076-37