Presentation on Private Equity Exit Considerations April 2012

advertisement

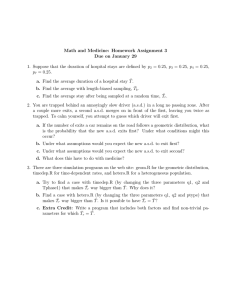

Presentation on Private Equity Exit Considerations April 2012 Exits: Key Considerations for Private Equity Exits by Year Exit Capital ($B) $140 $120 # of Exits VALUE 600 510 449 434 $100 420 350 400 $80 300 207 $60 ECONOMY TAX MORALE TIMING 200 $40 $20 500 $121 $120 $80 $40 $106 $104 $0 100 0 2006 2007 2008 2009 2010 2011 Median Exit EBITDA Multiple 9.9x 10.0x 9.3x 9.0x 8.7x 8.6x 8.5x 8.0x FINANCING 8.0x 8.0x 7.4x 7.0x 6.9x 6.6x 6.0x 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Source: Pitchbook & Grant Thornton, 2011. 1 Plan Your Exit Know How to Get Out Before You get In • • • ONEX – Sky Chefs EBITDA (1987-2000) Abundance of natural buyers? • Strategic acquiror? • Financial buyer? • IPO candidate? Confidentiality issues? • Vendors, competitors, customers 120 107.0 100 80 EBITDA ($MM) • Micro Analysis – Is Your Company Ready? • • If NO – nothing else matters Execution of the investment thesis is key • Capex, acquisitions, asset sales, HR • Tangible success? ROI? • Opportunity cost – time / money / outlook 60 46.0 CAGR: 15.1% 40 25.6 CAGR: 8.7% 1987 1994 20 0 IRR: Multiple of Capital: 2 2000 29.7% 16.5x Exit Paths – IPO • • • 60 51 50 IPO market can be shut (mid-late 2008) 40 40 30 30 Profit margin disclosure 24 20 14 10 Hard to “exit” 100% • 66 70 Confidentiality is lowest • • Typical market cap: $1 billion The most “macro sensitive” option • • Number of PE-Backed IPOs Rarely a “mid-market” option - Exit in stages over time 2006 2007 2008 2009 2010 2011 Average IPO Market Cap ($MM)1 1,315 1400 1,267 1000 800 1,200 1,099 1200 827 772 700 600 400 200 2006 1. Source: S&P Capital IQ. average value of sponsor backed offerings of at least 5% of shares offered with gross proceeds over $50 mm. 3 2007 2008 2009 2010 2011 2012 Exit Paths – Auction vs. Targeted Sale Auction Targeted Sale • The most common mid-market exit • Effective for “natural fit” • Story needs broad appeal • Often involves unsolicited approach • Consumes time and management • Value not compromised • Confidentiality “contained” • Confidentiality maximized Case–Study – ONCAP/CSI Case Study ONCAP/WIS International Case Study – ONCAP/WIS International Date: Calls Made: Buyer Interest: Preliminary Bids: Result: January 2007 18 Strategic / 52 Private Equity Date: November 2010 Buyer: Moody’s Corp. Rationale: 7 Strategic / 36 Private Equity 12 Private Equity 8.1x ROI / 73.7% IRR Result: 4 Complimented global effort in regulation, risk management and education tools 5.8x ROI / 57.2% IRR Financing Considerations …And High Equity Contributions Will Drive Values Higher Strong Debt Multiples = Strong PE Interest… 6.0x 60.0% 5.6x 5.5x 5.0x 50.8% 50.0% 39.5% 40.0% 4.8x 4.7x 37.8% 4.7x 4.7x 4.5x 4.5x 4.2x 33.6% 30.0% 4.3x 26.2% 4.2x 30.0% 4.1x 4.0x 3.9x 4.0x 20.0% 3.8x 3.4x 3.5x 20.7% 10.0% 3.3x 7.0% 3.0x 0.0% '97 '99 '01 '03 '05 '07 '09 '11 '87 Debt/EBITDA '90 '93 '96 '99 '02 Equity Contribution to LBOs Source: Lcdcomps.com 5 '05 '08 '11 Other Exit Considerations Tax Considerations –Tax Number of Exits (2010) Fundraising – Inventory of PE-owned Companies 180 7,000 163 Number of PE-Backed Companies 160 Number of Exits (2010) 140 120 104 100 84 83 80 60 40 20 6,000 5,164 5,000 5,968 4,549 3,678 4,000 2,894 3,000 2,223 2,000 1,000 - Q1 • 5,435 5,745 Q2 Q3 '04 Q4 • • Tax rate fears drove activity in late 2010 6 '05 '06 '07 '08 '09 '10 LP’s like to see realizations 40% of PE-owned companies have been held more than 5 years '11