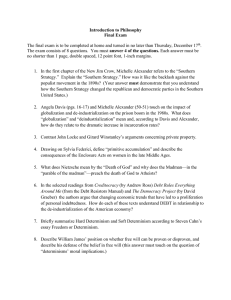

De-Industrialization and Underdevelopment: A

advertisement