AMP FLS AMP Capital Dynamic Markets PDF Factsheet

advertisement

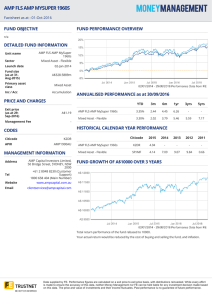

AMP FLS AMP CAPITAL DYNAMIC MARKETS Factsheet as at : 01-Oct-2016 FUND OBJECTIVE FUND PERFORMANCE OVERVIEW The Fund aims to provide a total return (income and capital growth), before costs and before tax, of 4.5% pa above the performance benchmark, on a rolling 5 year basis. DETAILED FUND INFORMATION AMP FLS AMP Capital Dynamic Markets Unit name Sector Mixed Asset - Aggressive Launch date 03-Mar-2014 Fund size (as at 31Aug-2015) A$14.2307m Primary asset class Mixed Asset Inc / Acc Exit price (as at 29Sep-2016) A$1.14 Management Fee Tel Website Email 6m 1yr 3yrs 5yrs AMP FLS AMP Capital Dynamic Markets -0.72% 2.36 1.94 0.62 - - Mixed Asset - Aggressive 2.47% 3.19 4.87 5.69 6.35 9.30 HISTORICAL CALENDAR YEAR PERFORMANCE AMP FLS AMP Capital Dynamic Markets KONJ Mixed Asset - Aggressive Citicode 2015 2014 2013 2012 2011 KONJ 0.58 - - - - SP:IMG 4.74 7.95 16.96 12.80 -5.67 AMP1935AU MANAGEMENT INFORMATION Address 3m - CODES APIR YTD Accumulation PRICE AND CHARGES Citicode ANNUALISED PERFORMANCE as at 30/09/2016 FUND GROWTH OF A$10000 OVER 3 YEARS AMP Capital Investors Limited, 50 Bridge Street, SYDNEY, NSW 2000 +61 2 8048 8230 (Customer Support) 1800 658 404 (Main Number) www.ampcapital.com.au clientservices@ampcapital.com Total return performance of the fund rebased to 10000. Your actual return would be reduced by the cost of buying and selling the fund, and inflation. Data supplied by FE. Performance figures are calculated on a exit price to exit price basis, with distributions reinvested. While every effort is made to ensure the accuracy of this data, neither Money Management nor FE can be held liable for any investment decision made based on this data. The price and value of investments and their income fluctuates. Past performance is no guarantee of future performance. AMP FLS AMP CAPITAL DYNAMIC MARKETS Factsheet as at : 01-Oct-2016 ASSET ALLOCATION Key Rank Asset Class % of Fund (31-Aug-2015) 1 International Equities 41.08 2 Money Market 30.05 3 Australian Equities 10.80 4 International Property Shares 5.91 5 Others 5.09 6 Australian Fixed Interest 5.00 7 Global Fixed Interest 2.07 REGIONAL BREAKDOWN % of Fund (31-Aug-2015) Key Rank Region 1 International 49.06 2 Money Market 30.05 3 Australia 15.80 4 Others 5.09 SECTOR BREAKDOWN Key Rank Asset Class % of Fund (31-Aug-2015) 1 International Equities 46.61 2 Money Market 17.01 3 Australian Equities 14.69 4 Others 8.95 5 Property 5.85 6 Fixed Interest 4.91 7 International Fixed Interest 1.98 Data supplied by FE. Performance figures are calculated on a exit price to exit price basis, with distributions reinvested. While every effort is made to ensure the accuracy of this data, neither Money Management nor FE can be held liable for any investment decision made based on this data. The price and value of investments and their income fluctuates. Past performance is no guarantee of future performance.