Merging Municipalities: Is Bigger Better?

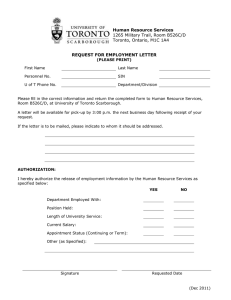

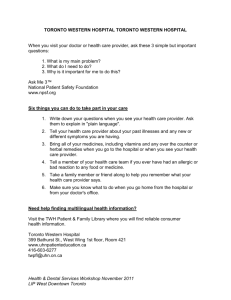

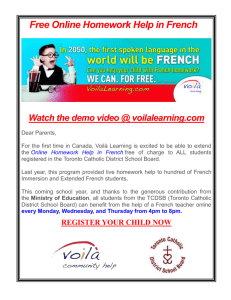

advertisement