Economic Impact of Chatham Park Development

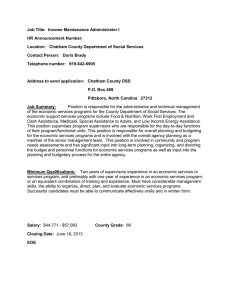

advertisement

THE ECONOMIC IMPACT of THE CHATHAM PARK DEVELOPMENT Dr. Michael L. Walden, Project Director North Carolina State University December 2014 EXECUTIVE SUMMARY Chatham Park is a planned multi-use “live, work, play” development under construction in eastern Chatham County, North Carolina. Comprising over 7,000 acres, when fully developed Chatham Park will have approximately 22,000 residential units, 2.4 million square feet of commercial space, 16.6 million square feet of office space, and 2.5 million square feet of civic, school, and hospital space. A project of this size and scope will clearly have large economic impacts. Indeed, the calculated economic impacts on Chatham County, the Triangle region, and North Carolina are significant. After accounting for the leakage of some spending and employment impacts to outside of the area as well as direct and supply-chain effects within the area, the analysis shows the peak of annual spending generated from the project will occur in year 40 at $4 billion for Chatham County, $7 billion for the Triangle region, and $7.7 billion for North Carolina. After year 40 as construction ends and full occupancy occurs, the annual spending impacts moderate to $3.6 billion in Chatham County, $6.2 billion in the Triangle region, and $6.8 billion in North Carolina (all dollar values are in 2014 purchasing power dollars). Also, after the full build-out of Chatham Park, the development will have created 61,000 permanent jobs in Chatham County, 99,000 permanent jobs in the Triangle region (including Chatham County), and 115,000 permanent jobs in North Carolina (including Chatham County and the Triangle region). Local and state governments will receive a share of the economic gains from Chatham Park through additional public revenues. After completion, the economic impacts of Chatham Park will generate $146 million of annual public revenues to Chatham County, $248 million of annual public revenues to the Triangle region (including Chatham County), and $442 million of annual state public revenues to North Carolina (all dollar values are in 2014 purchasing power dollars). 2 TABLE OF CONTENTS General Limiting Conditions ……………………………………………………………. 5 Acknowledgements ……………………………………………………………………… 6 About the Project Director ………………………………………………………………. 6 Introduction ……………………………………………………………………………… 7 Concepts and Measures of Economic Impact …………………………………………… 8 Economic Impact at 10-Year Intervals ………………………………………………….. 10 Construction Impact …………………………………………………………….. 11 Occupancy Impact ………………………………………………………………. 15 Combined Construction and Occupancy Impact ………………………………... 18 Public Revenue Impact …………………………………………………………………. 21 Conclusions ……………………………………………………………………………… 24 Tables 1. Aggregate Construction Impact at 10-Year Intervals ……………………….. 12 2. Annual Occupancy Impact at 10-Year Intervals ……………………………. 16 Figures 1. Aggregate Value-Added & Employment Construction Impacts, Chatham Co. 13 2. Aggregate Value-Added & Employment Construction Impacts, Triangle ….. 13 3. Aggregate Value-Added & Employment Construction Impacts, N.C. ……… 14 3 4. Aggregate Value-Added & Employment Occupancy Impacts, Chatham Co... 17 5. Aggregate Value-Added & Employment Occupancy Impacts, Triangle ……. 17 6. Aggregate Value-Added & Employment Occupancy Impacts, N.C. ………... 18 7. Smoothed Total Annual Combined Value-Added Construction & Occupancy Impact ………………………………………………………. 19 8. Smoothed Total Annual Combined Employment Construction & Occupancy Impact ……………………………………………………… 20 9. Estimated Public Revenues to Chatham Co, the Triangle, and N.C. ………. 23 4 GENERAL LIMITING CONDITIONS All practical and reasonable efforts have been used to make the analysis and conclusions developed in this study reflect the best possible estimates of economic impact. The study is based on numerous data, assumptions, and parameters provided by the client and other sources cited in the study. No responsibility is assumed for inaccuracies reported by the client or any other data source used in developing and preparing the study. No warranty or representation is made by North Carolina State University or the project director that any of the values or estimations in the report has been, or will be, actually achieved. 5 ACKNOWLEDGEMENTS Numerous individuals and organizations contributed to the completion of this project. Funding was provided by the Chatham County Economic Development Corporation, and thanks are due to the organization’s President, Dianne Reid, for supporting the project. Ken Atkins, Director of Economic Development for Kilpatrick, Townsend, and Stockton LLP, Thomas J. D’Alesandro IV, President of Blakefield LLP, and Bubba Rawl and Tim Smith, both of Preston Development Company, provided background information and data for the project. The research assistant for the project was Robert Dinterman, who accomplished vital tasks in support of the project. ABOUT THE PROJECT DIRECTOR Michael L. Walden is a William Neal Reynolds Distinguished Professor at North Carolina State University, where he has taught since 1978. The author of eight books and over 250 articles and reports, among Walden’s specialties is economic impact analysis, particularly for public and educational institutions. His most recent book is North Carolina in the Connected Age (The University of North Carolina Press, 2008). Walden frequently comments about the economy in the media, writes a biweekly newspaper column, broadcasts a daily radio program, and makes scores of public presentations each year in various forums. The winner of several national and state awards, he was the recipient of the UNC Board of Governors Award for Excellence in Public Service in 2010. In 2013 he was made a member of the Order of the Long Leaf Pine by North Carolina Governor Perdue, and in 2014 he was presented with the Alexander Quarles Holladay Medal for Excellence by North Carolina State University. 6 INTRODUCTION Chatham Park is a planned, multi-use “live, play, work” development under construction in eastern Chatham County, North Carolina. When completed in 40 years, it will be the largest such development in North Carolina and one of the largest in the country. Comprising over 7,000 acres, Chatham Park will have approximately 22,000 residential units, 2.4 million square feet of commercial space, 16.6 million square feet of office space, and 2.5 million square feet of civic, school, and hospital space. A development of this size will obviously have a significant economic impact on the community. The purpose of this report is to estimate multi-dimensional measures of this economic impact for three geographical areas: Chatham County, the multi-county Triangle region, and the state of North Carolina.1 Economic impact is measured by three key quantities - contribution to gross domestic product (GDP)2, creation of employment, and contribution to public revenues. The economic impacts are based on activity from construction of the project as well as occupancy and operation of the residential, commercial, and industrial spaces. Since the project will require several decades until completion, the economic impacts are measured at the end of each decade during the development period. The report is divided into several sections. The next section discusses the concepts and measures of economic impact and applies them to Chatham Park. Using data for the expected pace of the build-out of Chatham Park, the third section applies the economic impact concepts to arrive at economic impact measures for the three geographical areas at each decadal point of the project’s 1 The Triangle region is composed of the two metropolitan areas of Raleigh-­‐Cary and Durham-­‐Chapel Hill and includes the counties of Chatham, Durham, Franklin, Orange, Person, and Wake. 2 GDP can be viewed in two ways – as the aggregate value of output using local inputs, or as the aggregate income of local input owners. 7 development. The fourth section estimates the potential public revenue impacts. A summary and conclusions are offered in the final section. CONCEPTS AND MEASURES OF ECONOMIC IMPACT A large development such as Chatham Park creates economic impact in two phases. The first phase occurs during the construction of the project. Funds will be spent on labor, materials, and equipment in the construction of the various components of Chatham Park, such as residences, office space, commercial space, and roads. That portion of the spending going to local input owners will generate new local income and new local spending. The construction phase of economic impact lasts until construction is completed. The second phase of the development occurs when construction is completed and the resulting projects are occupied and used. This is commonly termed the occupancy phase. New residences will attract new households to the area who will bring with them new incomes which, in turn, will produce new local spending. Similarly, business occupants of Chatham Park will produce output and sales that will add to local income and spending. 3 The occupancy phase is measured on an annual basis once households and firms move to Chatham Park. Economic impacts from both the construction phase and the occupancy phase occur at several levels. The direct effect measures impacts from the economic activities at the development – for example, from the on-site construction, from the households occupying the new residences, and from the firms occupying the new non-residential space. The indirect effect measures impacts from off-site suppliers who sell products and services to on-site households and firms. Examples 3 Some of the new households and firms moving to Chatham Park may come from other locations in the Triangle or North Carolina. However, since both North Carolina – and especially the Triangle region – are growing areas which are expected to continue adding population and firms, a move by a within-­‐region or within-­‐state household or firm to Chatham Park will ultimately be matched by a new household moving to the region and state from an out-­‐of-­‐state location and by a new firm being created in the region and state. 8 are suppliers of lumber and concrete to construction activities, and farm and food processing firms supplying food products to supermarkets and restaurants operating in Chatham Park. The induced effect accounts for further economic impacts when employees or other input owners of companies engaged in the direct and indirect effects spend their additional earning. The total effect is the sum of the direct, indirect, and induced effects. The indirect and induced effects are sometimes referred to as multiplier effects because they multiply, or expand, the impacts of the original direct effects. An important – but sometimes overlooked – aspect of measuring economic impact is the element of leakage. Leakage occurs when an expenditure made in the local economy immediately leaves the area and so is not effectively a component of direct, indirect, and induced effects. A good example is spending on gasoline. Almost two-thirds of the price per gallon of gasoline ECONOMIC IMPACT CONCEPTS Direct Effect: Economic impacts from the activities occurring at the project Indirect Effect: Economic impacts from off-­‐site suppliers of activities at the project Induced Effect: Economic impacts from the spending of input owners engaged in the direct and indirect effects Total Effect: The sum of the direct, indirect, and induced effects Multiplier Effect: The size of the indirect and induced effects relative to the direct effect Leakage: Spending occurring in the local economy that is immediately sent to input owners outside the local area Value-­‐Added: Economic output after subtracting leakage IMPLAN: A proprietary model of local economies used to measure economic impacts 9 is accounted for by the cost of the crude oil and the refining of that crude oil into gasoline.4 So although an individual might spend $3.00 for a gallon of gasoline pumped at a local station, the majority of that price leaves the area and flows to the suppliers of the crude oil and the refinery owners. Another example is specialized construction equipment or machinery that is supplied to the project by owners outside the local area. Spending which is “leaked” from a local area should not be counted as local economic impact. Value-added is the term to describe economic output after leakage has been subtracted.5 Models of local economies have been developed to calibrate direct, indirect, and induced effects and to account for leakage. This report uses the IMPLAN economic model for Chatham County, the Triangle region, and North Carolina to measure the economic impacts from the Chatham Park development.6 IMPLAN is the most widely-used such economic model in the country. It is used by the North Carolina Department of Commerce to evaluate the economic impacts to the state of a new business location or an existing business expansion. ECONOMIC IMPACTS AT TEN-YEAR INTERVALS The Chatham Park development is expected to require 40 years for total completion. This section provides economic impacts for ten-year intervals during that process. Each ten-year snapshot includes the economic impact of all the construction which occurred during the ten years plus the occupancy impact at the tenth year of the interval. Thus, this section presents economic impacts at four points of time defined as: 4 U.S. Department of Energy, Energy Information Administration. Value-­‐added can also be considered as Gross Domestic Product. 6 IMPLAN, LLC, Huntersville, North Carolina. 5 10 At Year 10: Economic impact of construction from year 1 to year 10 plus occupancy impact at year 10. At Year 20: Economic impact of construction from year 11 to year 20 plus occupancy impact at year 20. At Year 30: Economic impact of construction from year 21 to year 30 plus occupancy impact at year 30. At Year 40: Economic impact of construction from year 31 to year 40 plus occupancy impact at year 40. The construction impacts are aggregate values for the entire decade. Each occupancy impact is an annual value at the decadal points. The rate of construction and implied rate of occupancy can be used to provide annual occupancy impacts between the decadal estimates. Several parameters were required to develop the economic impact estimates. As already indicated, IMPLAN is the source for the parameters used to calculate the direct, indirect, induced, and total economic impacts, as well as leakage. Preston Development Company – the developer of Chatham Park – provided the planned rate of build-out of Chatham Park, including number or square footage of units and unit or square footage prices. CONSTRUCTION IMPACT The aggregate construction impact of Chatham Park at ten-year intervals is shown in Table 1 for the three geographic areas, Chatham County, the Triangle region, and North 11 Table 1. Aggregate Construction Impact at 10-Year Intervals of Chatham Park. Value-Added Effects (2014$ millions) Employment Effects (Person-Years)1 Direct Indirect Induced Total Direct Indirect Induced Total Chatham Co. Yrs. 1-10 Yrs. 11-20 Yrs. 21-30 Yrs. 31-40 674 849 794 272 362 453 424 145 158 198 186 63 1,194 1,500 1,404 480 4,291 5,379 5,026 1,714 2,179 2,732 2,553 870 678 865 796 272 7,148 8,976 8,375 2,856 Triangle Yrs. 1-10 Yrs. 11-20 Yrs. 21-30 Yrs. 31-40 990 1,245 1,166 399 452 567 530 181 474 596 557 190 1,916 2,408 2,253 770 9,511 11,898 11,134 3,791 3,999 5,006 4,685 1,596 2,998 3,754 3,513 1,197 15,411 20,658 19,332 6,584 North Carolina Yrs. 1-10 Yrs. 11-20 Yrs. 21-30 Yrs. 31-40 1,123 1,414 1,322 453 539 679 635 218 517 642 610 208 2,179 2,735 2,567 879 12,438 15,611 14,587 4,983 5,166 6,525 6,097 2,084 3,709 4,603 4,291 1,450 21,313 26,739 24,975 8,517 1 total employment, including full-­‐time and part-­‐time employment Carolina.7 Note that the impacts rise as the geographic area expands. This is because as the geographic area expands, leakage decreases and more local inputs are able to be supplied to the project. Value-added is the economic spending impact remaining in the geographic area after subtracting leakage. Each person-year employment is one job held by a person for one year. So, for example, the number “4,291” in Table 1 for Chatham County direct employment effects, years 1-10, means there were a total of 4,291 job positions held for one year. Of course, the same person could hold the same position for ten years (which would be counted as “10 person- years”), 7 The rate of the construction build-­‐out was provided by Preston Development Company, the developer of Chatham Park. Construction costs are also from Preston Development and the American Road and Transportation Builders Association. 12 Figure 1. Aggregate Value-Added (2014$ millions, left scale bar) and Employment (personyears, right scale line) Construction Impacts by Decade for Chatham County. 1600 10000 1400 9000 2014 $ millions 7000 1000 6000 800 5000 600 4000 3000 400 # of person-­‐years 8000 1200 2000 200 1000 0 0 Yrs. 1-­‐10 Yrs. 11-­‐20 Yrs. 21-­‐30 Yrs. 31-­‐40 Figure 2. Aggregate Value-Added (2014$ millions, left scale bar) and Employment (personyears, right scale line) Construction Impacts by Decade for the Triangle. 3000 25000 20000 2000 15000 1500 10000 1000 # of person-­‐years 2014 $ millions 2500 5000 500 0 0 Yrs. 1-­‐10 Yrs. 11-­‐20 Yrs. 21-­‐30 Yrs. 31-­‐40 13 3000 30000 2500 25000 2000 20000 1500 15000 1000 10000 500 # of person-­‐years 2014 $ millions Figure 3. Aggregate Value-Added (2014$ millions, left scale bar) and Employment (personyears, right scale line) Construction Impacts by Decade for North Carolina. 5000 0 0 Yrs. 1-­‐10 Yrs. 11-­‐20 Yrs. 21-­‐30 Yrs. 31-­‐40 or different persons could hold the position for different numbers of years over the ten-year period. The estimates are substantial. Total value-added impact exceeds $1 billion for three of the four decades in Chatham County and is near or exceeds $2 billion for three of the four decades in the Triangle and North Carolina. Employment (person-years) is also significant. Employment (person-years) is between 7,000 and 9,000 in three of the four decades in Chatham County and is between 15,000 and 27,000 in the Triangle and North Carolina in three of the four decades. The impacts are greatest during the years 11-20 and years 21-30 decades. Figures 1, 2, and 3 graphically summarize the total value-added and employment (personyears) construction impacts on the three regions. 14 OCCUPANCY IMPACT The occupancy impact measures were constructed separately for the residential and nonresidential occupants of Chatham Park. For the residential occupants, average annual incomes of the households occupying the Chatham Park dwelling units were derived by assuming a household could afford a unit with a value 2.6 times the household’s annual income.8 Parameter values from IMPLAN were then used to identify that part of household spending that “leaks” to outside the region and that part that remains in the region and creates direct, indirect, and induced effects for the three geographic areas. The development of the non-residential occupancy impacts began with the plans for construction of various types of non-residential structures, including general office space, research and development office space, retail space, lodging space, civic space, school space, and hospital space – all measured in square footage.9 The square footages were converted to expected number of employees using average parameters for each type of space.10 The numbers of employees were converted to the expected dollar value of output for each type of non-residential structure using parameters from the U.S. Census.11 Labor income was subtracted from the output values so as not to “double count” the labor income already identified with the household occupancy effect. The output values (less labor income) were then used with the IMPLAN parameters to identify leakage and to construct the direct, indirect, and induced effects for each of the geographic areas. 8 This is the average value to income ratio used by lenders in the current market, from forbes.com. Average dwelling unit prices were provided by Preston Development Company. 9 The planned build-­‐out of these non-­‐residential structures and their square footage were provided by Preston Development Company. 10 The parameters for the average number of employees per square foot in each structure type are from the Institute of Transportation Engineers and the U.S. Dept. of Energy, 2011. 11 U.S. Census Bureau, 2012 Economic Census. No market value of output was assumed to be associated with the school and civic structures. The 2012 dollar values from the U.S. Census Bureau were converted to 2014 dollar values using data from the U.S. Dept. of Commerce. 15 Table 2. Annual Occupancy Impact at 10-Year Intervals at Chatham Park. Employment Effects1 Value-Added Effects (2014$ millions) Direct Indirect Induced Total Direct Indirect Induced Total Chatham Co. At year 10 At year 20 At year 30 At year 40 434 869 1,676 2,759 116 278 434 576 87 208 322 307 637 1,355 2,432 3,642 7,378 14,773 28,153 50,077 868 1,738 3,352 6,484 781 1,654 2,937 4,660 9,027 18,165 34,442 61,221 Triangle At year 10 At year 20 At year 30 At year 40 731 1,477 2,554 4,256 168 354 591 897 201 427 709 1,049 1,100 2,258 3,854 6,202 14,511 30,113 50,859 79,793 1,608 3,249 5,619 9,363 1,765 3,625 6,182 9,926 17,884 36,987 62,660 99,082 North Carolina At year 10 At year 20 At year 30 At year 40 809 1,656 2,838 4,593 192 404 677 1,028 226 480 797 1,183 1,227 2,540 4,312 6,804 17,422 36,722 61,374 92,964 1,918 3,953 6,733 10,769 2,147 4,502 7,556 11,592 21,487 45,177 75,663 115,325 1 total employment, including full-­‐time and part-­‐time employment Table 2 combines the occupancy impacts for both residential structures and non-residential structures at 10-year intervals in the development of Chatham Park. As the Park is constructed, the occupancy impacts increase. At full build-out in year 40, the annual occupancy impact in valueadded is $3.6 billion for Chatham County, $6.2 billion for the Triangle region, and $6.8 billion for the state. In terms of permanent jobs, by year 40 over 61,000 jobs will have been created in Chatham County, over 99,000 jobs (including those in Chatham County), will have been created in 16 Figure 4. Aggregate Value-Added (2014$ millions, left scale bar) and Employment (right scale line) Occupancy Impacts by Decade on Chatham County. 4000 70000 3500 60000 50000 2500 40000 2000 30000 1500 employment 2014 $ millions 3000 20000 1000 10000 500 0 0 At yr. 10 At yr. 20 At yr. 30 At yr. 40 7000 120000 6000 100000 5000 80000 4000 60000 3000 40000 2000 employment 2014 $ millions Figure 5. Aggregate Value-Added (2014$ millions, left scale bar) and Employment (right scale line) Occupancy Impacts by Decade on the Triangle. 20000 1000 0 0 At yr. 10 At yr. 20 At yr. 30 At yr. 40 17 Figure 6. Aggregate Value-Added (2014$ millions, left scale bar) and Employment (right scale line) Occupancy Impacts by Decade on North Carolina. 8000 140000 7000 120000 100000 5000 80000 4000 60000 3000 employment 2014 $ millions 6000 40000 2000 20000 1000 0 0 At yr. 10 At yr. 20 At yr. 30 At yr. 40 the Triangle, and over 115,000 jobs (including those in Chatham County and in the Triangle) will have been created statewide. These levels of value-added and employment would then persist annually beyond year 40. Figures 4, 5, and 6 summarize the total value-added and employment occupancy impacts on the three regions. COMBINED CONSTRUCTION AND OCCUPANCY IMPACT This section shows the combined construction and occupancy impact over the forty year build-out period of Chatham Park. The combined impact assumes a smooth rate of construction and occupancy over the build-out period. 18 Figure 7. Smoothed Total Annual Combined Value-Added (2014$) Construction and Occupancy Impact for Chatham County, the Triangle Region, and North Carolina. 9000 8000 2014 $ millions 7000 6000 5000 4000 3000 2000 1000 0 1 10 20 30 40 41 42 43 Year Chatham Co. Triangle North Carolina Figure 7 shows the combined value-added construction and occupancy impacts for the three geographic areas of Chatham County, the Triangle region, and North Carolina. For each area the value-added impact peaks at year 40 when the build-out is complete. After year 40 the impact is derived only from the continuing annual occupancy impact associated with full usage. Figure 8 presents the same information for the combined employment construction and occupancy impacts. For the annual construction employment impact, the annual averages for the person-years in Table 1 are used. 19 Figure 8. Smoothed Total Annual Combined Employment Construction and Occupancy Impact for Chatham County, the Triangle Region, and North Carolina. 140000 Total Empoyment 120000 100000 80000 60000 40000 20000 0 1 10 20 30 40 41 42 43 Year Chatham Co. Triangle North Carolina SUMMARY OF ECONOMIC IMPACTS OF CHATHAM PARK Combining both construction and occupancy impacts, the estimated economic impact of Chatham Park is significant. For Chatham County, annual economic activity (GDP) peaks at $4 billion (2014$) at year 40 and then settles at $3.6 billion in years thereafter once construction is complete. Employment peaks at 61,000 in years 40 and after. For the Triangle region, maximum annual economic activity is $7 billion (2014$) in year 40 and $6.2 billion thereafter; maximum employment is 99,000 in years 40 and after. For the entire state, top annual economic activity is $7.7 billion (2014$) in year 40 and $6.8 billion in later years, while peak employment is 115,000 beginning in year 40 and continuing in later years. 20 PUBLIC REVENUE IMPACT Local and state governments are interested in the public revenue impact of economic development. It is important to realize these impacts are not in addition to the economic impacts already reported; instead they are an allocation of those impacts. Estimating public revenue impacts over a long period of time – such as the forty year buildout of Chatham Park – is challenging because the composition of public revenue levies frequently change. Both tax and fee rates as well as the economic bases for taxes and fees frequently change. However, what is more stable is the proportion of public revenues to economic bases. Research has shown that despite changes in rates and bases, the relative size of public revenues stays remarkably constant.12 For local governments in the Triangle region (including Chatham County), a long-run average over several business cycles is near 4% of total value-added (also termed gross domestic product). For the state government in North Carolina, a similar long-run average is near 6.5%.13 These rates are applied to the estimated value-added totals generated by Chatham Park to derive public revenue estimates with one addition. Chatham County is one of only two counties in North Carolina to levy a one-time impact fee of $3,500 per residential unit. This fee is applied to the pace of construction of the residential units and included in the public revenue totals for Chatham County. The results are shown graphically in Figure 9. Recognize that the amounts for the Triangle region include those for Chatham County, but the state amounts are only based on state revenues 12 W. Kurt Hauser, "The Tax and Revenue Equation," The Wall Street Journal, March 25, 1993. Reprinted in: W. Kurt Hauser, Taxation and Economic Performance (Stanford, California: Hoover Institution Press, 1996), pages 13-­‐16; 2009 U.S. Government Budget documents, Congressional Budget Office, 2009. 13 Both the local rate and the state rate are based on a multi-­‐year analysis of data from the U.S. Census and the U.S. Dept. of Commerce. For public revenues, only “own revenues” – meaning revenues from local or state tax bases – are used. 21 and fees. The annual amounts peak in year 40 and decline slightly after construction ends. The long-run annual amounts after the Chatham Park build-out is complete is $146 million for Chatham County, $248 million for the Triangle region (including County), and $442 million for North Carolina. The Triangle region and state outside of Chatham County experience long run public revenue gains as a result of the economic interactions created in those locations with the Chatham Park development. The public revenue estimates in Figure 9 excluded revenues from the undeveloped land at Chatham Park, since the land existed prior to the development. The value of the undeveloped land is estimated at $131 million.14 The estimates also assumed a long-run real (inflation-adjusted) appreciation rate of real estate of 0%, which is consistent with the findings of Shiller.15 Some research has found that planned communities, such as Chatham Park, are able to extract price premiums for units and structures compared to similar units and structures in unplanned communities.16 Presumably this occurs because planned developments significantly reduce negative externalities to property owners from future development that may be inconsistent with existing development. The public revenue benefit from these premiums is accounted for in the prices estimated for the units.17 14 Based on 7,500 acres of undeveloped land and an average price per acre of $17,500 (Preston Development Corporation). 15 Robert Shiller, Irrational Exuberance. Princeton University Press, 2005 p. 13 16 Chris Eves, “Planned Residential Community Developments: Do They Add Value?” Property Management, vol. 25, issue 2, 2007, pp. 164-­‐179. 17 As indicated earlier in the report, unit prices were provided by Preston Development Company. Interestingly, Eves’ research showed no higher appreciation rate for properties in planned developments compared to properties in unplanned developments. 22 Figure 9. Estimated Public Revenues (2014$) to Chatham County, the Triangle Region, and North Carolina Provided the Value-Added Developed by Chatham Park. 600 2014 $ millions 500 400 300 200 100 0 1 10 20 30 40 41 42 43 Year Chatham Co. Triangle North Carolina SUMMARY OF PUBLIC REVENUE IMPACTS OF CHATHAM PARK After construction build-­‐out and total occupancy of Chatham Park, annual local public revenues to Chatham County will be $146 million (2014$) annually, annual local public revenues to Triangle governments (including Chatham County) will be $248 million (2014$), and annual state public revenues to North Carolina will be $442 million (2014$) 23 CONCLUSIONS Chatham Park is a planned multi-use “live, work, play” development under construction in eastern Chatham County, North Carolina. Comprising over 7,000 acres, when fully developed Chatham Park will have approximately 22,000 residential units, 2.4 million square feet of commercial space, 16.6 million square feet of office space, and 2.5 million square feet of civic, school, and hospital space. A project of this size and scope will clearly have large economic impacts. Indeed, the calculated economic impacts on Chatham County, the Triangle region, and North Carolina are significant. After accounting for the leakage of some spending and employment impacts to outside of the area as well as direct and supply-chain effects within the area, the analysis shows the peak of annual spending generated from the project will occur in year 40 at $4 billion for Chatham County, $7 billion for the Triangle region, and $7.7 billion for North Carolina. After year 40 as construction ends and full occupancy occurs, the annual spending impacts moderate to $3.6 billion in Chatham County, $6.2 billion in the Triangle region, and $6.8 billion in North Carolina (all dollar values are in 2014 purchasing power dollars). Also, after the full build-out of Chatham Park, the development will have created over 61,000 permanent jobs in Chatham County, 99,000 permanent jobs in the Triangle region (including Chatham County), and 115,000 permanent jobs in North Carolina (including Chatham County and the Triangle region). Local and state governments will receive a share of the economic gains from Chatham Park through additional public revenues. After completion, the economic impacts of Chatham Park will generate $146 million of annual public revenues to Chatham County, $248 million of annual public revenues to the Triangle region (including Chatham County), and $442 million of annual state public revenues to North Carolina (all dollar values are in 2014 purchasing power dollars). 24