White paper: Casualty

When to consider a loss-sensitive

casualty program structure

By Doug O’Brien, National Casualty Practice

April 2015

Most middle-market companies have guaranteed-cost

programs for primary casualty insurance. In these

programs, also called first-dollar programs, you pay a fixed

premium in exchange for full coverage of a loss, including

damages, defense costs, claims handling, and other costs.

Companies have historically preferred the convenience

and budget stability of these programs. Plus, the entire

premium is a potential tax deduction, there are no

collateral requirements, and the insurance company is

somewhat motivated to help you control losses.

However, times have changed. Today, during this

tightening market, insurance companies’ capacity

for these programs is decreasing and premiums are

increasing — especially for workers’ compensation due to a

number of factors — which is creating volatility in pricing

from one year to the next. As a result, many companies are

considering a loss-sensitive program instead.

With this structure, you pay a lower premium in exchange

for partial coverage of a loss in excess of a deductible

borne by the insured, and you can further reduce your

retained costs by improving safety and claims-handling

procedures. For many companies, loss-sensitive programs

are proving more cost-effective than guaranteed-cost

programs.

Organizations choose to retain risks for several reasons,

and moving to a loss-sensitive program is not an easy

decision. As you evaluate your options, it’s important to

consider the differences between guaranteed-cost and

loss-sensitive program structures.

Drawbacks of guaranteed-cost programs

In the Wells Fargo Insurance book of business,

guaranteed-cost programs account for 65% to 70%

of the primary casualty structures for middle-market

companies with average revenues up to $250 million.

Although there are many benefits and they are suitable

for many organizations, these programs also have several

drawbacks:

• Price swings. During hard or tightening market cycles,

guaranteed-cost programs can experience significant

swings in premiums, carrier appetite, and degree of

coverage.

• Reduced benefit for good loss experience. Many lines

of business are rated by class, so you may not get credit

for your historically favorable loss experience. And, if

you do, it may be delayed. In workers’ compensation

insurance, for example, experience modifications take a

number of years to capture the impact of good loss

experience and many carriers are eliminating optional

schedule credit modifications.

• Less control over your costs. In a guaranteed-cost

program, you have less control over claims handling,

and you have less incentive to maintain safety

standards since your insurer will cover any loss on a

first-dollar basis.

• Less cash flow for you and more profit for the insurer.

Since you pay your premium up front, any investment

income on that money goes to the insurer — not to you.

Furthermore, for each dollar of guaranteed-cost

premium, approximately 60% is intended to pay losses,

while the remaining 40% goes to fixed costs, such as

taxes, claims handling, loss control, administration, and

broker commission. If your losses do not exceed 60% of

the premium, then the insurer makes a profit. (In a

loss-sensitive program, on the other hand, the more you

can impact the expected losses and the fixed costs

through proactive loss control and claims management,

the more you can reduce your total cost of risk over the

long term.)

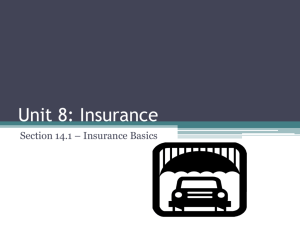

The advantages of loss-sensitive programs

Compared to guaranteed-cost programs, loss-sensitive

programs require you to bear some portion of the loss —

usually on a vertical, per-occurrence basis. Some losssensitive programs have a built-in maximum premium

or provide the option to purchase an aggregate stop loss,

which will cap your retained losses (please see the exhibit

on page 5 for a comparison). This structure can provide

several advantages:

• Lower premium. In exchange for bearing some portion

of the loss, you receive a 20% to 70% credit on the

guaranteed-cost premium. Your premium depends on

the line of coverage, the amount and type of loss you

retain, your company’s historical and future loss profile,

your initiatives for loss control and claims handling,

general market conditions, and other factors. Although

there are programs with small deductibles ranging from

$1,000 to $25,000, you will derive the most premium

savings by taking on higher retention levels at $50,000

or more.

Wells Fargo Insurance white paper: When to consider a loss-sensitive casualty program structure | April 2015

2

• Savings through loss control and claims handling. In

addition to taking a higher retention, you can further

reduce your costs by preventing losses, since any

reduction in losses below the chosen retention level

accrues directly to you — not the insurance company.

When you pay the majority of your own losses, you have

a clear and immediate incentive to prevent losses in the

first place and, if they occur, manage them more

proactively through aggressive claims handling,

return-to-work programs, managed care, and other

initiatives. Any reduction in loss has a direct impact on

your bottom line.

• Improved cash flow and investment income. Losssensitive programs can be structured on a pay-asyou-go basis, which enables you to improve cash flow

and receive investment income on the loss reserves —

instead of giving them to an insurer.

• Price stability and lower cost of risk. While losssensitive programs will not eliminate pricing volatility

entirely, they can help reduce the swings in pricing that

often come with guaranteed-cost programs. In addition,

over several years of good loss experience, effective loss

control, and proactive claims management, you can

often reduce your average total cost of risk versus a

guaranteed-cost structure. Of course, in any given year,

the total cost of a loss-sensitive program may exceed a

guaranteed-cost premium; nevertheless, companies that

switch to loss-sensitive programs are usually satisfied

with their decision.

Types of loss-sensitive programs

Middle-market companies have access to several

different loss-sensitive programs, including:

• Dividend plans

• Deductibles (paid and incurred)

• Retrospectively rated programs

• Captive reinsurance

• S

elf-insurance (more common for general and

product liability; less common for workers’

compensation and auto liability)

When to consider a loss-sensitive program

While there is no specific rule of thumb for determining

the right kind of program for your company, it might be

wise to consider a loss-sensitive structure if one or more of

the following applies:

• Your guaranteed-cost premium is high relative to the

expected losses.

• Your aggregate loss experience at various retention

levels by coverage line is fairly predictable year over

year and can be actuarially measured. Review of prior

losses is usually a good gauge of the future.

• You understand the potential severity for aggregate and

large losses.

• Your company has the financial capacity to assume the

maximum amount of retained losses within a given

policy year and over a period of years.

• There are no contractual requirements that prohibit

your company from assuming a certain level of risk.

• Your company wants a financial incentive to control

losses and manage claims.

• Your company can post collateral in the form of a letter

of credit, cash, or other vehicle.

• A guaranteed-cost program is not available.

In addition, consider how peer companies are structuring

their casualty insurance programs, and work with your

broker to analyze the suitability of a loss-sensitive

program. Wells Fargo Insurance, for example, can help you

in your decision by offering:

• Loss forecasts and variability studies

• Risk-retention analysis to help you determine the

optimum per-occurrence retention levels, maximum

premiums, and the impact that accruals for retained

losses will have on your balance sheet

• Calculations of the compounded savings expected over

a multi-year period in varying loss scenarios

• Evaluation of pre-loss efforts, such as safety initiatives

and other loss-control programs

• Evaluation of post-loss efforts, such as claims handling,

managed care programs, and return-to-work initiatives

Wells Fargo Insurance white paper: When to consider a loss-sensitive casualty program structure | April 2015

3

• Analysis of additional administration needs

• Evaluation of different loss-sensitive program structures

• Assessment of insurance companies, claims handling

companies, and loss control specialists

How can we help?

For more information on this topic, please contact your

Wells Fargo Insurance sales executive, or:

Douglas O’Brien

212-209-0253 office | doug.obrien@wellsfargo.com

Conclusion

As companies see higher insurance premiums and

reduced capacity from carriers, loss-sensitive programs

are becoming an important alternative to guaranteed-cost

structures. While loss-sensitive programs can result in a

higher cost than first-dollar programs in any given year,

loss-sensitive programs tend to be more cost effective over

time, especially for companies that remain proactive with

respect to controlling losses and managing claims.

Wells Fargo Insurance white paper: When to consider a loss-sensitive casualty program structure | April 2015

4

Exhibit

Loss-sensitive program

Guaranteed-cost

Guaranteed cost program

Individual claims or occurrences

Individual claims or occurrences

Losses paid by carrier

Losses retained by ABC

Losses paid by carrier

Limited or

unlimited

Primary

limits

Primary

limits

$250,000

$250K

$250,000

$250K

retention

level

level

Losses

collateralized

Losses within policy year

Losses include defense costs and

claims handling

Losses within policy year

Need to negotiate inclusion of defense costs in losses.

Claims handling costs usually in addition

Loss

amount

negotiated

separately

Optional

aggregate

protection

This material is provided for informational purposes only based on our understanding of applicable guidance in effect at the time of publication, and should not be construed as being

legal advice or as establishing a privileged attorney-client relationship. Customers and other interested parties must consult and rely solely upon their own independent professional

advisors regarding their particular situation and the concepts presented here. Although care has been taken in preparing and presenting this material accurately, Wells Fargo Insurance

Services disclaims any express or implied warranty as to the accuracy of any material contained herein and any liability with respect to it, and any responsibility to update this material

for subsequent developments.

To comply with IRS regulations, we are required to notify you that any advice contained in this material that concerns federal tax issues was not intended or written to be used, and

cannot be used to avoid tax-related penalties under the Internal Revenue Code, or to promote, market, or recommend to another party any matters addressed herein.

Products and services are offered through Wells Fargo Insurance Services USA, Inc., a non-bank insurance agency affiliate of Wells Fargo & Company.

Products and services are underwritten by unaffiliated insurance companies except crop and flood insurance, which may be underwritten by an affiliate, Rural Community Insurance

Company. Some services require additional fees and may be offered directly through third-party providers. Banking and insurance decisions are made independently and do not

influence each other.

© 2015 Wells Fargo Insurance Services USA, Inc. All rights reserved. WCS-1184719 (05/15)

Wells Fargo Insurance white paper: When to consider a loss-sensitive casualty program structure | April 2015

5