São Paulo, 04 de agosto de 2010

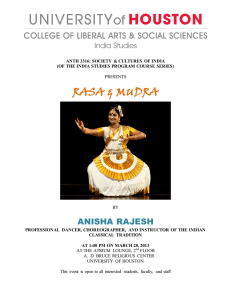

advertisement

Earnings Release Release de Resultados 1Q16 4T10 São Paulo, May 16th, 2016 Banco Sofisa S.A. (SFSA4), a multiple bank specializing in originating credit o small and medium enterprises, announces today its results for the first quarter of 2016 (1Q16). Except where stated otherwise, all operating and financial information is in Brazilian real and presented on a consolidated basis, in accordance with Brazilian Corporate Law. Highlights Net Income in 1Q16 of R$8.4 mn; Basel Ratio (100% Tier 1) of 23.5%; Cash of R$ 1,195.9 mn; 95.8% classification credit portfolio of the ratings of AA-C. Reduction of R$3.7 in expenses for doubtful accounts in 1Q16 compared to 4Q15; Message from the CEO The first quarter of the year was marked by the deepening of Brazil’s recession, which began at the end of 2014. Consequently, we maintained a highly conservative credit policy and continued not prioritizing loan portfolio growth, at least while the current situation lasts. The Bank generated Income before Taxes and Minority Interest in line with the healthy results of the previous year, although Income and Social Contribution Taxes substantially reduced Net Income, mainly due to the impact of the exchange variations. However, this impact may even out as the year goes on. We will continue to focus on maintaining the good quality indicators of our loan portfolio and high level of capitalization, exemplified by a Basel III ratio of 23.5% and an excellent free cash level of R$1.2 billion. The public tender offer by our controlling shareholder continues to move ahead in line with the normal procedures associated with such offers. Alexandre Burmaian Chief Executive Officer 1Q16 Earnings Conference Call th May 17 , 2016 PORTUGUESE 10:00 a.m. (NY) / 11:00 a.m. (Brasilia) Dial-in: +55 (11) 2188-0155 Code: Banco Sofisa www.sofisa.com.br/ir Investor Relations +55 (11) 3176-5836 / 5834 ri@sofisa.com.br Plinio de Lucca Junior Executive Board of Corporate Governance, Risks and IR Márcio do N. Miguel IR Manager 1 1Q16 4T10 Earnings Release Release de Resultados Main Indicators R$ millions (except where indicated) 1Q16 4Q15 1Q15 1Q16/4Q15 (1) 1,195.9 1,047.8 1,185.6 14.1% 0.9% Loan Operations(2) (A) Funding (B) 1,839.1 1,918.1 1,897.0 -4.1% -3.1% 3,398.9 3,152.0 2,996.7 7.8% 13.4% Total Deposits 3,067.5 2,843.0 2,366.5 7.9% 29.6% Balance Sheet Free Cash 1Q16/1Q15 Loan Operations / Funding Index (A/B) 54.1% 60.9% 63.3% -6.8 p.p. -9.2 p.p. Shareholders' Equity (C) 711.4 691.0 675.2 3.0% 5.4% Leverage (A/C) 2.6 2.8 2.8 1Q16 4Q15 1Q15 61.9 56.6 5.2 4.8 Personnel Expenses (16.7) Other Administrative Expenses (13.1) Results Result from Financial Intermediation Income from Services Provided Employees profit sharing -6.9% -8.0% 1Q16/4Q15 1Q16/1Q15 32.7 9.3% 89.2% 3.7 9.3% 40.3% (16.5) (12.7) 1.6% 31.8% (13.2) (13.5) -0.7% -3.0% (4.2) (1.8) (3.9) 138.5% 9.1% 8.4 19.6 21.5 -57.3% -61.0% 1Q16 4Q15 1Q15 0.06 0.14 0.16 137,747 137,747 137,747 - - 5.16 5.02 4.90 3.0% 5.4% Dividends + Net Interest on Equity - 21.7 - -100.0% - Dividends + Net Interest on Equity per share | (R$) - 0.16 - -100.0% - 82.9% 66.7% 1Q16/4Q15 1Q16/1Q15 Net Income Shares Net Income per Share (R$) Number of Shares Outstanding | (thousands) Asset Value per Share | (R$) Market Value Eficiency / Profitability (%) 516.6 282.4 309.9 1Q16 4Q15 1Q15 1Q16/4Q15 -57.3% 1Q16/1Q15 -61.0% ROAE 4.8% 11.4% 12.9% -6.6 p.p. -8.1 p.p. ROAA 0.8% 1.8% 2.2% -1.0 p.p. -1.4 p.p. 7.1% 8.1% 4.6% -1.0 p.p. 2.5 p.p. 43.9% 44.3% 46.7% -0.4 p.p. -2.8 p.p. 23.5% 21.0% 21.2% 2.5 p.p. (3) Net Interest Margin Efficiency (3) Basel Ratio Credit Portfolio Quality (%) 1Q16 Provision for Loan Losses / Loan Operations(2) (4) Delinquency Cred. w/more than 90 days / Loan Oper. (1) (2) 1Q15 1Q16/4Q15 2.3 p.p. 1Q16/1Q15 3.2% 3.3% 3.9% -0.1 p.p. -0.7 p.p. 0.8% 0.9% 1.0% -0.1 p.p. -0.2 p.p. Cash and cash equivalents + short - term investments + securities - open market funding. | www.sofisa.com.br/ir 4Q15 (2) Excludes provisions for NPL . 2 Earnings Release Release de Resultados 1Q16 4T10 Operating Highlights | Total Loan Portfolio (R$mn) Due to the economic slowdown in the period and consequent caution in lending, the loan operation totaled R$ 1,839.1 mn at the end of 1Q16, representing the decrease of 4.1% in relation to 4Q15 and of 3.1% over the same period last year. 1,897.0 1Q15 1,918.1 4Q15 1,839.1 1Q16 The credits demonstrate satisfactory dilution, and the largest debtor represented only 1.4% of Credit Operations and the largest sectoral participation represented 16.6% at the end of 1Q16. About the distribution operations by maturities, the predominance of operations remained in the short term, with 86.6% of the operations has a term of up to 1 year. R$ millions Portfolio Breakdown | (R$mn) 1Q16 4Q15 1Q15 Overdraft-Secured Account 564.4 603.9 566.7 -6.5% -0.4% Working Capital 946.3 990.2 1,021.8 -4.4% -7.4% (1) 328.3 323.5 305.7 1.5% 7.4% 1,839.0 1,917.6 1,894.2 -4.1% -2.9% 0.1 0.5 2.8 -73.8% -95.3% 1,839.1 1,918.1 1,897.0 -4.1% -3.1% Others Subtotal Acquired Financings Total 1Q16/4Q15 1Q16/1Q15 (1) Includes: discounted bonds, import financing and export advances to depositors, check company, leases, vehicles, payroll loans, CDC, other receivables and exchange. www.sofisa.com.br/ir 3 1Q16 4T10 Earnings Release Release de Resultados Collateral Breakdown | (R$ mn) R$ millions 1Q16 Trade Notes Receivable 4Q15 % of Total % of Total 1,300.4 70.7% 1,398.8 72.9% Pledge on Real Estate, Vehicles and Equipments 145.9 7.9% 147.2 7.7% Rent and Property Receivables 139.8 7.6% 141.2 7.4% Investments 66.1 3.7% 52.4 2.7% Post-dated Checks 21.0 1.1% 10.1 0.5% Warrants and Lien 9.3 0.5% 9.6 0.5% Overseas Companies Withdrawals 9.2 0.5% 9.6 0.5% Joint Obligations from other Financial Institutions 6.2 0.3% 5.5 0.3% Agreements and Blocked Accounts 5.1 0.3% 5.8 0.3% Others 0.2 0.0% 0.7 0.0% Subtotal 1,703.2 Promissory Notes 92.6% 135.9 Total 1,780.9 7.4% 1,839.1 92.8% 137.2 100.0% 1,918.1 7.2% 100.0% Loan Operations | Delinquency and Provisions for Losses The pulverization linked with our selectivity in lending, resulted in maintaining the level of our reserves even in this scenario of greater insolvency of companies. 1Q16 4Q15 Own Portfolio Provision Credits "AA - C" 28.5 47.7% 1,833.9 29.9 46.8% 31.2 52.3% 84.2 34.0 53.2% 1,839.1 59.7 100.0% 1,918.1 63.9 100.0% - 3.2% - - 3.3% - - 1.7% - - 1.8% - - 0.8% - - 0.9% - (2) Overdue More Than 90 Days(1)/Credit Portfolio (2) (1) Considers credits and installments overdue than 90 days.| (2) % of Total 77.1 Provision/Credit Portfolio (2) Provision D-H/Credit Portfolio Provision 1,762.0 Credits "D - H" Total Own Portfolio % of Total Including credit assignments with recourse. The impact of the strong management of the company, due to the quality protection strategy of assets, is evident when checked the evolution of indicators of default and coverage in the last 12 months. In relation to the loan portfolio in 1Q16 the provisions represented 3.2% (3.9% in 1Q15), provisions for loans loss with D-H ratings represented 1.7% (2.3% in 1Q15) and overdue loans over 90 days amounted to 0.8% (1.0% in 1Q16). Maintains a high coverage ratio, which was 432.6% in the 1Q16 and 394.0% in the 1Q15. 2, 700. 0 5. 0% 3.9% 3.9% 300. 0 3.9% 3.3% 3.2% 550. 0% 432.6% 4. 0% 2, 500. 0 2.3% 2.4% 1.0% 1.0% 250. 0 2.4% 3. 0% 1.8% 2, 300. 0 1.3% 0.9% 1.7% 0.8% 394.0% 394.9% 450. 0% 307.1% 365.4% 2. 0% 200. 0 350. 0% 150. 0 250. 0% 100. 0 150. 0% 1. 0% 2, 100. 0 0. 0% 1, 900. 0 - 1. 0% - 2. 0% 1, 700. 0 1,897.0 1,829.6 1,889.7 2Q15 3Q15 1,918.1 50. 0 1,839.1 1, 500. 0 - 3. 0% - 4. 0% 1Q15 4Q15 1Q16 PORTFOLIO (R$ MM) OVERDUE CREDITS > 90 DAYS/PORTFOLIO PROVISION D-H/PORTFOLIO PROVISION/PORTFOLIO www.sofisa.com.br/ir 50. 0% 73.4 71.1 73.5 63.9 59.7 1Q15 2Q15 3Q15 4Q15 1Q16 - - 50. 0% PROVISION COVERAGE RATIO (OVERDUE CREDITS > 90 D / PROVISION) 4 Earnings Release Release de Resultados 1Q16 4T10 Shareholders’ Equity The Bank’s Shareholders’ Equity stood at R$711.4 mn in 1Q16, as the following table shows: R$ millions Position as of 12.31.2015 691.0 MTM Adjustments 12.0 Results of the period 8.4 Position as of 03.31.2016 711.4 Funding Funding totaled R$3.4 bn in 1Q16, representing the increase of 7.8% compared to 4Q15 and of 13.4% compared to 1Q15. R$ millions Funding 1Q16 Demand Deposits Time Deposits + Agribusiness, Financial and Real Estate Letters of Credit Up to 1 year 4Q15 1Q15 1Q16/4Q15 1Q16/1Q15 64.9 95.6 132.0 -32.1% 1,803.2 1,568.7 1,455.8 14.9% 23.9% 1,167.9 1,024.4 1,035.3 14.0% 12.8% More than 1 year -50.8% 635.3 544.3 420.5 16.7% 51.1% Interbank Deposits 108.9 106.4 50.9 2.3% 113.9% Open Market Funding Foreign Borrowings and Onlending Obligations(1) 163.4 148.2 208.6 10.3% -21.7% 168.0 160.9 421.6 4.4% -60.2% Time Deposit with Special Guarantee ("DPGE") 1,090.5 1,072.2 727.8 1.7% 49.8% 3,398.9 3,152.0 2,996.7 7.8% 13.4% Total (1) Includes foreign loans and onlendings, promissory notes, repo, linked notes and fixed rate notes. Ratings The credit-rating agencies maintained the ratings assigned to Banco Sofisa, reflecting the excellent quality of its assets, the conservative policy adopted by its Management, its vast expertise in the SME segment, as well as its healthy liquidity and capitalization. Aa3.br/Br-1 (domestic) September 2015 www.sofisa.com.br/ir A-(bra): Long Term Low Risk: Mid Term F2(bra): Short Term Disclosure: Excellent December 2015 April 2016 5 Earnings Release Release de Resultados 1Q16 4T10 Annex I – Consolidated Balance Sheet R$ thousands ASSETS 1Q16 4Q15 1Q16/4Q15 1Q16/1Q15 1Q15 % Change % Change Cash and cash equivalents 43,852 27,664 96,691 Interbank investments 221,280 135,624 123,873 63.2% 78.6% Securities and derivatives 942,789 470,661 250,057 100.3% 277.0% 58.5% -54.6% Interbank accounts 24,021 16,524 61,595 45.4% -61.0% Lending operations 1,472,417 1,554,312 1,531,167 -5.3% -3.8% Leasing operations Other credits 915 157,238 960 174,236 1,210 180,127 -4.7% -9.8% -24.4% -12.7% Other assets 8,375 7,618 4,798 9.9% 74.6% 2,870,887 203,000 2,387,599 127,523 2,249,518 161,899 20.2% 59.2% 27.6% 25.4% Securities and derivatives 670,588 1,011,606 896,211 -33.7% -25.2% Lending operations Leasing operations 237,876 515 229,779 421 222,247 862 3.5% 22.3% 7.0% -40.3% Other credits 338,008 346,142 306,532 -2.3% 10.3% 20,281 1,470,268 21,535 1,737,006 23,008 1,610,759 -5.8% -15.4% -11.9% -8.7% Current Assets Interbank investments Other assets Long-Term Assets Investiments Property and equipment Deferred Permanent Assets Total Assets LIABILITIES AND SHAREHOLDERS' EQUITY Deposits Money market funding Funds from acceptance and issuance of securities 907 907 907 0.0% 0.0% 35,428 61 35,655 71 36,630 104 -0.6% -14.1% -3.3% -41.3% 36,396 36,633 37,641 -0.6% -3.3% 4,377,551 4,161,238 3,897,918 5.2% 12.3% 1Q16 4Q15 1Q15 1,675,833 127,266 1,491,123 60,314 1,273,873 148,158 12.4% 111.0% 1Q16/4Q15 1Q16/1Q15 % Change % Change 31.6% -14.1% 197,898 223,144 458,627 -11.3% -56.8% Interbank and Interdepartmental accounts Borrowings 61,959 77,007 83,850 83,696 28,671 128,766 -26.1% -8.0% 116.1% -40.2% Onlendings 55,983 3,373 22,911 1559.7% 144.3% 8 103,481 2,258 117,723 892 62,980 -99.6% -12.1% -99.1% 64.3% 2,299,435 1,188,271 2,065,481 1,104,432 2,124,878 818,407 11.3% 7.6% 8.2% 45.2% Money market funding 36,123 87,849 60,490 -58.9% -40.3% Funds from acceptance Borrowings 41,214 - 39,922 1,276 53,147 8,262 3.2% -100.0% -22.5% -100.0% Derivatives Other payables Current Liabilities Deposits Onlendings Other payables Long-term Liabilities Deferred income Shareholders' Equity Minority shareholders' Equity Total liabilities and Shareholders' Equity www.sofisa.com.br/ir 58,789 47,802 -100.0% -100.0% 100,543 1,366,151 - 112,463 1,404,731 109,340 1,097,448 -10.6% -2.7% -8.0% 24.5% 89 98 76 -9.2% 17.1% 675,221 295 3.0% -716.9% 5.4% 61.0% 3,897,918 5.2% 12.3% 711,401 475 4,377,551 691,005 (77) 4,161,238 6 Earnings Release Release de Resultados 1Q16 4T10 Annex II – Consolidated Income Statement R$ thousands 1Q16 Lending operations Leasing operations Securities operations Derivatives Foreign-exchange operations Sales operations or transfer of financial assets Income from financial intermediation Funding operations Borrowing and onlending operations Leasing operations Sales operations or transfer of financial assets Allowance for loan losses Expenses on financial intermediation Gross profit from financial intermediation Income from services provided Personnel expenses Other administrative expenses Tax expenses Other operating income Other operating expenses Other operating income (expenses) Income from operations Non-operating result Income before taxes and minority interest Income and social contribution taxes Provision for Income and social contribution taxes Deferred taxes Employees profit sharing Minority interest in controlled companies Net income www.sofisa.com.br/ir 4Q15 1Q16/4Q15 % Change 1Q15 1Q16/1Q15 % Change 102,295 392 57,528 5,439 5,397 10 171,061 (103,338) (1,019) (327) (4,508) (109,192) 61,869 5,241 (16,723) 108,920 1,156 50,963 (7,771) 1,991 27 155,286 (96,025) 6,677 (1,086) (8,249) (98,683) 56,603 4,794 (16,452) -6.1% 103,058 -66.1% 2,688 12.9% 35,191 -170.0% 10,192 171.1% 23,065 -63.0% 122 10.2% 174,316 7.6% (77,659) -115.3% (60,781) -69.9% (2,538) -45.4% (640) 10.6% (141,618) 9.3% 32,698 9.3% 3,735 1.6% (12,689) (13,139) (6,717) 4,083 (7,815) (35,070) 26,799 133 26,932 (14,355) (11,884) (2,471) (4,231) 16 (13,228) (5,508) 6,164 (8,774) (33,004) 23,599 232 23,831 (2,741) 2,071 (4,812) (1,774) 273 -0.7% 21.9% -33.8% -10.9% 6.3% 13.6% -42.7% 13.0% 423.7% -673.8% -48.6% 138.5% -94.1% (13,549) (4,043) 25,984 (6,877) (7,439) 25,259 (351) 24,908 (2,315) (3,794) 1,479 (3,879) 2,747 -3.0% 66.1% -84.3% 13.6% 371.4% 6.1% -137.9% 8.1% 520.1% 213.2% -267.1% 9.1% -99.4% 8,362 19,589 -57.3% 21,461 -61.0% 2015 -0.7% 413,304 -85.4% 5,673 63.5% 168,680 -46.6% 37,148 -76.6% 74,736 -91.8% 281 -1.9% 699,822 33.1% (337,586) -98.3% (152,771) -87.1% (5,332) (10,842) 604.4% (24,711) -22.9% (531,242) 89.2% 168,580 40.3% 17,176 31.8% (57,231) 2014 2015/2014 % Change 341,295 51,072 102,343 15,419 36,282 1,513 547,924 (256,354) (47,827) (49,375) (7) (36,893) (390,456) 157,468 13,908 (49,999) 21.1% -88.9% 64.8% 140.9% 106.0% -81.4% 27.7% 31.7% 219.4% -89.2% 154785.7% -33.0% 36.1% 7.1% 23.5% 14.5% (54,510) (18,679) 52,590 (13,601) (74,255) 94,325 (2,522) 91,803 (1,129) (11,748) 10,619 (11,023) 4,256 (53,818) (22,203) 32,145 (7,256) (87,223) 70,245 (2,666) 67,579 (21,915) (11,701) (10,214) (10,563) 959 1.3% -15.9% 63.6% 87.4% -14.9% 34.3% -5.4% 35.8% -94.8% 0.4% -204.0% 4.4% 343.8% 83,907 36,060 132.7% 7 1Q16 4T10 Earnings Release Release de Resultados Annex III – Consolidated Cash Flow Statement R$ thousands 1Q16 Adjusted Net Income Net Income Provision for Loan Losses Deferred tax Depreciation and Amortization Exchange Variation of Cash and Cash Equivalents Changes in Assets and Obligations (Increase) Decrease in Short-Term Interbank Investments (Increase) Decrease in Securities and Derivatives Financial Instruments (Increase) Decrease in Interbank Accounts (Increase) Decrease in Credit, Leasing and Other Credit Operations (Increase) Decrease in Other Credit and Other Assets Income tax and social contribution paid Increase (Decrease) in Deposits Increase (Decrease) in Money Market Funding 4Q15 2015 16,794 13,197 111,755 8,362 19,589 83,907 4,508 8,249 24,711 (15,470) 802 829 3,137 3,122 478 (2,797) (185,305) (160,614) 486,384 (160,419) (119,076) (406,910) (347,245) (29,388) 59,341 83,294 69,241 (26,206) 68,715 25,628 34,403 4,682 2,890 3,187 268,549 225,103 333,356 15,226 (112,577) (41,922) 2014 76,317 36,060 36,893 3,364 (100,080) (55,992) (41,131) (1,768) (234,865) (4,106) 13,649 448,491 (38,304) Increase (Decrease) in Resources from Securities Issued (23,954) (290,154) (52,866) 66,345 Increase (Decrease) in Borrowing and Onlending Obligations Increase (Decrease) in Derivative Financial Instruments Increase (Decrease) in Other Obligations Increase (Decrease) in Deferred Income Exchange Variation of Cash and Cash Equivalents Interest on Equity Dividends Payments Minority interest in controlled companies Capital Decrease OPERATING ACTIVITIES - Net Cash Generated (Used) Investments PP&E Disposal Deferred (14,143) (2,250) (29,052) (9) (3,122) 552 17,272 (575) 10 (21,247) (106) 62,132 (16,000) (147) 10,400 (1,343) 11 (84,655) 1,818 39,659 34 (25,500) (4,256) (73,550) (1,701) 43 (155,193) (1,223) (10,699) (176) (6,000) (24,000) (5,108) (50,000) (23,763) 39,374 1,079 - (565) (1,332) (1,658) 40,453 16,707 9,068 (75,208) 16,690 56,263 72,970 47,195 56,263 131,471 56,263 114,781 131,471 16,707 9,068 (75,208) 16,690 INVESTMENT ACTIVITIES - Net Cash Generated (Used) CASH AND EQUIVALENTS INCREASE (DECREASE) Cash and Cash Equivalents at the Beginning of the Period Cash and Cash Equivalents at the End of the Period CASH AND CASH EQUIVALENTS NET INCREASE (DECREASE) www.sofisa.com.br/ir 8