INR Demand Draft Form - ICICI Bank Singapore

advertisement

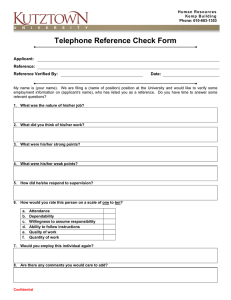

Singapore INR Demand Draft Form Section A: Important • Please complete this form in English, BLOCK LETTERS and tick wherever appropriate. • All fields are mandatory unless otherwise stated as optional. Any overwriting or alteration should be countersigned (full signature only). Please strike out sections that are not required. • For Joint Accounts only: If the mode of operation of the account(s) stated during account opening is “All to sign”, both the principal and joint account holders’ signatures are required/relevant. • Valid personal identification proof as per bank's record is required • INR demand draft request is only available for account holders only. The beneficiary amount is capped at INR 500,000. • Please note that collection of draft can only be made by self only. No third party collection is permitted in any case. Section B: Applicant’s Particulars Principal Account Holder Joint Account Holder Name : Name : Customer ID: Customer ID: Section C: Type of Request Issuance of Demand Draft (to fill in Section 1 – 3) Cancellation of Demand Draft Amendment of Demand Draft (to fill in Section 1 – 3) Revalidation of Demand Draft Duplicate Issuance of Demand Draft Section 1: Beneficiary Details Name* Middle Name Relationship with Applicant* Last Name* DOB D D M M Y Y Y Y Communication Address* City State Postal Code* Purpose of Payment __________________________________________________________ Source of Funds _____________________________________________ Section 2: Beneficiary Details ICICI Bank Limited India Account Holder Account no Non ICICI Bank Account Holder Account no Bank Name Branch Address City Postal Code State Section 3: Payment Mode Debit ICICI Bank Account Number: Demand Draft Amount(in figures): Demand Draft Amount (in words):____________________________________________________________________________________________ Registered address - 9 Raffles Place, #50-01 Republic Plaza, Singapore 048619 Company Reg No.T03FC6380G Section F: Terms and Conditions These terms and conditions govern and regulate the demand draft request placed by an applicant ("Applicant") with ICICI Bank Limited, Singapore Branch (the "Bank" or “ICICI Bank”) (“DD Terms”). These DD Terms shall be read in conjunction with the General Terms and Conditions Governing Accounts and Secured Facilities of the Bank ("GTC"), as made available at www.icicibank.com.sg (“Website”), In the event of any inconsistency between the GTC and these DD Terms, the DD Terms shall prevail. 1. The Bank shall not be liable for any loss, delay, error, omission which may occur in the transmission of the message or for its misinterpretation when received or any delay caused by the clearing system of the country in which the payment is to be made or any act, default or negligence of the beneficiary's bank in collecting the demand draft. In no event shall the Bank, under any circumstances, be liable for any loss of profits or contracts or special, indirect or consequential losses or damages. 2. All charges/commission outside Singapore are for the beneficiary's account unless otherwise specified. If so specified by Applicant’s account, such charges/- commission shall be in accordance with the Bank's prevailing schedule of charges, available on the Website. 3. The Applicant shall ensure that the complete beneficiary information (including but not limited to the details of the beneficiary’s bank, beneficiary's name and account number, beneficiary's postal details etc.) is provided and such information is true, complete, up-to-date, accurate and valid in all respects. The Bank shall not be liable for any losses, damages, or claims whatsoever arising as a result of any rejection, return or any delay in processing a request due to false, incomplete, inaccurate or invalid information being provided by the Applicant. Any charges, fees, costs or the like imposed by related parties arising therefrom shall be borne by the Applicant. 4. Encashment of the demand draft (“DD”) is subject to applicable exchange control and other similar restrictions which may be imposed by the rules and regulations of the country where such encashment is to be made and/or of the relevant clearing house. Neither the Bank nor its correspondents or agents shall be liable for any loss, damage or delay caused by compliance with any such rules and regulations. 5. Applications for same day value are subject to cut-off times related to the geographical location of the destination country. 6. Any request for amendment and/ or cancellation of DD has to be made by the Applicant, and refund can only be made by the Bank upon receipt of its correspondent's effective confirmation of such amendment/ cancellation and such refund shall be made at the Bank's current buying rate of the currency of the DD at the time of such refund. The Bank is entitled to reimbursement from the Applicant for the expenses so incurred by it and its correspondents or agents. All cable/postage, other charges and commission collected are non-refundable. 7. The Bank is entitled to collect from the Applicant all DD and other charges including charges collected or to be collected by the Bank's correspondent, agent or sub-agent in connection with carrying out the instructions of the Applicant in accordance with the Bank's prevailing schedule of charges, available on the Website. 8. The Bank reserves the right to revise all DD charges, from time to time. 9. The Bank may refuse to affect a DD of an Applicant if the application does not fulfill the requirements as designated by Monetary Authority of Singapore ("MAS") or the relevant clearing bank in Singapore, from time to time. 10. The Applicant represents and warrants to ICICI Bank (which representation and warranty shall be deemed to be repeated on each day) that neither the Applicant nor any other person benefiting in any capacity, directly or indirectly, in connection with or from the transactions hereunder is a Specially Designated National (SDN) or otherwise sanctioned under the sanctions (and related laws) promulgated by the United States (including its Office of Foreign Assets Control), India, United Nations, European Union, Singapore (including under the MAS notice dated June 18, 2012 on “Prohibition of Transactions with the Iranian Government and with Iranian Financial Institutions”) and/or any other country (collectively, the "Sanctions"). 11. For the avoidance of doubt, the provisions pertaining to Section I of the GTC shall apply to this application form and are incorporated herein by reference. 12. If your DD is lost or stolen, please inform the Bank, forthwith. 13. Each DD issued will be valid for a period of 3 months from the date of such issuance (subject to revision of applicable guidelines by RBI, from time to time). An Applicant may wish to check whether the draft has been paid before the expiry of such validity period. On the 92nd day from the date of issuance of DD, a letter will be sent to the Applicant informing whether the DD has been claimed or not and providing the Applicant a period of 10 days from the date of such letter to visit the Bank’s branch and provide any further/ alternate instructions. In case of no response, the amount of the DD will be re-converted to the currency of your ICICI Bank account (at the prevailing rate of exchange available on the date of such re-conversion) and credited back. Any losses/ damages due to any exchange rate related fluctuations shall be borne by the Applicant. 14. Do note that ICICI Bank may call a Applicant and such call(s) may be recorded for internal training and quality purpose(s). Declaration of Non-evasion of tax and pertaining to Sanctions To, ICICI Bank Limited Singapore Branch, 9 Raffles Place, #50-01 Republic Plaza Singapore – 048619 (“ICICI Bank”). By signing this application form, I/We, in addition to accepting the DD Terms (as defined above), hereby further affirm, confirm and undertake that I/We have read, understood and agree to abide and be bound by the DD terms and the GTC (including but not limited to Clauses 41 (OFAC and other sanctions) and Clause 42 (Non-evasion of tax)) of ICICI Bank, as made available on ICICI Bank’s Website (as defined above) and as amended and updated from time to time. I/We authorise ICICI Bank to debit the above monies for the lawful purpose(s) detailed above. I/we hereby agree that the Demand Draft requests shall be governed by the DD Terms, the GTC and the FAQs as available on the Website, which I/we accept and consent to abide and be bound by at all times. I/We further understand and agree that the DD service offered to me by ICICI Bank is on the basis of the aforementioned statement/declarations made by me/us. Signature : Date D D M M Y Y Y Y Branch Seal For ICICI Bank Singapore USE Only Amount with currency FX Rate Charges Value Date of DD Verified by (Employee ID and Signature) Trans ID Please indicate if MT110 is required: Yes No Demand Draft No.: Please indicate if MT111 is required: Yes No Old Demand Draft No.: Authorised by (Signature) Acknowledgement of Receipt of INR Demand Draft I acknowledge the receipt of the INR demand draft no. _______________________________ with the value of INR _________________________________________________ Authorised Signature(s) with company stamp___________________________________________________Date _____________________________________________________ Registered address - 9 Raffles Place, #50-01 Republic Plaza, Singapore 048619 Company Reg No.T03FC6380G