history, development and reorganization

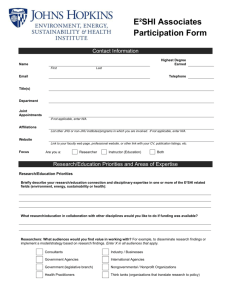

advertisement