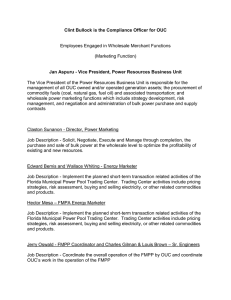

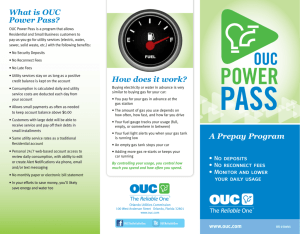

94905000 orlando utilities commission utility system revenue

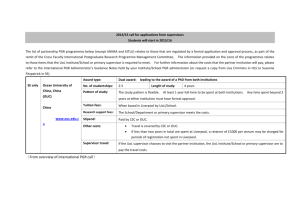

advertisement