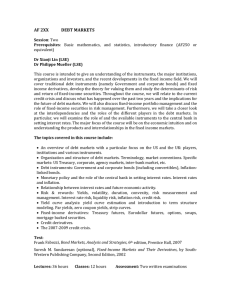

. Classifications: Financial Instruments, Functional Categories, Maturity

advertisement