Whether you’re constructing a portfolio for the first time or reviewing it to determine if adjustments are needed, you want to make sure the end result fits your comfort with risk and financial goals. That’s why we focus on

quality and diversification to build a solid portfolio that may be able to withstand the market’s swings over time.

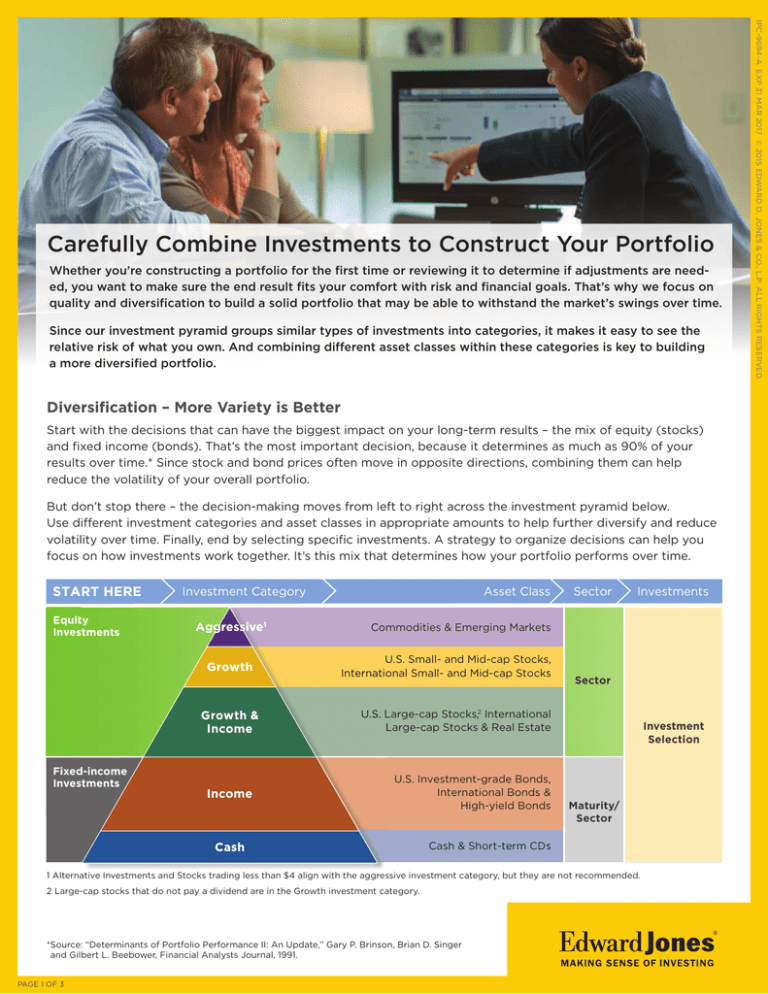

Since our investment pyramid groups similar types of investments into categories, it makes it easy to see the

relative risk of what you own. And combining different asset classes within these categories is key to building

a more diversified portfolio.

Diversification – More Variety is Better

Start with the decisions that can have the biggest impact on your long-term results – the mix of equity (stocks)

and fixed income (bonds). That’s the most important decision, because it determines as much as 90% of your

results over time.* Since stock and bond prices often move in opposite directions, combining them can help

reduce the volatility of your overall portfolio.

But don’t stop there – the decision-making moves from left to right across the investment pyramid below.

Use different investment categories and asset classes in appropriate amounts to help further diversify and reduce

volatility over time. Finally, end by selecting specific investments. A strategy to organize decisions can help you

focus on how investments work together. It’s this mix that determines how your portfolio performs over time.

START HERE

Equity

ty

Investments

tments

Investment Category

Aggressive1

Asset Class

Sector

Investments

Commodities

& Emerging Markets

Com

U.S.

U Small- and Mid-cap Stocks,

International

Small- and Mid-cap Stocks

Internatio

Sector

U.S. L

Large-cap Stocks,2 International

Large-cap

Stocks & Real Estate

L

d-income

Fixed-income

tments

Investments

Income

U.S. Investment-grade Bonds,

International Bonds &

High-yield Bonds

Investment

Selection

Maturity/

Sector

Cash & Short-term CDs

1 Alternative Investments and Stocks trading less than $4 align with the aggressive investment category, but they are not recommended.

2 Large-cap stocks that do not pay a dividend are in the Growth investment category.

*Source: “Determinants of Portfolio Performance II: An Update,” Gary P. Brinson, Brian D. Singer

and Gilbert L. Beebower, Financial Analysts Journal, 1991.

PAGE 1 OF 3

IPC-9694-A EXP 31 MAR 2017 © 2015 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Carefully Combine Investments to Construct Your Portfolio

As a group within the investment pyramid on page 1, the equity investments in the top (green) portion are more

volatile (risky) than fixed-income investments in the lower (gray) portion. The same holds true for the investment

categories and asset classes within them. But don’t avoid more volatile investments – in appropriate amounts,

they can help reduce swings in your portfolio’s value because they may be moving at different times. And our

investment pyramid includes specific asset classes aligned to an investment category to help you consider a wide

range of investments.

We think you should own both domestic and international investments, including those classified as small-, mid- and

large-cap because these asset classes tend to perform differently over time as well. And including more different

asset classes in your portfolio could help provide better risk-adjusted performance versus owning just a few.

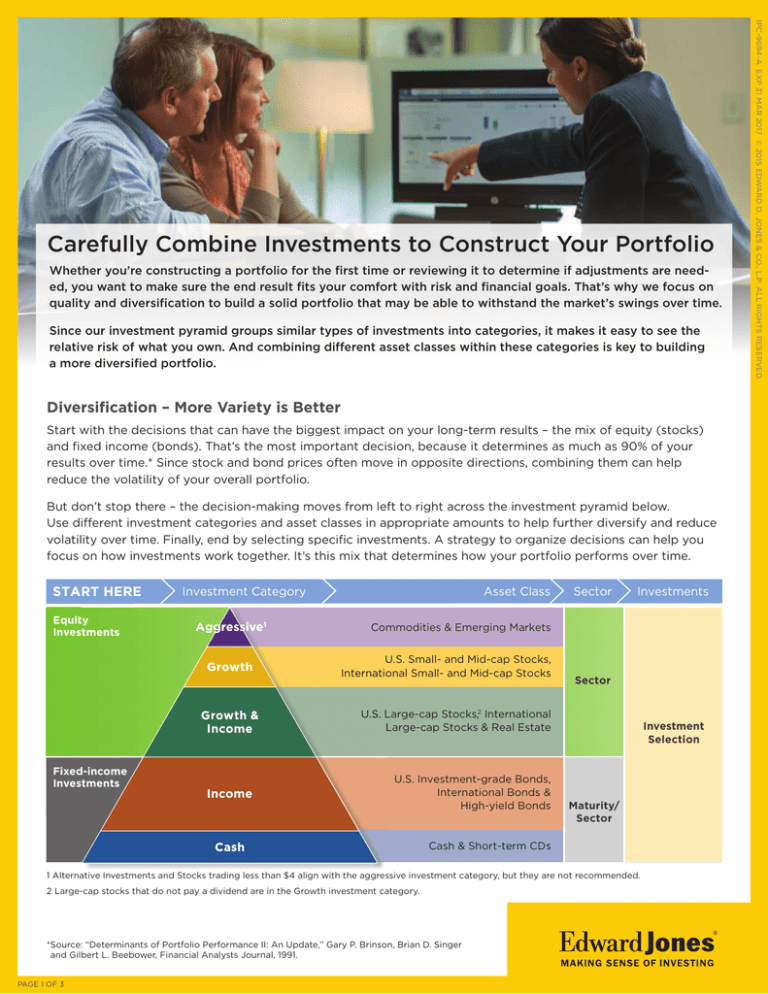

Understanding Asset Class Risk and Return

The chart below shows asset classes grouped into the different investment categories based on differences in

risk. You can also see the historical returns.

• Fixed income investments, including high-yield bonds,

are less volatile (less risky) than equity investments.

• Large-cap U.S. investments (in Growth & Income) are

less volatile than mid-cap and small-cap investments

(in Growth). While there are many types of large-cap

investments, and they each may behave differently,

they tend to perform much more similarly as an

overall group. This is especially true when compared

to mid- and small-cap.

• We group mid- and small-cap together in the investment pyramid because they tend to perform more

similarly as an overall group.

• Aggressive investments carry the most volatility.

10-year Risk & Return of Different Asset Classes

12%

Income

Growth

& Income

Growth

Aggressive

U.S. Asset Classes within

Growth & Income

Large-cap investments are

10%

mostly included here because

they are generally less volatile

than mid- or small-cap. As the

Return

8%

Large-cap Growth

6%

High-yield Bond

Large-cap Core

Mid-cap Growth

Small-cap Growth

Mid-cap Core

Mid-cap Value

Small-cap Core

Small-cap Value

box shows, U.S. large-cap

investments tend to perform

more similarly to one another

Large-cap Value

than to other asset classes –

Intermediate-term Bond

4%

whether they pay a larger

Diversified

Emerging

Markets

dividend today (typically

large-cap value), or a smaller,

but growing dividend (typically

2%

large-cap growth).

Commodities

0%

5%

10%

15%

20%

Risk (Standard Deviation)

25%

30%

Source: Morningstar, Oct. 1, 2005, to Sept. 30, 2015. 10-year annualized return. Morningstar assigns categories to all types of portfolios, such as mutual

funds. Portfolios are placed in a category based on their average holdings statistics over the past three years. Morningstar’s editorial team also reviews and

approves of all category assignments. If the portfolio is new and has no history, Morningstar estimates where it will fall before giving it a more permanent

category assignment. Morningstar’s analysts review each fund’s category on a quarterly basis to account for any change in its style. When necessary,

Morningstar may change a category assignment based on recent changes to the portfolio. In the United States, Morningstar supports 71 categories, which

map into four broad asset classes (U.S. Stock, International Stock, Taxable Bond, and Municipal Bond).

PAGE 2 OF 3

IPC-9694-A EXP 31 MAR 2017 © 2015 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Why Asset Classes Matter

IPC-9694-A EXP 31 MAR 2017 © 2015 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Similar But Not the Same

You can also see there are differences between investments within

investment categories. That’s true within each asset class as well.

Investments within an asset class tend to move together, but they

aren’t exactly the same either. So while, in general, large-cap investments

tend to move similarly and are much different than mid- and small-cap,

we think it’s also important to diversify within asset classes.

What’s Your Strategy?

Using a variety of investment categories and asset classes, you should

expect solid diversification and better risk-adjusted performance over

time. Even investments with higher price volatility can help reduce the

overall swings in your portfolio’s value if they frequently move differently

from other investments. That’s why you may be taking more risk than you

realize if your portfolio is concentrated in just one asset class or investment category. And remember, when you own many different investment

types, it’s likely some will be up and some down at any given time.

Your strategy is designed to help you invest without taking unnecessary

risk. That’s why we recommend sticking to the basics of building a

portfolio of quality investments that includes an appropriate amount

in equity and fixed income and is further diversified across many asset

classes. By working with your financial advisor to do this, we believe

you’ll own a solid portfolio that you can feel comfortable holding over

the long-term to help you meet your goals.

Diversification does not guarantee a profit or protect against loss. Past performance

is no guarantee of future results.

Kate Warne, Ph.D., CFA Investment Strategist

PAGE 3 OF 3

www.edwardjones.com

Member SIPC