Printable 2015 UMB Bank Fact Sheet

advertisement

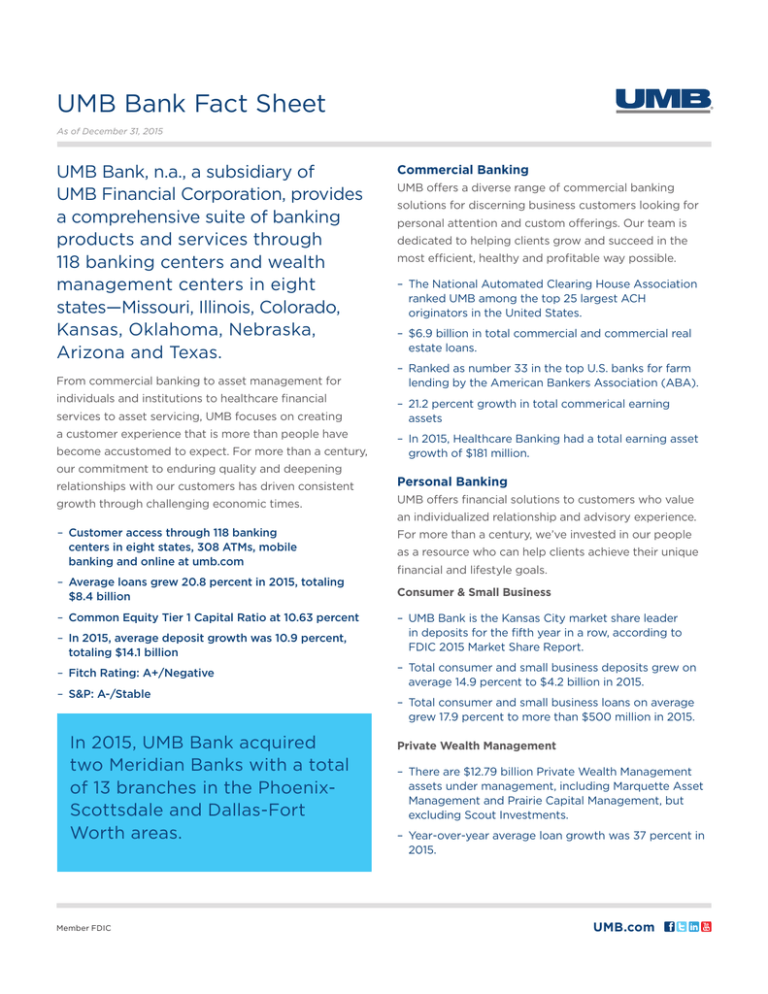

UMB Bank Fact Sheet As of December 31, 2015 UMB Bank, n.a., a subsidiary of UMB Financial Corporation, provides a comprehensive suite of banking products and services through 118 banking centers and wealth management centers in eight states—Missouri, Illinois, Colorado, Kansas, Oklahoma, Nebraska, Arizona and Texas. From commercial banking to asset management for individuals and institutions to healthcare financial services to asset servicing, UMB focuses on creating a customer experience that is more than people have become accustomed to expect. For more than a century, our commitment to enduring quality and deepening relationships with our customers has driven consistent Commercial Banking UMB offers a diverse range of commercial banking solutions for discerning business customers looking for personal attention and custom offerings. Our team is dedicated to helping clients grow and succeed in the most efficient, healthy and profitable way possible. –– The National Automated Clearing House Association ranked UMB among the top 25 largest ACH originators in the United States. –– $6.9 billion in total commercial and commercial real estate loans. –– Ranked as number 33 in the top U.S. banks for farm lending by the American Bankers Association (ABA). –– 21.2 percent growth in total commerical earning assets –– In 2015, Healthcare Banking had a total earning asset growth of $181 million. Personal Banking growth through challenging economic times. UMB offers financial solutions to customers who value –– Customer access through 118 banking centers in eight states, 308 ATMs, mobile banking and online at umb.com For more than a century, we’ve invested in our people –– Average loans grew 20.8 percent in 2015, totaling $8.4 billion –– Common Equity Tier 1 Capital Ratio at 10.63 percent –– In 2015, average deposit growth was 10.9 percent, totaling $14.1 billion –– Fitch Rating: A+/Negative –– S&P: A-/Stable In 2015, UMB Bank acquired two Meridian Banks with a total of 13 branches in the PhoenixScottsdale and Dallas-Fort Worth areas. Member FDIC an individualized relationship and advisory experience. as a resource who can help clients achieve their unique financial and lifestyle goals. Consumer & Small Business –– UMB Bank is the Kansas City market share leader in deposits for the fifth year in a row, according to FDIC 2015 Market Share Report. –– Total consumer and small business deposits grew on average 14.9 percent to $4.2 billion in 2015. –– Total consumer and small business loans on average grew 17.9 percent to more than $500 million in 2015. Private Wealth Management –– There are $12.79 billion Private Wealth Management assets under management, including Marquette Asset Management and Prairie Capital Management, but excluding Scout Investments. –– Year-over-year average loan growth was 37 percent in 2015. UMB.com UMB Bank Fact Sheet As of December 31, 2015 In addition to providing a solid portfolio of financial products, UMB has built a distinguished reputation throughout our footprint for supporting community success through philanthropy and environmental action. Whether it’s financing for small businesses, providing working capital loans to companies that support job creation and retention, our corporate philanthropy or our associates’ own personal volunteerism activities, UMB and our associates remain dedicated to the communities we serve. Executive Management Team Mariner Kemper President, Chairman and Chief Executive Officer, UMB Financial Corporation Mike Hagedorn opportunities, grow agriculture, strengthen families, restore neighborhoods, develop Vice Chairman and Interim Chief Financial Officer, UMB Financial Corporation; President and Chief Executive future leaders and improve health and wellness. Officer, UMB Bank n.a. In 2015, UMB, along with our dedicated associates, made a tremendous impact in Media Relations Contacts our communities. Kelli Christman Corporate Communication 816.860.5088 Historically, we’ve supported organizations and programs that expand access and appreciation of the arts, further economic development, advance educational Investor Relations Contacts Kay Gregory Investor Relations 816.860.7106 937 9,540 UMB associates volunteered their time Total Volunteer Hours Valued at $220,000 P.O. Box 419226 Kansas City, MO 64141-6226 $550,000 1,192 Donated in Kansas City region alone Volunteer Time Off Workdays Community Support by the Numbers Member FDIC UMB.com