Extended Account Analysis

Insight

XAA Insight combines XAA with the ease of use of Windows® to create an

intuitive maintenance and inquiry vehicle. Features include:

Streamlined maintenance procedures

Dropdown lists of available codes and their descriptions in addition to

online help

Online processing and pricing parameters

Graphical representations of the structure of complex relationships

Upload service activity, demographic information, exception pricing,

processing and promotional pricing plan overrides, and invoice chargeoffs

Trending for balances, services and results displayed at account,

relationship or bank level

Online review of waived fees and services in addition to the impact of

processing and promotional pricing overrides

Title Page

Here

Launch

(Calibri, 21 pt.)

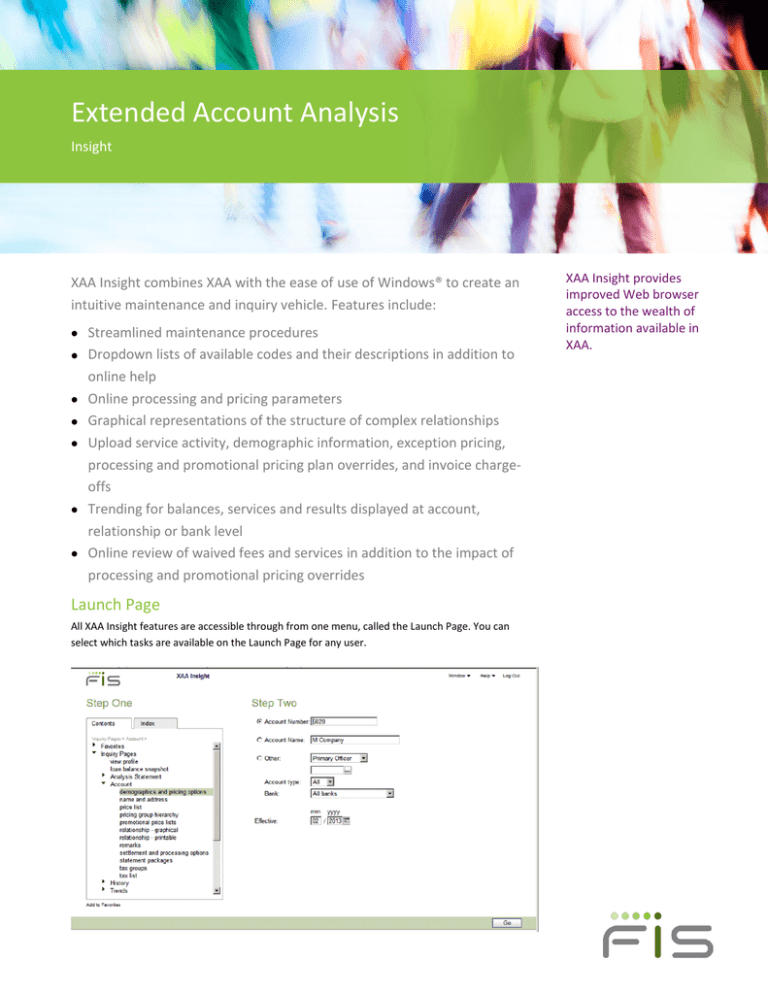

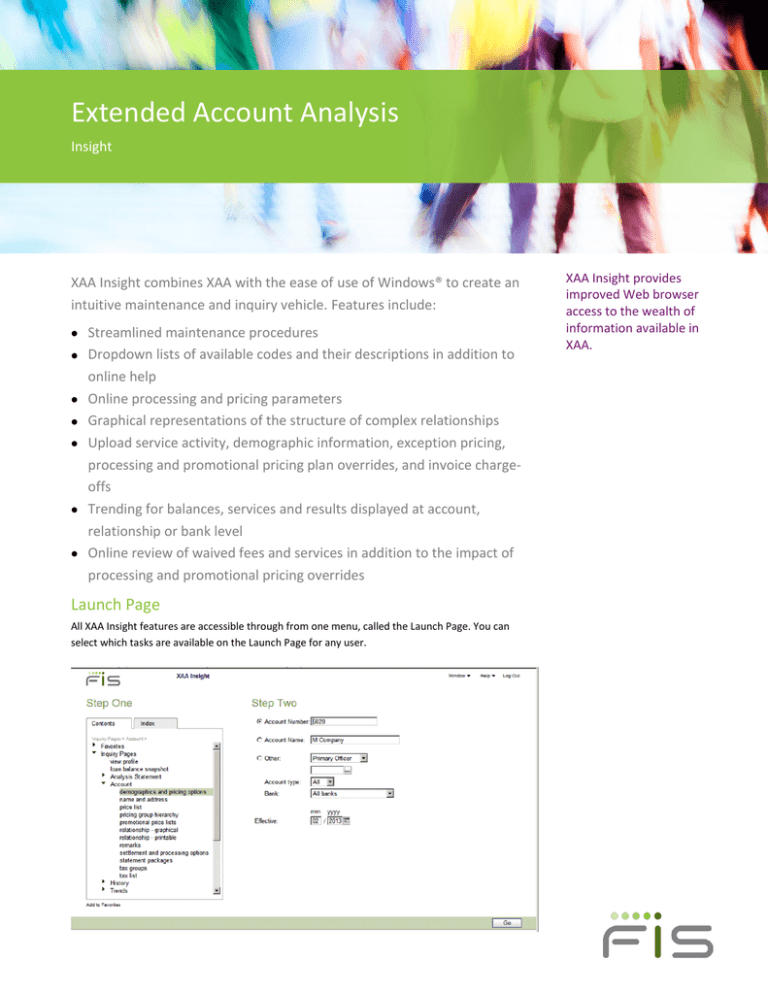

All XAA Insight features are accessible through from one menu, called the Launch Page. You can

select

Firstwhich

Lasttasks

Author

are available

Name on

(Calibri,

the Launch

12Page

pt.)for any user.

Title, Department or Group (Calibri, 12 pt.)

XAA Insight provides

improved Web browser

access to the wealth of

information available in

XAA.

Insight

Title Here (Calibri, 12 pt.)

Ease of Use

Clarity of Information Displayed

XAA Insight combines Web browser technology with improved

page design to make inquiry and maintenance more intuitive

than ever before.

XAA Insight makes great use of Windows technology and

graphical interfaces to provide information that is easily

understood. It also makes it possible to combine relevant

information and avoid performing multiple inquiries.

Once a user initiates an inquiry session, any account it the

relationship may be reaccessed without re-entering the

account number.

Retrieval of accounts is possible by account name, cost

center and officer, as well as by account number.

Trending functionality allows you to view balances, services

and results at the account, relationship or bank level.

Online help is available in the form of function-specific

“Guide Me” instruction text.

A graphical interface is used to virtually eliminate

abbreviations or codes in labels, instructional text and

messages. It also uses Windows technology to allow

multiple pages to be viewed at the same time.

Date lists show months of historical information,

eliminating any question regarding the amount of history

available.

A copy of an original or adjusted invoice can be generated

directly from XAA.

www.fisglobal.com

Account analysis operations personnel, who have an in-depth

knowledge of the system, and customer relationship managers,

who have a keen interest in the balances maintained and

services used by their customers, can use XAA Insight to

retrieve and/or modify the information stored in XAA.

Relationship structure information including all related

accounts, relationship settlement, statement setups and

demographic updating is displayed in a graphical format.

Drill-down capabilities make it possible to retrieve

additional details for each account displayed.

©2015 FIS and/or its subsidiaries. All Rights Reserved.

2

Insight

Title Here (Calibri, 12 pt.)

Trending

View Waived Results

Numeric and graphical trending of balances, services and

results can be displayed for accounts, entire relationships and

at the bank level.

XAA Insight users can easily identify waived or referred result

charges and waived service fees established on accounts. Fields

such as Open Date, Average Ledger and Average Collected

Balance are displayed so users can identify possible qualifying

criteria for the result charge disposition. Displayed information

can be exported into a customizable table format.

Snapshot Analysis Statement

Service, result and balance inquiries allow users to view the

information in graph form. The graphs are customizable and

may be exported for use in word processing software.

www.fisglobal.com

XAA Insight provides ability to preview an analysis statement

that shows what a deposit account’s fees would be if the

account were analyzed today for the current month’s activity.

The Snapshot Analysis Statement allows you to collect any

outstanding analysis charge before the account is closed,

collecting income that might otherwise be lost and adding

services that have yet to be interfaced into analysis. It also

allows your financial institution to provide any client with a

snapshot of their analysis position for the current month, giving

the client an opportunity to adjust balances prior to the end of

the month, if necessary.

©2014 FIS and/or its subsidiaries. All Rights Reserved.

3

XAA Insight

Here (Calibri, 12 t.)

Assisted Information

Maintenance

Maintenance is significantly simplified by focusing

on process and not just data. Streamlined

processes, in conjunction with the Web browser

technology, ensure accuracy in all maintenance.

Analysis Statement Inquiry

Users can access customer’s analysis statement

information by name, officer or account number or even select from a list of accounts assigned to a

specific cost center.

Flexible

Snapshot

Any field edited for validity provides a dropdown list of possible values. “Cheat sheets”

that identify values for codes and indicators

are no longer necessary.

XAA Insight does not allow a maintenance

process to remain unfinished or incomplete.

Multiple-step processes display a running total

of tasks completed and tasks remaining.

Required tasks must be completed before the

information is posted.

In account relationships, users can apply a

change to all the accounts while actually

entering the change only once.

XAA Insight provides the ability to upload

service volume and fees, account

demographic, processing plan and

promotional pricing overrides, as well as

invoice charge-offs, and exception pricing.

XAA Insight can present a statement inquiry for

any month retained in history. Select from options

on the related pages menu to view additional

detail not shown on the statement itself.

Account information can be viewed in a

generic statement format, or an PDF mock-up

of the actual statement format.

Multiple moths of information may be viewed

side-by-side to identify variances of trends

over time.

If a user is viewing a relationship statement that

shows several units of a particular service, the

user can select that service, and with a click of

button view which accounts in the relationship

used the service.

www.fisglobal.com

©2015 FIS and/or its subsidiaries. All Rights Reserved.

4

Insight

Here (Calibri, 12 pt.

A Flexible Solution Offering

FIS™ is the only financial provider of this leading-edge solution that offers both licensed and ASP

(outsourcing) solutions for the commercial financial service marketplace.

XAA – The licensed solution

As a licensed solution, Extended Account Analysis offers you complete control of the implementation and

operation of XAA. The licensed software provides your organization with two-way integration with our

current systems, including custom interfaces to and from XAA.

XAA – Advantage Center – ASP Solution

The XAA Advantage Center is specifically designed for financial institutions that want to outsource the

account analysis function. It offers all the functionality of FIS’ industry-leading XAA while significantly

reducing initial time and money commitments.

The Advantage Center can help you manage and grow your business through:

Speed to market – Standard platform and architecture promote rapid integration through common

interfaces to your applications.

Limited upfront expenditures – The bulk of your institution’s upfront investment is limited to interface

development, rather than the implementation and testing of hardware and software components.

Predictable costs – Your institution will know all of its costs upfront.

Concentration on your business – Outsourcing with FIS allows your institutions to focus on what is really

important: its customers.

Partner for Success

When your institution chooses XAA, it receives superior business functionality and a solid business partner –

FIS. We understand commercial banking from your institution’s perspective and from that of your

commercial customers.

Our commercial banking team is comprised of bankers and design engineers who are professionals with

demonstrated experience in software development and industry experience. These key strengths enable FIS

to tailor product-based solutions to meet the specific needs of your institution’s commercial marketplace

and deliver bottom-line results. The FIS team also offers a full Consulting and Professional Services team

ready to assist your institution with any of its commercial banking needs.

Contact Us

To learn more about Commercial Treasury Solutions from FIS, please contact your FIS strategic account

manager, or visit us online at www.fisglobal.com or call 800.822.6758.

www.fisglobal.com

©2015 FIS and/or its subsidiaries. All Rights Reserved.

5