Merging Municipalities: Is Bigger Better?

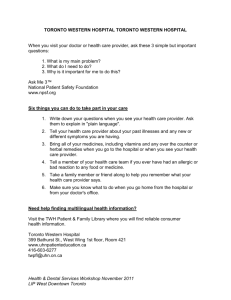

advertisement