Hints and Tips for Business Current Accounts

advertisement

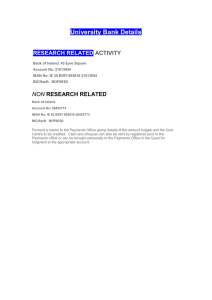

Hints and tips to reduce fees and service charges Ever changing technology impacts on the way we all live and work. It has also changed the way we operate and the way in which you can access and undertake your day to day banking. The following hints and tips could potentially reduce the fees and service charges on your account and you should consider these carefully. You can also find out more information about the digital banking solutions available to you on our website : www.danskebank.co.uk/busapp For your ease of use we have separated these hints and tips into the different migrations, which you can access using the links below : Small Business to Large Business Large Business to Small Business Small Business to Large Business Hint and Tip Why? Instead of sending a cheque to your supplier for a payment, why not ask for their Bank details (sort code and account number) and send them a payment via Business eBanking If you issue invoices, include your sort code and account number on the invoice and ask to be paid electronically Pay your utility bills and other regular payments by Direct Debit or Standing Order. A cheque costs 82p while a Faster Payment via Business eBanking costs 40p or 70p You could reduce other costs, such as postage and stationery A lodgement costs 72p (with additional charges for cash and cheques lodged) while an automated credit costs 40p Cleared funds will be paid directly to your account improving your cash flow A cheque costs 82p while Direct Debit and Standing Order payments cost 40p You could reduce other costs, such as postage and stationery Some utility providers offer discounts for electronic payments If you collect regular payments from your customers you could establish your business as a Direct Debit originator. (Lending criteria, set-up fees and terms and conditions apply.) If you withdraw small amounts of cash at our Branch counters (such as for Petty Cash), why not use one of our business debit cards at our cash machines. You can also use this card to make payments at retailers and online. Cash withdrawal at a branch counter costs 82p plus £1.32 per £100 withdrawn while cash machine withdrawals cost 40p Use the cash drop facility at our branches when lodging cash Save time waiting at the branch counter If you accept payments by cheque or cash why not apply for Merchant Acquiring services to accept payments by card. (Set-up fees and terms and conditions apply.) A lodgement costs 72p (with additional charges for cash and cheques lodged) while an automated credit costs 40p Cleared funds will be paid directly to your account improving your cash flow Improved security with no cash being held on your business premises Using the Danske Mobile Business App* or Danske Tablet Business App* while on the go, or using our Business eBanking service. (*You must be registered for Business eBanking to use Danske Mobile Business App and Danske Tablet Business App) A lodgement costs 72p (with additional charges for cash and cheques lodged) while an automated credit costs 40p Cleared funds will be paid directly to your account improving your cash flow Provides ease of access to your accounts providing an overview and transaction details Signing up to the notification service means you could receive text or email alerts on your balance, reducing costs associated with contacting or visiting your branch Large Business to Small Business Hint and Tip Why? Instead of sending a cheque to your supplier for a payment, why not ask for their Bank details (sort code and account number) and send them a payment via Business eBanking If you issue invoices or receive regular subscriptions, advise the payer of your sort code and account number and ask to be paid electronically Pay your utility bills and other regular payments by Direct Debit or Standing Order. A cheque costs 82p while a Faster Payment via Business eBanking is free You could reduce other costs, such as postage and stationery A lodgement costs 72p (with additional charges for cash and cheques lodged) while an automated credit is free Cleared funds will be paid directly to your account improving your cash flow A cheque costs 82p while Direct Debit and Standing Order payments are free You could reduce other costs, such as postage and stationery Some utility providers offer discounts for electronic payments If you collect regular payments from your customers you could establish your business as a Direct Debit originator. (Lending criteria, set-up fees and terms and conditions apply.) If you withdraw small amounts of cash at our Branch counters (such as for Petty Cash), why not use one of our business debit cards at our cash machines. You can also use this card to make payments at retailers and online. Cash withdrawal at a branch counter costs 82p plus £1.32 per £100 withdrawn while cash machine withdrawals are free Use the cash drop facility at our branches when lodging cash Cash lodged at a branch counter costs 82p per £100 but costs 62p per £100 at a cash drop ; Cheques lodged at a branch counter cost 72p but cost 51p at a cash drop Save time waiting at the branch counter If you accept payments by cheque or cash why not apply for Merchant Acquiring services to accept payments by card. (Set-up fees and terms and conditions apply.) Using the Danske Mobile Business App* or Danske Tablet, Business App* while on the go, or using our Business eBanking service. (*You must be registered for Business eBanking to use Danske Mobile Business App and Danske Tablet Business App) A lodgement costs 72p (with additional charges for cash and cheques lodged) while an automated credit is free Cleared funds will be paid directly to your account improving your cash flow A lodgement costs 72p (with additional charges for cash and cheques lodged) while an automated credit is free Cleared funds will be paid directly to your account improving your cash flow Improved security with no cash being held on your business premises Provides ease of access to your accounts providing an overview and transaction details Signing up to the notification service means you could receive text or email alerts on your balance, reducing costs associated with contacting or visiting your branch