Factsheet as at : October 01, 2016

CMI Ins SR UK Bond

Fund objective

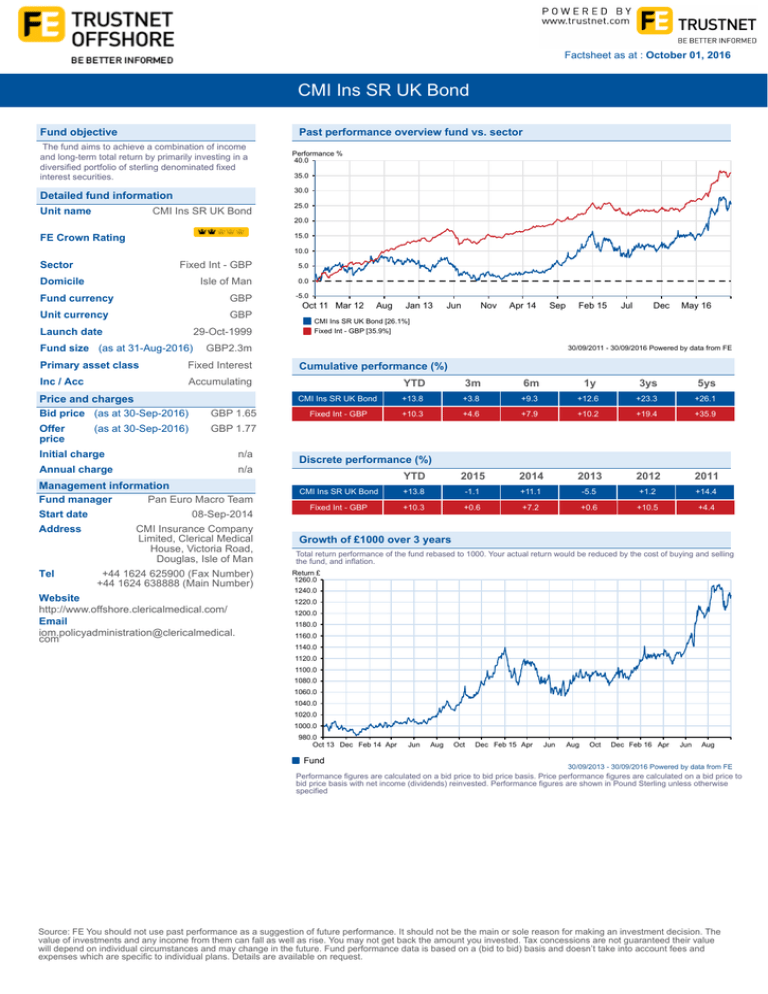

Past performance overview fund vs. sector

The fund aims to achieve a combination of income

and long-term total return by primarily investing in a

diversified portfolio of sterling denominated fixed

interest securities.

35.0

30.0

Detailed fund information

Unit name

Performance %

40.0

CMI Ins SR UK Bond

25.0

20.0

15.0

FE Crown Rating

10.0

Sector

Fixed Int - GBP

Domicile

5.0

Isle of Man

0.0

Fund currency

GBP

-5.0

Unit currency

GBP

Launch date

29-Oct-1999

Fund size (as at 31-Aug-2016)

Fixed Interest

Inc / Acc

Accumulating

Offer

price

(as at 30-Sep-2016)

Aug

Jan 13

Jun

Nov

Apr 14

Sep

GBP 1.65

Feb 15

Jul

Dec

May 16

CMI Ins SR UK Bond [26.1%]

Fixed Int - GBP [35.9%]

GBP2.3m

Primary asset class

Price and charges

Bid price (as at 30-Sep-2016)

Oct 11 Mar 12

30/09/2011 - 30/09/2016 Powered by data from FE

Cumulative performance (%)

YTD

3m

6m

1y

3ys

5ys

CMI Ins SR UK Bond

+13.8

+3.8

+9.3

+12.6

+23.3

+26.1

Fixed Int - GBP

+10.3

+4.6

+7.9

+10.2

+19.4

+35.9

GBP 1.77

Initial charge

n/a

Annual charge

n/a

Management information

Fund manager

Pan Euro Macro Team

Start date

08-Sep-2014

CMI Insurance Company

Address

Limited, Clerical Medical

House, Victoria Road,

Douglas, Isle of Man

+44 1624 625900 (Fax Number)

Tel

+44 1624 638888 (Main Number)

Website

http://www.offshore.clericalmedical.com/

Email

iom.policyadministration@clericalmedical.

com

Discrete performance (%)

YTD

2015

2014

2013

2012

2011

CMI Ins SR UK Bond

+13.8

-1.1

+11.1

-5.5

+1.2

+14.4

Fixed Int - GBP

+10.3

+0.6

+7.2

+0.6

+10.5

+4.4

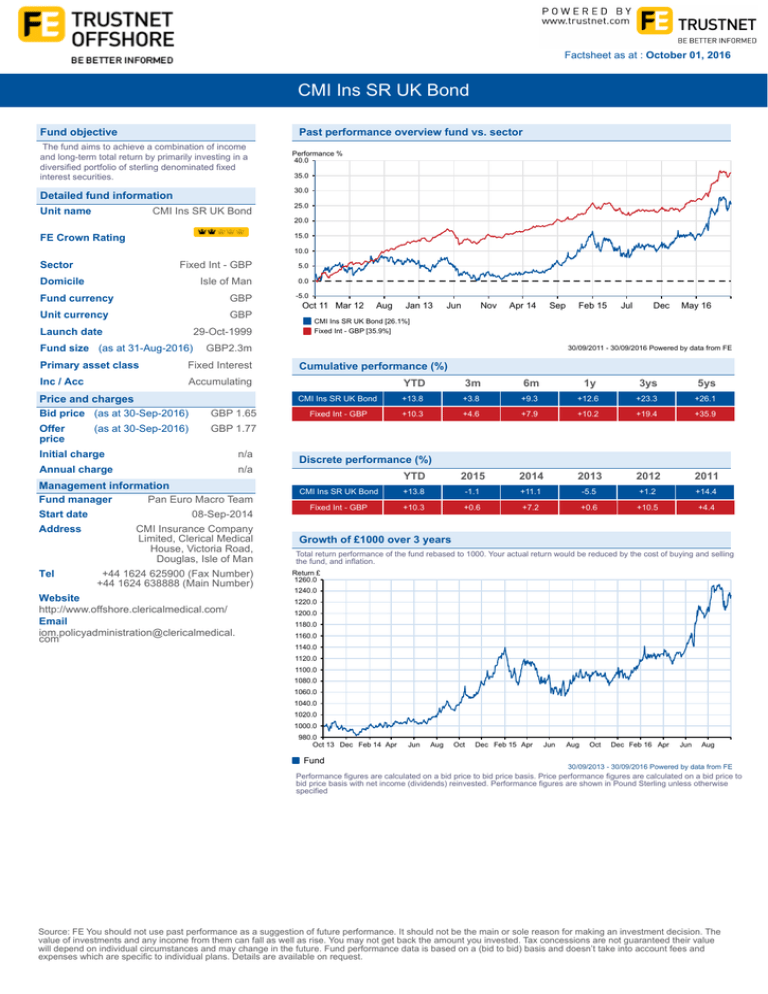

Growth of £1000 over 3 years

Total return performance of the fund rebased to 1000. Your actual return would be reduced by the cost of buying and selling

the fund, and inflation.

Return £

1260.0

1240.0

1220.0

1200.0

1180.0

1160.0

1140.0

1120.0

1100.0

1080.0

1060.0

1040.0

1020.0

1000.0

980.0

Oct 13 Dec Feb 14 Apr

Fund

Jun

Aug

Oct

Dec Feb 15 Apr

Jun

Aug

Oct

Dec Feb 16 Apr

Jun

Aug

30/09/2013 - 30/09/2016 Powered by data from FE

Performance figures are calculated on a bid price to bid price basis. Price performance figures are calculated on a bid price to

bid price basis with net income (dividends) reinvested. Performance figures are shown in Pound Sterling unless otherwise

specified

Source: FE You should not use past performance as a suggestion of future performance. It should not be the main or sole reason for making an investment decision. The

value of investments and any income from them can fall as well as rise. You may not get back the amount you invested. Tax concessions are not guaranteed their value

will depend on individual circumstances and may change in the future. Fund performance data is based on a (bid to bid) basis and doesn’t take into account fees and

expenses which are specific to individual plans. Details are available on request.

CMI Ins SR UK Bond

Asset allocation

Key

A

B

C

D

Rank

1

2

3

4

% of Fund

(30.06.2016)

Asset class

UK Fixed Interest

Overseas Bonds

UK Index Linked

Money Market

91.7

5.5

3.0

-0.2

Regional breakdown

No Breakdown Data available

Sector breakdown

Key

A

B

C

Rank

1

2

3

Sector

AA

AAA

NR

% of Fund

(30.06.2016)

94.7

5.5

-0.2

Top ten holdings

% of Fund

(30.06.2016)

Rank Holding

1

2

3

4

5

6

7

8

9

10

TREASURY 1.75% GILT 22/07/19 GBP0.01

TREASURY 2% GILT 07/09/25 GBP0.01

TREASURY 4% GILT 7/09/2016

TREASURY 4.25% GILT 07/06/2032 GBP0.01

TREASURY 3.25% GILT 22/01/44 GBP0.01

TREASURY 4.5% GILT 7/9/2034 GBP0.01

AUSTRALIA(COMMONWEALTH OF) 3.75% BDS 21/04/37 AUD1000

TREASURY 1.25% GILT 22/7/18 GBP0.01

TREASURY 3.75% GILT 22/07/52 GBP0.01

TREASURY 4% GILT 22/01/60 GBP0.01

16.1

13.1

9.7

7.8

7.8

6.6

5.5

5.5

4.3

3.4

© Trustnet Limited 2016 FE Trustnet is a free website devoted exclusively to research, and does not offer any transactional

facilities to its users, or offer any advice on investments.The Institute of Company Secretaries and Administrators (ICSA)

Registrars Group has issued an official warning to investors to beware of fraudulent use of authorised firms’ logos and trademarks

by illegitimate and illegal trading operations or ‘boiler rooms’. Data supplied in conjunction with Thomson Financial Limited,

London Stock Exchange Plc, StructuredRetailProducts.com and ManorPark.com, All Rights Reserved. Please read our Disclaimer

and Privacy Policy.