E" ,re ag affiliates Included?. nym O NO a

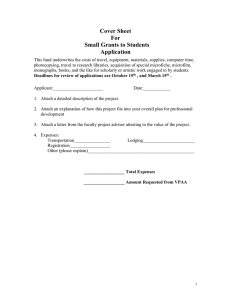

advertisement

2001

Under section 8!Q7(e), 527, or 4947(aX1) of the Internal Revenue Code (except black long

benefit trust or private foundation)

Qepsrtment of the Treasury

tnte~rred Revenue service

Name change

The organization may have to use a copy of this return to satisfy state reporting

0 5 - 01 . 2x01 . and endirn

Please C Name a# organbAtion

LOYAL ORDER OF MOOSE 576 ~'-'N~

Primer

Number and street (of P.O. box if nom Is not delivated to street address} aoor,r

Final return

specift

A Fog the 2001 calendar year, or tax year beginning

8 Check If applicable:

Q aaaresscnange

Amended return

Applicatib. pending

a,

OMB No. 1sas-oae7

'Retehn of organization Exempt From Income Tax

F`

2400 NORTH sTxTE xwY 3

City or town, state or country, arid ZIP + 4

NORTH VERNON,

IN 47265

Q other t1 b-

~ Soc~an':0"

and

('Q ~xma~ept

mssmiscatt~acompte~easd~eaulsa(Fa~a9sorir`~ilo-ExJ .

j OroRlYPe(eheGcoNyr-)

04-30,2002

D EmpbyerldenWiraHan 1neder

35-4312169

ETeiephonenanber

PI' Qg 501(e)( ~( ) A(insertrp.)

U 491T(aj('1) a

x cnacc nece 0- Off the cayarazatka'es growreceipts am normally riot mom thw$M.000. The

527

tioet rimed not Sea reiuriewil hthe IRS; but if the organization received a Farm 994 Package

inthemail.Rshouldfik+areUxnurithaitfinanefaldaia.5amietequUasaeomPletenhrn

Ha~C we not appOeable to section 527 organisations.

LV-% I- *%,.t- agta req- taasfl~ates?

W

JO.

HM ff -Yes,' enter number of affiliates

D Y- MU-

E" ,re ag af tes

filia

Included?.

(f-No,-attach a fit. See

ova

nu6n9?

H" :=====

f

Entix4-dMRGEN 1- 0002

nym O NO

~ 1Resc Q !b

M Check t 0 if the organ¢ation is riot required

L GroSS receipts. Add lines sb, Sb, sb, and 1ob co One 32 >

to attach Sch. B (Form 590, 990-E2. or 990-PF).

Expenses,

and

C

in

Net

Assets

or

Fund

Balances

(See specific Instructions on eye 1s.)

. . . Revenue,

... . . . i Contributions, gifts, grarNs, and similar amounts received:

-"...

a Direct public support . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Is

6 , 272

b Indirect pubic support . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1b

C GOYB1'IIIYIe1'it contributions (grants) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

IC

d Tots! (add fines 1a through 1t) (cash $

toneash $

~ . . . . . . . . . . . . . . 1d

6,272

6,272

2

2 Program service revernte incki*g govefRxrant fees and contracts (from Part VII, line 93) . . . . . . . . . . . . . .

3

3 Membership dues and assessments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

'870

4 Interest on savings and temporary cash investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

329

. .

. . . . . . . . .

S

5 Dividends and interest from securities . . . . . . . . . . . . . . . . . . . . . . . . . .

fia Gross reins . . . . - - - - . . . . . . . . . , . . . . . . . . . . . . . . . . . . . . .

6a

b Less: rental expenses . . . . . . . . . . . . . . , . . . . . . . . . . . . . . . . . . .

6b

x ..kSr»~

C Net f+2r" income OF (loss) (subtract

6F! from fine Ea) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Vj GCh

s 7 Other investment incorrie (describe 10,

v

(A) Securities

{B} Other

8a Grass amount from safes of assets other

s

than inventory . . . , . . , > . . . . . . . . . . . . . . . . . . .

8a

. . . . . . . . . . .

R

b less: cost or her basis and sales expenses

$b

'; ..

e

SC

C Gain or (loss) (attach schedule) . . . . . . . . . . . . . . . . , * .

tL Not CJ'dtl'E O( (Io!S3) (combine it* SC> COli!'1'k'tS (A) and (B)) . . . . .. .. . . . . . . . . . f . . .. . . . . . . . . . . .

S(J

9 Special events and activities (attach schedule)

a Gross revenue suit '

$

of

co'tri1xidol'IS reported OFI 1im Pdj . . e . . . . s . . . . . . . . . . w . . . . . e . . . .

a"

b Less: direct expenses other than fundraising expenses

. . . . . . . . . . . . . . . .

9b

c Not income or (loss) from special events (subtract line 9b from line 9a) . . . . . . . . . .

10a cps o¬ inventory, less returns and allowances

. . . . . . . . . . . . . . . . .

. 1oa

109 , 063

b less: cast of goods sold , . . . . . . . . . . . . . . . . . . . . . . . . . , . . . . .

lob

5 3 3 5 5'

c Cuss profit or (loss) from sales of inventory (attach schedule) (subtract fine itNb from line t0a) " - - . . . . . . . .

55,708

tt Other revenue (from Pact V11* one i03) . . . . . w . . , . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

t1

12 Total revenue tea lines Id, 2, 3, a> s, sc, 7, ft 9c, 1oc, and 11)

12

68 379

p 14 Management and general (from lina 44, column (C)) . . . . . . . . . . . .

is wnar(frorn line aa, column (o)) . . . . . . . . . . . . . . . . . . .

16 Payments to affiliates (attach schedule) . . . . . .

a

. . . . . . . . . . . .

s 17 Total expenses (act! lines 16 and 44, column (A))

'C8 Excess or (deficit) for the mar (subtract line 17 fin line 12)

.

" Not assets air fund balances at bed of year (**In line 73, column (A))

s 20 Other changes K

in not assets or fund balances (attach explanation) . . . .

1-21 Not assets or fund balms ac end of year (combine yes 1s, is* and

'or Paperwork Reduction Art Notice, see the separate ructions.

/~

1L!

.

. . . . .lRS . 0'5C .

. . . . . .

. . . . . .

. . . . . MAY

. . . . . .

. .

. . . .

. . . . . . . . . . . . . . . . . . . .

. .

' EEn "

14

Is

t6

1?

Is

Z~

2't

- /

94,072

1

C QA~

,,

~

120,071

94,178

Form 990 f2001)

F~

~v (zw' )

S

Page 2

nlerr! of

Functional Expenses

Do not include amours reported on fine

6b, 8b, 9b, 10b, or 16 of Part I.

Grants and allocations

ns. (attach schedule}

(cash $

6 , 9 6 3 noncash $

Specific assistance to individuals (attach schedule)

Benefits paid to or for members (attach schedule) .

Compensation of officers, directors, etc. . . . . . .

Other salaries and wages . . . . . . . . . . . . .

Pension plan contributions . . . . , - - , " - - Other employee benefits . . . . . . . . . . . . .

Payroll taxes . . . . . . . . . . . . . . . . . . .

Professional fundraising, fees . . . . . . . . . . .

Accounting fees . . . . . . . . . . . . . . . . .

Legs! fees . . . . . . . . . . . . . . . . . . . .

Supplies . . . . . . . . . . . . . . . . . . . . .

Telephone . . . . . . . . . . . . . . . . . . . .

Postage and shipping . . . . . . . . . . . . . . .

Occupancy . . . . . . . . . . . . . . . . . . .

Equipment rental and maintenance . . . . . . . .

Prireing and publications . . . . . . . . . . . . .

Travel . . . . . . . . . . . . . . . . . . . . . .

Conferences, conventions, and meetings . . . . .

Interest . . . . . . . . . . . . . . . . . . . . . .

Depreciation, depletion, etc. (attach schedule) . . .

22

23

24

25

26

Z7

29

29

30

31

32

33

&1

35

36

37

38

39

40

41

42

43

All orgadretona must rnnplete caunn (Al. cohsne (e). (c.7. WKI (D) are required for section 501(co) and (4) organizations

and section 4s+7(a(1) nomocempt charitable wets but optional for arms. (see Specific: Instructions on page z t.)

19

)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

a ADVERT

MISC OTHER TAXES

other expenses not covered above ptemizek

b SALES TAX,

e PRIZES

d MISC

e STATE AN NATIONAL DUES

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

,v

~~ ~

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

'J9

40

41

42

43a

43b

43e

Ai3d

43e

TAI fwifonal aqaoes (add lines 22 through 43) . Or~a

44

(B) Program

services

(A) Total

(C)

Management

and general

(D) Fundraising

6 , 963

228

19,175

9 1 246

775

10 , 902

859

1 , 023

15 , 017

3 , 440

1,657

1,569

8,736

343

5469

100

876

7,694

complelling column"). a+ynuese mrab to Ems i3-is .

. ~ 44

94,072

Joint Comes. Check 10- [] it you are following SOP 98-2.

Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services? . . . . . . ~

If Yes," enter (i) the aggregate amount of these joint costs $

: (ii} the amount allocated to Program services $

E]Yes IM Ib

(ill) the amount allocated to Management and general E

; and (iv} the amount allocated to Fundraising $

___ Statement of Program Service Accomplishments (see Specific tr,struceor,s or, Page 24 .)

What is the organization's primary exempt purpose? b- FRATERNALISM

AK organizations must describe their exempt purpose achievements in a clam and concise manner. State the number

of clients served, publications issued, etc. Discuss achievements that are not measurable. (Section 50i(cx3) and (4)

ort,~arwzations and 4947(aXt ) nonexempt charitable trusts must also enter the amount of grams and allocations to others.)

a

THE LODGE UNITES ITS MEMBERS IN THE BONDS OF FR.ATERN

BENEVOLENCE AND CHARITY

.)

for others

(Grants and allocations S

b

(Grants and allocations $

c

(Grants and afbcations S

d

e UaM p~

f Total of

qufroa for so1(c)(3) and

ergs, and 4947(aX1)

; but optional

trusts

services laRach scneawe)

(Grants and allocations $

(GrarMs and avocations $

equal ins 44, column (8), Program services)

EEA

990 (2001

.M(SM11

f-

Page 3

$a~ Sheets

~c

(See Specific Instruc6ons on page 24 .)

Note.~ Where required, attached schedules and amours within the description

column show be for end-of-year amounts only.

4'3

Cash - non-interest-bearing . . . . . . . . . . . . . . . . . . . . . . . . .

46

B

Savings and temporary cash investments . . . . . . . . . . . . . . . . . . .

47 a Accounts receivable . . . . . . . . . . . . . . .

b Less : allowance for doubtful accounts . . . . . .

'

(A)

of yeas

13 , 547

15,000

47a

4m

(B)

End of year

8 , 819

45

46

k ~:

'`

47c

15 , 609

"

JMM

~

4S a

b

49

50

A

s

s

Pledges receivable . . . . . . . . . . . . . . . .

'~4$a

~x>:ox:."

Less : allowance for doubtful accounts . . . . . .

48b

4"c..

Grants receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

49

Receivables from officers, directors, trustees, and key employees

50

(attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

51 a Other notes and bans receivable (attach ;,

schedule . . . . . . . . . . . . . . . . . . . . .

51a

<~~N~>

b Less: allowance for doubtful accounts . . . . . .

51b

. 51c

5. . . . .n

e

t

s

52

Inventories for sale or use

. . . . . . . . . . . . . . . . . . . . . . . . . .

53

Prepaid expenses and deferred charges - - . . . . . . . . . . . . . . . . .

SA

Investments - securities (attach schedule) . . . . . . . " E] Cost [] FMV

55 a Investments - land, buildings, and

~~~

~~

~~~~70

~7

equipment: L70

5~ .

. .

.

.

. .

.

. . .

.

. .

.

.

~

b Less : accumulated depreciation (attach

schedule) . . . . . . . . . . . . . . .

Si

Investments - other (attach schedule) .

57a Land, buildi

basis

, and

b Less : accumulated depreciation (attach

schedule) . . . . . . . . . . . . . . .

ngs

`

a

6

y

e

. . . . . .

. . . . . . .

. . . . . .

55b

. .

57a

. . . . . .

S7b

. . . . . . . . .

236,270

5 , 500

59

Total assess (add fines 45 through 58) (must equal line 74) . . - - - . - - . -

Accounts payable and accrued expenses . . . . . . . . . . . . .

Grants payable . . . . . . . . . . . . . . . . . . . . . . . . . .

Deferred revenue . . . . . . . . . . . . . . . . . . . . . . . . .

Loans from officers, directors, trustees, and key employees (attach

schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

64a Tax-exempt bond liabilities (attach schedule) . . . . . . . . . . .

.,55c:

56

277,079

:yC;sI;G!y;

Other assets (describe

60

61

62

63

53

54

.~'tf

.,:'

rr

58

DEPOSIT

52

4,417

)

250

. . . . . .

. . . . . .

. . . . . .

. . . . . .

. . . . . .

b Mortgages and other notes payable (attach schedule) . . . . . . . . . . . . .

66

Other liabilities (descnbe PMISC UTILITIES ETC

)

s

. .57c~

250

59

307,257

269,484

58

60

61

62

:v

149,413

64a

64b

65

66

Trial amides (add fees 60 through 65) .

66

149,413

Onganizadons that follow SFAS 117, cheek here t

u and complete lines

67 through 69 and lines 73 and 74 .

67

Unrestricted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

N F

68

Temporary restricted . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

68

e u

t n

69

Permanently restricted . . . . . . . . . . . . . . . . . . . . . . . . . . . .

69

:~::<;rF

A

Organizations that do not foRaw SFAS 117, check here b~ and

s B

complete lines 70 through 74.

;~~'

s a

TO

Capital

stack,

truest

principal,

or

cumerk

funds

.

.

.

.

.

.

.

.

.

705

.

.

.

.

.

.

.

.

e I

t a

71

Paid-in or capital surpkis, w land, building, and equipment fund . . . . . . .

71

s n

72

Retained eamings, endownwnt, accumulated incone, a other funds . . . . .

120,071

72

e

73

TaW net assets of fund balances (add fines 67 through 69 OR ones

:

o e

r 5

70 through 72;

. .~.

column (A) must equal One 19; column (B) must equal lire 21) . . . . . . . .

120,071

73

74

Total IiWbiNes and net assets / land balances (add lines 66 and 73) . . . . .

~

269,484

74

Form 990 is available for public inspection and, for some people, serves as die primary or sole source of information about a

particular organization. How the public perceives an organization in such cases may be determined by the information presented

on its return. Therefore, please make sure the return is complete and accurate and fully describes, in Part III, the organization's

programs and accomplishments.

EEA

18 , 553

152 , 077

1,015

171,645

171,645

t

HeconcillaNOn of Revenue per Audited

Financial Statements with Revenue peir

Return (see specific instructions, page 2s.)

Total revenue, galas, and other support

per audited financial statements

b

Amounts included on fine a but not on

line 12, Form 990:

(1)Net unrealized gates

on investrrleMS . . :

(2) Donated services

and use of facilities

(3) Recoveries of prior

year grants . . . . $

(4) Other (specify) :

a

68,17

~.. ,.. .:..~;:, .. .

a

b

(1)

(2)

(3)

(4)

i

Add amours on fines (1) through (4)

e

d

(2) Other (specify):

e

TAI revenue per fine 12. Form 990

e

.

t

68,179

^'~`<~"~< :

::?e

...

.

Total expenses and losses per

audited financial statements . . . . .

Amours included on line a but not

on line 17, Form 990 :

Donated services

and use of facilities

Prior year adjustments

reported on firm 20,

Form 990 . . . . . .

Losses reported on

line 20, Form 99o

Other (specify):

4

' .94 . 0'7

.> wYr:- ~ ~ . : ;

Y"Win. S

L

~k. .. . .

S

Line a minus line b

. . . . . . . . . ~

Amounts included on fine 12,

Form 990 but not on line a:

(1) Investment expenses

not included on line

6b, Form 990 . . . . S

Add amounts on lines (1) and (2) .

Reconciliation of Expenses per Audited

Financial Statements with Expenses per

Return

c

d

De

Add amounts on ones (1) through (4)

Line a minus fine b

94,072

. . . . . . . . .

An-curds included on line 17,

form 990 but not on line a:

-'. < = 3 '`~

(1) Invesbrient expenses

?<:" :s:~f .:

riot ceded on line

bb, Form 990 . . . . ~

~i5~^S.

~:~<<,yf

:~l

(2) Other (specify):

,: ~:r. ...,::~>.c.~: . .......:.. ..... :. .: .:.. . ...::.

........ .

d

a

Add amounts on dace (1) and (2) .

. .

.. . .. ~.~........ ......:,.

. . . ..,.,-,.

. .. . . ..........,.... .. :. ... ...:.:

..

d

~

Tots! expenses per fine 17, Form 990

(fine c plus line d) .

t e

68, 179

(line e plus fine d) .

~ e

94,072

List O} Officers, Directors, Trustees, and Key Employees (List each one even if not compensated; see Specific

JMW

75

Did any officer, director, trustee, or key employee receive aggregate compensation of more than $100,000 from your

cuganaation and all related organizations, of which more man $10,000 ryas provided by the related orgartimations?

If "Yes," attach schedule - see Specific Instructions on page 27 .

EEA

11,

n Yes ~X No

Form 990 (2001)

Fam 990 (2001 )

., . , dthW 1CffOTtttt (See Specific Instructions on pa

2? .)

repoated to the !!tS? # "YWattach a

of each equity . . . .

76 `.V Did the OPnWMM eegage In air actl+ritY not

77

Were ally changes made in the organizing or governing documents but not reported to the IRS? . . . . . . . . . .

!f "Yes," attach a conformed copy of the changes.

711a Did the organization have t 'eiated business cross income of $1,000 or mots during the year covered by ttds return?

b If "Yes ." has it fwd a tax return on Form 99E1-T for this year? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

79

Was there a liquidation

; dissolution. terrnitnation. or substantial contraction during die year? If "Yes," attach a statement

80a, Is the organization related (offset than by association with a statewide or nationwide organization) through common

. . . .

mew, governing bodies, trustees, officers, etc., to any other exempt w nonexempt organization? .

b it "`lei," enter the name of the organization

exerr~st OR

more~cempt

and check whether it is

.

.

76

7?

.

.

.

78d

78b

79-

.

,~. .

8~~

``c" .,

~ :

81a Enter direct or indirect political expenditures. See line 81 Instructions . . . . , . . . . .

8ta

b Did the organization file Form 1124-POL for this year? . . . , . . . . . . . . . . . . . . . . . . . . . . . . . . . .

82a Did the organization receive donated services or the use of material, eciuiPmeM or facilities at no charge

of at substantially less than fag rental value? . . . . . . . . . . . . . . . . . . . . . . . , . . . . . . . . . . . . .

b

83a

b

84a

b

$'S

b

a

d

e

f

g

h

86

if "Yes," You may indicate the value of these items here. Do not hwlude this amount

as revenue in Part 1 w as an expense in Part q, (See suctions in Part Ifl .) . . . . . . . .

Did the organization comply with the public inspection requirements for returns and exemption appGcations? . . . .

. . . . . . . .

04 the organization comply with the disclosure requiremerxs relating to quid pro qua contributions?

Did the organization solicit any ins or gets dot were rat tax deductible? - - . . . . . . . . . . . . . . . .

V'Yes," did the organization include with every solicitation an egress statement that such cordons

or gifts were not tax deductible? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

501(cX4), (5), or (6) organizations. a Were substantially all dues nondeductible by members? . . . . . . . . . . . .

Did the organization make only in-house lobbying expenditures of $2 .000 of less? . . . . . . . . . . . . . . . . . .

If "Yes" was answered to either 85a or 85b, do not complete 85c through 85h below unless the organization

received a waiver fog proxy tax owed for to prior year.

cues, assessrnerds, and similar amounts from members . . . . . . . . - - - . . . . .

a5c

Section 162(e\f lobbying

_!°~' and /~~

political expenditures

. . . . . . . . . . . . . . . . . . . . . 85d

'Y~

85e

Aggregate nondeductible amount of section 6033(eX1XA) dues notices . . . . . . . . .

Taxable amount of lobbying and political ewes (ir+e 85d less &5e) . . . . . . . .

esf

Does the organization elect to pay the section 6033(e) tax ors ft amotrt on line 8sf? . . . . . . . . . . . . . . . .

1f section 6033(eX1 XA) dues notices were serf, does the organization agree to add the amount on line 85f to its

reasonable estimate of dues allocable m nondeductible lobbying and political expenditures for the following tax year?

5Q1(cx7) orgs. Eriter. a Initiation fees and capital contributions girded on fine 12 . . .

863

Gross receipts, included on line 12, for public use of club facts . . . . . . . . . . . .

86b

.

.

.

.

.

.

.

.

.

.

07

501(cX12) orgs. Enter: a Gross kvAxm from members or shareholders

87a

b Gross income from other sources . (Do not rat amounts due or paid to other

sources against amounts due or received from them.) . . . . . . . . . . . . . . . . . . . an

88

At any lime during the year, did the organization own a 50°h or greater interest in a taxable corporation or

partnership, or an entity disregarded as separate horn the organization under Regulations sections

3Q1 .7701-2 and 301 .7701-3? If "Yes," complete Part IX . . . . . . . . . . . . . . . . . . . . . . . . . . .

89a SD1(c}j3) organiz:atlons. Enter- Amount of tax imposed on the organization during the year under:

section 4911 1

; section 4912 r

; section 4955

b 501(cX3) and 5Uf(eX4) orgs . Did the organ engage in arty section 4958 excess berg transaction

dung !he year or did it become aware of an excess benefit transaction from a prior year? If "Yes," attach

a statement eking each transaction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

a Enter. Amount of tax imposed on the organization managers or disqualified persons during the year under

sections 4912, 4955, and 4958 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . : . . . . . . . .

d Enter: Amount of tax on line 89c, above, reimbursed by the organization . . . . . . . . . . . . . . . . . . .

90a List the states with which a copy of this return is filed lob Number of employees employed in the pay period that includes March 12, 2001 (See instructions) . . . . . .

91

The books are in care of >

Telephone no . b Located at 092

Section 4947(aXt) nonexempt charitable trusts filing Form 990 in lieu of Form 1041 - Check here . . . . . .

and enter the amount of tax-exempt interest received or accrued during the tax year .

~

eEa

.

.

.

.

.

.

Yes

X

x,

,X

- - -- -

81b

X

oft

X

83a

X

X

X

83b

84a

Page 5

too

=y

84b

85a

85b

"`~~ .t c `'

:rile

.

.

y :`

. . . .:s

85h ~~.

b

. . . . .

88

. . . . .

89s

. . .

. . .

.

X

t

90b

. .

. . . . . . .

~ 92 '

Form 990 (2001)

Form 990

8

NoW Eitt

Enter gross aiRtS unless otherwise

93

mar.

Program service revenue:

a

b

c

d

e

(A}

1

(8)

r

Faces by so

2,513,514

EkchWon code

Amatrd

(c)

(E)

WOr

ruricnon

MEMBERSHIP ACTIVITIES

Medicare/Medicaid payments . . . . . . . . . . . .

Fees and contracts from government agencies . .

Membership dues and assessments . . . . . . .

Interest on savings and temporary cash investments

Dividends and interest from securities . . . . . . .

97

Net rental Income or (loss) from feat estate :

102

103

ilrried business Mme

6ushmmaode

f

g

94

9'S

96

98

99

100

101

fIf1ES (See Specific tnsVuctiotts on page 32.

a

b

14

debt-financed prop . - . . . . . . . . . . . .

not debt-financed property . . . . . . . . . . .

Not rental income or ( loss) from personal property .

Other investment irmrrae . . . . . . . . . . . . . .

Gain or (low) from yes of assets other than inventory

Diet income or (bss) from special events . . . . .

Gross profit or (loss) from sales of inventory . . .

Other revenue : a

b

c

d

e

18

104

Subtotal (add columns (BI (DI end (E)) " - - " "

105

Total (add line 104, columns (B), (D), and (E)) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Notes : Line 105 plus line 1d, Part I, should equal the amount on line 12, Part I.

..qu

. Line Na

. Relatianshi

of Activities to the Accom fishmerd of Exempt Pur

a (see specific

n~ instructions on pa

Explain how each activihr for which income s reported in column (E) of Part VII contributed importantly to the accomplishment

of the organization's exempt purposes (other than by providing fins for such purposes).

instructions on paw 33.

Nam, address, ahdEIN of corporation,

I

Nature

Total

o

_ ..,..M Information Regarding Transfers Associated with Personal Benefit Contracts (See Specific Instructions on paces: 33.)

(a)

(b)

ntd the wgantzatior, aurin9 the yam. reeeave any fuel, dreety or hwkee+Ur, wpay pona personal eeriettc c«waet?

Did the organization, during the year, pay premiums, directly or indirectly, on a personal benefit contract?

Note: If "Yes" to (b), fife Form 8870 and Farm 4720 (see instructions).

Under PeraMes af PeI". t declare that I trove mcxnhied this rehxn,

and beflegAtN true, correct, and ate. Deginatim of pseparer (other

P$'

Hkam

` Type

Preperor'S

sFir's terms (orYa~xs

aixs

mss,

t ZtP ~ 4

~~ ACCOUNT'

~,

215 HOOSIER STR;

I

NORTH VERNON IN

. . . . . .

El Yes

[' Na

. . . . . .

[]Yes

[]No

SCHqPLk-k A

(F~miiO or SWEZ)

Deparbnowt of the T-asury

howwReverumserwke

Organization Exempt Under Section 501(cX3)

(E,,=(nX

P*:1se=

aW wid Seedw 501(o), S01(tj 501(k),

aXI) NonexwW Charitable Thist

OMB No. IS4S-0047

2001

SuppWnentary Info"nation -- (See separate knbuctions.)

MUST be completed by the above organ

and aftadwd to Vveir Form 990 or 990-EZ

ORDER OF MOOSE 576

Cwnpensallon of the Five H4hest Paid Employees Odw Than OWN

(See page 1 of the instructions . List each one. If there are none, enter "None.")

00 Hame and address of each ewp" paid more

(b) Me arw averege hours

C-rip-tion

tharl$501000

I per vweek devoted to position

Total number of other employees paid over

$-%ODD . . . . . . . . . . . . . . . . . . .

lo-

(See page 2 of the Instnictions. List each one (whether individuals or

35-0312169

(b) F.~

to I

MS& accouritandother

tractors for Professkmal

It tore are none, enter *Nor*.*)

(a) Name and address of each kideperiderd contractor pald awre than $50,000

ft Type of servke

(c) Compensad-

None

TOW number of others recervrQ over $5DOOD for

professional serAces . . . . . . . . . . . . .

*

I

F-Papermck PleductImAct Notk :esee the kwtrw~for ftrrnmoor Foi

M

EEA

ScheduIeA(ForM990or990-EZ)2W1

Form

Overflow Statement

%7*7V

Name as shown on Return

Employer identification number

LOYAL ORDER OF MOOSE 576

35-0312169

------ OCCUPANCY -------Form 990

Description

INSURANCE

UTILITIES

Total

2001

Amount

7,435

7,582

15,017

------ overflow for : ------Form 990

Description

Amount

SALES TAXES

3,389

PROPERTY TAXES

1,500

LICENSES AN PER

580

Total

5,469

--MISC EXP LINE 43 D--Form 990

Description

Amount

PRIZES

100

LAUNDRY

697

FLOWERS

79

Total

876